© 2024 First Samuel Limited

This week’s Investment Matters will continue to focus on the recent ASX profit reporting season.

Within that, we elect to focus on our REITS’ exposures within clients’ property sub-portfolios.

In general, we’ve maintained higher weights in cash holdings within property sub-portfolios. This is because an expectation that the significant rise in interest rates would necessitate an increase in cap rates (implied returns on property values).

A resultant reduction in property book valuations would imply a need to restore REIT balance sheets to within bank funding covenants. This would trigger a large number of equity capital raises at discounted share prices.

Read previous week’s Investment matters about Profit reporting season.

For the most part, we’ve been largely disappointed that the capital raises have not yet come. While rising property rents have no doubt assisted with underlying property cashflows and helped support valuations, the continued significant discounting of leases by office property owners has not been captured in professional valuer pricing nor property company valuations.

Still, can foreign buyers with lower return hurdles and a desire for trophy locations help support the market and prevent bigger write-downs (and capital raisings)? Early evidence from property transactions indicates such a trend is possible. It will take the remainder of 2024/25 to determine if the quantum of demand approaches similar levels to the early 1990s, late 2000’s or exultant periods of foreign interest stretching all the way back to the 198th century.

In the medium-term, we expect to see less skew to development of office space (given work-from-home trends), and more exposure towards industrial and warehouse property assets and a shift within residential property books towards lower-price, more affordable solutions such as Build to Rent.

As a quick summary we continue to build a property portfolio that is designed to benefit from:

- Positive trends in industrial property:

- Continued growth in the demand for industrial property, particularly new developments that benefit from the constant adaption of industrial buildings for changing needs.

- We also appreciate industrial property’s cheaper underlying land price vis-à-vis office or retail developments. In the medium-term, land use patterns tend to converge to higher and better uses, especially when land is well located. Large-scale industrial development of 30 years ago become today’s niche multi-use centres and perhaps tomorrow’s urban retail and employment precincts. Accessing this capital growth is an aim of our positioning in the portfolio.

- Core industrial holdings in the portfolio include.

- Harrick Rd Properties

- Garda Property Group (GDF)

- Goodman Group (GMG)

- Mirvac (part) (MGR)

- Centuria Industrial Properties (CIP)

- Positive trends in suburban small-scale retail developments. As travel times and congestion rise, the relevance of sub-regional scale in the provision of supermarkets, fresh food and convenience becomes more important. In addition, lower utilisation (spare land) in many suburban sites increases the likelihood that this land will be used for last-mile logistic solutions and higher-value uses in the future.

- Holdings in the portfolio that are benefiting from these themes include:

- HomeCo Daily Needs REIT (HDN)

- HMC Capital Limited (HMC)

- Stockland (SGP)

- Holdings in the portfolio that are benefiting from these themes include:

- Build to Rent, alternative land use, and master planned community development. We see future growth in these sectors benefiting our holdings in Stockland (SGP) and Mirvac (MGR)

The Markets

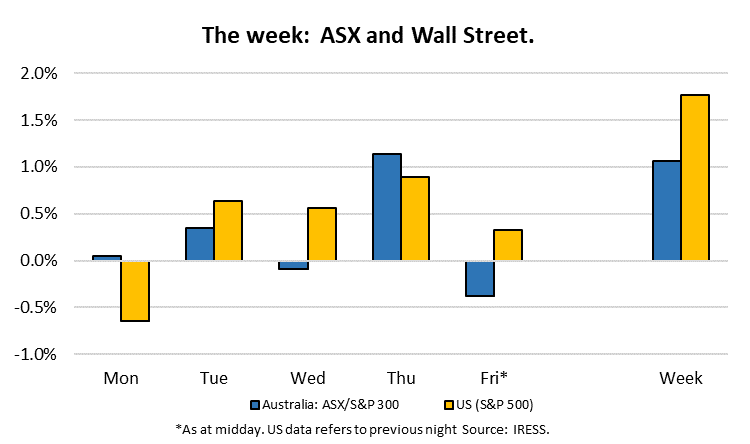

This week: ASX v Wall Street

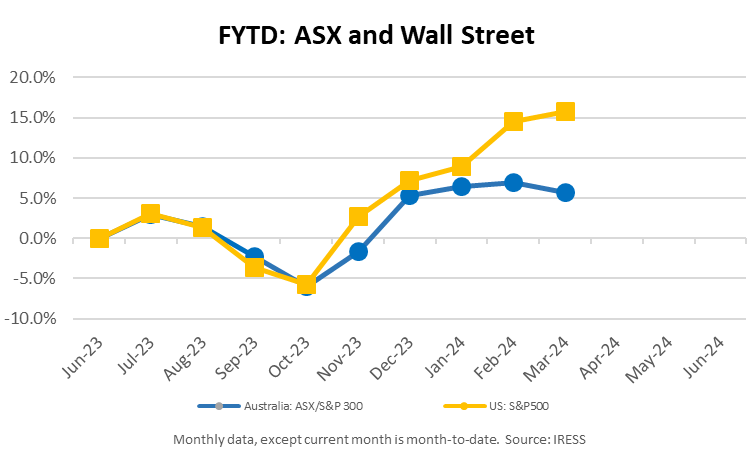

FYTD: ASX v Wall Street

Stockland (SGP) Profit Reporting 1H24 result

Stockland is a major Australian player in property development and management. It builds and invests in residential communities, shopping centres, workplaces, and logistics facilities. It’s known for creating master-planned communities and are one of Australia’s largest retail property owners.

In the medium-to longer term, we think that Stockland’s position as one of the largest residential developers will become an advantage. New (albeit not entirely satisfactory from this writer’s perspective) property solutions like Buy to Rent (typically apartments) and residential ‘Communities’ similar to those offered by Lifestyle Communities, Ingenia and others (people buy in but do not own the land upon which their home is built, providing it with a lower cost entry point) will become high margin opportunities for developers like Stockland in Australia’s ludicrously priced residential real estate market.

In this respect, this transition within the business is apparent, with Stockland having purchased Lend Lease’s Master Planned Communities business in the past 12 months.

The result

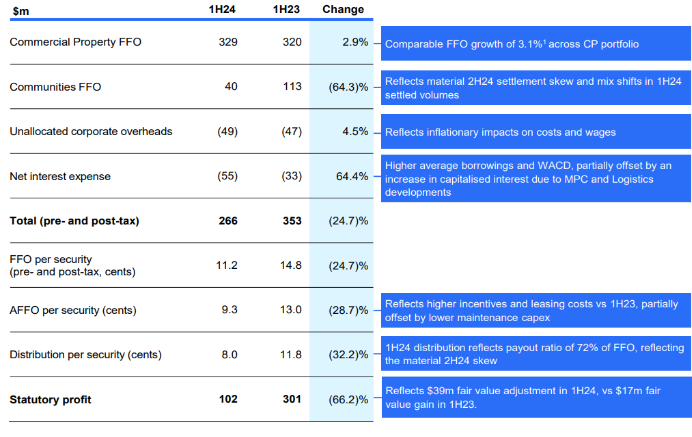

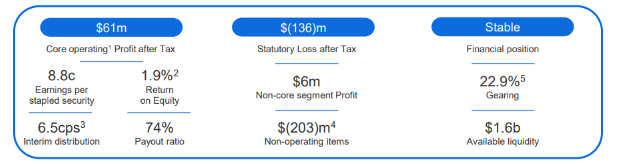

Figure 1 : Financial Summary – a soft 1H24 result

Source: Company reports

A more challenging residential property market with a decline in settlements in their Communities business as well as a rise in interest costs caused the company to deliver a disappointing result versus market expectations. Funds from Operations (FFO) declined 25% year on year to $266m, albeit the company indicated that it anticipated that there would be a stronger-than-usual skew in earnings towards the 2H, maintaining FY24 earnings guidance at previous levels.

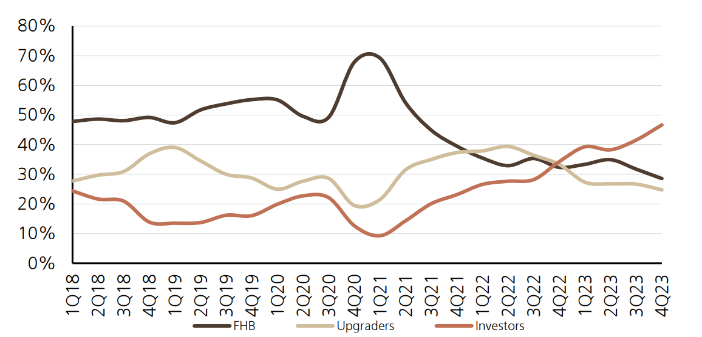

Figure 2: Residential housing mix – First Home Buyers have pulled back

Source : UBS, Company reports

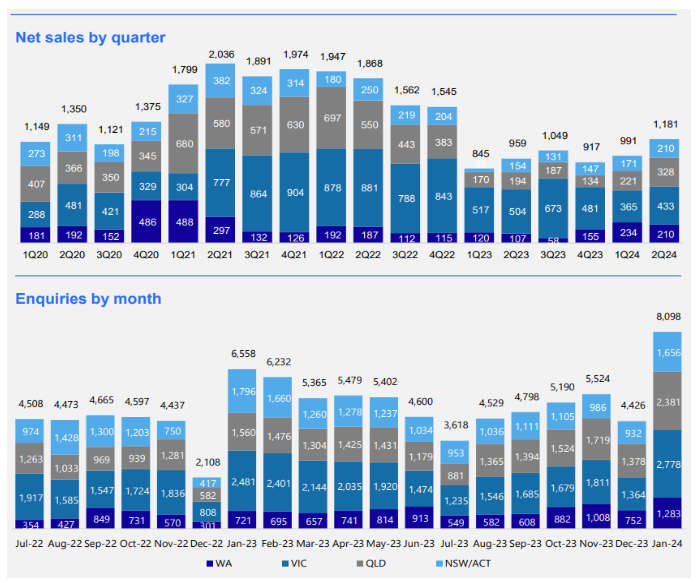

The company expects improved fortunes in the second half, with an improvement in the New South Wales market in particular anticipated. Recent sales trends and enquiry levels point to improved fortunes.

Figure 3: A stronger pipeline in the Communities business

Source: UBS, Company Reports

What they said

“SGP has capital partnerships across MPark, land lease and communities which position the business well for growth when conditions improve, despite gearing edging up. Nearterm logistics lease expiries and a sizeable development pipeline support commercial property, but also require capital. Further capital partnerships across logistics development and retail (and potentially a rationalisation in workplace?) would support the range of development opportunities in front of SGP. We see continued affordability constraints on the MPC side limiting a strong recovery, absent material interest rate cuts, though the current ‘soft landing’ scenario appears to be supporting confidence leading to incrementally higher sales.” UBS

Mirvac (

Mirvac has over 50 years of experience in the property development market. Similar to Stockland, it too focuses on residential development, creating award-winning apartments and master planned communities across major cities. They also own and manage office, retail, and industrial properties, including developments like the world’s first net zero carbon office building.

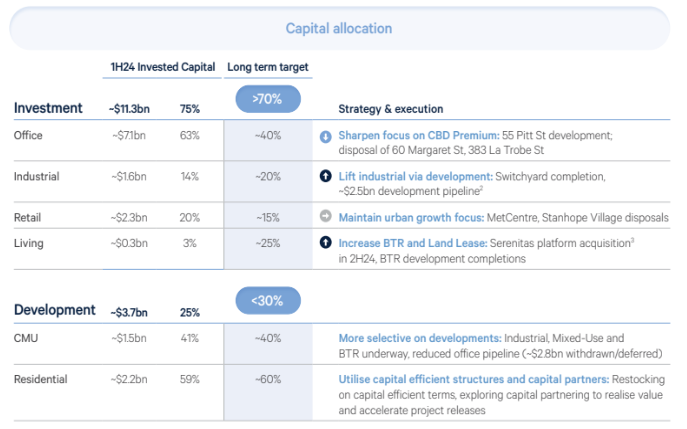

Like Stockland, an increasing shift in Mirvac’s capital allocation will be away from Commercial Office property and increasingly towards property focussed on ‘Living’ including Build to Rent (BTR) and Land Lease projects

Figure 4 – A progressive shift in focus

Source: Company Reports

The result – soft but the market had anticipated worse.

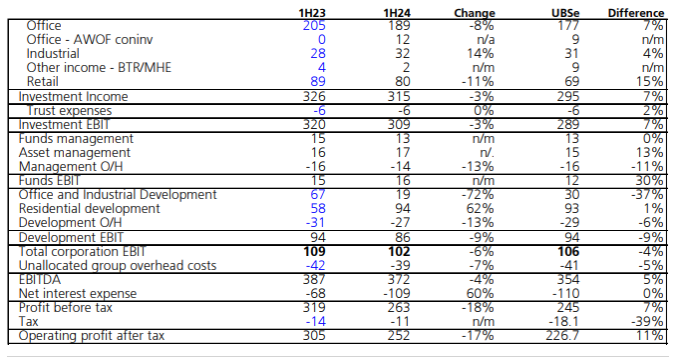

Figure 5 – Mirvac 1H24 financial results snapshot

Source : Company reports, UBS

Write-downs on Office property holdings were less than expected, reflecting in part, stronger leasing results, still relatively modest vacancies in their selective assets and higher required cap rates.

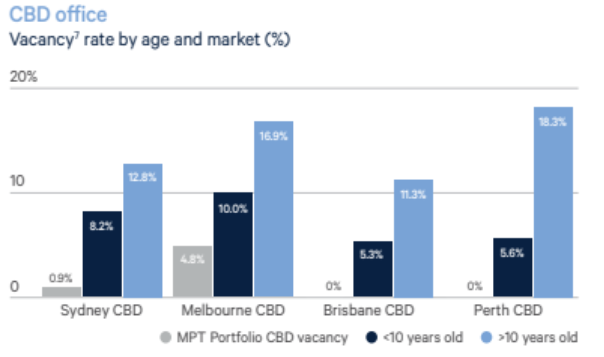

Figure 6: CBD Office vacancy rates by capital city

Improving valuations on Industrial properties were once again a solid contributor to Investment Income as they were at other REITS.

Residential development income was up strongly given a 40% uplift in property settlements in the period, a better outcome than Stockland managed.

Rising financing costs and an increase in gearing from 25% to 27% were reasons for caution for the market from this result.

What they said

“While investors are prepared to look through weak resi sales to a recovery, the capital position remains in focus. Gearing is expected to remain around 27% with asset sales (383 La Trobe and 367 Collins for ~$430m) and ~$750m of pre-sales settled in 2H not enough to bring gearing materially lower given further investment in the pipeline and Serenitas settling (with look through gearing increasing further). Substantial future asset sales/capital partnerships will be required to ensure gearing returns to the low end of the 20-30% range and to reduce office to the new target of 40% of investments, despite the development of new next generation office assets (55 Pitt etc.).” UBS

Garda (GDR 1H24 result – XXX)

Garda is a mid-sized REIT headquartered in Brisbane, that largely focuses on industrial property sites in Queensland. We have always enjoyed our interactions with CEO Matthew Madsen, who has always presented to us as a realist in an industry populated with over-inflated estimates of the robustness of valuations of Australian property.

Garda has progressively sold out of its investments in the Melbourne market in the past 12 months, having been caught holding suburban office properties in Burnley and Box Hill through the Covid period and the resultant downturn in office worker attendance since.

Unfortunately, this has led to the realisation of discounted prices for these assets (14-33% below recent book values), but these disposals have allowed a reduction in corporate gearing and a focus on holdings in more prospective territories and asset classes that offer more long-term capital growth.

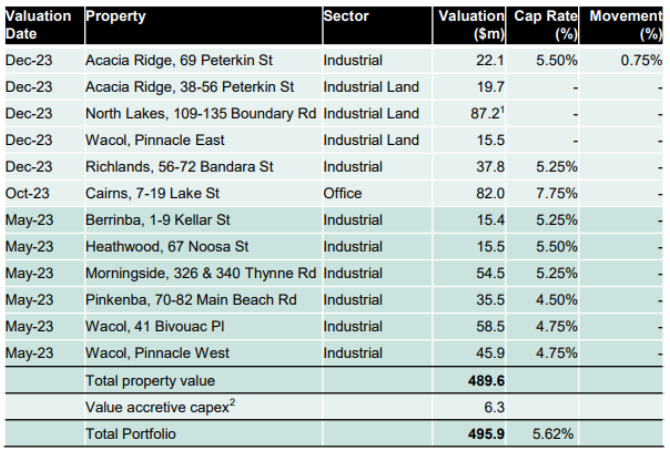

Figure 7 – Property valuations and Cap rates – still some room to move lower)

Source : UBS

We are excited about Garda’s prospects as it continues developing the North Lakes precinct and realise profits from previous transactions.

Consistent with management’s historical approach, Garda is positioned to benefit from various options within its current portfolio. Garda is not a ‘set-and-forget’ asset owner, unlike some other managers. Instead, it is looking to deploy its expertise in management, development, and transactions to continue to create value from the pool of capital it has at its disposal.

The stock currently trades at a significant discount (28%) to its net tangible value (NTA) of $1.73 per share and is forecasting a cash distribution of 6.3 cents per share (5% dividend yield).

Lend Lease (LLC) 1H24 result

Market observers widely regarded this as one of the most disappointing results of the reporting season. However, that is also consistent with our thesis for buying the stock—poor management will eventually be replaced or the strategy dramatically overhauled.

To that extent, activist investors HMC and Tanarra are on the register and agitating to see change.

While a number of strategic shifts, business disposals and cost reductions are being made, the market is increasingly becoming frustrated with the pace of change and level of returns.

The result – a poor one

A raft of reasons led management to abandon its ROE guidance of 8-10% in FY24, and market participants continue to ask serious questions about the medium-term target of 10-13%.

The Group recorded slower activity in construction and property sales as well as a reduction in valuations in the Investments segments of its business ($125m).

From a positive perspective, the portfolio recalibration continues, with the divestment of 12 Communities projects (to Stockland), exiting of West Coast and Central US Construction Operations and the business has progressed through 90% of its previously identified cost reduction initiatives, which will deliver $60m (pre-tax) savings in FY24.

What they said

“Since the strategy reset in FY22, investors have patiently waited for a ‘normalised’ FY24 ROE in the 8-10% target range. The quality of FY24 earnings guidance was downgraded last year (Google term. payment, communities sale profit and bond buyback in FY24) and now ROE guidance is lowered to 7% (18% downgrade to consensus estimates), with management citing a ‘challenging market backdrop’. Our prior Buy thesis for LLC was based around a normalisation of earnings (to target returns) and a consequent multiple re-rate (reflecting an improved growth profile) but a near-term recovery in earnings now looks uncertain” UBS

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.