© 2024 First Samuel Limited

The Markets

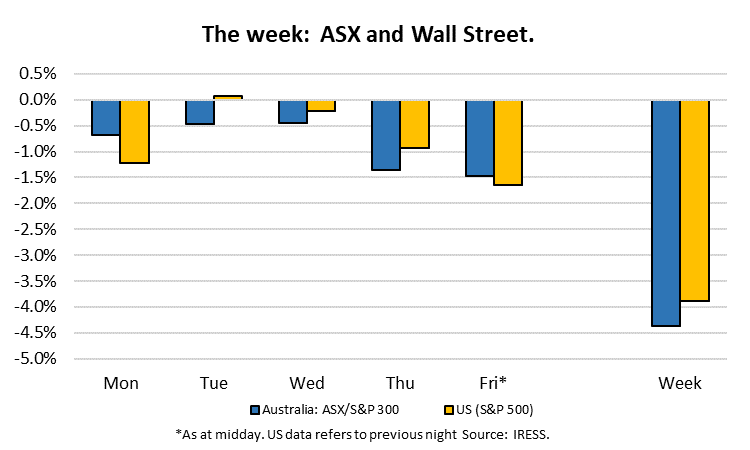

This week: ASX v Wall Street

FYTD: ASX v Wall Street

Note: not all clients will hold all of the securities we discuss.

To provide a more complete investment picture, we will continue to provide some updates on the prospects of our sub-portfolios’ companies as gleaned from our coverage of the ASX Company Profit Reporting Season:

- Nufarm (NUF)

- Mirvac (MGR)

- Ventia (VNT)

Nufarm (NUF 1H23 result)

Nufarm is a new addition to clients’ Australian shares’ sub-portfolios, but a very old company that has been operating in agricultural markets – producing chemicals and fertilisers for over 100 years. It’s perhaps best known as the manufacturer and international distributor of Roundup weed killer. Agriculture is an industry segment that we are fond of, seeing the opportunity to feed the world, via development of new technologies and improved farming techniques as a profitable opportunity within a global growth story.

Unusually, Nufarm operates on a September year end, reporting in May and November for its financial results.

Coming into the result in mid-May, softness in global peer earnings performance and volatility in agchem prices had resulted in the company’s shares underperforming the ASX200 by 20% ytd. Management was able to deliver a better-than-expected earnings result, with EBITDA of $316m for the half (down 4% on pcp), beating consensus estimates by 8%, while reiterating an expectation for full year earnings growth. We have taken the opportunity to add the stock to our client portfolios.

While the business has been operating in many of its core products and geographies for a long time, we also think that it has a prospective portfolio of assets within its (Nu)Seed Division. The major focus products within this division are as follows:

1/ Omega-3 (important for cell development, particularly in eyes, brain and heart)

In recent months, approval in Norway for Aquaterra’s Omega-3 Oil as a source of sustainable, human and animal-friendly product has provided a boost to Nufarm’s business. Wild fish are the main source of Omega-3 oils for humans and this product can be used in Norway’s salmon farming industry, the largest in the world, to sustain supplies.

Nufarm’s Omega-3 Canola Oil seed business

Source: Company reports

However, a flagged uplift in capex of ~50% in FY24 (from $1.7bn to $2.5bn) has some elements of the market concerned about cost overruns and project timing in order to meet volume targets. Softening iron ore price expectations amongst consensus has seen the company recognise significant impairments in parts of their portfolio too.

2/ Carinata, a non-food cover crop that can be used to produce low-carbon/renewable fuel feedstock

Nufarm recently signed a deal with BP Products North America, entering into a strategic offtake and market development agreement for BP to purchase Nuseed Carinata oil. BP plans to process or sell into growing markets for the production of sustainable biofuels . BP will use this as a carbon offset to its traditional fossil fuels business.

Nufarm: Carinata crop

Source: Company reports

The ‘consensus’ institutional investor in the market has a more conservative appetite towards expansion and balance sheet gearing than we do. This is in part a function of the longer-term horizon that we take towards managing money and our propensity therefore to not manage to quarterly performance metrics.

What the market said:

“We remain Buy-rated on Nufarm. The stock is trading at an undemanding FY23e P/E of 13x, below its long-term average of 15x. In our view, the current Nufarm share price presents an attractive entry point to gain leverage to the solid global agriculture cycle as well as the significant upside from successfully ramping up the Omega-3 and Bioenergy (Carinata) seeds platforms. These Seed growth platforms drive our forecasted 5yr EPS CAGR of 10% (FY22-27).” UBS

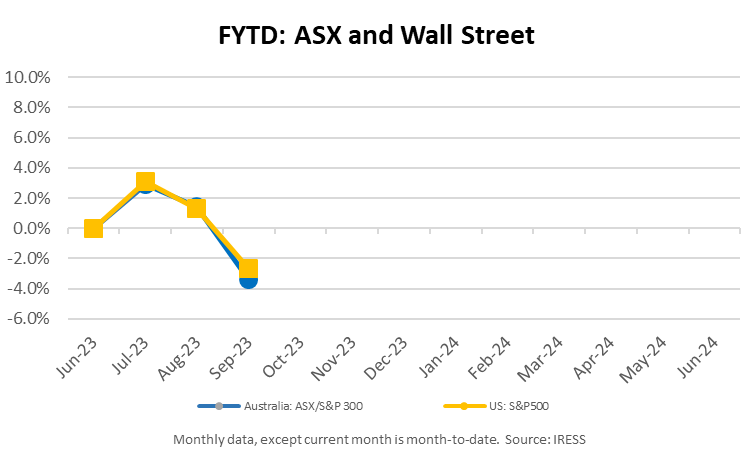

Mirvac (MGR FY23 result)

Mirvac is part of clients’ property sub-portfolios. It is a diversified Australian property group with operations across property investment, development and retail services and within the residential, office and industrial and retail segments.

Figure 1: Mirvac’s earnings in a snapshot

Source: Company reports

Lower residential development revenues (down 34%) resulted from a 9% reduction in property settlements to 2,298 that were adversely impacted by weather and labour availability. This was enough to fully offset strength (9% higher) in the group’s largest revenue source Investment income (which is earned from a range of property assets but is around 2/3rds from Office). Mirvac is looking to reduce its mix of exposure to office buildings given this segment has the most significant near-term valuation pressures owing to changes in work habits.

The year ahead

The outlook for FY24 residential settlement volumes of 2,500-3,000 was ahead of market expectations, with around 30% to come from apartments (11% in FY23). In aggregate, however, Operating Earnings Per Share (excluding revaluations) of 14.0-14.3c was modestly below FY23 and consensus expectations, driven by lost income on property trust assets slated for redevelopment (eg 90 Collins Street), lower commercial development profits (55 Pitt St, Sydney and 7 Spencer St in Melbourne) and the affect of higher debt costs.

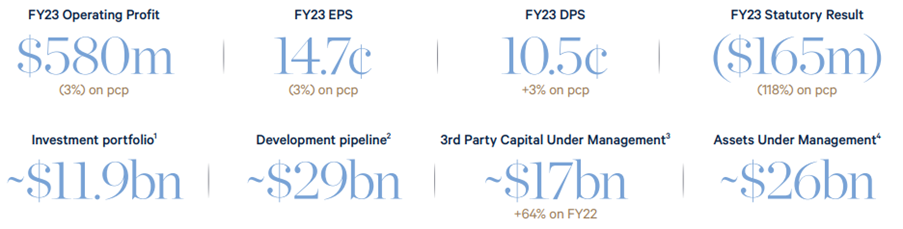

Figure 2: How Mirvac thinks about value creation

Source: Company reports

What the market said:

“In our view, affordability is the main issue driving residential into FY24, with mortgage repayments typically 20-30% of income but now approaching a record at >40% (as mortgage rates have increased from ~2% to ~6%). We therefore retain a preference for apartments over house and land/MPC (prefer MGR over SGP) given the better relative affordability of apartment product in a given catchment, but with all residential likely be supported by strong demand (record immigrations, vacancy <2%, 10% rent growth and limited supply as production challenges remain.” (UBS)

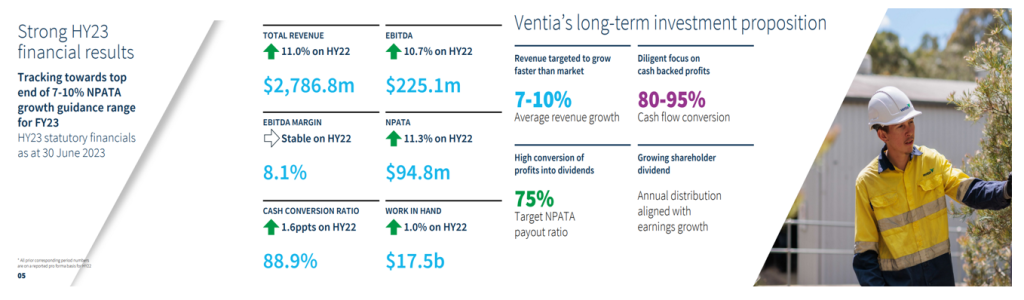

Ventia (VNT FY23 result)

Ventia is a company that focusses on the provision of essential infrastructure services including footpath maintenance for local councils, building repairs at schools and hospitals, specialist fire and rescue services for the defence force as well electricity tower upgrades.

Figure 3: Key industry segments

Source: Company reports

Ventia’s existence allows businesses to variabilise their cost bases by only having these types of workers on site when required but also allows the company to have access to skilled/trained workers. This offering is proving popular with a range of Government and large corporations and the business is being effectively managed to ensure good growth and strong cashflows for its shareholders.

Figures 4&5: Solid growth profile – current and expected

Source: Company reports

What the market said: “We believe the consistency of VNT’s performance is underpinned by a number of favourable operating characteristics. Contract structures are skewed towards lower-risk Cost Reimbursable (18%) and Schedule-of-Rates (73%) contract structures which supports VNT’s ability to deliver a stable EBITDA margin profile (>8.0% since CY21). This contract backdrop, coupled with 1) Defence contract capabilities (VNT short-listed across all recent tenders); 2) an improving Telco revenue environment (highest margin division: B*e at c.13%); and 3) revenue from new/adjacent end market verticals provides greater confidence in VNT’s ability to deliver against our CY22-25e EPSa forecasts (3-yr CAGR: +7%).” (Barrenjoey).

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.