The Markets

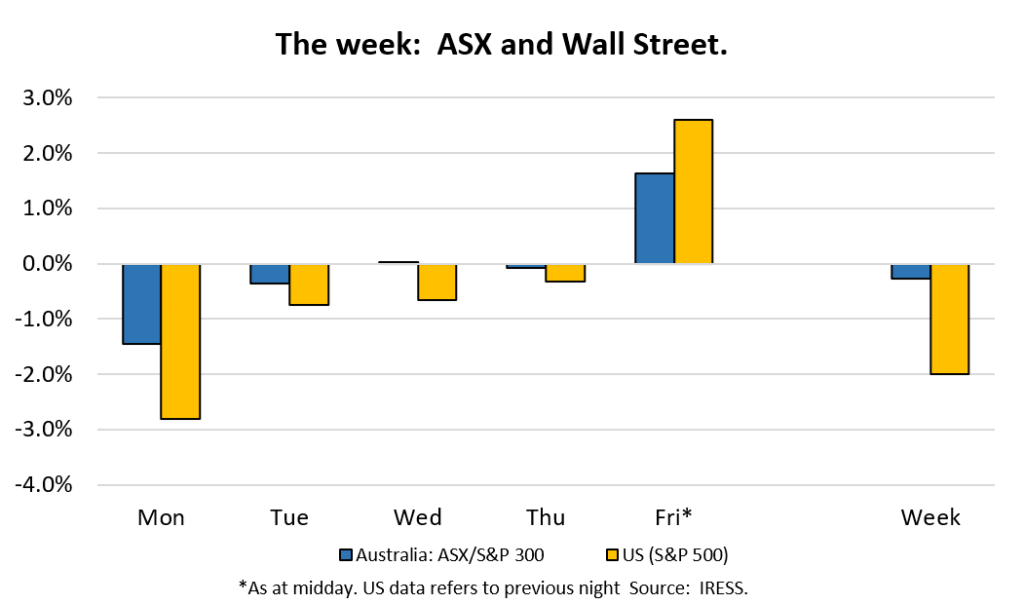

This week: ASX v Wall Street

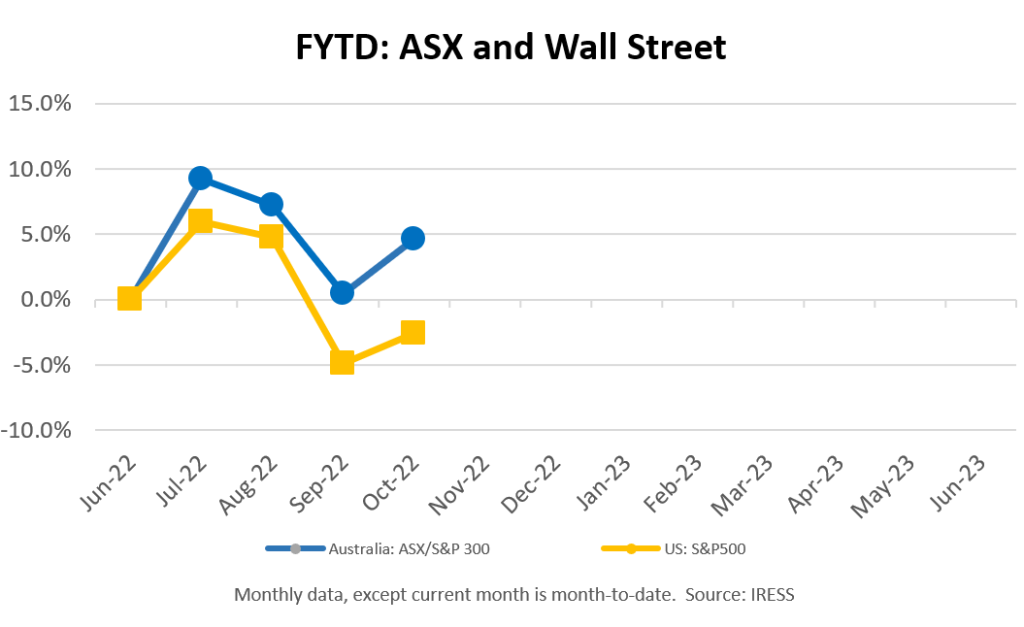

FYTD: ASX v Wall Street

Your investment team fielded a pertinent question from a client this week:

“What happens if the RBA can’t get interest rates under control due to too much inflationary pressure coming from non-domestic sources, such as commodity prices and supply chain issues?”

Inflation is now a global phenomenon.

Yet, while inflation is often seen as an all-encompassing description of rising prices, not all inflation is equal.

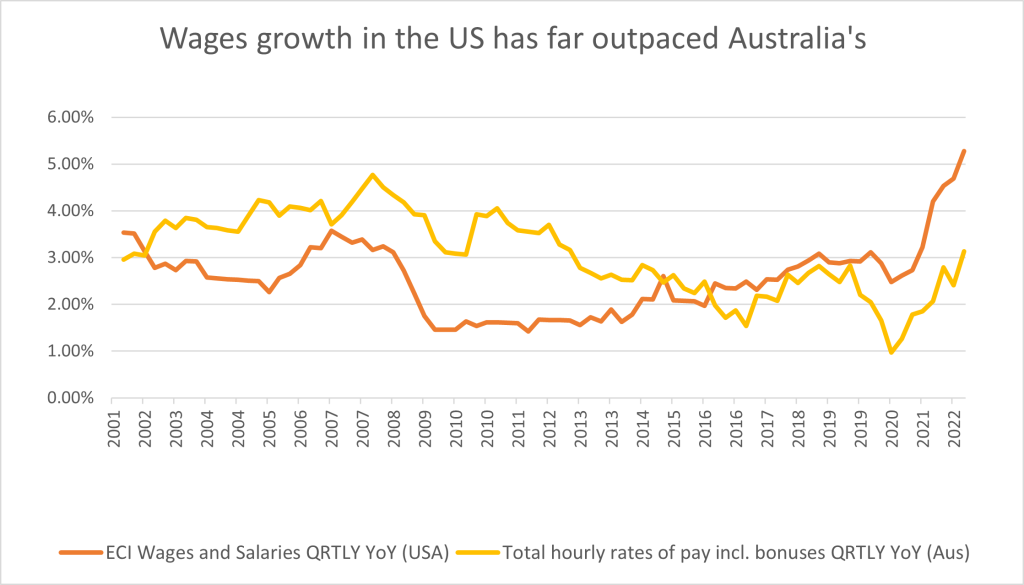

For instance, we have seen pervasive inflation in the US economy, which has translated to the strongest wages growth seen in decades. Yet, here in Australia, we have seen a much more muted impact on wages.

This calls into question the durability of inflation in Australia and, consequently, what the policy response should be.

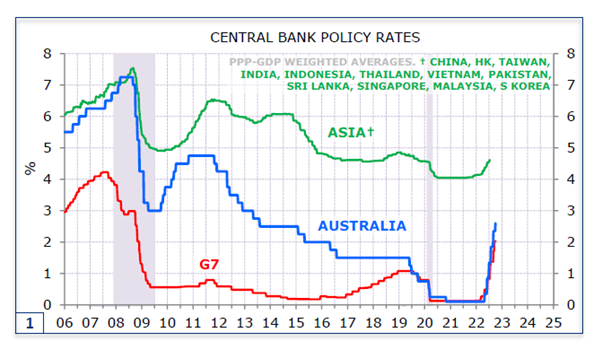

And yet, with interest rates rising globally, the Reserve Bank of Australia (RBA) has thus far followed the piper, raising interest rates in line with the US Federal Reserve.

However, the latest meeting of the RBA highlighted that we are at an impasse.

The RBA has clearly recognised that there are large structural differences between our economy and the US that limits our capacity to blindly follow the Federal Reserve’s lead.

The path taken from here is therefore not set in stone.

Will the RBA continue to hike interest rates in lockstep with the US Federal Reserve?

Or will it choose to take a divergent path?

And what might the consequences (of either approach) be?

We explore these issues in answering the question posed above.

A fork in the road

The issue in Australia regarding interest rates and inflation is very much related to the maxim of the “cure being worse than the disease”.

And, in keep with this medical metaphor, the difference between two otherwise similar patients, the United States and Australia.

Australia is ostensibly an open trading economy, exposed to a mix of domestic consumption and global demand for a small range of high-value mining products.

We are used to being battered around by changing conditions and have usually adapted well.

In the face of rising global inflation, problems with supply chains, and the need to normalise interest rates, we could have historically assumed that being led by the US through this transition would be relatively simple.

But unfortunately, we have created a set of circumstances that increase the risk of divergent outcomes.

Source: Minack Advisors

Structural differences

The excess demand in the US fuelled by fiscal expansion, when matched by supply chain problems, has created an historic burst of inflation. This inflation has in part at least been matched by strong wage growth.

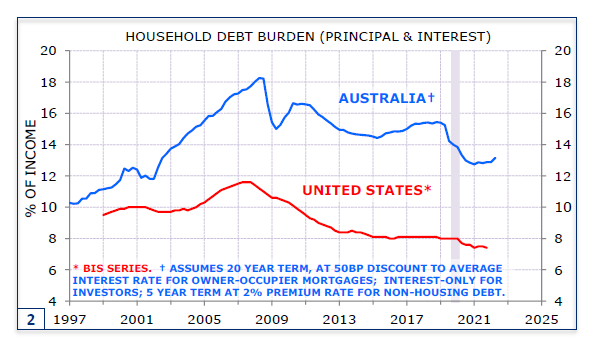

In the US a lower level of household debt, a broader range of economic activity, and less reliance on population fuelled economic growth allows the US to create a short sharp burst in interest rates designed to extinguish domestic inflation.

Source: Minack Advisors

The Federal Reserve knows that if excess inflation expectations become embedded in wages growth, the strong performance of the economy and labour markets could be unravelled by permanently high levels inflation (stagflation).

Without excessive financial leverage in the household sector, the spike in medium-long term interest rates in the US will be accommodated by more subdued house price growth, and less activity in deeply cyclical components of the economy (housing construction, car sales etc).

At the same time moderate wages growth, relatively low unemployment, and catch-up of housing formation (nee homes) offer the opportunity for a shallow recession or slowing of the US economy for a short duration.

To achieve these outcomes, the Federal Reserve will have raised short term rates to above 3% in the short run, and the bond market has assumed they will rise to above 4% in coming months. Should the Federal Reserve be successful in slowing the economy, US rate expectations may peak and begin to fall in 2023.

For Australia the circumstances are different.

Namely:

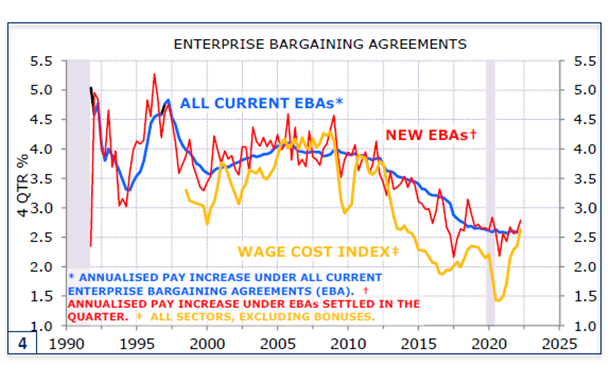

- Wages growth isn’t as strong – workers have seen significant falls in real income – and many industries have Enterprise Bargaining Agreements (EBAs) which continue to support wage growth of less than 3%.

- Our currency is flexible, and historically responds to interest rates differentials.

- Our debt is very high: 20%+ of households are highly leveraged, many with fixed interest rates in the short term (due to reset over the coming year), and of course our house prices are high.

- Our core inflation rates aren’t as high, and we risk imported inflation although such trends in important inflation have proven less problematic than imagined in the past.

Source: Minack Advisors

Source: ABS, BLS, First Samuel

Misstep or side-step?

These structural differences are not lost on our Reserve Bank. While they present a recipe for a policy mistake, these structural differences appear to be well understood by the RBA:

“Higher inflation and higher interest rates are putting pressure on household budgets, with the full effects of higher interest rates yet to be felt in mortgage payments. Consumer confidence has also fallen and housing prices are declining after the earlier large increases.”

Monetary Policy Decision Statement by Governor Phillip Lowe, 4th of October 2022

Thus far the RBA has sent a signal that it is willing to raise interest rates, the Australian Dollar has fallen, and businesses are gearing up for changing supply chains, onshoring, a movement away from just-in-time, and an understanding of the need for higher wages.

Given sufficient time and the room to adapt we consider a path that navigates these conditions well is possible. In these circumstances house prices could melt lower, new loans could be smaller and more resilient, and the higher wages would allow for the domestic economy to grow into its debts.

A return of students and medium-term visitors could increase demand for housing and tourism products. The ongoing energy transition and new demand for metals and minerals could support terms of trade. Slower relative growth in interest rates by the RBA would continue put downward pressure on the Australian Dollar. Growth would be weak, but manageable, with the domestic industry becoming more sustainable.

In very few scenarios would domestic wages growth be a problem, especially if student migration was to return to pre-Covid levels.

A goldilocks navigation so to speak.

The risks to this are if:

- Core inflation stays higher (above 4%) for longer, or

- If we continued to follow the rest-of-the-world with higher interest rates, were global inflation to continue at current levels.

Thus far there is little evidence of the first, and there are several structural shock absorbers (alluded to above) that reduce its probability.

As to the second, there is a clear recognition that raising interest rates excessively would be killing the patient, so to speak. There would be little sense in doing so if inflation was global, not local, wages growth remained weak, and inflationary expectations were subdued.

We would argue that given the known constraints that include the roll-off of low fixed rates over the next 12mths, the huge levels of existing debt and the importance of housing to the economy, the RBA wouldn’t kill the patient to cure the disease.

If it did it would be a terrible mistake that was easily avoided.

What are the costs of not responding?

Few in our mind, the Australian dollar would continue to fall, the government may have to provide additional support for growth. This is support would be made easier by higher commodity prices. And moderate growth would eventually reduce domestic demand that risks higher imported inflation.

Thus, there is a clear path for Australia to once again successfully navigate (sidestep) what is a challenging period globally. Not guaranteed but clearly possible.

Company News

Aurelia Metals (negative impact)

AMI has released its Federation Feasibility Study, FY23 guidance and 2022 reserves and resources. Federation is the key new asset for Aurelia, a tier-1 underground base metals project with significant Zinc and Lead deposits at high grades. Note a Feasibility study is usually the final step before securing funding for new development. Completing both feasibility and funding allows a company to finally extract value.

The Feasibility study confirmed previous work on the resources available, and reinforced the view that existing facilities can be used to process the ore from Federation, reducing the capital cost of developing the mine. Critical for the medium term the deposit at Federation remains “open” (more resources available) along strike and should grow with further drilling.

The Federation asset adds to Aurelias regionally significant gold-copper projects at Peak (Cobar) and Hera.

Unfortunately having great assets alone doesn’t always make for a guaranteed success in a listed stock. Navigating the sequencing of cash accumulation, exploiting existing assets and providing clarity to the market prior to seeking final funding is critical.

Partly due to disappointment with an underperforming gold mine that was purchased in recent years (Dargues), and partly due to management decisions, Aurelia failed to deliver a funding solution to accompany the Feasibility report.

This leaves the project underfunded, and options for funding remain uncertain. The pressure on the share price has been significant (down 35% this week). Ultimately, we expect the company to secure funding, providing an opportunity to recover lost value. The next three months will be critical.

***

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.