© 2024 First Samuel Limited

The Markets

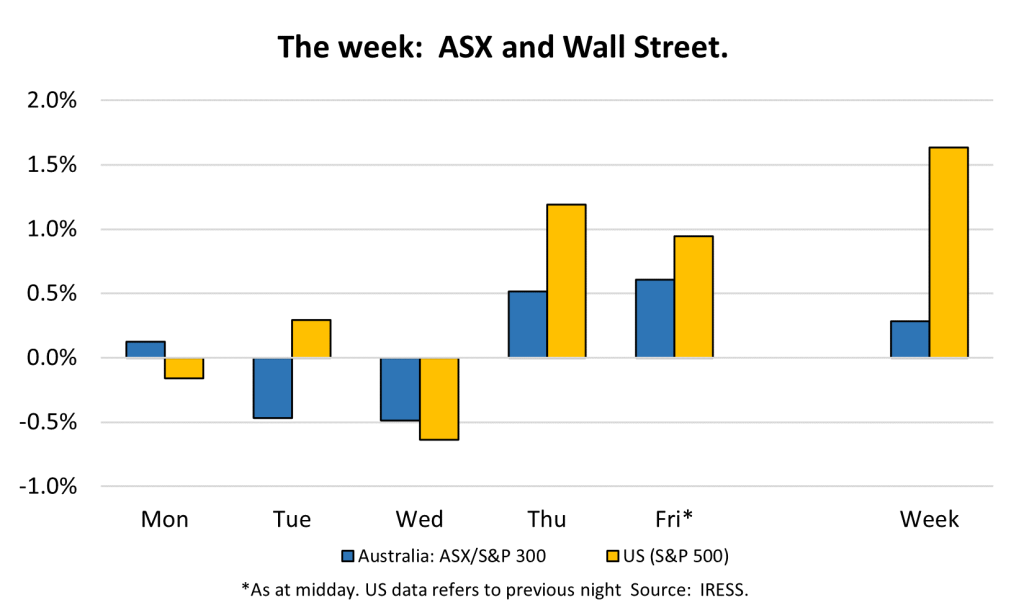

This week: ASX v Wall Street

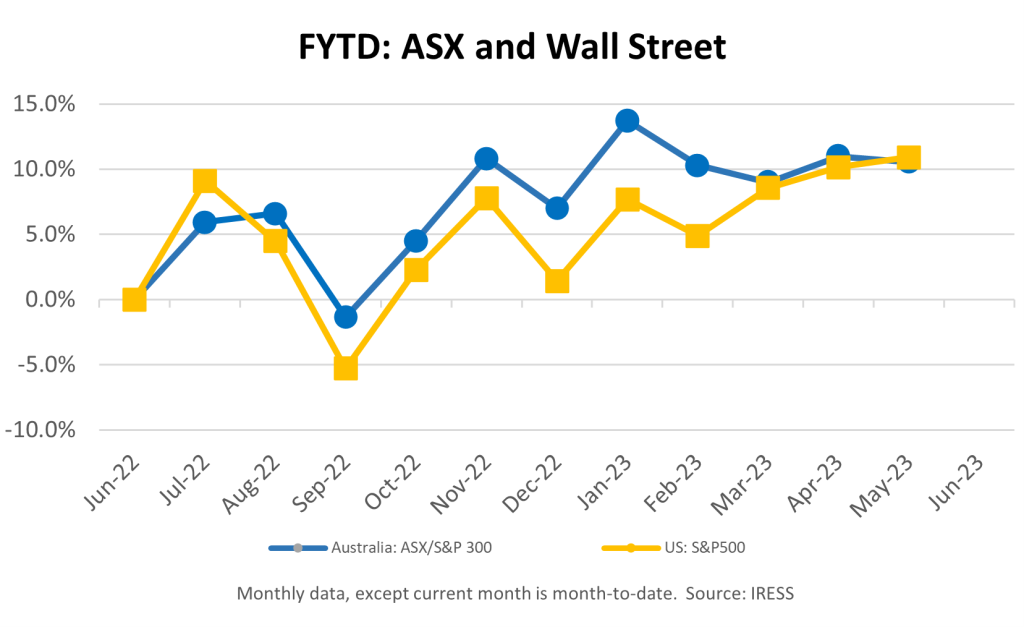

FYTD: ASX v Wall Street

We’re always looking for new ideas to introduce into the investment portfolios. A spate of recent takeovers within the portfolio (think Newcrest, Origin, United Malt, Pushpay, Eildon Capital) has accelerated the need for fresh ideas to replenish building cash positions.

New Portfolio Positions Explained

1. Imdex (IMD)

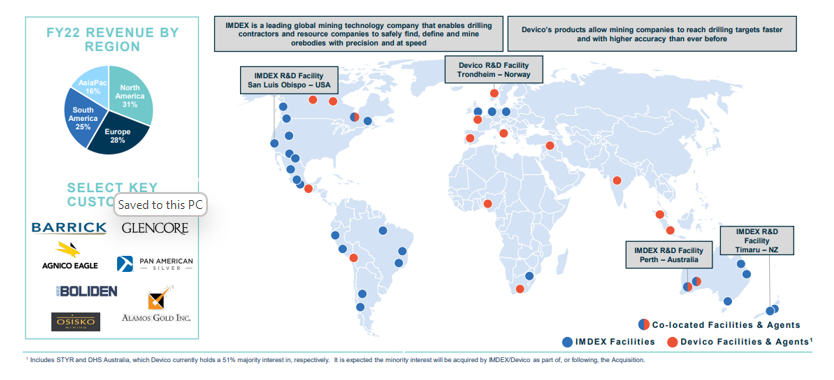

Imdex is the leading global mining-tech company. Its business is centred primarily around technical drilling and sensor equipment.

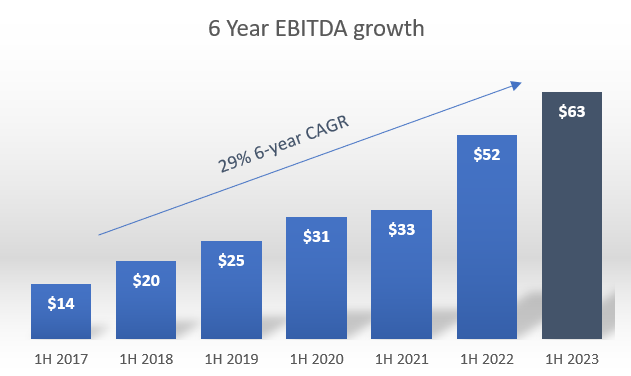

A company with a solid growth history

For a company of this nature, it is reasonable to anticipate some cyclicality in revenue with commodity/metals pricing and mining exploration activity. However, an increasing proportion of IMD’s revenue is recurring, given Software as a Service (SaaS).

Expected underlying 5-year growth estimates for their core Sensor Technologies (17% CAGR) and Directional Drilling Technologies (22%) markets are strong.

Management has a very solid track record of execution, with above market earnings’ growth and cashflow generation that, directionally, we expect to remain favourable in the long run given. This is because:

- As resource orebodies progressively get more complex to successfully mine and extract ore, better technical equipment is required to improve exploration capability and to improve mine economics.

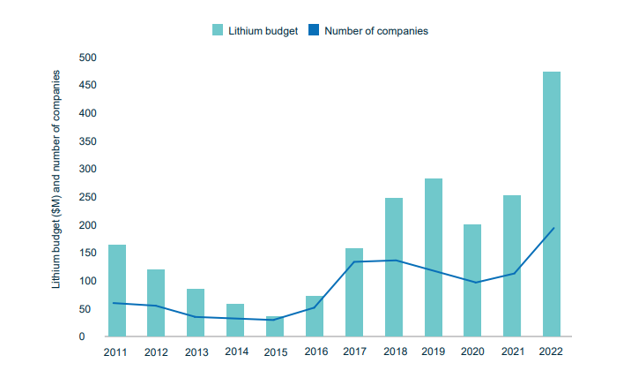

- While the company has been primarily leveraged to increases in mining exploration spending in the gold sector, increasingly it will be exposure to those metals most leveraged to the energy transition thematic (e.g. lithium, copper). These will become a growing source of opportunity, with associated increases in mining exploration/drilling budgets.

Source: Company records, S&P Mining intelligence

- Improved scale from recent acquisitions should assist with R&D budgets and provide the company with a technical/product edge as well as geographic earnings diversification.

In February 2023, the company closed the acquisition of the global # 2 player in the mining technology market, Norway-based Devico, creating an enviable market position.

This deal is complementary in terms of both geographic reach but also adds product and development capability.

2. AGL Energy Limited (AGL)

AGL is an energy producer and retailer, with ownership of assets such as the Loy Yang coal-fired power plant in Victoria.

With the impending takeover of Origin Energy (ORG) we have been researching the viability of investing in the other major electricity market producer. Our investment thesis for Origin related to a recovery in earnings, the value of its critical assets including its consumer base, and its strategic role in the electrification / decarbonisation of the Australian economy.

When investment bank Barrenjoey recently issued a research report on AGL with a price target nearly 50% higher than the prevailing share price, we sat up and took a little bit more notice!

The major thrust to the investment thesis is as follows.

a. Near-term earnings momentum

Theoretically, AGL’s revenues should be relatively easy to understand.

- It has a Customer Markets business with earnings driven by customer numbers/volumes multiplied by a relatively stable margin that is influenced by a relatively rational industry structure

- Its Integrated Energy business sources electricity/gas to fill the short position created by customer demand. Earnings are underpinned by structurally lower energy costs (Short Run Marginal Cost of coal generation – e.g. Loy Yang and legacy gas contracts) versus current prices

With earnings volatility generated by the underlying cost of electricity generation and the market-based forward electricity prices passed-on in customer contracts of 1-5 year duration, the business undertakes hedging to manage the risk.

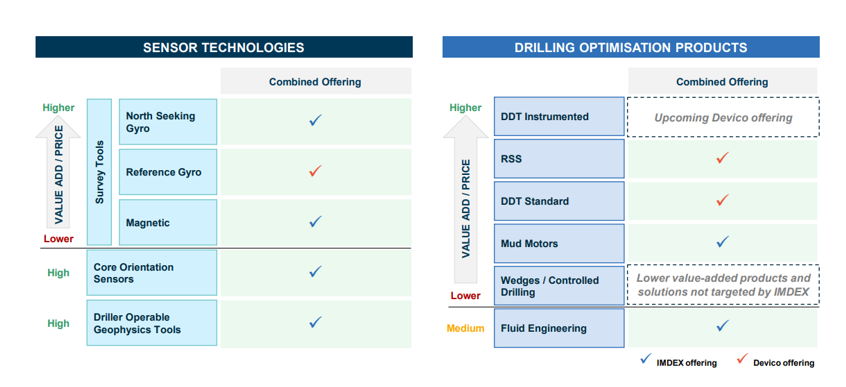

The correlation between consumers’ transfer price reported in results and the observable East Coast forward electricity price is apparent in the chart below. It highlights that there is significant upside to customer electricity pricing to emerge.

Source: Barrenjoey

b. Strategic appeal

In the medium term, AGL is a business that is amid the broader energy transition which is being undertaken across Australia and the globe.

There will be significant expenditure required for legacy energy market providers to continue to maintain some of their existing electricity generation assets, which may be required to;

- meet affordable energy requirements of the nation

- provide a generation bridge while new forms of energy capacity are brought on board

- remain in place as a backup for system reliability (being paid to exist not produce)

Additionally, AGL must transition itself from sourcing energy from its own coal assets to new forms of energy. The cashflow generated from current strong market conditions will be a ready source for this investment.

In the case of Origin Energy, the magnitude/cost of the investment requirement was a task that public market investors did not seem keen to meet. In the end, it was the patience and deep-pockets of private equity funds that purchased the asset. We believe that, while AGL’s business and market position is a little different to ORG (it owns more legacy coal generation capacity), AGL could end up experiencing a similar fate of being acquired by an unlisted investor.

For clients considering the ESG (Environmental, Social and Governance) implications of AGL, it is complicated. We believe that AGL will play an important role in electrification, facilitating growth in electricity generation and distribution. But it does rely on coal-fired generation in the interim. After much debate, on balance it will not be included in client portfolios that have restrictions on fossil fuels.

Pointsbet (BET) cashes in early on its US expansion

PointsBet, the sports betting/gaming company has been a small portfolio position for some clients. The company is locally famous for its easy-to-use app technology and their use of Shaquille O’Neal (Shaq) in their recent advertising blitz.

The most interesting aspect of the business from an investment thematic has been the opportunity the company has been pursuing in the burgeoning and potentially incredibly lucrative US sports gaming market.

It was therefore considered a disappointing development when it was announced that the company had agreed to sell its US operations (including a licence to operate in 15 states and an exclusive partnership deal with NBCUniversal) to global sports giant Fanatics for US$150m (AUD$225m). The sale will yield a special dividend for shareholders of between $1.07 and $1.10 per share.

We have been speaking with industry experts in the US over the past week. Each conversation regarding current developments and future trends, had the same opinion: the long-term value of the opportunity was extraordinary, and that PointsBet had laid some very important groundwork.

Following the sale, PointsBet will continue to operate an Australian and Canadian business and will now move closer to generating a positive position on an EBITDA basis within 12 months, given the stemming of ‘bleeding’ of significant negative cashflow associated with the establishment of its US presence.

There remains a strong prospect that the company may be looking at strategic options within its Australian operation as well, with a round of industry consolidation expected as operating conditions become more challenging considering rising cost-of-living pressures.

The stock price fell appreciably on the announcement (down more than 30%), but by the end of the week had recovered some ground as investors worked through the value that remains.

United Malt results calms nerves

United Malt reported its 1H-23 results this week. The result was weak as expected, but the result is significantly overshadowed by;

- the KKR backed Malteries Soufflet takeover bid and due diligence effort, and

- by the strength of recovery expected in the 2H and beyond.

Notwithstanding the weak 1H-23 result, UMG has reiterated its prior FY-23 guidance of $140-160m EBITDA. We suspect gross margin improvement of 70% in 2Q-23 vs 1Q-23 will give UMG confidence in its ability to deliver continued improvements in gross margin and EBITDA in 2H-23.

Critically, the United Malt CEO informed the market that KKR’s undertaking remains in place for a formal binding bid – likely in the coming months. There were a few moving parts, positive and negative in the result that could impact the readiness of KKR to complete the deal:,

- margin improvements and quality control that were components of 2022 management mishaps are expected to be addressed quickly regardless of who owns it – this occurred in this half and improves the value to KKR.

- the debt levels were higher than the market expected, although we would note they remain backed by inventories (barley) that have increased in value. One of the benefits of taking a company private is that short-term fluctuations in debt levels are not as toxic to long-term value as they are to short-term share prices. The move in higher debt is concerning but should not be critical to a deal taking place. It may require an adjustment to the price.

- reduced capex plans, and the commissioning of the Inverness plant are now in place. KKR would have already been assuming these changes.

Clients would appreciate that we have already sold down around 40% of our position in United Malt at the time of the bid. We remain confident of the bid completing (a 10%+ premium to the current share price) and note that should it fail to occur that the business is in relatively good shape to generate value in the medium term.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.