© 2024 First Samuel Limited

This week’s Investment Matters will concentrate on news flow and early profit reporting season results.

In last week’s Investment Matters we concentrated on the ‘confession season’, the period in which companies make early announcements to the market surrounding material changes to upcoming earnings reports.

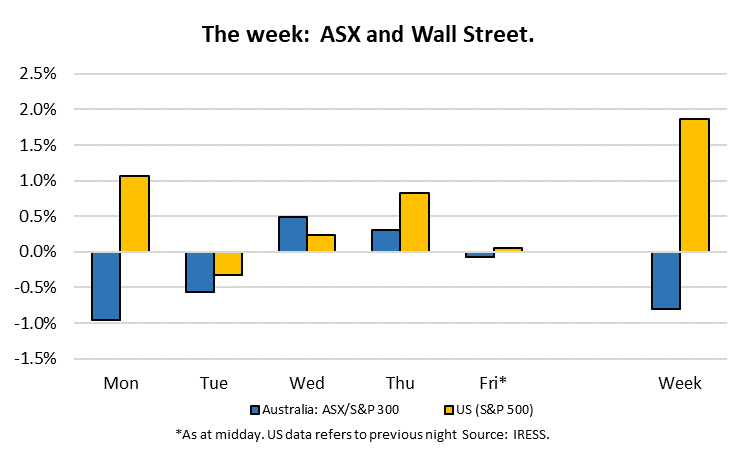

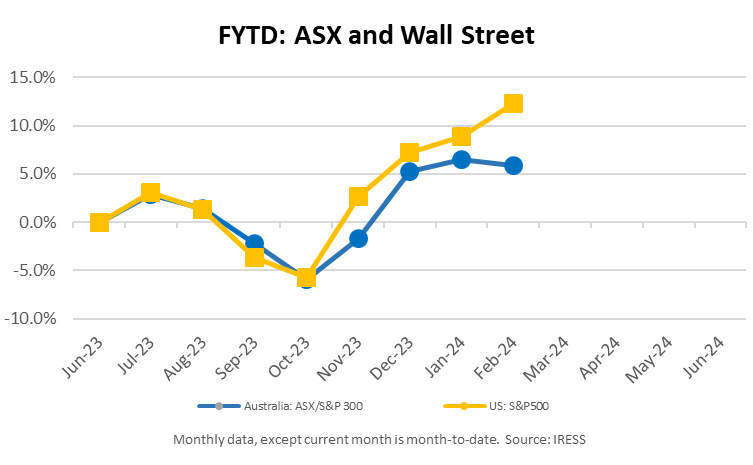

The Markets

This week: ASX v Wall Street

FYTD: ASX v Wall Street

Elmore (ELE.ASX) FY24 reporting

Elmore, a small historical position in many clients’ Australian shares sub-portfolio, announced to the market this week that it had entered voluntary administration. This was particularly vexing information, considering the company had only just completed its first step towards being requoted for listing.

We have maintained ELE through 2023 for clients primarily for tax planning purposes. For most clients, the value of the remaining tax losses exceeded the value of the shares.

In June 2023, we subscribed to a small capital raise (0.15% of clients’ Australian shares sub-portfolios). At approximately the same time, we took the opportunity to sell all remaining shares in Elmore on the market. This provided clients with the benefit of locking in tax losses from 2018 for use in FY23 or FY24.

Unfortunately, since the raising in June, the company has struggled to relist, and having completed all the required details at an AGM in January, it would have ordinarily been able to do so. Following the AGM, the new shares relating to our obligations from the capital raising in June 2023 were paid for and issued in January 2024. Unfortunately, it appears in client portfolios that new shares were purchased close to the administration date, but this is not true.

Although not a preferred outcome, we were pleased to secure tax losses from what is a tiny holding, and we will look to the administrators in the hope of recovering some value from the remaining company’s assets.

Johns Lyng Group (JLG) FY24 reporting

On 5th February, Johns Lyng made an ASX release:

“Johns Lyng USA appointed to AllState panel, advancing their US strategy”

Johns Lyng provides building and restoration services. It operates through the following segments: Insurance Building and Restoration Services, Commercial Building Services, Commercial Construction, and Other. The Insurance and Building Restoration Services segment engages in building and restoration jobs.

Johns Lyng has expanded its business in the US over the past 5 years.

Who is Allstate?

Allstate is one of the largest insurance underwriting companies in the US and a top 20 player by premiums in a global context. It has a longstanding history in the US, being originally founded in 1931 as part of Sears, Roebuck and Co.

The new partnership with Allstate will see Johns Lyng join its Emergency Response and Mitigation Panel. The contract will give Johns Lyng USA access to a potential 16 million Allstate policy holders throughout the US and covers the provision of emergency response make safe and water mitigation.

The deal with Allstate, whilst incremental to overall US plans, is critical in establishing Johns Lyng’s reputation as a solution provider for customers and insurance companies alike. Since 2019, JLG USA has strategically grown with 25 business partners across 51 locations in five states, contributing approximately 28% to FY23 group revenue (BaU), reaching A$239m and EBITDA of A$24.6m.

This deal will help drive organic growth and also awareness of JLG USA. In particular, the deal will boost its emergency response segment, which are often the conduit for JLG’s broader capabilities.

The market was impressed with the news, with the share price rising 5.5%.

Aurelia Metals (AMI) – Don’t rain on my parade.

Last week, we had the pleasure of hosting Aurelia Metals CEO Brian Quinn and his management team post the company’s recent operations update.

After some turmoil in 2023, the company is very well placed in early 2024 with a strong balance sheet, significant progress on new mine developments at Federation and efficient progress on closure of the Dargues mine.

The highlights of the quarterly report included:

- Very strong balance sheet. Cash (A$109m) was in-line with lower capital spend offsetting the production impact.

- All in-sustaining costs (AISC) of A$2,081/oz basis came in line with our expectations.

- Development of Federation mine on track

- Great drill results at Chesney North

The only negative news for the month, raining on their parade, was the announcement that Aurelia mine sites endured a significant rain event linked to ex-tropical Cyclone Kirrily, which has also adversely affected much of Central and Western NSW.

At Hera, the location of the new Federation mine, 63mm of rainfall was recorded. “Water entering the mine at Federation has been directed to the underground mine sumps but pumping water out of the mine may be slowed by the limited available capacity in surface water storage facilities.” Unfortunately, this rain event only added to the wet conditions experienced by the region in Jan 2024.

Despite Aurelia confirming that full-year production and cost guidance remained within previously stated ranges, ongoing rain may put these forecasts at risk.

We have always been attracted to Aurelia Metals as a major beneficiary of broader industry consolidation activity and ongoing exploration in the Cobar region. The major mine in the town of Cobar is the CSA Mine, one of Australia’s best copper mines in terms of ore grade and scale of production.

The current owner of the mine, Metals Acquisition Corporation, is planning an IPO on the ASX in the coming weeks. We expect the two companies to have a strong incentive to merge in the medium term. They currently participate in a range of efficiency activities between the two operations.

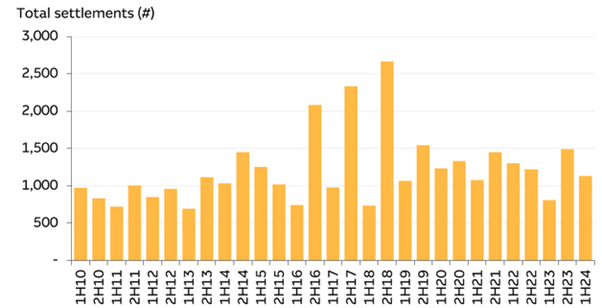

Mirvac Group (MGR).

Mirvac Group is a large ($8.8bn market cap) property development and management company. Readers would be aware it is a small position in the Property sub-portfolio.

MGR is a diversified property group generating earnings from both residential and non-residential development, its property trust and its funds management business. MGR’s portfolio is predominantly exposed to office and supplemented by retail and industrial. MGR has exposure to the residential markets, with ~30% of EBIT currently derived from development for external sale. The residential development portfolio is predominantly exposed to NSW and VIC.

The company delivered its 1H24 results, highlighting moderating conditions and confirming confidence in delivering forecast earnings as planned. This pleased the market, with Mirvac’s share price increasing by 4.7 per cent.

The slow unwind in asset prices, which we expect to continue in the Property sector, was apparent. Driven by negative revaluations across Office (-4.7%) and Industrial (-2.6%) portfolios partially offset by retail (+1.3%), the company’s asset value is falling. This slow melt in asset values is partly why the entire sector trades at a discount to net tangible asset value (NTA).

The strongest part of the Mirvac portfolio remains its high-quality residential development business. Driven by strong migration, the resilience of sales across the medium term is assured. The chart below shows the consistency of settlements (sales).

Source: Company data, Macquarie Research, February 2024

We remain attracted to Mirvac as a small position based on its relative price, exposure to population growth and strong development pipeline. Of concern remains their exposure to office assets and expected reduced rental income. As a conglomerate, however, we believe that the discount applied to the current share prices is more than adequate to support investment.

Some portfolio trimming on exceptional performance.

In recent months, the market has extended to new highs.

Naturally, a range of client positions have seen their share price rise to levels where we no longer see compelling value or where the future risk/reward trade-off demands a small position size.

As investors, we believe that understanding each company’s long-term value is critical in deciding which companies to buy and when to do so. This point extends to the decision to sell or reduce a position size.

In recent months we reduced positions in the following companies

- Inghams Group

- ANZ Group Holdings

- MMA Offshore

- Seven Group Holdings

- Aristocrat Leisure

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.