© 2024 First Samuel Limited

The Markets

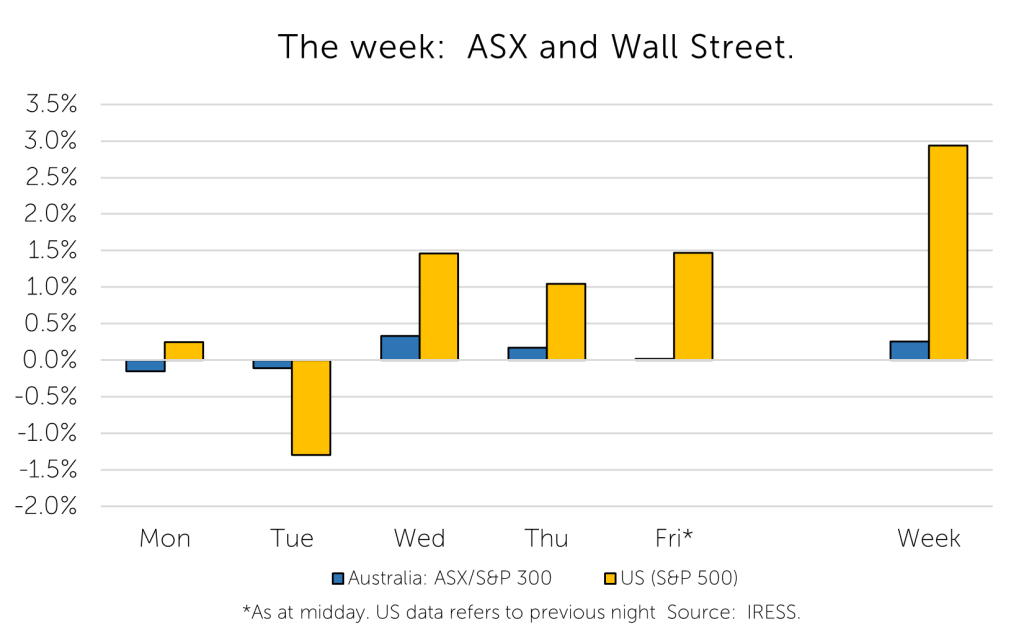

This week: ASX v Wall Street

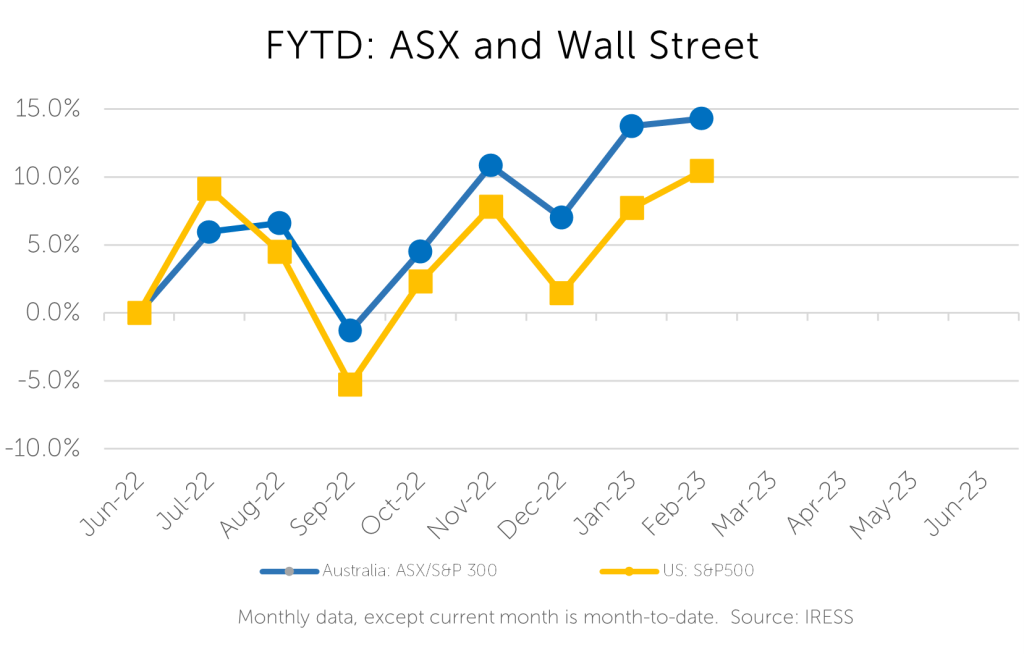

FYTD: ASX v Wall Street

What’s in this Issue

In the first of Investment Matters for 2023 we will concentrate on the large volume of news and information regarding portfolio positions.

Overall market commentary, including analysis of the strong markets in January, will be available in this month’s CIO Video Update (to be sent next week).

Late January and early February marks the start of the company profit reporting season, the period in which many companies provide detailed financial reports for the previous period, along with an update on current conditions and imminent plans.

With significant uncertainty regarding the outlook for the global economy and prevailing interest rates impacting market from the top down, it will be refreshing to concentrate on the day-to-day strategic and operational aspects that drives long-term value.

January is also the time that mining companies provide all-important production updates that provide critical information about the efficiency of mining operations and the realised prices for the materials they produce.

So, let’s kick off with company news. Following this review of major announcements, there is also an update to the Alternatives sub-portfolio. It contains both goods news on receipts of funds from a recent sale of Patties Foods, along with a brief outline of a new position in portfolios.

Company News

Here There and Everywhere (HT1) – good news

HT1 provided good news to begin CY–23 with the announcement that it had sold its stake in Soprano Design for $66m in cash. The proceeds are higher than our estimate of the value of the 25% stake and the sale has occurred substantially ahead of schedule.

Soprano was a high-quality business, in a growing market of internet advertising. However, the value of HT1 of the stake always suffered from the lack of control regarding the direction of the company. As such a sale has been the best course of action for some time.

HT1 shares have sold off heavily over the past six months as the broader market worries about recession risks in 2023. Based on positive recent company updates in December and historic experience with mild Australian downturns the worrying seems overblown.

Following the Soprano sale, we estimate the company will return to being ‘net cash’ (i.e.. no net debt), a strong balance sheet position for a media stock, especially considering further industry consolidation is likely in coming years

***

EarlyPay (EPY) – disappointing news

EarlyPay (EPY) is a listed financial services company engaged in invoice financing. It also has smaller turnover in equipment and trade financing.

EarlyPay delivered a disappointing update prior to Christmas, which we covered in the January CIO video. Click here to listen to that segment for a quick refresher.

The core business within EarlyPay is one that generates significant revenue and profits, this value is not currently reflected in the share price. We will remain patient as we have previously been. On those previous occasions material outperformance was delivered through a mix of strong operating outcomes and corporate actions. We expect the same on this occasion.

***

Nanosonics (NAN) – good news

Nanosonics is an infection prevention company that produces a unique automated disinfection technology, the trophon® device, for high level disinfection of ultrasound probes. The trophon, is now available in most major markets for disinfecting obstetrics/gynaecological probes. There are over 30,000 installed units worldwide. The company benefits from not only original equipment sales, but also increasingly upgrades to older units, along with the ever-present demand for consumables needed for ongoing usage.

Nanosonics pre-released their 1H-23 results in late January, confirming growth in revenue from both capital equipment sales and consumables. Critically, in an inflationary environment the company demonstrates pricing power. The update resulted in upgrades to market expectations for the following year, and critically additional comfort around the recent restructure of the parts of its American business.

We had always been comfortable with the evolution of the business in US having experienced two previous rounds of change over the past decade. Each time change provided Nanosonics with more independence, better pricing power and increased control over its marketing and supply chains.

The market was less certain, however, and the pre-release is expected to provide comfort. Critical catalysts for the company in the next 12 months include the imminent commercialisation of the CORIS product.

The small portfolio position in Nanosonics provides important exposure to the health care industry in general, and its associated growth. It also provides exposure to specific innovation capacity that will be increasingly important as the risks of poor disinfection are increasingly understood globally, not just in the US and Australia.

***

Ioneer Limited (INR) – good news

Ioneer is a small lithium/boron producer in the development phase, based in Nevada, USA.

Other than the bright future for lithium, we hold our stake in Ioneer for 3 primary reasons:

- We were able to purchase stock in INR at a substantial discount to its fundamental value

- We believe that the geopolitical value of onshore lithium mining in the US is likely to attract significant political support

- We believe that in addition to explosive demand for locally sourced lithium, the future use cases for boron represent a potentially significant revenue source that the market currently discounts.

News on the 16th January provided support for our 2nd contention. The company received a Conditional Commitment from the U.S. Department of Energy following finalisation of a term sheet with the DOE for a proposed loan of up to US$700 million to develop the Rhyolite Ridge Lithium-Boron Project.

Along with funding already secured, this loan dramatically reduces the uncertainty regarding the company’s capacity to fund the capital required to start mining.

***

Fischer and Paykel Healthcare (FPH) – good news

Fisher and Paykel Healthcare (not the dishwashers!!!) is a leading designer, manufacturer and marketer of products and systems for use in acute and chronic respiratory care, surgery, and the treatment of obstructive sleep apnea.

The company has achieved tremendous growth over a long period and the outlook for the use of its respiratory products within a range of hospital and in-home settings remains buoyant. During Covid, as you may suspect, demand for its product sky-rocketed, along with the share price. However, in 2022 the market become concerned about the “COVID hangover” – just how much would sales fall, seeing the stock sell off by more than 50%.

This sell-off provided our clients with an opportunity to purchase shares for a reasonable price.

Within this context of uncertainty, the company provided an update. The FPH update noted that they expect FY-23 operating revenue guidance within a range of $1.55-1.60 billion – this was approximately 5 per cent higher than the market expected. The elevated expectation has seen the stock rally appreciably.

***

Sandfire Metals (SFR)

Sandfire is a core holding in clients’ portfolios due to its exceptional range of global copper assets. As the world continues with electrification, demand for copper is expected to continue to grow. Finding high quality resources to mine efficiently and cost effectively continues to be a global challenge. Within such an environment, the Sandfire assets are becoming increasingly valuable, and the price realised for copper remains elevated.

To know more about Sandfire, you might like to check out the Deep Dive in last month’s CIO video. Click here.

Sandfire’s share price has consequently benefitted; it has approached our valuation in recent weeks we have reduced our holding.

***

Mineral Resources (MIN) – good news

Mineral Resources is a major lithium and iron ore producer based in Western Australia. It has been a strong portfolio performer in FY-23, as global lithium prices have surged, and iron ore prices remain elevated.

The company reported their 2QFY-23 result in late January, and it was another encouraging result. The highlights included an above-expectations outcome in the realised prices received for both iron-ore and Mt Marion spodumene (lithium). Mt Marion expansion was pushed back due to supply disruptions and labour shortage; capex remains unchanged at A$120m (100% basis).

In recent weeks, global analysts have continued to upgrade their medium-term expectation for lithium pricing. Along with Independence Group (IGO), Mineral Resources is likely to continue to benefit from elevated pricing in the short-term, as well as resilient future revenue from the establishment of down streaming processing, which is coming on line.

***

PointsBet (PBH) – treading water

PointsBet is originally an Australian based wagering company that is now heavily investing in a rollout of operations in the newly created US wagering market.

PointsBet provided the market with an update on the critical 4Q of calendar 2022 operations. This period encompasses both the Australian Spring Carnival and parts of US NFL and NBA seasons. We were pleased with a number of reported trends. Although the market reacted negatively on the initial impression, the stock had recovered much of losses as we write.

The trends we appreciated from the operating result included;

- Continued growth in client/user numbers in the US

- The restructure of the marketing agreement with CNBC, which facilitates a more measured marketing spend over the next 5 years

- The tech platform that drives the PointsBet product remains attractive to industry participants and clients alike

- The company retains significant financial runway for growth in subscriber numbers; its path to cash flow breakeven in critical markets appears achievable.

The components that disappointed include operating costs and overall market share in newly opened markets.

Whilst the stock price has been disappointing over the past 12 months, we retain a position in the company for 4 core reasons;

- Legal wagering in the US is still in its infancy with legalisation in barely a dozen states at this time

.

- The sport betting and informal wagering landscape in the US is consistent with markets that are early in the learning phase. Customers are learning how to approach the offers and providers are learning about client preferences. Turnover per adult is a fraction of more mature markets.

- Future consolidation of firms within such a nascent industry is a natural outcome that we have seen in Australia 15 years ago, and almost any time whenever a new industry emerges. Whilst every car company wanted to be Ford in the early 1900’s, many failed and more still joined together to benefit from initial investment and specialization to create the General Motors of today. We expect that PointsBet will play a critical role in such consolidation.

- PointsBet has a strong Australian business which is worth a considerable amount – regardless of the success of the US operations. This view has been franked by recent speculation about offers for this business.

Note: only clients without a gambling prohibition hold PointsBet.

***

TZ Limited (TZL) – disappointing news

TZ Limited provided a disappointing update to the market in late January. The announcement included a change to the CEO (with a former CEO taking the reins), and changes to the Board.

Following several years of IT investment, the company faces a critical juncture as it transitions its sales model. TZ Limited was a company that sought revenue primarily from once-off sales of capital goods (lockers and locking technology), along with revenue from maintenance and updates. Aligned with general trends in software provision and progressive service propositions, TZ has embraced a more sustainable monthly recurring revenue model. The benefit of sustained yearly revenue comes at a cost of missing larger lumpier upfront payments.

This is occurring at the same time as major upgrades to the product offer are being delivered. The resulting squeeze on cash flow presents a challenge to management. However, despite short-term concerns the shift towards significant levels of recurring revenue is likely to sustain long-term value creation, especially in the hands of a larger acquirer.

Update on Alternatives and New stock position

Australasian Foods (Patties Foods) (HOLDCO) – good news

Following the sale of Patties Food by Pacific Equity Partners (PEP) in October 2022, we awaited news on the exact proceeds that would be delivered back to clients as the PEP ownership structure was unwound.

Pleasingly the return in January 2023 was $1.3045 per share. This was 8.7% higher than the average anticipated $1.18 to $1.24 from previous communications.

The remainder of the proceeds, a little more than 20c per share, will be paid 13 months after the initial sale. Whilst there is some uncertainty about the final amount payable, we anticipate a healthy return on an albeit small position.

Note that the proceeds from the sale are recorded as a return of capital at this stage, with the finalisation of the sale of the asset not completed until final payment. As a result, a cursory glance at the portfolio may suggest that the current value (that is the value of the remaining $0.20+ per share) is far lower than the original purchase price, implying a loss on the position since purchase.

This is not the case, as the total proceeds will be significantly in excess of both the original purchase price, as well as the carrying value of $0.65 as at June 2022. The final cost price and the CGT implications will be updated in June 2023 and finalised in 2024.

***

Regal Tasman Market Neutral Fund – new position

We have added an investment in a managed equity fund to the Alternatives sub-portfolio. It is a ‘Market Neutral’ strategy and is consistent with the aims of the Alternatives sub-portfolio.

Of critical importance is the low correlation this fund has demonstrated with a basket of local and global companies (0.24 with ASX200 and 0.28 with the MSCI World). This low correlation well aligns with the general characteristics of an Alternatives investment.

Market neutral strategies are designed to capture the value from individual stock positions, rather than market moves in general. As a strategy it is successful when the fund differentiates between companies that do well and which companies will do poorly from similar industries.

For instance, Regal may prefer National Australian Bank (NAB) over Commonwealth Bank (CBA). As such the fund will buy exposure to NAB and sell exposure to CBA.

Market neutral funds are perfect investments in markets that are approaching fair value, and at times where significant reshuffling of expectations are taking place. We contend this is such a time, and clients would appreciate this investment within their Alternatives sub-portfolio.

The Regal fund has returned 11.1% per annum since June 2007.

The focus of the Fund is on listed investments in Australia, with a portion of the fund also invested in the Asia-Pacific region and other global markets.

The position is approximately 7 per cent of clients’ Alternatives Sub-Portfolio.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.