This week’s Investment Matters will continue to focus on the recent reporting season.

While the dull shine of copper comes in focus, we shed little light on BHP. Similarly, our focus this week on financial services dives deeper than the four major banks.

Read previous week’s Investment matters about Profit reporting season.

The Markets

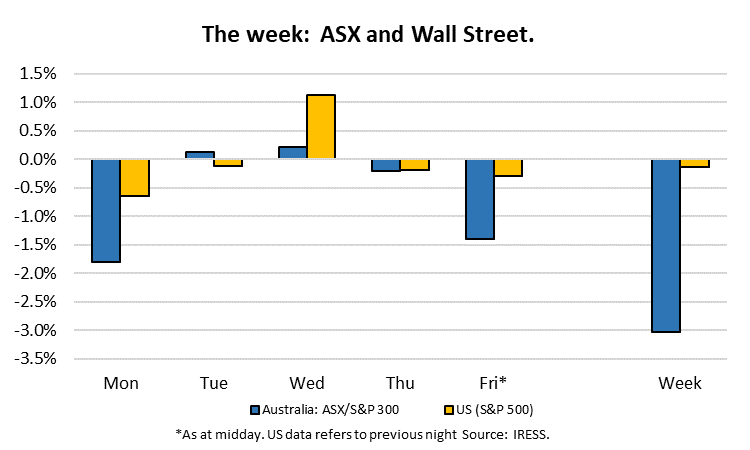

This week: ASX v Wall Street

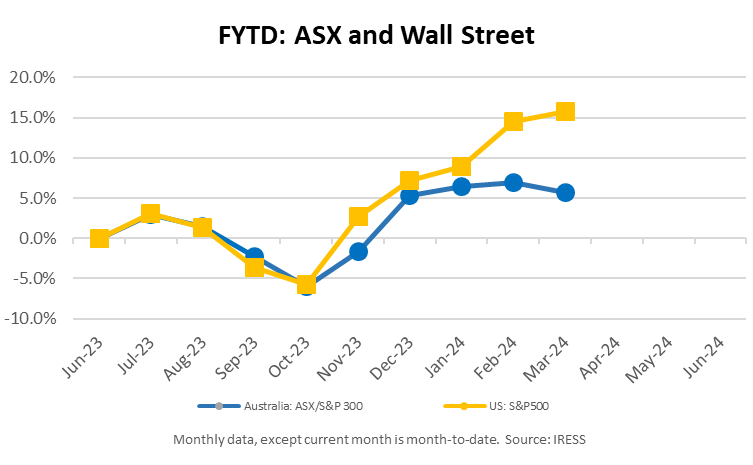

FYTD: ASX v Wall Street

Sandfire and the Copper Outlook (SFR 1H24 result – Positive – Stock price up 16 per cent since result)

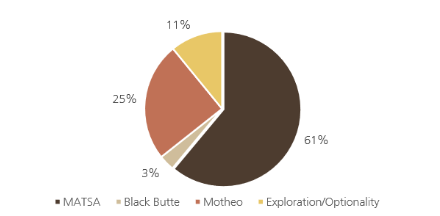

Sandfire Resources (SFR) is a Perth-based copper company. Historically, its flagship asset was the 100%-owned DeGrussa copper-gold mine in WA, which has now reached its end. SFR used the cashflows from the successful DeGrussa operations to acquire the MATSA copper-zinc mine in Spain, to develop the Motheo copper project in Botswana and to continue to progress with the Black Butte project in Montana.

The company’s high-quality result pointed towards improved operations in Spain and an exciting ramp-up to total production in Botswana. Motheo’s January run rate was 4.3Mtpa, with the ramp-up to 5.2Mtpa still continuing. SFR has indicated that pre-stripping activities for the A4 pit are going well, and the mine is on track to supply the first ore from the September 24 quarter. Further progress is also being made in Montana.

The 1H24 result was largely pre-released in January, with new news including improvements in the company’s corporate debt funding package. A US$200m corporate revolver and revised repayment reschedule should provide financial flexibility and reduced near-term repayments.

We caught up with the company’s CEO, Brendan Harris, last week and remain impressed with the understanding of the significant optionality the company retains in its asset base. We believe that a further 18 months of cashflows, alongside the ramp-up of Botswana, will provide Sandfire with several opportunities to grow its asset base in a number of jurisdictions, including exploiting the potential of Spain and Montana.

What they said

“The revised debt repayment schedule pushes ~US$50m repayments from FY25 into FY26. On our forecasts, SFR trades on ~10% free cashflow yield (US$395m/US$427m) over FY25/26E post US$30m in debt repayments. This is probably the best indication of what the business can do so far (and also before considering higher prices). Given any potential Black Butte capital investment is probably still some time away, we can start turning our mind to other uses in time, even dividends?” UBS

Outlook for copper price

At the same time, as the company was demonstrating improvement, global news of declining copper production and problems in Chile provided further support for copper prices in general and mid-size companies such as Sandfire.

Regular readers may recall that our attraction to copper as a “future metal” is based on both an increasing demand outlook associated with global electrification trends and a declining outlook for mine capacity, especially at ore grades consistent with current production.

As grades (the percentage of copper in the ore mined) fall, the volume of ore mined increases, as does the energy intensity of the overall production process. Both factors lead to higher costs. In addition, the ratio of upfront costs to copper ore continues to rise for a relatively fixed amount of overheads required for mine processing.

AME group reported that the average mined grade of ore fell from 0.77% in 2005 to 0.58% in 2017. In the Resources journal in 2016, it was reported that;

“(copper) ore grade is gradually decreasing for the selected mines, while production and energy consumption is increasing … decreasing ore grades is no longer a theoretical issue but a global reality in the case of mines in operation, caused by the increasing demand of raw materials …. the total energy consumption has increased at a higher rate than production (46% energy increase over 30% production increase)”.

This combination of more difficult production and higher energy costs will likely impact the long-term copper price we and the market use to value copper mining companies. Ultimately constrained supply and higher mining costs are likely to increase the average price realised by copper miners.

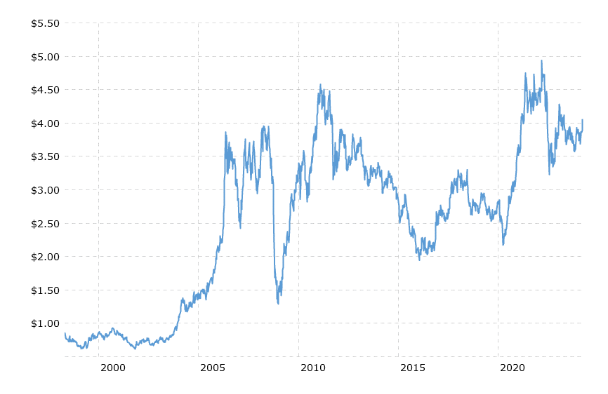

The chart below shows the LME copper price since pre-2000.

Figure 1 – Historical price of LME copper (USD/lb)

Source: Macrotrends

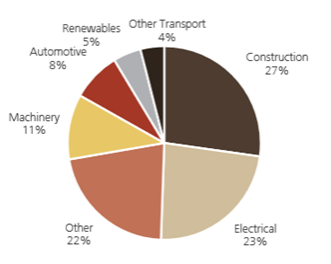

Note the impact of the rapid expansion of the Chinese economy in the early 2000s. Demand from China rose as the nation built out its housing and infrastructure base and replaced the rest of the world as the major supplier of machinery and electronic equipment. Machinery and electronic equipment are both heavy users of copper (see piece chart below).

Figure 2 – Copper demand by source (2023)

Source: Wood Mackenzie, UBS

Due to internal demand and global exports, China now represents about 50% of the global demand for copper production. Much of the copper used in this production is subsequently exported for final use to the rest of the world.

The previous price chart (Figure 1) also shows how the price of copper has responded to increased demand for electrification (EVs, power supply) since the mid-2010’s.

The price the market assumes for copper going forward (long-run) also needs to respond to a demand outlook that has been more robust than ever since 2015.

We assume a long-run copper price of $3.80. Many market commentators suggest that this price may be too conservative. UBS analysts recently discussed the likelihood of this price needing to rise to $4.50 USD/lb.

Sandfire has considerable leverage to a permanently higher forecast copper price. Its new mine in Botswana has an anticipated copper grade of above 0.90%, and its costs are low in the global cost curve. Higher prices will generate significantly greater profits over its anticipated life. Higher long run prices also improve the value of likely exploration targets owned by the company.

Figure 3: Valuation by asset

Higher copper prices are also valuable for other portfolio companies, including Aurelia Metals (AMI), New World Copper (MWC) and Metals Acquisition Corporation (MAC).

UBS analysts noted that using a copper price of US$4.50/lb (real/inflation-adjusted) indefinitely would result in a valuation uplift of nearly 50%. Our modelling produces similar results, with a slightly higher increase in expected return due to our view of Black Butte’s prospectivity.

With strong demand fundamentals and highly high-quality assets, the importance of the basket of copper-producing companies in clients’ portfolios cannot be understated.

Short term factors

At the top of the piece, we noted that production issues are plaguing the major mines in South America, including those owned by Rio and BHP. Analysis by UBS suggests that these problems and growth in demand will create a “meaningful deficit in 2024 (>300kt) driven by a sharp slowdown in supply that more than offsets deceleration in global refined copper demand growth”.

There may be limited capacity for the market to respond quickly because “the copper project pipeline is getting smaller, executing on projects/sustaining output appears to be getting harder, not easier, and in recent years, the miners/market has been far too optimistic on supply growth.”

Perpetual (PPT) Profit reporting – 1H24 result

Perpetual is a 100+ year old company built on the back of its Corporate Trustees business. It has also been a leading provider of investment management services in Australia under its own brand, having been the home of many well-respected Investment Professionals such as John Sevior, Matthew Williams, Peter Morgan and Anton Tagliaferro and portfolio managers of its value-oriented Equities Funds. More latterly, the company has expanded its investment management business into different asset classes and geographies with mixed success. In calendar 2022, it more than doubled the size of its Assets Under Management in the Australian market with the purchase of Pendal Group (formerly BT Investment Management) as it hoped to add scale to the business and compete with the scale of the industry super funds.

First Samuel has owned shares in this business as a means of accessing the leverage to rising equity markets.

The result

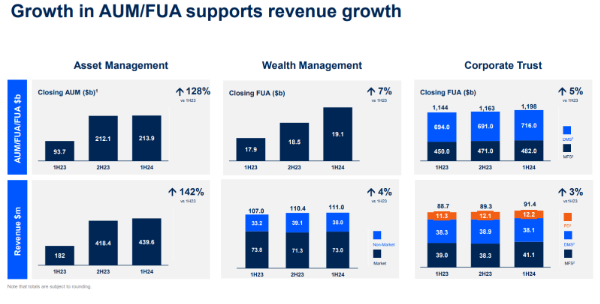

On the back of the growth in the Asset Management business, doubling in size post the Pendal acquisition, Perpetual was able to grow its revenue base in all divisions yoy.

Figure 4: Asset growth trends

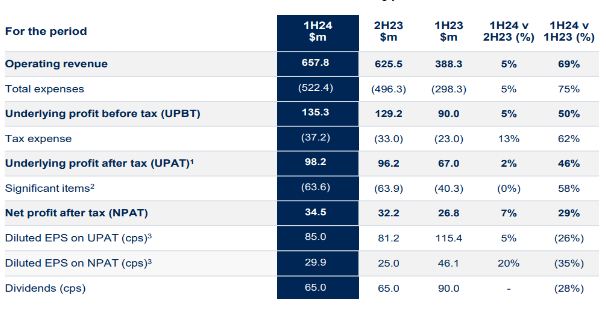

However, a growing expense base, including integration costs and a significant expansion of the shares on issue as part of the Pendal transaction, led to a significant contraction in the Earnings Per Share delivered. Dividends Per Share were scaled back accordingly.

Figure 5: Earnings Snapshot

Source: Company Reports

Analysts were also critical of the earnings quality given a revaluation profit booked, meaning the underlying miss to consensus earnings estimates was greater than first appeared.

Finding the value in the franchise

In August, after completing post results meetings with management, we made the following observations in Investment Matters

“…we think there is an opportunity for management to break up the business in the event that the market doesn’t recognise the fair value of the company over the next couple of years.

Our meeting with senior executives confirmed to us that this path is potentially part of the thinking at Perpetual, should the market continue to fail to assess the overall value in each component of the business. In the meantime, management is committed to bedding down its recent acquisitions with a view to stabilising outflows and realising synergies.”

And by December, our view was vindicated, with Washington Soul Pattinson emerging as a suitor. We wrote at the time

“Washington H. Soul Pattinson (‘Soul Patts’ – SOL.ASX) revealed on Wednesday 5th December that it has made a non-binding indicative proposal to purchase Perpetual for $27 per share. Under the terms of the offer, there is no cash component, with PPT shareholders receiving $1,060m worth of SOL scrip. SOL will retain PPT’s Trust (PCT) / Wealth Management (WM) businesses (and all of the debt and corporate overheads of the existing PPT business) and the remaining value will be shares in the demerged asset management business. As per the offer, investors would still hold the Perpetual Asset Management (PAM) shares and additional shares via a shareholding in SOL”

The board of directors of Perpetual are now conducting a strategic review of the business but immediately spurned the overtures of Soul Patts as a suitor, having declared its offer as “significantly undervaluing” the franchise. This comes off the back of this board having already rejected a similar offer to purchase the business by Regal Partners in 2022. We believe that time is running out for this executive team and Board of Directors to unlock value.

What they said

“An update on the strategic review (which began Dec 6th) was expected with this result, but is now deferred to the 3Q update in April. This was disappointing given the time lapse and level of interest in PPT’s assets. A successful separation of CT/WM would require circumventing CGT issues which the rejected bid from SOL offered. However, due to the passage of time, Asset Management earnings have deteriorated and margins in its key CT division have compressed further. Further delays on an outcome could prove detrimental for shareholders in our view, particularly if existing shareholders end up retaining the Asset Management business.” UBS

Judo Bank (JDO) 1H24 result (Positive – up 8% since result)

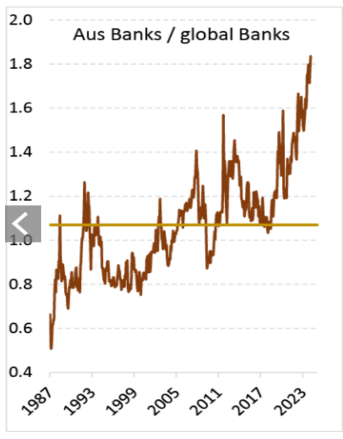

Having sold ANZ Banking Group in our portfolios, we recognised that the major Australian banks are at prohibitively high valuation levels. Last year, we added Judo Bank to our portfolios as an undervalued challenger bank providing traditional relationship banking services to Small and Medium Enterprise companies. .

Figure 6: Australian Bank PEs are almost twice their global peers

Source : UBS

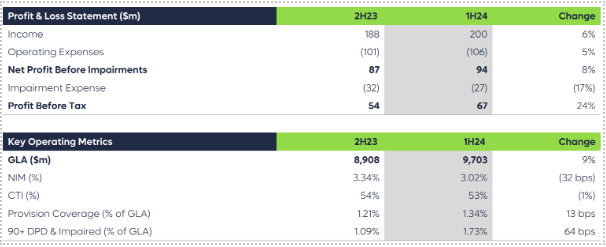

Figure 7: 1H24 Operating Performance – continued improvement

The Net Interest Margin (essentially the return from lending in excess of the cost of deposits and other funding incl equity), at 3.02%, remained above the targeted ‘at scale’ level associated with healthy returns for shareholders and was better than anticipated. We consider this to have been well managed by the executive team, and a reflection of the capacity to be nimble in a manner much more challenging for a major bank. As the figure X below shows, management was able to slow growth in larger-ticket Commercial Real Estate lending with finer margins and in the process expand lending margins over the Bank Bill Swap Rate (BBSW).

Figure 8: Rising lending spreads to protect net interest margins

Source: Company records

While there remains pressure on NIM’s across the industry as the outworking of Banks repaying the Federal Government’s supplied Term Funding Facility (TFF) accessed during Covid

What they said

“JDO has assembled a strong management team and an enterprise well-equipped to carve out

a specialist niche with zero impediment from IT legacy, tech debt and bureaucracy. JDO is a purpose built pure-play enterprise with a sharp focus, a clear plan and a strong pitch to SME Australia (a ~$600bn growing market)…” Jefferies

Read more on profit reporting season here.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.