New Financial Year, New Opportunities Part II – Energy sector

Beach Energy, is a leading Australian independent oil and gas exploration and production company. While the energy sector is subject to volatility given underlying commodity prices, Beach Energy’s strategic positioning, future cashflow outlook and growth prospects make it an attractive investment within the sector.

Read this week’s Investment Matters as Craig explains why we think Beach Energy presents a prospective investment opportunity. Many investment banks’ Energy-sector experts see excellent value in Beach Energy at current prices.

Read why we are predominantly interested in owning exposure to movements in the price of gold, both as an insurance policy against global uncertainty or conflict and as a hedge against inflation. Plus, Craig explains why we suspect that the Mining Services and Industrials sector is likely to continue to outperform despite tough conditions.

New Financial Year, New Opportunities – Pathology and Healthcare

Part four of the year-end stocktake will outline our exposure to a final basket of stocks, the gold basket, our mining services exposure, three large industrial companies and two long-held smaller companies.

Read why we are predominantly interested in owning exposure to movements in the price of gold, both as an insurance policy against global uncertainty or conflict and as a hedge against inflation. Plus, Craig explains why we suspect that the Mining Services and Industrials sector is likely to continue to outperform despite tough conditions.

Year-end stocktake part 4: Gold, Mining and Industrial companies

Part four of the year-end stocktake will outline our exposure to a final basket of stocks, the gold basket, our mining services exposure, three large industrial companies and two long-held smaller companies.

Read why we are predominantly interested in owning exposure to movements in the price of gold, both as an insurance policy against global uncertainty or conflict and as a hedge against inflation. Plus, Craig explains why we suspect that the Mining Services and Industrials sector is likely to continue to outperform despite tough conditions.

Year-end stocktake part 3: Non-bank financials and technology

Part Three of the year-end stocktake will outline our exposure to non-bank financial stocks and several technology and medical device companies our clients own.

Discover why we have chosen to invest in areas of the non-bank financial sector, including business banking, global and domestic insurance, invoice financing, and insurance.

Year-end stocktake part 2: Lithium and Domestic economy

This week’s investment sought to highlight the logic and investment fundamentals we are creating in our lithium basket. Once again, the impact of baskets is to increase the number of stocks clients see in their portfolio, from a purely numeric perspective, but not from a thematic perspective.

The stocktake also highlights the economic outlook for our domestic economy exposure by referencing how current conditions mix with the type of management and asset features we are looking for to create an overall exposure.

Understanding Portfolio Diversification: a year-end stocktake

Each week in Investment Matters, we discuss the types of thematics that are crucial in building portfolios. We aim to combine these thematics with thorough bottom-up company research to create a well-diversified portfolio that can outperform in the medium term.

Over the next four weeks, leading into the end of the financial year, we will go towards a more detailed level, looking at individual positions. We will present an update on the portfolio companies, a year-end stocktake.

Australia’s ‘National Accounts’ – little growth, other than in population

Investment Matters highlights our Top Eight insights on the ABS (Australia Bureau of Statistics) estimation of the size and growth of the Australian economy, the so-called National Accounts.

Finding wisdom from history – forecasting supply and demand

“Life’s tragedy is that we get old too soon and wise too late.” – Benjamin Franklin.

‘That men do not learn very much from the lessons of history is the most important of all the lessons that history has to teach’ — Aldous Huxley

Federal Budget deep dive – the Labor Government’s 3rd Federal Budget

This week, the Albanese-led Labor Federal Government handed down its 3rd Federal Budget.

One of the dangers of Budget analysis, especially the type of analysis that finds its way to mainstream media, is how Federal Budgets are equated to household finances. Part of the problem is using the term ‘budget’, often used in the home reflecting a household’s natural constraints of income and spending. For those of limited means, hard budget constraints are everyday considerations.

Instead, Budgets are a nation’s policy decisions, not the state of its savings account. So, we generally baulk at the idea of balancing money ”collected” and “spent” as a misunderstanding of both history and finance.

Macquarie Group and Perpetual – analysis of FY24 results and company outlook.

As part of the usual ‘confession season’ leading into the Macquarie Australasian Companies Conference in Sydney this week, weakness has been apparent in businesses exposed to the consumer and these stocks have been sold off. We hold little exposure to these names.

Several significant announcements by our portfolio companies have also been made in the past week. We focus on two of these in Investment Matters discussion this week.

Finding the crunch point – RBA raising rates? What?

In our recent communications, we have suggested that the RBA, while it can reduce interest rates and mortgage costs through 2024, could benefit significantly by following the rest of the world’s lead in reducing rates. This approach would result in a longer pause at current rate levels, particularly in the face of higher or persistent domestic inflation.

Read as our CIO explains how interest rate increases can disproportionately affect different segments of the economy.

Is gold the new haven? The mystery behind the price surge

This week’s Investment Matters will shed light on the surge in the price of gold and gold stocks in the past few months.

We hold gold stocks in our clients’ sub-portfolios for several reasons. It is therefore useful to understand why increases in the gold price warrant special attention.

The task for First Samuel is to profit from such price increases.

In discussing this, I have split this week’s Investment Matters into two lengthy sections. I urge you not to skip straight to the second section (on how we profit from gold prices increases).

Optimistic optimism: strong returns to both Australian and global equities

This week’s Investment Matters will focus on different asset classes, their relative performance, and our broad thoughts on the implications of tactical asset allocation decisions.

When we survey benchmark performance, we see that Australian and Global equities portfolios have delivered returns well above expected long-term returns for those asset classes this financial year.

Revisiting takeovers

we’ve maintained higher weights in cash holdings within property sub-portfolios with an expectation that a significant rises in interest rates would necessitate an increase in cap rates (implied returns on property values), a resultant reduction in property book valuations and trigger a resultant slew of equity capital raises at discounted share prices in order to restore balance sheets to within bank funding covenants.

While the dull shine of copper comes in focus, we shed little light on BHP. Similarly, our focus this week on financial services dives deeper than the four major banks.

Profit Reporting Season – Stockland, Mirvac, Garda and Lendlease

we’ve maintained higher weights in cash holdings within property sub-portfolios with an expectation that a significant rises in interest rates would necessitate an increase in cap rates (implied returns on property values), a resultant reduction in property book valuations and trigger a resultant slew of equity capital raises at discounted share prices in order to restore balance sheets to within bank funding covenants.

While the dull shine of copper comes in focus, we shed little light on BHP. Similarly, our focus this week on financial services dives deeper than the four major banks.

Profit Reporting Season – Sandfire, Perpetual and Judo Bank

This week’s Investment Matters will continue to focus on the recent reporting season.

While the dull shine of copper comes in focus, we shed little light on BHP. Similarly, our focus this week on financial services dives deeper than the four major banks.

Profit Reporting Season – Cleanaway, Emeco, ParagonCare and Worley

This week’s Investment Matters will concentrate on key company results as the reporting season winds down. On balance, market strategists have noted that earnings revisions have been neutral across the board, which is better than historical outcomes of net negative earnings revisions by optimistic investment banking equity analysts.

Profit Reporting Season – Ventia, Johns Lyng, Earlypay and Nanosonics

Read key company results as the reporting season winds down. On balance, market strategists have noted that earnings revisions have been neutral across the board, which is a better than historic outcomes of net negative earnings revisions by optimistic investment banking equity analysts.

Profit Reporting Season – Week 2

This week’s Investment Matters will concentrate key company results as the reporting season ramps up.

Profit Reporting Season Update

This week’s Investment Matters will concentrate key company results as the reporting season ramps up.

Early profit reporting season and news update

In last week’s Investment Matters we concentrated on the confession season, the period in which companies make early announcements to the market surrounding material changes to upcoming earnings.

This week’s Investment Matters will also concentrate on news flow and early reporting season results.

Confessions of a corporate earnings season

Most ASX-listed companies in Australia have a June fiscal/financial year-end. Accordingly, those with June and December balance days will tend to present their (half-year/annual) financial results to the market in each of the months of February and August.

Judo Capital – back to the future of banking

As a raft of stocks in the portfolio have been taken over or have successfully met our internal price targets, we’ve been on the hunt for new names to replace.

Perpetual – finding a way to unlock value

In the past year, we have often commented that we’ll exhibit due patience as part of our investment approach. This is required as we often seek to invest in businesses that are significantly unloved and misunderstood and where assets may, therefore be mispriced.

Premier Investments – A deep dive into a new opportunity

In recent weeks, clients will have seen the addition of Premier Investments to their Australian equity sub-portfolios. Famously partly owned and operated (whether formally or informally) by Solomon Lew, Premier Investments is amongst the most successful discretionary retailers in Australian history.

Steadfast in its approach

© 2024 First Samuel Limited The Markets This week: ASX v Wall Street FYTD: ASX v Wall Street Steadfast Group Limited is an Australian insurance broking network that provides insurance broking services to businesses and individuals across Australia and New Zealand. The company was founded in 1991 and has become one of Australia’s largest insurance […]

Growing – in two very different ways

In recent weeks, we heard the mildly alarming statistics that the ASX had fallen to a low in October 2023 of 6703.2, lower than the levels seen in the broad market index at the close of October in 2007 (6770).

Falling share prices – An opportunity (not) to be wasted

This week we highlight a new addition to the portfolio.

Inghams: laying golden eggs

Inghams is the dominant supplier of chicken products in Australia. It is also amongst the largest positions in client portfolios. In the past week, it delivered an update on progress within the business across the first half of the fiscal year.

Lynas gets a rare (earth) licence reprieve in Malaysia

This week, we discuss developments in the critical minerals sector and take a look at Woolworths Q1 trading update and what it may reflect with respect to the Australian consumer.

When should we be worried about worrying? Consumer confidence.

This week we look at Consumer Confidence and Consumer Sentiment and hope to relate it to longer-term historical trends and current portfolio construction.

RBA Speaks – more nuance, slightly less ideology?

On Wednesday, RBA Assistant Governor Christopher Kent gave a speech to a Bloomberg gathering with a title that would surely only excite economists: “Channels of Transmission.”

Consolidation of Newcrest/Newmont – Do we continue to hold?

To provide a more complete investment picture, we will continue to provide some updates on the prospects of our sub-portfolios’ companies as gleaned from our coverage of the ASX Company Profit Reporting Season.

Company Profit Reporting Season – the final instalment

To provide a more complete investment picture, we will continue to provide some updates on the prospects of our sub-portfolios’ companies as gleaned from our coverage of the ASX Company Profit Reporting Season.

Company Profit Reporting Season – the journey continues

To provide a more complete investment picture, we will continue to provide some updates on the prospects of our sub-portfolios’ companies as gleaned from our coverage of the ASX Company Profit Reporting Season.

Company Profit Reporting Season – more companies and colour

To provide a more complete investment picture, we will continue to provide some updates on the prospects of our portfolio companies as gleaned from our coverage of the ASX Reporting Season.

Company Profit Reporting Season continues

In an effort to provide a more complete picture, we will continue to provide some updates on the prospects of our portfolio companies as gleaned from our coverage of the ASX Reporting Season.

Company Profit Reporting Season – Closing Week

As the curtain closes on the end of August, ASX reporting season also comes to a conclusion. We provide some of the more relevant company-result takeaways:

• Perpetual

• Home Consortium (HMC)

• ARN Media (A1N)

• MRM

Company Profit Reporting Season: Peak Week

The ‘peak’ week of company reporting season has just gone by. We provide some of the more relevant company-result takeaways.

Company Profit ‘Reporting Season’

The second substantive week of company reporting season kicked off last week. We provide some of the more relevant company result takeaways.

Company Profit ‘Reporting Season’

The first substantive week of company reporting season kicked off last week. We provide some of the more relevant company result takeaways.

Company Profit ‘Reporting Season’ preview

It’s an intense time of year for equity market professionals. But one that is welcomed because of the opportunity to review financial data, hear about company strategy, assess management and operational performance, and to review one’s own stock selection and analytical prowess.

Lull before company profit reporting season

Late July is when there is a lull in company news, as industrial companies are in communication lockdown before company profit reporting in August. Mining companies are busy releasing production reports and not much else, also ahead of profit reporting.

Out with the old, in with the new

There has been a significant period of de-equitisation in the Australian equity markets in the past couple of years. Our portfolios, and performance, have been the beneficiaries of this phenomenon. Several stocks we own are subject to takeover bids:

Selectivity and Productivity

This week we discuss two major topics. Japan and why we are more heavily invested than global benchmarks and Productivity: why is this a problem for Australia and how does it impact returns?

Going, Going, Gone – the de-equitization of the Australian Equities Market

Two of our investments, Costa Group and United Malt, received confirmation relating to takeover bids this week.

Both takeovers provided support for our investment strategy. This strategy concentrates on finding opportunities where the market fails to price either the long-run asset or the franchise-based value of a company, and instead focuses on short-term earnings fluctuations. In such cases it is often an external party, via a takeover, that unlocks the value.

EOFY, Inflation and Small Caps

The curtain is about to fall on another financial year. FY-23 has been a year of very good investment performance across First Samuel various portfolio strategies.

Clients should expect their Flash Performance reports within 10 days, always noting that all portfolios are individually managed, with different asset mixes and security selections.

Some interesting introductions

We’re always looking for new ideas to introduce into the investment portfolios. A spate of recent takeovers within the portfolio (think Newcrest, Origin, United Malt, Pushpay, Eildon Capital) has accelerated the need for fresh ideas to replenish building cash positions.

Banks and Budgets

A busy week in financial markets given the conclusion of the Australian Bank 1H23 profit reporting cycle and the announcement of the Federal Budget. Our discussion will focus on each in turn.

Conferencing

This week the Australian investment world was dominated by one event – the Macquarie Equites Conference in Sydney. We will provide a quick run through of major themes and highlights from companies to which our clients have exposure.

Sayonara

This week in Investment Matters, we have three sections that provide important updates on clients positions in Eildon Capital, Reliance Worldwide and Mineral Resources.

Over the course of the later part of this week and next many companies will provide updates to the market, including mining companies, smaller companies and those presenting at upcoming investor conferences. We will cover as many as possible of these updates in coming weeks.

O the economic front we discuss the impacts of the review into the RBA that goes beyond the changes mentioned in the headlines.

Battery Powered Portfolios

This week in Investment Matters, we have two news items relevant for client portfolios and a piece designed to assist with understanding how an investment in the portfolio has been restructured

Gold and price of money

This week in Investment Matters we have two items relevant for client portfolios. The first is the revised takeover conditions for Newcrest Mining and the 2nd is the pause in rate hikes announced by the Reserve Bank last week. Again, this week we have the much-needed assistance of Patrick Cooks’ cartoons.

Cheers

This week in Investment Matters we have highlighted three news items relevant for client portfolios. Similar to the previous week, is the enhancement of these stories with the sensational Patrick Cook cartoons.

A little more for the collection

This week in Investment Matters we have highlighted three news items relevant for client portfolios. The highlight of the week however is the enhancement of rather plain text with the sensational Patrick Cook cartoons.

GDP, the RBA decision and some leftovers from reporting season

With reporting season now behind us, Investment Matters returns to cover off on three companies in slightly more detail than would have been possible in recent weeks:

Ventia Services

TPG Telecom

Garda Property Group

The end of company profit reporting season

The final week of reporting season is traditionally occupied by some of the smaller companies with less well-developed internal reporting structures and possibly some news they are reticent to share!

The week also saw the much-awaited update from EarlyPay which is discussed.

Busy week of company news

The third week of company profit reporting season is traditionally the busiest with a range of large companies presenting updates to the market. We have provided some detail on those results important to client portfolios in today’s Company News section.

Busy week of company news, and RBA Governor Lowe commentary

This week saw the first concentrated week of half-yearly results from the largest of the ASX-listed companies. Commonwealth Bank, Wesfarmers, Origin Energy and Seven Group, amongst others in client portfolios, updated the market.

Another takeover bid

Client portfolios benefited this week from another takeover bid this time for Newcrest Mining. A non-binding indicative offer came from another giant global gold miner, Newmont Mining, based in Denver USA.

Strong start to 2023 – The January Effect

In the first of Investment Matters for 2023 we will concentrate on the large volume of news and information regarding portfolio positions.

RBA meeting and the inflation, employment and debt dilemma.

The final Investment Matters of 2022 is a weighty one. First Samuel’s CIO, Craig Shepherd, puts together the critical pieces in the mosaic of interest rates. It is worth the patience needed.

Synthesis from the state of Black Swans and Kangaroo Paws

Following a commitment made last week, I have returned to pen the second in a series on my recent visit to Perth. Most importantly, after almost a decade of stagnation, Australia is once again seeing explosive growth in mining investment.

How the sausage is made

In this week’s Investment Matters, CIO Craig Shepherd provides some insight into the way in which the investment community organises in-person meetings and company access, and how First Samuel makes use of its scale to access the best of such opportunities.

<strong>“Value” on offer?</strong>

A key point during the CIO dinners this month was that long-term value is emerging in the Australian share market (at last). With the aid of a simple chart, we discuss the reasoning behind this and how our clients are positioned to benefit.

Misstep or side-step?

The Reserve Bank of Australia (RBA) is currently an impasse. Will it continue to hike interest rates in lockstep with the US Federal Reserve? Or will it choose to take a divergent path? And what might the consequences (of either approach) be?

What GDP data doesn’t tell investors

This case study focuses on the transition aspects and not the broader benefits of holding a commercial in an SMSF.

Understanding the rise in mergers and acquisitions

When the share-market does not see value or investment merit in a particular stock the stock’s share price will recede. This could be because the company’s earnings (i.e. profit) outlook is poor (e.g. Bega Cheese Ltd) or perhaps the industry in the which the company operates is struggling (e.g. ARN Media Limited).

But often someone or a company will see value where the share-market does not. The logical outcome of this is one of the more interesting aspects of investment: the merger or the acquisition. Or, in jargon: M&A.

How Relevant is the ASX in View of Large Takeovers?

A client recently asked some questions about the affect on the ASX of the takeover of companies by private equity funds and large industry superannuation funds. Craig Shepherd, our CIO, responds.

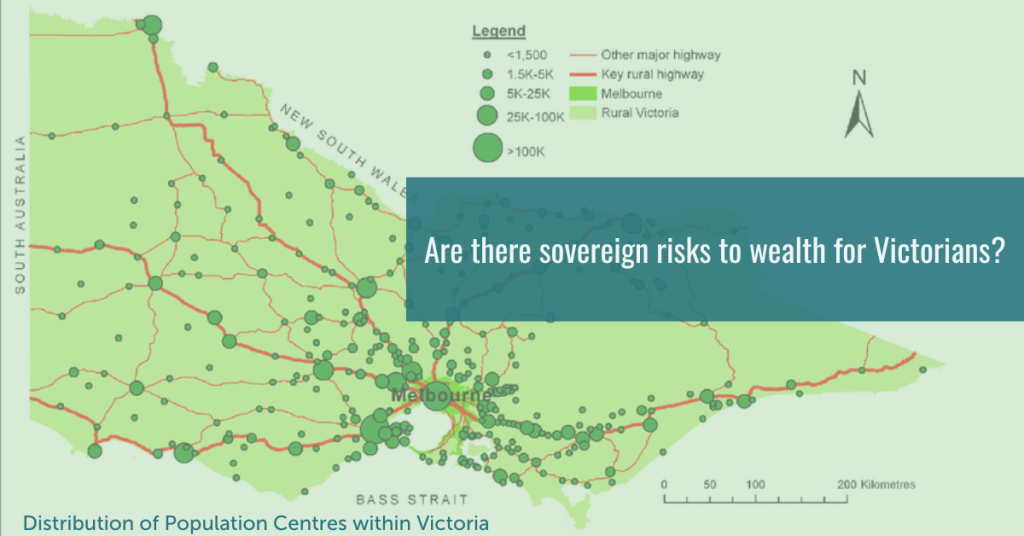

Are there sovereign risks to wealth for Victorians?

The irony is that Victoria needs to invest even more to provide amenity to the expected increased population growth.

Should Victoria fail to invest, higher public transport and health care costs will be the most significant risks to the cost and quality of living of families and individuals in the middle of the income wealth scale.

The difference between equities and other financial assets

It is during years such as FY-23 that some of the lesser appreciated aspects of equity investment come to the fore. For e.g., the ability to adapt and evolve.