The Markets

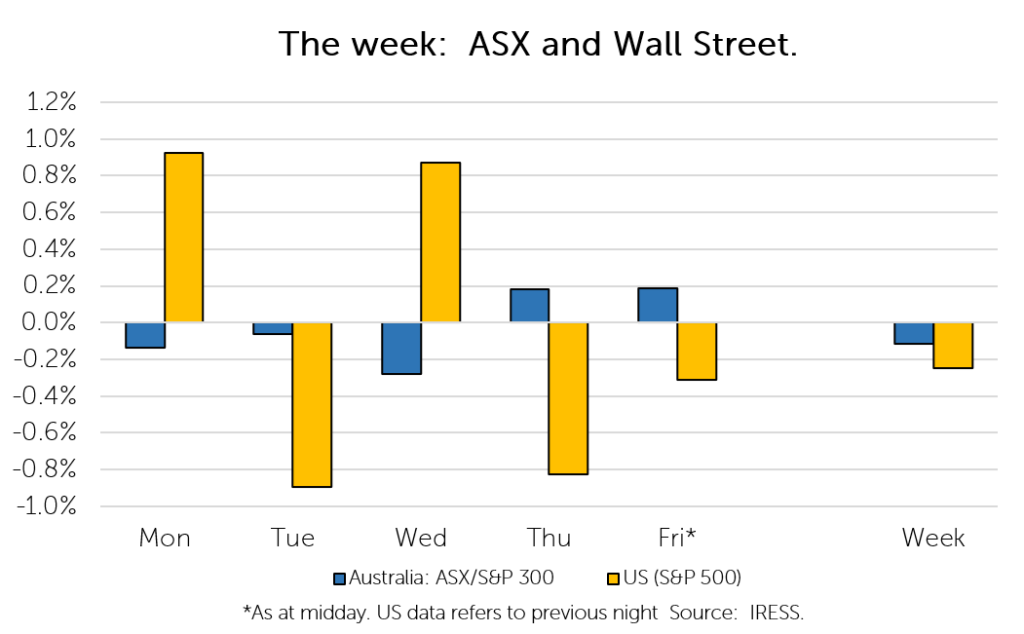

This week: ASX v Wall Street

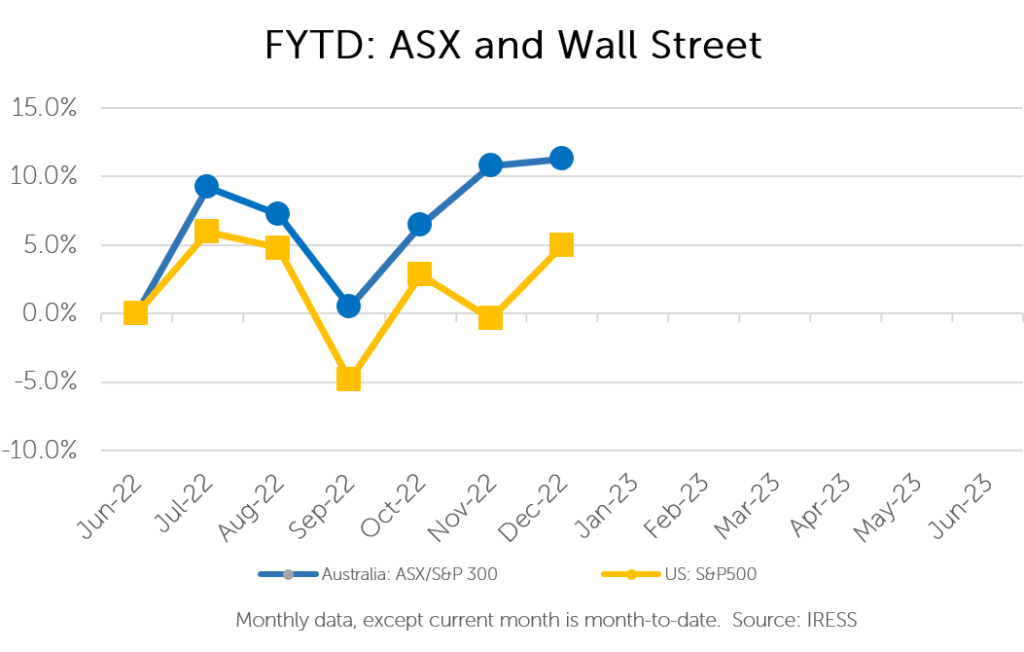

FYTD: ASX v Wall Street

Many of our clients based in Victoria and New South Wales have attended our CIO Dinner events during the previous two months. With the aid of several slides, I discussed how we have begun to see long-term value emerge in the Australian share market.

Central to this are three distinct observations:

- Australian equities in total are reasonable value on a 5-year view

- Amongst the more than 150 companies that we model from the ground up (that is, based on their financial accounts, the markets and our own forecasts) several are presenting valuations that are compelling; and

- The sell-off of expensive growth stocks in the wake of rising interest rates has resulted in the simultaneous sell-off of cheaper assets.

The elephant in the room, of course, is the prospect of higher interest rates on the horizon, and the follow-on impact of rises that have already occurred.

Whilst higher interest rates can lead to recessionary conditions, and hence affect all stocks, we are convinced that “value stocks” in general (excluding banks) had already incorporated a reasonable discount of future earnings.

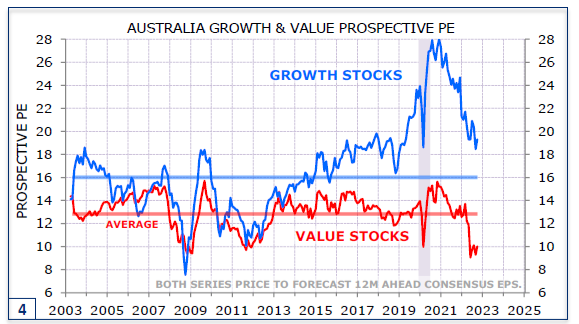

There is a simple chart below that shows each of these factors:

Source: Minack Advisors

As a reminder: the P/E or price-to-earnings ratio is a simple, often effective way of determining the value of a market as a whole or a single stock. It is simply the price being paid today divided by the expected amount of future earnings (usually and in this case, the following years). So, a /PE of 19 for growth positions (in the chart above) would imply that the market is paying $19 for every $1 of future earnings generated by “growth stocks”.

Whilst the overall levels of P/E are ultimately determined by the cost of money (interest rates), the riskiness of the equities on offer (beta) and the growth that is expected (g) we know that over the long-term certain trends in earnings emerge. For this reason, it can be very informative to view long-term charts of P/Es to get one’s bearings when determining the relative value of the market through time.

Growth stocks are more highly valued because investors expect their earnings to grow faster in the future and so whilst you may pay more for such a position, the price can be reasonable when we consider the earnings potential in say 5 to 10 years.

Value stocks, which often have weaker growth outlook, may provide a greater level of earnings certainty, and can often generate significant positive cash flow. First Samuel has tended to look for such “value stocks”.

In the chart above we can see that the P/E ratio of the red line has fallen significantly in FY22 to levels only seen in 2009, 2011 and during the COVID crisis. Our view is that despite the risks of recession in the coming 12-18 months positioning in these stocks will prove profitable as the underlying earnings and market conditions improve in the medium term.

In the case of the growth stocks (the blue line) it is possible that in addition to earnings risks from a possible recession that the P/E itself has further to fall. This would be consistent with higher rates and higher inflation for longer than current market expectations.

Some examples of “Value” stocks in clients’ portfolios include:

- Fund managers

- Platinum

- Perpetual

- Building materials companies:

- Reliance Worldwide

- Seven Group which includes exposures to Boral, Westrac and Coates Hire

- Smaller companies including

- Early Pay

- Emeco Holdings

- Paragon Care

- Here There and Everywhere

We classify more than 50% of our clients’ Australian Equities positions (by value) as “value stocks” and their average PE is approximately 11.5 times next year’s expected earnings.

In recent months we have deployed a significant amount of cash into these value positions. New value-type positions in the portfolio have included Ventia, Mineral Resources and Omni Bridgeway.

Other explicitly non-value positions may nonetheless trade on relatively low PEs as their earnings grow, recover and improve in 2/3 years’ time, especially those affected by disruptions.

Recognition (in private)

As noted in last week’s Investment Matters, conditions that are consistent with a future appreciation of value stock can be correlated with strong conditions for takeovers.

Investors of private capital have voted with their wallets and have seized on the opportunity provided by current valuations to take a number of companies private (including Origin Energy, as detailed last week), with a view that they represent value over the medium term.

Similarly, we have seen that companies that once looked internally for growth, often funded by low-interest rates, are rapidly looking to move towards “profitability” and “cash flow break-even” as markets have come to put a greater value on cash flow generation.

We see the increased activity by private capital as an affirmation that at current prices, there is value on offer for those who are patient and willing to look beyond the next 6-12 months.

Our clients’ portfolios are positioned accordingly.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.