The Markets

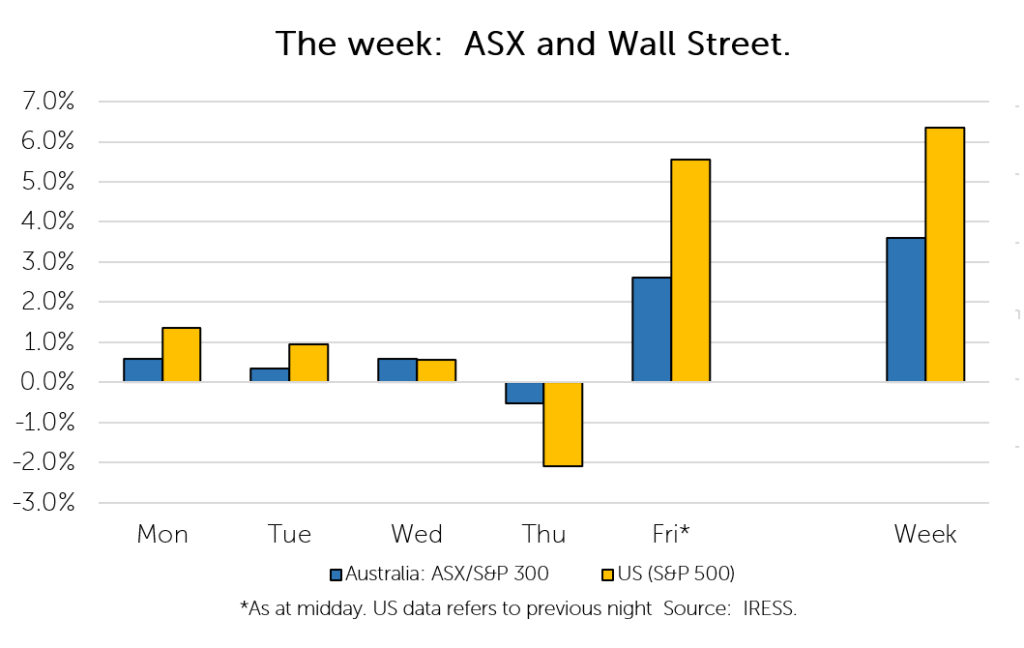

This week: ASX v Wall Street

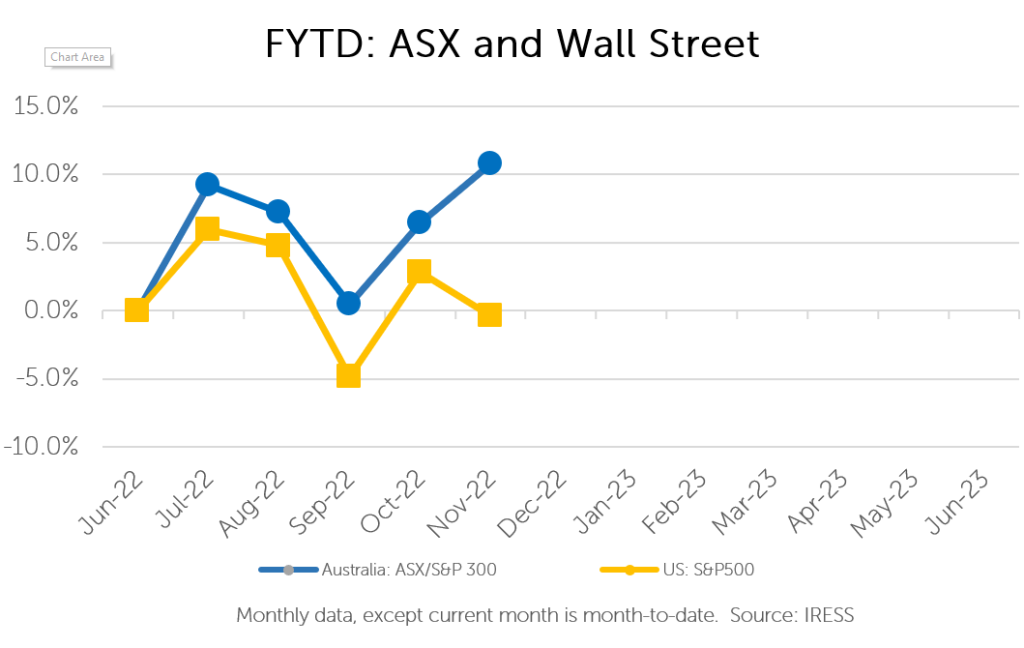

FYTD: ASX v Wall Street

What mattered this week? A fifth proposed takeover of a portfolio company in a matter of weeks.

And a big one at that.

Origin Energy (a $10bn+ company) has received a takeover offer at a considerable premium.

This was coupled with an increased offer ($33) for Perpetual Asset Management, which we discussed last week.

All of this takeover action conjures up two questions:

1.How are public markets getting it so wrong (given the size of the premiums being offered)?

And

2. Where to from here for the shareholders of these companies?

We explore both questions in this week’s Investment Matters.

The Origin Story: revisited

We have previously commented on the short-termism that has surrounded Origin.

The market has been particularly focused on the near-term outlook for earnings, given the flux in electricity markets and issues with coal contracting.

Yet, we continued to hold the view that Origin was well placed – financially and strategically, to be at the vanguard of the energy transition in Australia.

This was vindicated by the bid lobbed on Thursday, which was at a 56% premium to its previously traded share price. The suitors – private equity firms Brookfield and Washington-based oil and gas investor EIG recognised this same value.

Commenting on the proposed acquisition, Brookfield noted Origin is “due to the nature of the assets it has today, [is] best-positioned to be able to take advantage of investing quickly into the energy transition”.

With such a large premium on offer, how did the market get it so wrong? Particularly with regards to such a large, well-known publicly listed company?

We see it as a matter of differing time horizons.

Differing time horizons

Often, the market prices companies based on next year’s earnings, or expectations on how a company’s share price may perform over the next 12 months.

The reason is simple – capital is increasingly less patient, and so investment manager performance is increasingly judged over a shorter time horizon.

We only have to look to the change in coverage by large institutional brokers to see the bastard offspring this short-termism produces, such as the “12-month price target”.

Subsequently, the ideal company has become one whose revenue grows steadily, whose earnings trend upwards in a smooth line and who undertakes minimal investment.

These companies do not exist (or for long at least).

In reality, revenue fluctuates, often due to factors out of operators’ control. Likewise, earnings often are volatile (particularly over the last 3 years) and investments need to be made that may not seem like a sure thing (at the time).

This provides opportunities to those with a longer time horizon, that are willing to look through near-term volatility in earnings and invest based on a longer time horizon.

This is the approach taken at First Samuel.

We would like to think that companies aren’t defined by a single year of earnings and more by what we can reasonably expect them to earn over time. The bid for Origin this week has clearly recognised this.

The end, or the beginning?

And so, a bid for Origin has come. Fantastic. We can now pack up our things and go home.

Unfortunately, things are not so simple.

In fact, from the perspective of a shareholder, the question of ownership has become a little more complicated.

A bid for a company throws up several questions:

- Does the bid price represent the value of the company?

- What is the likelihood that the bid will proceed to a binding offer (post-due-diligence)?

- What is the likelihood of a revised offer – from the same suitor or another bidder?

- Will the necessary regulatory approvals for the takeover be received?

- Could something go wrong that the market is not aware of?

Until a bid is finalised, a company’s share price (ergo investors) will look to digest and impute all of these factors.

This is a task so nuanced and specialised that there are investment strategies that specialise solely in this – referred to as Merger Arbitrage.

Over the past three years, clients of First Samuel have seen the machinations a company’s share price can go through between an initial offer and the finalisation of a deal.

Or in some instances, as we saw with Ramsay Healthcare, the abandonment of an offer.

This complexity and uncertainty – can take time to reveal itself and be appreciated.

Therefore, as a matter of prudence, we have looked to “take some off the table” and sell a small part of clients’ holdings in both Origin and Perpetual after a week of large gains.

More to come?

With a disconnect in time horizons, it is evident that suitors are out in force again.

We would not be surprised to see more transactions involving companies within the portfolio in the near term.

***

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.