© 2024 First Samuel Limited

The Markets

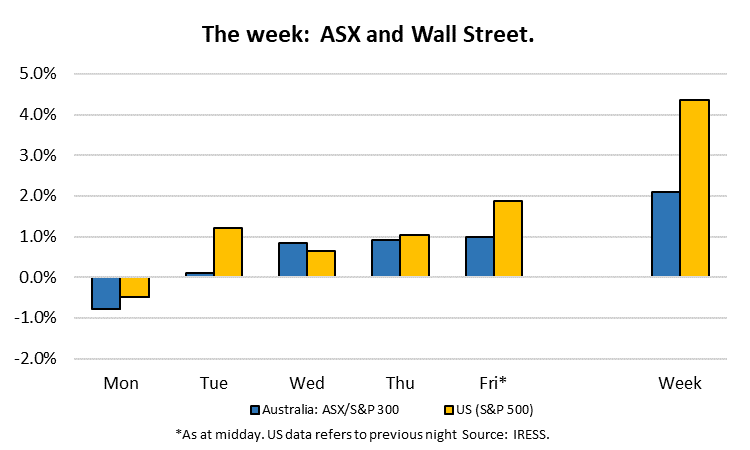

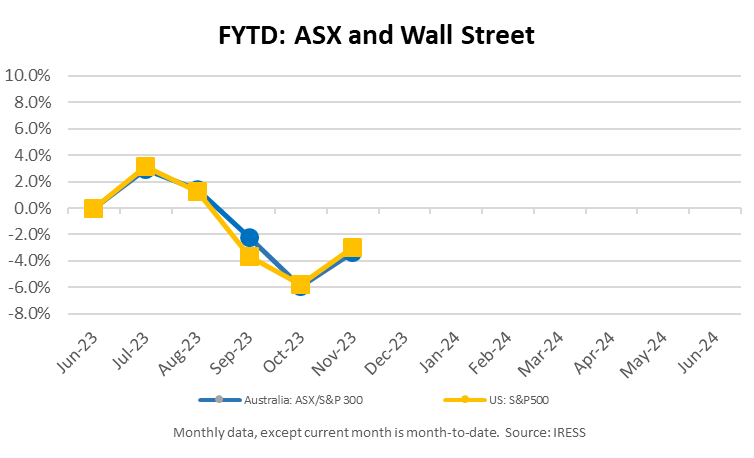

This week: ASX v Wall Street

FYTD: ASX v Wall Street

Inghams is the dominant supplier of chicken products in Australia. It is also among the largest positions in clients’ Australian shares sub-portfolios. In the past week, it delivered an update on progress within the business across the first half of the fiscal year.

We were very pleased with the breadth of the improvement in the business. The company identified:

- Continued improvement in operational performance metrics across farming and processing

- Strong demand for poultry, with some customers allocating more shelf space to the category

- Further improvements in Wholesale pricing

- Accelerated recovery in New Zealand

Inghams 1H24 – fattening the goose

The trading update on its 1H24 result suggests the company’s EBITDA (Earnings Before Interest Depreciation and Amortisation) is on track to rise >65% in the half. After generating EBITDA of $83m (pre-AASB-16) in the previous corresponding period, the company will generate close to $140m in 1H24.

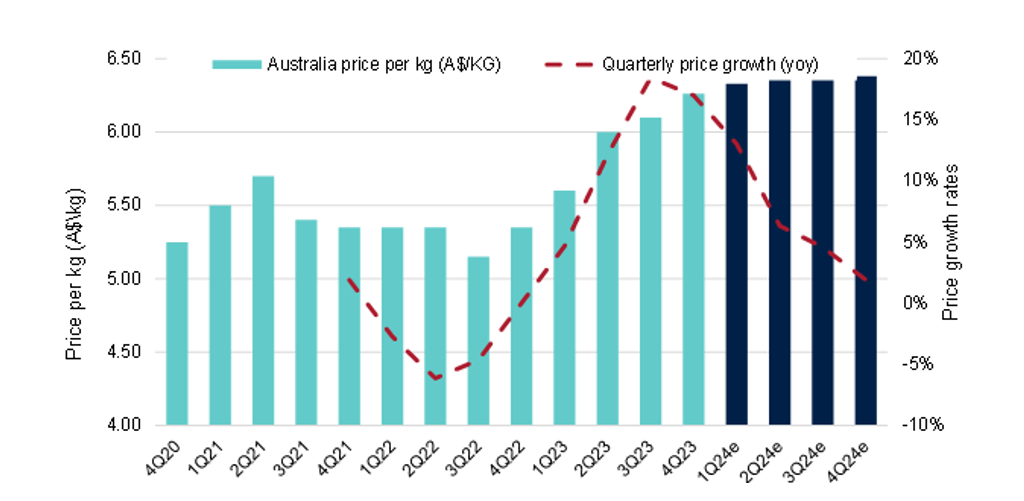

In a higher inflation environment, and with a backdrop of rising input costs, there had been some scepticism amongst investment market participants about the ability of the company to pass through higher prices to customers.

However, we believed that as a dominant market player, and given chicken was already one of the most affordable meat protein sources, Inghams would indeed have pricing power.

Chicken Price Inflation

Source: MST, Company reports

Such scepticism by the market has proven unjustified, with EBITDA margins set to return to above 8%, closer to pre-Covid levels, which peaked at 8.9%.

Recovery in New Zealand continues a recent trend, which is especially important to our long-term valuation. A New Zealand market that is less competitive and suffers from less oversupply of chicken provides an opportunity for higher margins in that part of Ingham’s business.

Consensus earnings (i.e. the average of earnings estimates of all of the stockbroking company analysts) proved too conservative. It was suggested in the market that these estimates would need to be increased by ~20%.

With such a large increase in anticipated earnings, it was not surprising to see the share price rise 17% across the week.

The impact of inflation is far from over for Inghams, with the company noting “continued inflationary headwinds across labour, feed and other costs including fuel, electricity and CO2”. The impact of this ongoing cost growth will be further price rises for chicken, which may lead to higher margins.

Additionally, as the company shifts from fixed contracts to variable-rate contracts with its growers, this process will result in a declining level of depreciation of right-of-use assets (leasing contract values). This will boost earnings on a post-AASB-16 accounting basis, which has now been adopted by the company as a contemporary basis upon which to report its financial results.

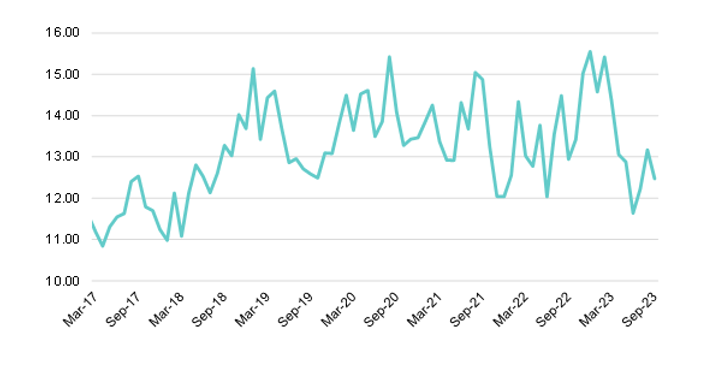

Valuation appeal remains

Ingham’s share price has risen greatly this year, and the position is the largest in clients’ Australian shares sub-portfolios. We still believe the stock has attractive investment characteristics. We view 12.5-14x PE as fair value on a post-AASB-16 EPS.

The stock was trading at just under 11x PE before the update. Moreover, with improving free cash flow (a critical feature of companies we favour), we believe a likely fully franked dividend yield of around 5% has appeal.

In time, it is possible that the company can be worth an even higher multiple. To do so, it would need to continue to grow sales in higher margin value-added products, continue to improve its manufacturing processes, manage its supply chains better, or rationalise its historic investment in its manufacturing plants. We suspect all are possible, although we are more sceptical of value-added products than the company often suggests.

Valuations on a PE basis (post AASB) – undemanding

Source: MST Marquee, ASX

Gamesmanship for Origin heats up

We’ve spoken about the appeal of having assets in our portfolios that we consider to be undervalued. While the share market is not always quick to realise value, an increasing source of value recognition in the Australian share market comes from Private Equity bidders and in-market takeovers.

Readers of this weekly portfolio commentary will be familiar with our position in Origin Energy and the ongoing process of the takeover offer from a consortium of Brookfield and EIG/Mid Ocean.

A quick recap

Having originally launched an offer in November 2022 at $9 per share, the consortium adjusted its bid lower in February 2023 to $8.90 per share. This offer was still considered adequate/attractive enough by the board of directors at Origin to accept the deal in March and for the parties to have entered a binding Scheme Implementation Deed.

The deal gained clearance from the ACCC in October 2023, solidifying the prospects of the transaction occurring.

However, the two largest shareholders in Origin, Australian Super and Perpetual, began to make noises about being dissatisfied with the terms of the Brookfield bid. A strong FY23 trading result from Origin, reflecting rising energy prices and the continued strong growth of its Octopus subsidiary, the now second largest energy retailer in the UK, had made Brookfield’s job of convincing existing shareholders of the adequacy of its bid extremely challenging.

Accordingly, the Origin share price had begun to trade a sizable premium to the bid price (~$9.20-9.30 per share). Prudently, we elected to take some profits in the stock (about 1/3 of our remaining clients’ portfolio position), reflecting the absence of a higher bid and the still risk that a transaction may not be consummated.

Since the first bid was lodged, we have sold more than 70% of the position.

Latest developments

Realising there was rising resistance to its offer, on 2 November, the bidding consortium revised its offer for Origin to an equivalent offer of $9.59 per share. In doing so, the consortium declared this was a final offer and was willing to step away from the transaction.

Undeterred, Australian Super had recently accumulated an extra 1% of the stock in a show of defiance. Officially, it has now twice indicated that it would not accept the bid, including at the higher price of $9.59 per share.

As the share market responded to the rejection of the revised offer by Australian Super, the market drove the Origin price lower, down 7% to ~$8.47, which reflected the prospect of the offer being withdrawn. Australian Super reinforced its stance by enlisting the help of Macquarie to add 21m shares to its position at prices up to $8.65.

Where to now?

We’ve seen takeover offers fall over when shareholder approval has not been forthcoming (think Qantas in 2007 when a bid of $11 billion for the airline occurred – market capitalisation today is $8.8bn via a tough of less than $3bn in 2012).

Without a Brookfield takeover, we’re not sure how Origin management will find a way to spend the estimated $20-30 billion that Brookfield was prepared to spend to transition Origin to renewable energy.

Similarly, we’re also a little bemused by the short-sighted nature of equity market investors when it comes to recognising the long-term value in assets and the level of investment required in businesses to realise value. Like Australian Super, we too, are conscious of the increasing lack of scale and liquidity in the Australian share market beyond the top 20-50 stocks.

We are likely to remain small shareholders through the remainder of the process. If the improved offer is ultimately successful, that would represent a strong return from current levels. Should the offer fail, we would also like to remain a shareholder in the public company with so much opportunity going forward.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.