© 2024 First Samuel Limited

This week’s Investment Matters will concentrate key company results as the profit reporting season winds down. On balance, market strategists have noted that earnings revisions have been neutral across the board, which is a better than historic outcomes of net negative earnings revisions by optimistic investment banking equity analysts.

While the earnings revision cycle has been kind this half, what has also been notable has been the level of volatility in share prices, which has seemingly been more pronounced than ever. Simply meeting earnings expectations has not been enough for some stocks who had share prices a little ‘ripe’ with expectation of future earnings estimate upgrades. In some cases, a mere meeting of near-term expectations has been met with a sell-off of >10%!

Read previous week’s Investment matters about Profit reporting season.

The Markets

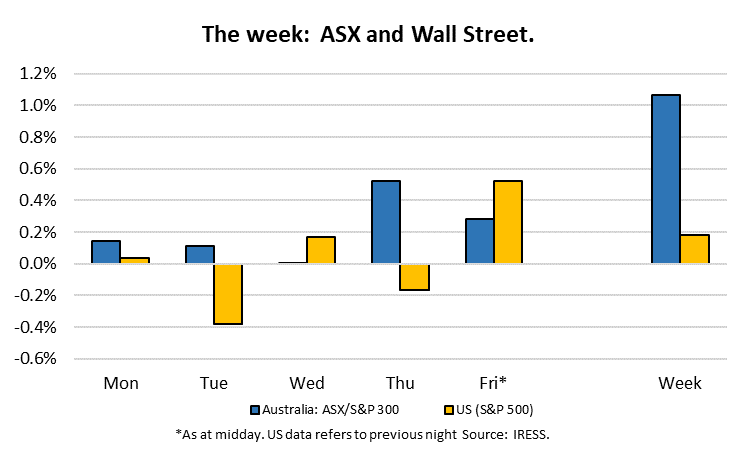

This week: ASX v Wall Street

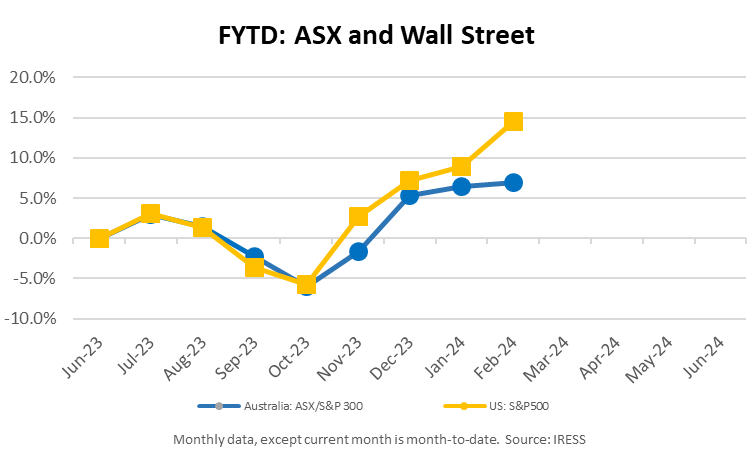

FYTD: ASX v Wall Street

Ventia Profit reporting (CY23 result – Positive – Share Price up 12 per cent)

Ventia is one of the largest essential infrastructure services providers in Australia and New Zealand. With over 35,000 workers, Ventia entia operates across a broad range of industry segments, including defence, social infrastructure, water, electricity and gas, environmental services resources, telecommunications and transport.

Ventia has proven to have been a strongly performing investment since entering client portfolios, and we remain attracted to this type of “people businesses”. We believe that demand for the type of services Ventia provides will continue benefit from population growth and the adoption of new technology and oversight to previously unstructured and low productivity work.

The CY23 result once again proved the strength of the model with profits (NPAT) coming in above guidance. More pleasing for the market was guidance for continued growth next year of 7-10% NPATA growth guided for calendar 2024.

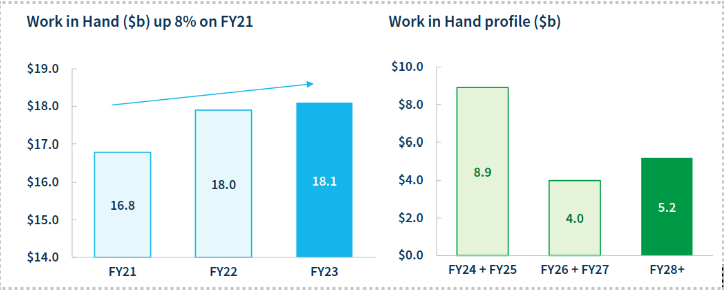

Ventia operates under contracts from clients, each of which needs to be regularly renewed. A critical indicator of the volume of the future is called Work in Hand (WIH). As investors, we would like to see a growing, healthy balance of WIH. The company reported WIH at $18.1bn vs $17.5b at June 30.

The chart below shows WIH since 2021. Note that much of the WIH is long dated, with $5.2bn of contracted work relating to contract that extend past 2028.

The company’s final dividend of 9.4cps was also higher than expectations.

There was keen interest in the management discussion that accompanied the results. Management noted the healthy market fundamentals growing at a 6.6% CAGR.

The simple facts are that despite pressure on government budgets the scale of population growth and service provision demand for schools, roads, hospitals and community infrastructure is constant.

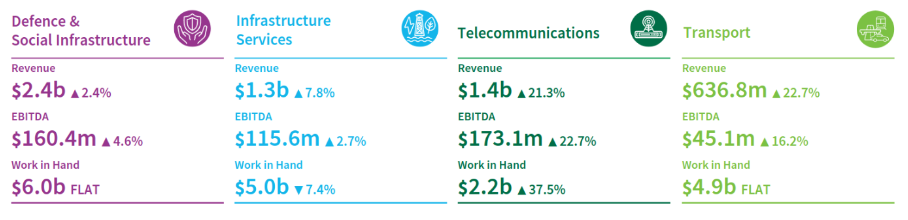

The business operates across four key segments. We were pleased by the progress made in Telecommunications (revenue up 21.3 per cent) and Transport in CY23. Telecommunications tends to secure the highest margins but has the smallest duration contracts. Work in Infrastructure and Transport has slightly lower margins but longer contracts.

First Samuel impressions

We were pleased by the result and new guidance. Ventia is a relatively low risk position, due to the diversity of its clientele, strong WIH and industry fundamentals. We remain attracted to the company as a straightforward way to benefit from population growth.

The stock price has, in the past 12-18 months moved from being very cheap to relatively well priced. We have taken some opportunity to lighten the position.

What they said

“VNT continues to build a track record of earnings delivery aided by defensive, essential services revenues and a strong risk management and cost focus. Telco the standout with 23% EBITDA growth on 21% rev lift driven by high contract volumes (Telstra/NBN) and ramp-up of new contracts (eg, SKAO)…… Balance sheet is strong at 1.2x which provides optionality re bolt-on acquisitions and/or additional cash returns to shareholders. We note VNT’s disciplined growth focus and its 75% div payout ratio already provides good cash returns.” Macquarie

Johns Lyng Profit Peporting (JLG) 1H24 result

Met expectations – stock price down 12% since result, but up 2% in 2024

Johns Lyng Group entered client portfolios in 2023. It is the leading provider of building infrastructure and maintenance services in Australia, providing catastrophe/emergency repair services, insurance restoration work, fire services and the like. It is a business that has successfully grown via a series of acquisitions, with successful expansion into New Zealand and, recently the US.

First Samuel impressions

The core trends of the business remain strong in terms of revenue growth and cashflow generation. The underlying revenue growth of the business was upgraded within company guidance for the FY24 year.

Cyclicality, due to Catastrophe work, adds to earnings volatility, and the business is cycling off a substantial weather event period in FY23, causing earnings estimates in this result to be missed.

While the market also reacted nervously to higher levels of investment in the US business and softer 1H24 results accordingly, the long-term growth story and track record remain intact in our eyes.

As we recently called out in an edition of Investment Matters earlier this year, Johns Lyng was recently added to the insurance repairer panel of Allstate, a top-tier US market participant and one of the top 20 insurers in the world. This looms as a significant boost to its prospects in its US business.

What they said

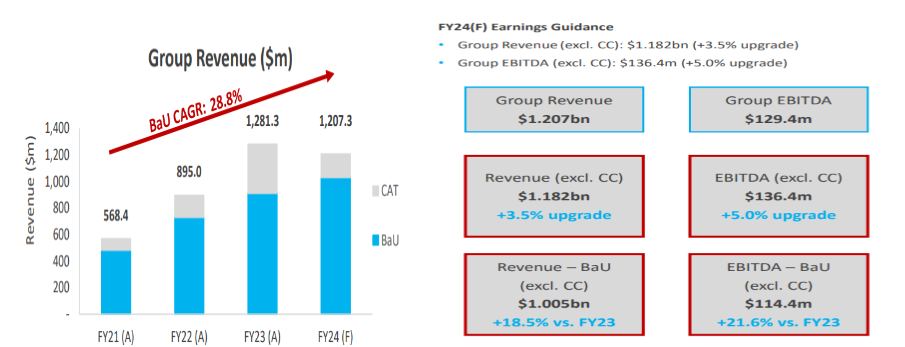

“ FY24 guidance, ex run-off business, was upgraded, with revenue +3.5% and EBITDA +5%. Guidance excludes further CAT contract wins. The upgraded guidance implies 18.5% revenue BaU growth (excluding CC segment in run-off) and 21.6% EBITDA BaU growth (excluding CC segment in run-off). Group BaU revenue CAGR is 28.8% (FY21-24E).” Macquarie

Earlypay (EPY) 1H24 result

Earlypay is a long-held but now a relatively modest portfolio position. FY23 delivered a disappointing operational performance, featuring a significant loss incurred on a fraudulent exposure to an Adelaide-based company called RevRoof, which wiped out the majority of earnings. Accordingly, the share price response reflected this, falling by more than half in the year to 30 June 2023.

We, and the market, have anticipated improved fortunes for the company in 2024. However, the 1H24 result proved a bit of a set-back for a recovering share price.

The result

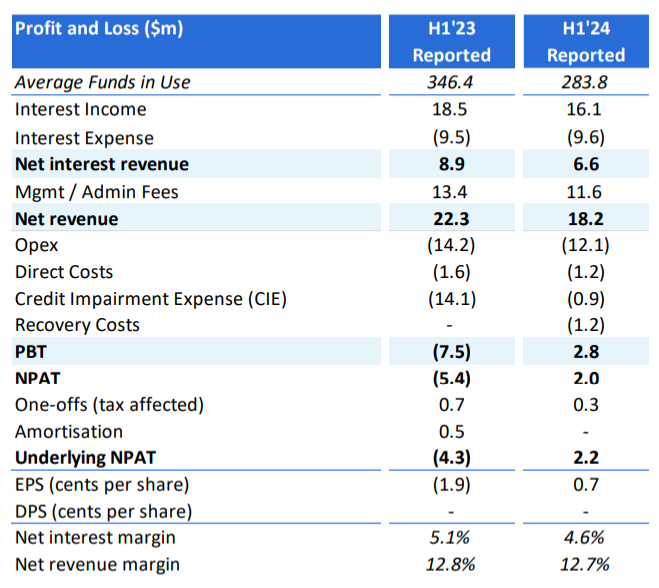

The following table highlights the impact of RevRoof on the reported result in 1H23 and the return to profitability (Underlying NPAT) in 1H24. Despite the rebound, the business is smaller (average funds in use), and the short-term net revenue has fallen from $22.3m to $18.2m.

The positives

The company returned to profitability, resolved the outstanding issues with RevRoof, and acquired a competitor Timelio. Critically management has renegotiated its funding agreements (with major banks), reducing its cost of funding going forward.

The company is well capitalised, net tangible asset (NTA) is now 14.5c only a small discount to the current share price, and the company has cash to deploy to a variety of possible uses. Senior management and the board are refreshed and now focussed on executing future growth plans.

The negatives

It is clear from both the presentation made to markets, and our discussion with senior executives this week, that the firm pivoted towards a lower risk appetite. In and of itself it should not be considered too problematic, even sound in principle given a clear need to recalibrate portfolio exposures to a more appropriate size. However, its execution (to lower risk) needs to be managed within a broader long-term strategy regarding customer proposition and capital management strategy.

Slower growth in receivables and lower margins has been the short-term impact to EarlyPay, its impact on customers and future growth is yet to be fully appreciated.

Going forward

As a significant shareholder we’re playing a patient game with this name, but very clear with management about potential courses of action going forward. A higher return on equity is required, and there are many ways to achieve this. Standalone businesses of this scale are often better placed as subsidiaries in much larger firm that can leverage broader financial services.

The large number of alternative banking business, neo-banks, and conglomerate financial services which would benefit from quality of EarlyPays clients, systems, balance sheet and niche expertise is not lost on us.

What they said

“Although the 1H24 result was better than expected at the headline NPAT level, the composition differed from our expectations. Lower Average Funds In Use (AFIU) and associated revenue have been offset by lower Credit Impairment Expense (CIE) provisioning than we expected – loss provisions, bolstered in FY23, have been used to absorb actual write-offs in 1H24. With the benefits of refinancing now largely offset by lower margin Timelio customers, we now look to EPY to recommence growth in the flagship ITF business to return earnings to historical levels…” Henslow

Nanosonics 1H24 result)

Nanosonics delivered their 1H24 result only weeks after updating the market of a significant reduction in expected sales and profits in FY24. The combination of the update and results has seen the stock fall 38% since the peak in late January.

The significant reduction in share price isn’t due to a collapse in profits or sales but a reaction to a rapid reduction in growth, which has led the market to re-assess medium-term prospects and, consequently, the appropriate multiple of earnings to value the stock at.

As a reminder, Nanosonics produces the leading global Trophon system for high-level disinfection of medical probes. The Trophon sits side by side with ultrasound machines worldwide, providing healthcare professionals with an efficient and effective workflow solution to cleaning instruments used repeatedly. The company generates revenue not only from the sale of the units but also from consumables required for each use.

The company’s second product, Coris, currently seeking FDA approval, will address the endoscopy market. The company generates no revenue from this product yet but still faces ongoing research and development costs.

For several reporting periods, the company has helpfully provided the profitability of the underlying Trophon business. The update in the 1H24 result again highlights the strong profitability of the core business. Splitting the company into a business with an existing product and another still in product development, highlights the value we continue to see.

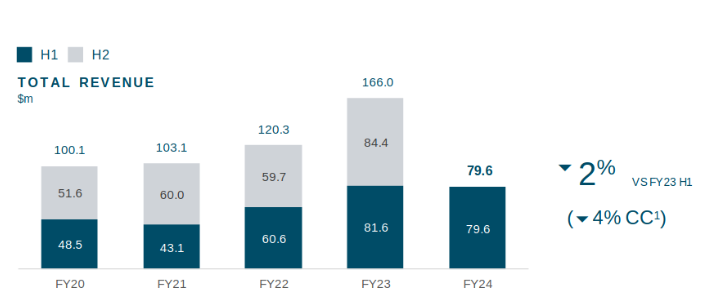

The reduction in revenue that Nanosonics has experienced is shown in the following figures. From fast paced growth of previous years revenue fell in 2024 by 2%.

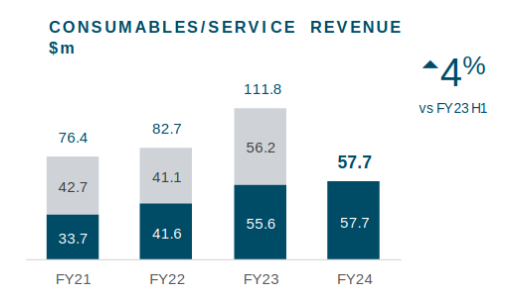

Total revenue has fallen due to a slowing in the number of new units sold – despite only increases in the amount of consumables sold from the operation of the existing units.

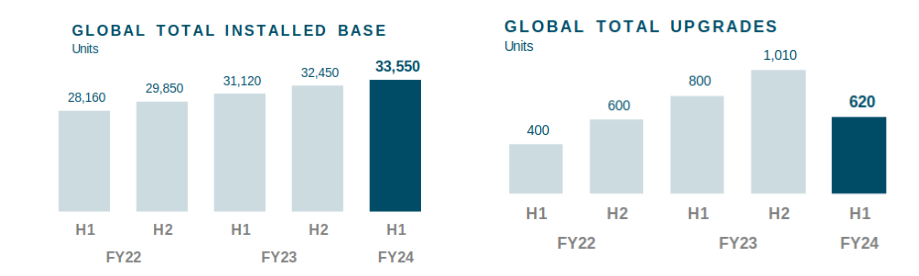

The figure on the left below shows the global installed base is up 1,100 to 33,550 units (up 3% in the last six months and 8% in the previous 12 months). The pace of growth was hit by a slowdown in the US as hospitals faced delays in funding which flowed through to the pace of order fulfillment at Nanosonics.

The pace at which upgrades have been deployed also slow somewhat. The market had expected the upgrade cycle to have continue to accelerate at a faster pace than implied in the 1H24.

Critically however the consumables revenue , which is very high margin (>80%)continues to grow.

The company now has 49% market share in the US and is now focusing on increasing Trophon sales into existing sites (i.e., into multiple departments in each hospital), and into new sites with alternative procurement methods. Previous visit we have made to the US hospital sector suggests that this course of action will be successful, the market is not currently convinced.

In addition to outlining new sales goals, the company reduced its planned expense growth. We were pleased by this outcome, as a reduction in the spending on other parts of the business would better manage the financial cost of delays in the Coris rollout.

What they said

“We upgrade Nanosonics … to OVERWEIGHT … Market sold Nanosonics off because the company announced concessions (e.g. volume discounts, alternative acquisition models) to enhance both installed base (IB) additions and upgrade sales. We assess a market over-reaction to gross margin uncertainty. We’re seeing it as a concessionary, rather than structural, change; and a long overdue stimulus for consumables and services earnings….” Wilsons

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.