© 2024 First Samuel Limited

The Markets

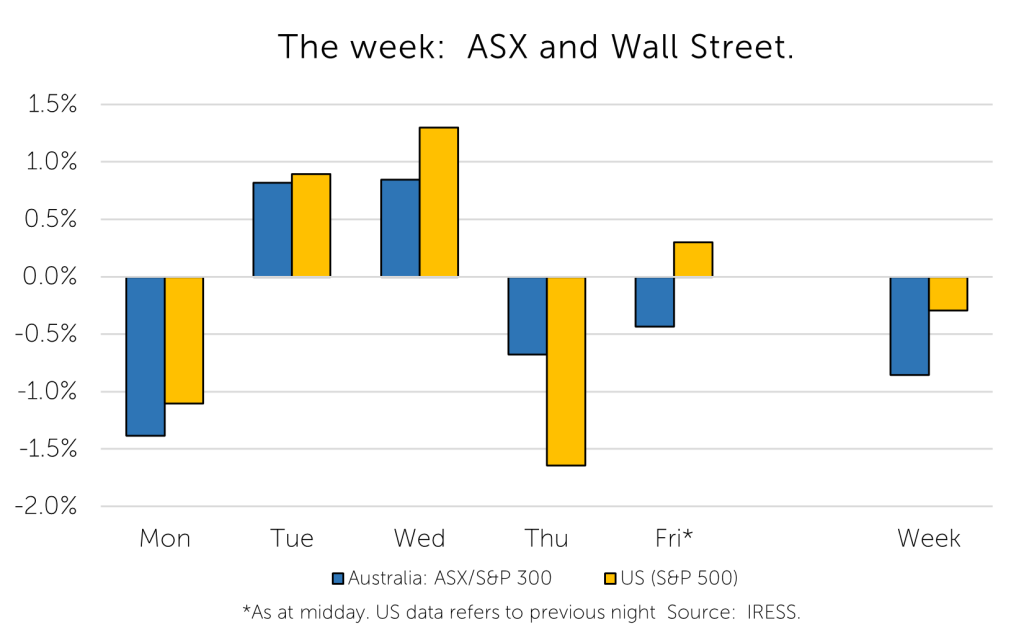

This week: ASX v Wall Street

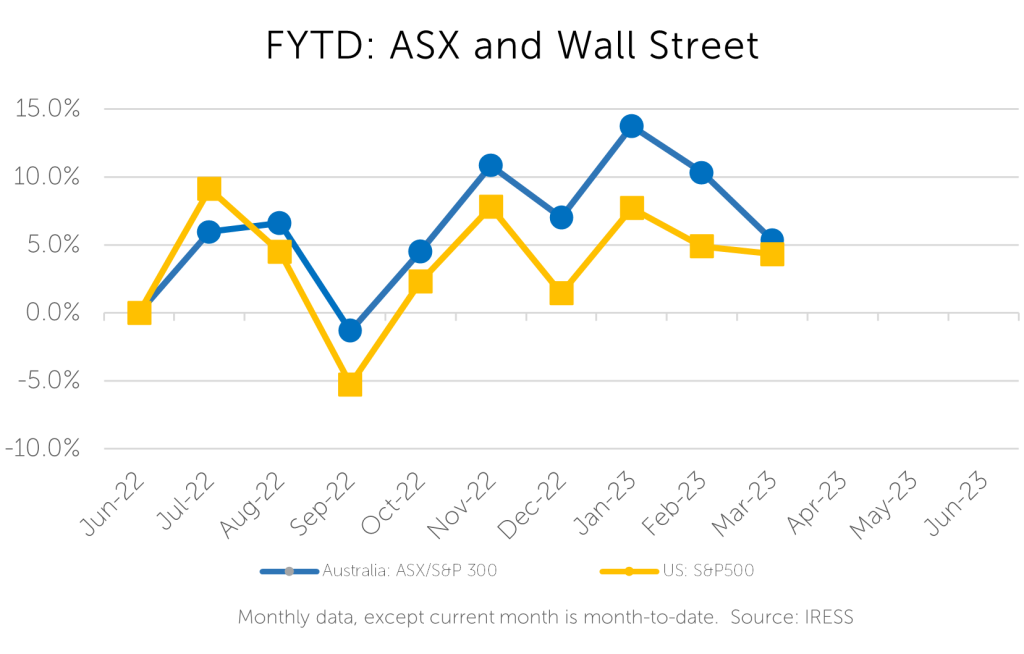

FYTD: ASX v Wall Street

This week in Investment Matters we have highlighted three news items relevant for client portfolios. The highlight of the week however is the enhancement of rather plain text with the sensational Patrick Cook cartoons.

Pushpay Holdings – A little more for the collection

Clients may recall our investment in the church donation software company PushPay Holdings. A spectacular contributor to investment returns through Covid, PushPay has remained as a small investment in the Australian equity portfolio.

Unlike many other technology companies PushPay generated significant positive cashflows and had strong growth prospects.

This combination of cash and growth is rare in global markets in general, but especially so in the Australian market. As such we were not surprised to find the company subject to takeover proposals over the past year, as a combination of strategic and financial investors sought to privatise the company.

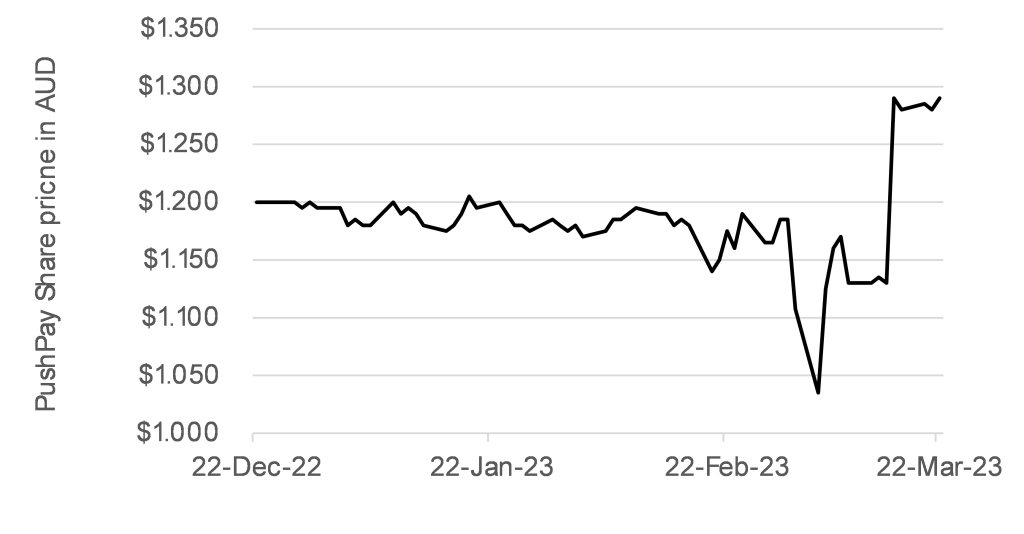

In November 2022 the company’s board accepted a takeover offer from a consortium (which included Sixth Street and BGH Capital) at a price of $1.34 NZD (PushPay is a dual-listed stock on the ASX and NZX). We were pleased with the offer but not the price, and hence chose to retain our stock all the way until the Scheme of Arrangement was implemented on the off chance a better offer would emerge.

Instead, there was a mini revolt amongst some shareholders, who were fortified by an independent expert report which highlighted the relative meagre price offered by the consortium. The revolt came to a head in recent weeks with the offer being rejected at a shareholder vote.

As shown in the chart below the PushPay stock price initially fell, but quickly rebounded when the parties returned to the negotiating table to resurrect the deal. Finally, last Friday a “sweetened” deal emerged in which shareholders will receive an additional 8c NZD per share.

We still believe that this price undervalues the business in the long run but will be glad to accept the offer in coming weeks.

The figure below shows the movements in the PushPay share price in recent weeks. This is typical of a stock in takeover, very stable until the final determination, followed by volatility created by the uncertainty of negotiations, and final the additional premium was reflected.

Figure 1: Pushpay share price since late 2022.

Banking turmoil

Markets have begun to settle down, for the time being, as they’ve absorbed a quick period of indigestion in the global banking system. By the end of the week the two great Swiss Investment Banks had become one with UBS buying the crippled Credit Suisse.

The regulatory response has been quick to protect deposit holders, albeit equity holders and Bank Hybrid Tier 1 capital holders have been less fortunate.

But it’s not really surprising that such a dramatic upward adjustment in interest rates and withdrawal of Central Bank support in markets has seen some of the more vulnerable banks find difficulty.

In reality, globally, there are hundreds/thousands of banks which have failed in the past decade including ~500 in the US alone.

While the Credit Suisse takeover of UBS was very high profile, it marks the end of a franchise which has struggled to compete in many of its chosen markets (ex-Private Banking) and accordingly for talent for some time. It’s a franchise which, given its size, reach and systemic importance, has required extra Government support since the GFC. The takeover of Credit Suisse by its stronger and better managed Swiss Banking peer, UBS will make the global banking system stronger.

Gold: Third times a charm – the precious metal hits $2,000 USD an ounce

Amongst the turmoil of the week, which included bank failures in the US, we witnessed the resurgence of gold – as sure as clockwork.

Those readers who are fans of portfolio theory or the history of markets will be aware that Gold has historically served a quite specific purpose in markets. Gold is (often) the final safe-haven investment. So, it is an investment that appreciates in the either of the following circumstances:

- When investors lose faith in the banking or broader financial system or

- When investors lose faith in the value of the currency in which they trade

For the past couple of decades, the increase in money printing by central banks, and the episodic turmoil of markets have together increased the opportunities for Gold to outperform.

We may understand how gold works in periods of turmoil, however there is extensive uncertainty about how much gold is worth intrinsically. Many investors, gold miners, and even people on the street will have their own views, but one aspect that is clear is that there are levels for the gold price that warrant special attention.

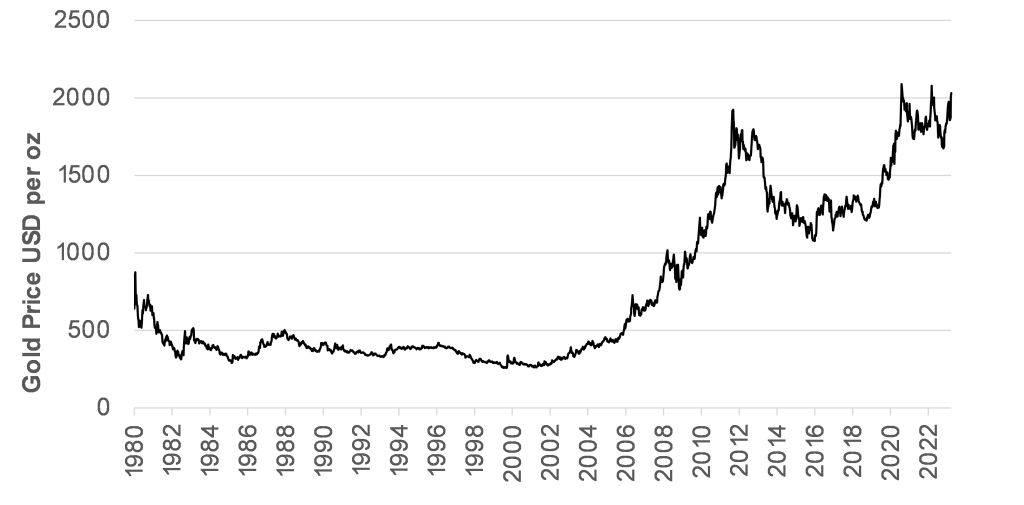

The most obvious recent landmark price is $2000 USD per ounce, and for just the third time the USD gold price has exceeded this amount. Figure 2 shows the gold price since 1980. In the price we see clear evidence of

- the long-term impact of inflation through the years,

- the impact of money printing since 2009 – the point from which this period of growth accelerated, and

- the episodes of volatility through the GFC, Covid, and today

Interestingly, the 1980 gold price in inflation-adjusted terms remains 60% higher than even today’s level, a truly wonderful period for gold that many readers may recall. Gold bulls suggest that such levels are possible in this cycle.

Gold mining stocks in Australia have had a strong period of price performance also. The Gold Index (including many of the listed gold miners) is up 12% for the month, and 33 per cent for the financial year. As you may expect we took the opportunity to take some profits this week in Newcrest Mining and De Grey Mining.

Figure 2: Long-term Gold price