The Markets

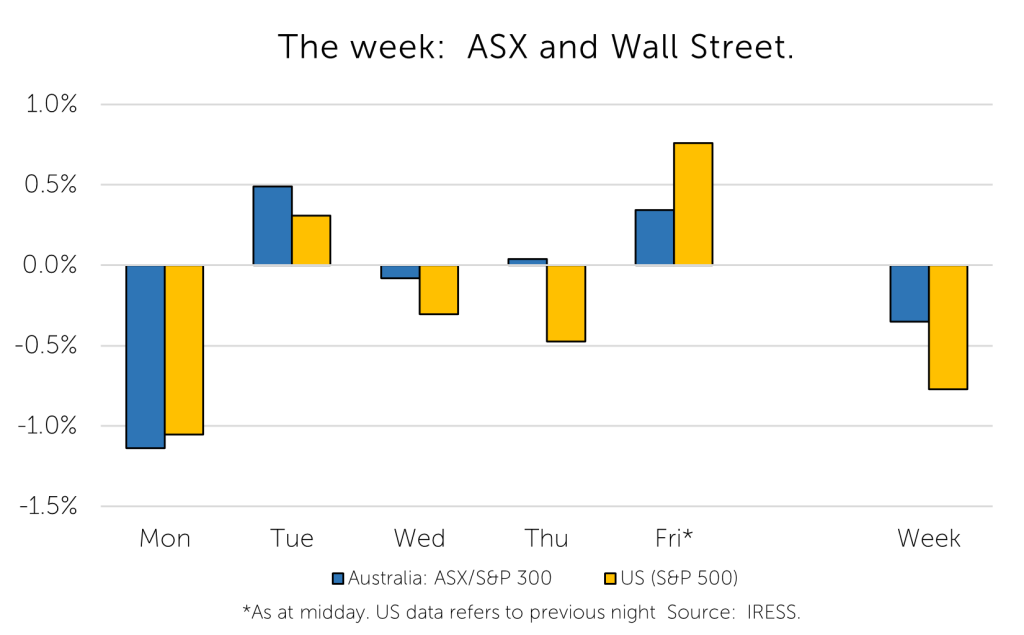

This week: ASX v Wall Street

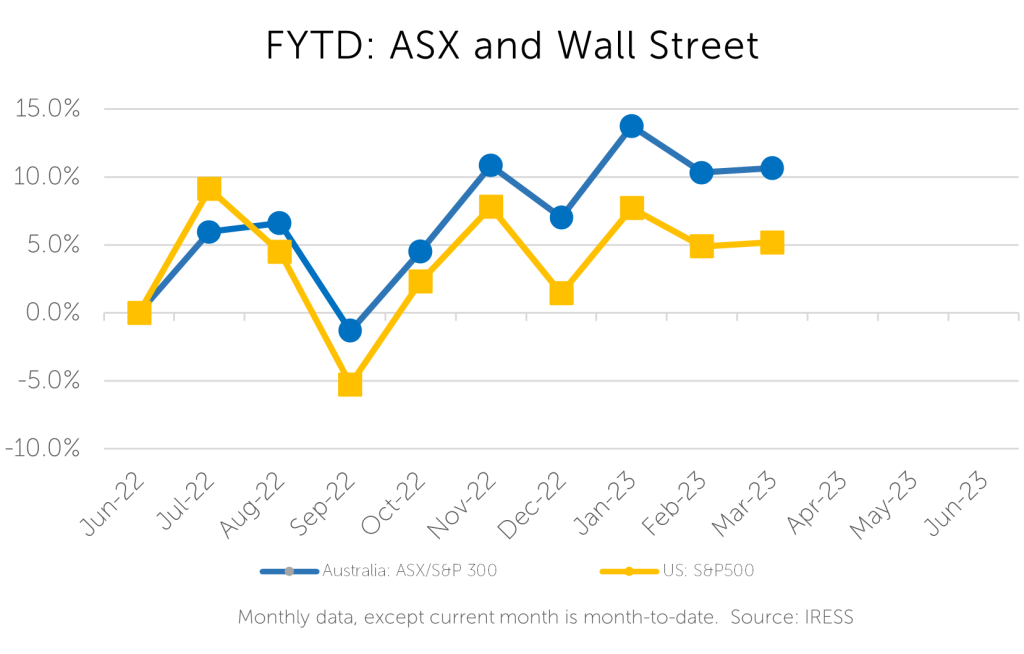

FYTD: ASX v Wall Street

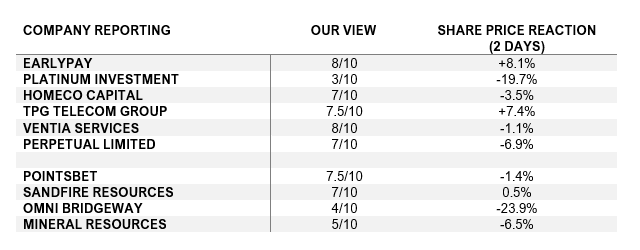

The final week of profit reporting season is traditionally occupied by some of the smaller companies with less well-developed internal reporting structures and possibly some news they are reticent to share!

The week also saw the much-awaited update from EarlyPay, which is discussed below.

The reporting season proved beneficial to clients’ portfolios despite overall market weakness. We were generally pleased with the impact increasing interest rates and higher inflation had on a range of companies we own, such as QBE, Woolworths, Seven Group and Inghams.

Our decision to hold almost no exposure to the domestic discretionary economy proved worthwhile. Those companies provided weak outlook statements that noted the impact of higher interest rates and the wind down of savings amongst domestic households is already biting. Even delivered pizza sales are faltering, with Dominos Pizza stock down more than 33% in February.

Two relatively new additions to the portfolio, TPG Telecom and Ventia Services also presented this week. Both results were impressive and well appreciated by the market. We will cover off on both companies in more detail in next week’s Investment Matters.

Many clients have asked for a deeper dive on reporting companies. And so I have erred on the side of providing too much detail.

A tabular snapshot of the quality and impact of the update for a range of companies is presented below.

The week also saw the release of the Australian Bureau of Statistics 4th quarter of 2022 GDP numbers, the official economic barometer of the economy delivered every three months. GDP growth is of course backward looking, and particularly stale with respect to the impact of more recent changes in interest rates now through household budgets.

Stale it may be, but it does however provide an important view of where we were jumping from today. The GDP result of just 0.5% for the quarter shows that the household sector is already weakening considerably in the face of falling savings and negative shocks in disposable income. This is the data that companies reporting over the past 4 weeks are seeing on the ground now.

In next week’s Investment Matters we will look at the role of debt and inflation within the context of this weeks GDP numbers and current RBA rates expectations in “The consenting adults view of the economy and its downside”.

Company News

EarlyPay – we are patient investors

Invoice financing company EarlyPay, a long time holding, has been the single most troublesome exposure in client portfolios this calendar year. Recapping a brief recent history:

September 2022: it was announced that the CEO would be retiring.

November 2022: at the AGM, the market was informed of expectations for the FY-23 result, reflecting flat net profit (driven by falling margins and a need for increased impairment provisions and rising tax rate), a decline in EPS, but maintenance of a flat dividend.

December 2022: a trading update was released, noting the appointment of administrators and associated large impairment to the firm’s single largest financing exposure. This caused a sharp downturn in the EPY share price.

We noted at the time that the critical update would be in February, addressing three critical issues:

- What is the size of the loss and when will it be reflected in earnings, cash flows and dividends?

- Is the loss ‘once off’ or recurring?

- What are the lessons learnt, and what changes to both management and the board are expected?

On all three grounds we were pleasantly surprised by an update last week:

1. Loss

- a $9.6m specific provision

- the amount owed remain outstanding

- differences between provision and actual final losses always occur: we assume the conservatism and diligence of the new CEO James Beeson through this event, would have extended to the estimation of this provision.

2. Once only?

- the loss (more than 50% of last year’s profit) is a once-off, and it will have a dramatic impact on this year’s earnings (including removing dividends)

- the underlying invoice financing business continues to grow and remains profitable

- the CEO noted that no additional equity was required to buttress the balance sheet in response to the losses announced.

3. Lessons learnt.

- the former CEO is gone

- the Chairman is gone

- we understand a range of responsibilities within the company have changed.

- more clarity on the cause of the failure to limit the size of this exposure is expected through time.

- the company has announced lower limits of exposure to single names

- the company is expected to focus more on the fabulous invoice financing business which is the heart of the business. The addition of trade finance, where profitable and complementary to existing clients, and equipment finance that is selective and standalone, together add profitability to the business.

In the spirit of never wasting a crisis we were also pleased to see the company increase its credit loss provisioning in the remainder of the business. This increase is likely prudent, and represents, in our minds, a degree of catch-up from previous years provisioning.

Three questions remain.

- Is the wind-up process completed without issue and the provisioning accurate?

- Is the remainder of the business growing sustainably?

- Are there additional actions being undertaken that are likely to support profit growth?

The answer to the first? Time will tell.

The answer to the second is a resounding yes, and for the right reasons. In an economy with higher inflation and rising interest rates the quantum of demand for invoice financing will rise with the growth of the nominal economy. As rates increase and cashflow tightens, firms may switch to invoice financing to maintain growth and liquidity. We saw this rise in demand in this half, despite some clear lags occurring better higher demand and the requisite higher net revenue.

The answer to the third came from the CEO. He was clear on the investor call that the company’s renewed focus on invoice financing and movement away from marginally profitable trade finance, will provide many options for balance sheet reorganization. This change to funding mix is expected to have a materially positive impact on FY-24 earnings (albeit off a low FY-23 base).

Additional points we would note include. The core invoicing financing and complementary equipment finance business are the assets that were highly prized by previous suitors in Scottish Pacific and COG (current 20% shareholder).

The company share price has more than halved since the start of September. It is trading at a fraction of the underlying value of the business and its price does not reflect the value of earnings expected in FY-24.

We are patient investors that concentrate on the value of the assets and will continue to do so.

***

Paragon Care (PGC) – better than the average value

Paragon Care has become recognised as a leading provider of equipment, devices and consumables to the healthcare market. The company also offers equipment repair, maintenance, and total equipment management through Paragon Care Service & Technology.

Whilst there is only one Paragon Care, it is actually a combination of a large number (more than 12) separate customer facing brands and service providers ranging across the breadth of medical services from aged care to ophthalmology. It organises itself internally in four pillars:

- Devices

- Diagnostics

- Capital & Consumables

- Service and Technology

In the past 12 months, the company merged with a similar ASX listed provider of capital equipment and services called Quantum. The integration has been successful and both management teams look forward to some of the growth available in Asian markets.

Paragon results this half year have showed growth and, more importantly/necessarily, with improving returns. Execution appears to have improved under the new CEO. While company net profit remains modest (barely double-digit $m currently), management suggests that the company will grow earnings to the $100m in time.

Management intends to support organic growth with merger and acquisition activity in coming halves. This is to cement top two positions in different markets across Asia, albeit previous talk of Chinese expansion seems to have been tempered.

We met with the CEO Mark Hooper and CFO Josephine De Martino in our offices this week. The strategy that is unchanged from previous discussions is a healthy mix of:

- Better internal alignment between the businesses

- Focus on the best opportunities each pillar or sub-unit has

- Adding new companies to strength the four pillars through mergers and acquisitions

- Demonstrating to the market the vale of the combination, within a business that is an order of magnitude larger than today

We generally think that there is better-than-average value in this stock relative to other portfolio holdings at a time when many large capitalisation stocks have significantly outperformed.

***

Mineral Resources – a star performer

Mineral Resources has been a star performer in our portfolio. The stock price is up almost 80% since 30 June 2022! The business remains one of the best ways to play the world’s growing demand for lithium (e.g. used in EV batteries). Additionally, the company is also well positioned to capitalise on the strength in iron ore prices as Chinese demand remains strong.

Importantly too, MIN does more than dig minerals up and ship them off in trucks, but also does other value-added services, as many Australians would lament is an opportunity for many of our mining companies.

Revenues were up 74% on the previous corresponding period, operating cashflow is positive, with capex up strongly as the business develops its downstream lithium conversion capability. Underlying EBIT margins are a healthy 29%.

The result fell slightly short of analysts’ expectation however, with prices (lower) and costs (higher) than appreciated.

In the short-term the price of Mineral Resources will be heavily influenced by the price of iron ore and lithium, however over the medium term one of the aspects of the company that we appreciate is its commitment to innovation and flexibility. One of the slides in its management presentation highlighted the ways in which Mineral Resources is implementing its innovation plans.

***

Nanosonics – proof in the pudding

Nanosonics base business of Trophon high level disinfection, the 1H23 result was what it needed to be – it provided proof of the benefit in NAN’s direct US sales model. The market had been sceptical. However the previous experience with similar changes over the past decade was repeated

- sales were higher,

- margins improved, and

- costs were controlled within expected rages.

Of critical importance is the fact that Nanosonics is now dictating the customer contracts in the United States, it is responsible for gross margin improvements and pricing increases. This result has provided the first visible signs of operational leverage being attained.

The big excitement from the result for the long-term investor was further news regarding Nanosonics next product, Oris. For the first time in many years detailed information and picture of the new device which is used to clean endoscopy probes was provided. (see below)

For a number of years, the investment in Coris offered few near-term positives. There was a view the goal of product release remained just out of reach. The wait appears over.

The market can now start to bake in expectations for growth in this lucrative area, build out scenarios around pricing and likely demand, and fully appreciate the benefits Nanosonics new solution will provide the clinical market.

As analysts and investors nail down their view on future sales, the value of Coris is expected to be included more fully in the stock price. Nanosonics remains a small long-term holding in the portfolio.

***

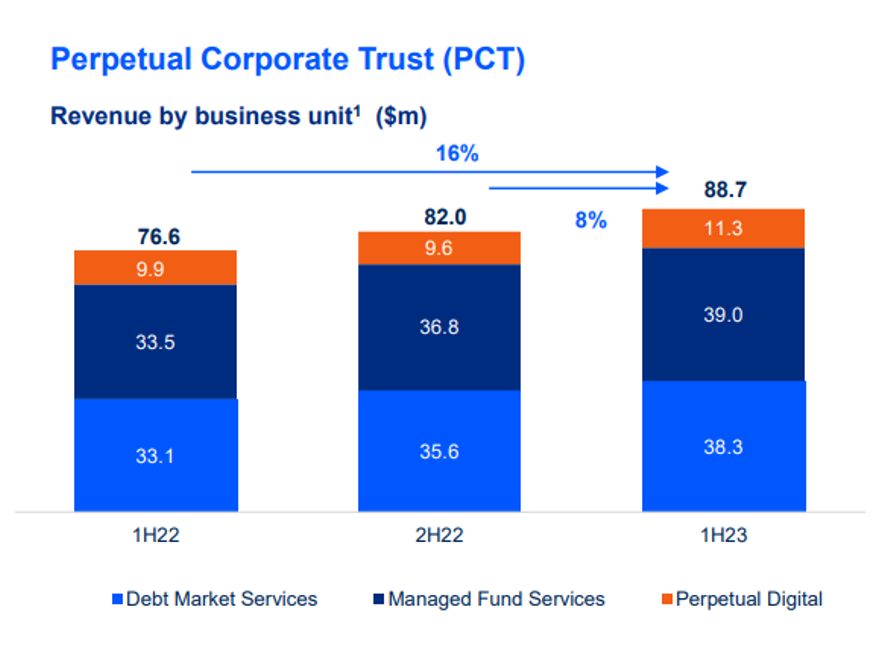

Perpetual Limited – share price too low

Despite 1H-23 revenues being broadly flat with the previous corresponding period, Perpetual had a 55% fall in NPAT due to higher costs.

Primary focus for investors will be on the synergy benefits realisable and risk of client outflows from the recently completed merger of Perpetual and Pendal Asset Management (the former BT Asset Management spun out of Westpac).

Together, the combined entity now has over A$200 billion of Assets Under Management, providing the company with significant scale with which to compete against the industry superannuation funds. But it also makes management across multiple managers, geographies and asset classes a little more challenging.

Given the business cross over, the combination of Perpetual and Pendal is expected to generate $60m of annualised cost savings within the next two years, helping to improve below-peer returns.

Progress with achieving synergies, and the ability to minimise outflows of funds will define near term movements in the stock price. We like the strategic approach that Perpetual is pursuing in asset management, despite the markets current dislike for the sector as a whole. Its assets, including the businesses contributed by the Pendal acquisition, include many with strong investment performance and positive outlooks for growth in funds under management. Each will benefit from the increased scale and efficiency that Perpetual can support in terms of back of house operations and sales optimisation.

The total value ascribed to Perpetual assets in the current share price is too low in our view, if you concentrate on each asset in turn.

One of the most attractive assets within the Perpetual business remains the corporate trust business which continues to grow, generate increasing profits, and develop new products for an increasingly financialised economy. The corporate trust business provides a variety of services and technical solutions for asset owners, managed funds, debt providers and unregister managed investments.

This corporate trust business is subject to less market volatility, has higher margins and higher levels of growth that the traditional Perpetual or Pendal asset management businesses. The combination of risk, profit margins and growth mean this business is worth significantly more (higher multiple of earnings) that the other businesses in Perpetual.

In discussions we had with the CEO Rob Adams and CFO Chris Green this week it was clear the company believes the market is not correctly appreciating the value of Perpetual Corporate Trust in Perpetual Limited as a whole. In time this part of the business could be demerged to unlock value.

***

Platinum Asset Management – weak update

Platinum Asset Management provided amongst the weakest update of client portfolio companies to the market. Rising costs and somewhat unhelpful commentary in the media from the founder weighed heavily on the stock price.

Whilst we didn’t like the cost growth, the pleasing aspect in the performance of the past six months is the underlying investment performance in key Platinum products.

The flagship Platinum International Fund (PIF) outperformed its benchmark by 15.6% over the past year and the Platinum Asia Fund (PAF) outperformed its benchmark by 4.7%. Often better performance stimulates demand for investment products, higher subsequent revenue and profits.

However, strong short-term performance and positive flows in funds under management (FUM) do not necessarily follow. In fact, funds flow can often be strongest when performance has already peaked. In this case the high conviction views that have driven performance are already well understood by institutional clients, so new inflows may emerge in coming periods.

The trend towards consolidation in the funds management sector in Australia is particularly relevant for Platinum. Regal Funds management recently emerged with a 5.5% stake in Platinum, and we believe consolidation will generate significant value, at least in the short-term, where the two company’s assets combined.

***

Omni Bridgeway – watching closely

Omni Bridgeway is an interesting company which in essence funds the cost of legal cases in exchange for a share of the proceeds in the event of successful litigation. It operates primarily in Australia, the US and UK.

Value in these purchased legal ‘assets’ can be realised in 3 primary ways:

- Win/Loss of a case

- The case is settled.

- The interest in the case can be sold off before conclusion of the litigation.

Recent results for the company have yielded disappointing returns, with Covid causing case delays amongst other complications. We are attracted to these earnings streams, whilst volatile they are not correlated with broader market conditions which makes for better diversification. However, we also need to see these earnings appear within a reasonable timeframe.

Further complicating things for investors is the announcement that the long-time CEO Andrew Saker, will be standing down and transitioning out of the company over the next 12 months. This appeared to spook the market, with the stock price falling almost ~19% on the day of its result announcement.

We have met with both the outgoing and incoming CEOs at First Samuel offices this week, and with senior management to gain comfort on the future strategy and confidence in the markets that Omni is operating. This is a position we will continue to review.

***

Emeco – waiting

The Emeco result was relatively uncomplicated. Recent updates to the market, and meetings we had with management and industry players in WA at the end of last year, meant few surprises were likely.

What did surprise was the departure of Thao Pham, the current CFO and past key negotiator of finance and corporate deals. Whilst the appointment of the new CFO ticks all the boxes, we expected Emeco to have lost critical human capital with Ms Pham’s departure.

On an operating basis, the company continues to fall short of our medium-term expectations for cash flow. Weak cash flow was the result of

- a bad debt charge that was previously flagged, and

- the reorganization of the Pit’N’Portal assets.

Apart of firm specific issues, industry conditions appear favourable, and the market brushed off the weak cash flow.

We remain optimistic for companies in this space of mining services and equipment hire, especially in Western Australia. The tight labour market, inflation in the price of capital goods from sources like Caterpillar, and strong investment outlook for miners, all point towards stronger revenue growth for companies like Emeco.

Waiting for Emeco to execute on such opportunities has not been fruitful for the past months.

***

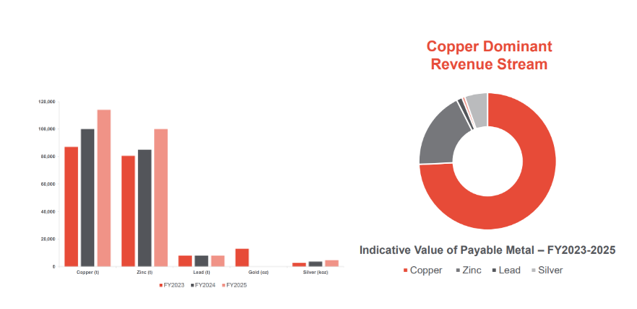

Sandfire (SFR) – a strong copper investment

Sandfire had pre-announced elements of its 1H-23 results, with EBITDA falling due to higher development and mining costs.

Sandfire is a business in transition, having recently closed copper mining operations in Australia and will soon begin production (April-June) at a new world class copper mine in Botswana (MATSA). Additionally, the company continues to operate another world-class copper mine in Spain (Motheo).

In aggregate, Sandfire still remains one of the best ways for investors to gain leverage to the growth in demand for copper (and zinc). Copper is critical in the electrification of industry.

The share price of Sandfire has recently been volatility along with the price of copper. As the market waxes and wanes around the risk of a global recession, the copper price follows suit. We remain attracted to the long-run outlook for the copper price rather than its short-term movements.

***

Pointsbet (PHB) – emerging opportunity

PointsBet Holdings announced its 1st Half 2023 financial results on Tuesday. Nearly all of the key operating metrics, including revenue and marketing spend, had already been announced at the end of January.

Additional information included an update on operating operations and gross margins. The release also provided an additional opportunity for analysts to question the company’s plans and current conditions with management.

The market impact was dramatic, but very short-lived. After falling more than 20% during trading on Tuesday the share price was back to the levels prior to the announcement by the end of Wednesday.

PointsBet continues to pursue its growth plans in the new US betting market, a market that is growing state by state, month by month. Within a decade the market will move from complete outlawing of sports betting outside of casinos, towards a market like Australia and the UK.

PointsBet already operates in Australia and is packed full of experience in rolling out digital gaming solutions worldwide. Consistent with the evolution of most new markets, the opportunity for an experience company to build brand power and expertise in the US has attracted many players.

When the potential market size is as large as the US, many players emerge in the early stages of the industry. Some will fail, others will merge with better operators, and in time a minority will thrive. PointsBet is an active player in the early stages of this market evolution.

Being at early stage of this new industry, the fight for customers, the battle to secure brand awareness, and the capacity to adapt business models that work in other countries, all cost an enormous amount of cash. PointsBet continues to lose money as it builds.

This investment phase is far from complete, and new states are opening up gradually, the critical issues for PointsBet remain:

- how much funding runway (capacity to sustain loses) does the company have

- what is the best use of these limited funds

- in the short to medium term, is PointsBet willing to sell its successful and profitable Australian operations to fund the investment in the US.

Time will tell, however, on balance, we see the opportunity is worth significantly more than the current share price, and worthy of an, albeit small, position in the portfolio.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.