© 2024 First Samuel Limited

The Markets

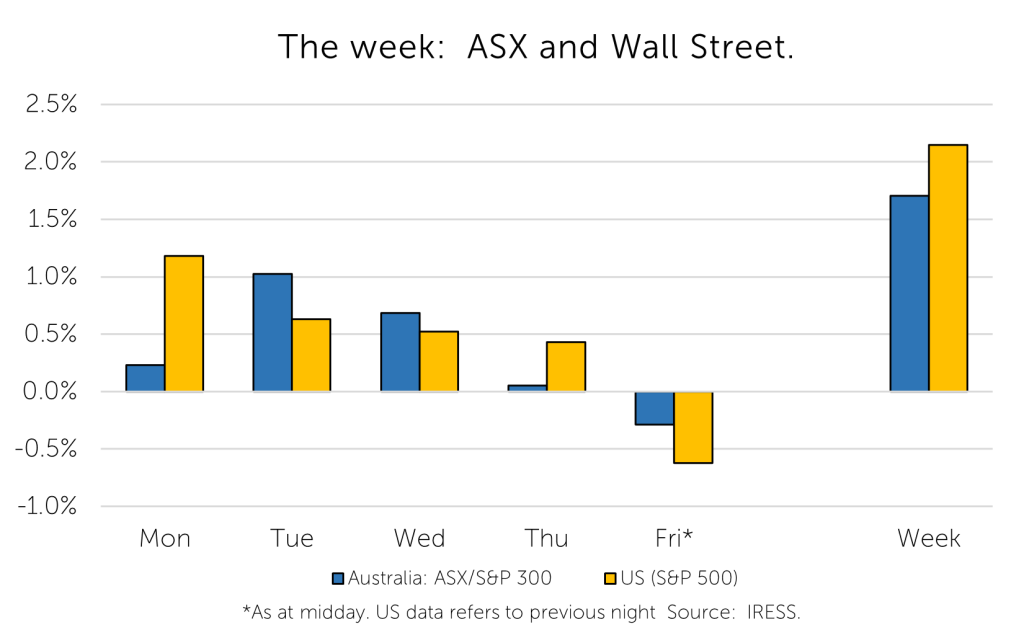

This week: ASX v Wall Street

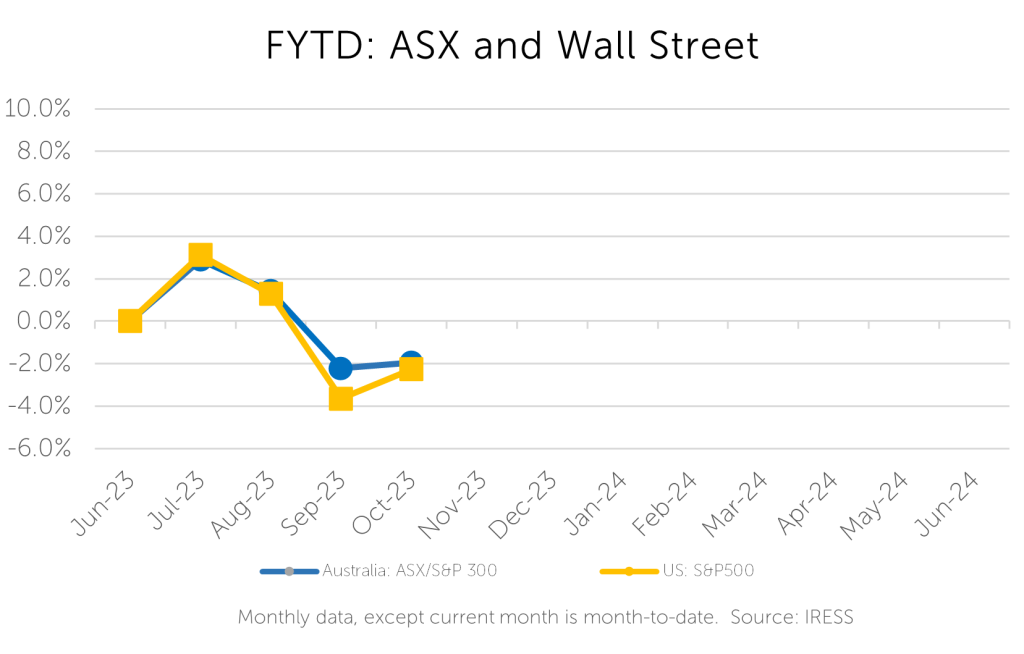

FYTD: ASX v Wall Street

On Wednesday, RBA Assistant Governor Christopher Kent gave a speech to a Bloomberg gathering with a title that would surely only excite economists: “Channels of Transmission.”

Its content wasn’t a barnburner, either. However, combined with other recent statements by new RBA Governor (Michelle Bullock) and information in regular RBA reports, the combination hints at a reserved and nuanced approach to monetary policy.

We are now confident that employment is held with appropriate regard within the RBA. Thus confirming the 20th June speech by incoming RBA Governor Bullock.

“But just because our inflation objective has been in focus recently, it does not mean that the other part of our mandate – maintaining full employment – has become less important. Full employment is, and has always been, one of our two main objectives.”

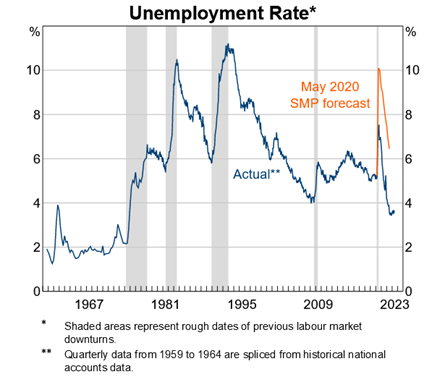

Low unemployment achievement

It can be easy to forget what a great achievement two-plus decades of low unemployment, especially since COVID-19 onset. As a reminder, in May 2020 (SMP, Statement of Monetary Policy) there was anticipated to be a large increase in unemployment. The chart below of unemployment since 1960 is a timely reminder of the progress made.

Source: ABS, RBA

As an equity investor, economics post-graduate and student of history, I am always concerned to hear barely masked ideology and mean rancour from the mouths of those extolling the virtues of the dismal science (i.e. economics).

“Policy error, policy error” seems to blare as loud from those bent on controlling inflation at all costs. The cost of policy error, which is almost always higher unemployment for those already disadvantaged, is quickly disregarded.

Sharply rising unemployment for the Australian equity investor is the least preferred outcome if choosing between the RBA’s dual tasks of controlling inflation or delivering low unemployment. Inflation could be a bigger bogeyman for those investing in financial speculation, financial engineering or those whose business model is simply gearing up economic rents.

The recent review of the RBA proposes an explicit dual mandate for the RBA to best contribute to price stability and full employment, with each given equal consideration. The importance of full employment for a nation that has chosen to grow its population at a global-leading pace and incur global-leading levels of indebtedness should be clear.

So why was the Kent speech important? It mainly reflected on the lags between the RBA raising rates, the intended change in economic activity, and finally, the future goal of reducing inflation and inflation expectations.

A sober assessment that reflected on nuance

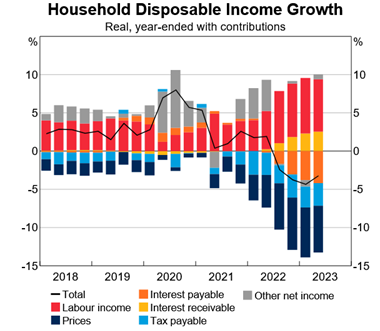

The Kent speech outlined how changes in monetary policy work through the economy. He highlighted how different factors affect the speed at which interest rate changes affect household disposable income (HDI).

The impact of these factors is well explained by the chart Kent used, and I have copied it below.

Sources: ABS, RBA

Simple, the black line (HDI) is the total of all of the coloured bars (being the various factors). For example, the HDI peaks in 2020 when Other net income (the gray bar) was higher than all other factors.

Pre-interest rate rises…

Before interest rates began to rise in 2022, the positive impact of the yellow (interest income received) and the negative impact in orange (interest paid) hadn’t been a driving force behind changes in HDI.

Benign labour income growth (wages – in red) since 2018 was only partially offset by higher prices and tax take (blue and light blue). Between 2018 and 2021, RDI, the black line, increased.

…then inflation

Since then, higher inflation (prices – blue) and taxes (light blue) have offset the growth of labour income (wages – red). And so total HDI (in real terms) began to decline. But those with mortgages bore all the costs (in orange), and the remainder of households almost all the benefits in yellow.

The result…

Kent’s point was that these cashflow impacts also flow through to changes in the savings rate, investment, and credit. In the RBA’s view, they have not yet affected house prices, which are higher because of migration.

According to UBS estimates, around 13% of households today have higher expenses than income. If interest rates rose by 1%, this share would increase to 18% of households. So, the real-world impact can already be measured in slower retail trade volumes. As a reminder, we have limited exposure to consumer discretionary spending stocks.

In the view of market economists, the speech highlighted that the RBA has had valid reasons to raise rates less aggressively than other central banks because inflation peaked lower in Australia, and wage growth has, so far, been more contained.

The speech also noted that many households with fixed-rate mortgages still to roll off to variable rates are yet to adapt fully. Critically, the speech references that whilst nations such as the US have raised their short-term interest rates to higher levels, the household sector, predominantly serviced by fixed 30-year mortgages, has seen limited increases in total interest burden.

In conclusion, the speech noted.

“The lags of transmission mean that some further effects of a rate increase to date are still to be felt through the economy, which will provide further impetus to lower inflation in the period ahead.”

We would also note that Kent paid due attention to the already high-interest cost burden felt by the economy in general – interest costs are now at a record high.

He also noted the oft-overlooked fact that the households that benefit from higher interest payments on savings are neither the same households as those with debt nor are they households likely to spend the additional income with the same abandon as those higher rates impact.

This suggests the scope for significant change in higher rates is limited and that a path in which no further rises were required would be preferred.

Summary

We are approaching the end of the rise in RBA cash rates. This does not mean that long-term market interest rates cannot continue to rise or that a small increase of 25bps is impossible.

More importantly, we are now seeing an active trade-off between the demand for higher rates due to persistent inflation and the real-world impacts on unemployment and household spending due to the circumstances that Australia finds itself in.

In turn, this reduces the risks of a policy error by the RBA, which should support equity prices, especially if other economic conditions such as wage growth, government investment and terms of trade (commodity prices) remain supportive.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.