© 2024 First Samuel Limited

This week’s Investment Matters will shed light on the surge in the price of gold and gold stocks in the past few months.

We hold gold stocks in our clients’ sub-portfolios for several reasons. It is therefore useful to understand why increases in the gold price warrant special attention.

The task for First Samuel is to profit from such price increases.

In discussing this, I have split this week’s Investment Matters into two lengthy sections. I urge you not to skip straight to the second section (on how we profit from gold prices increases).

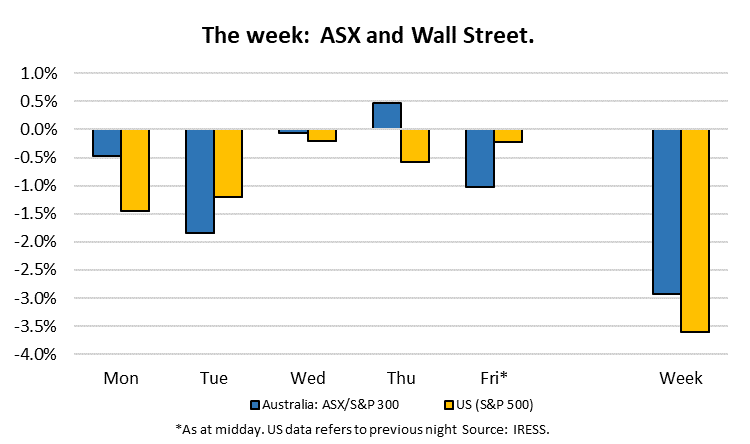

The Markets

This week: ASX v Wall Street

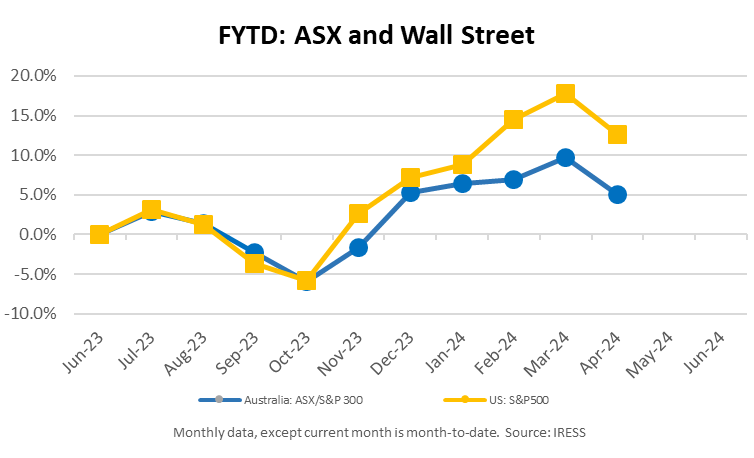

FYTD: ASX v Wall Street

Section 1: Why the gold price surge?

Figure 1: Gold price has boomed, especially since 20th February

Source: First Samuel, Trading Economics

Whenever the shiny metal moves in price there is rarely a shortage of people willing to explain the reasons why. We outline a range of reasons why gold could currently be gaining support.

The extent of the possible drivers is noteworthy. The fact that many themes will remain valid for years to come highlights the upside for gold in the medium term.

1. Return of persistently higher inflation

- A range of timely data, especially from the US, points to inflation being stickier (more persistent) and higher (above 2.5%) for much longer than was anticipated. Headline inflation increased 0.4% in March with inflation now running at 3.5% on an annual basis, up from 3.2% last month. That’s well above the Federal Reserve’s 2% target.

- In Australia, whilst inflation continues to fall, it remains at levels higher than the target.

- At a more detailed level, the breadth of inflation (how many sectors are in increasing in price) in major economies remains a challenge, with inflation no longer merely driven by the services sector or wages-driven inflation, which tends to remain higher following a spike in inflation like witness post-covid.

2. Reservations about central banks’ fortitude

- Higher inflation fiercely tackled by higher global interest rates, especially when these rates approach 5%, would typically be negative for the gold price. However, central banks are also concerned about domestic conditions, global uncertainty, and the need to continue stimulating investment in energy and infrastructure.

If they baulk at higher rates, allowing inflation to run and not providing investors with appropriate yields from cash, the attraction of gold only increases.

- In this vein, the gold market could consider the possibility that the US Federal Reserve will slow its monetary tightening plans:

- gold’s weakness was pronounced when the US Federal Reserve began raising interest rates and removing monetary stimulus in February 2022

- weakness continued through November 2022, when the largest rate hikes finally stopped: gold pulled back to around $1,600

- Since this period, rising hopes of cuts in US interest rates have fermented the idea of less Fed vigour, and the persistence of inflation has now fuelled the story that inflation will remain unchecked.

3. Increasing geopolitical tensions & bi-polar world risks

- In the short term, conflict in the Middle East and Ukraine provides uncertainty consistent with higher gold prices.

- In the medium term, risks of hot and cold conflict between the two global poles of power continue to rise.

- We have concerns about the future status of trade and capital flows between the emerging global power blocks of authoritarianism (Russia/China/Iran and North Korea) and liberal democracies.

- In the past month, NATO held an extraordinary meeting in which its invited their Asia-Pacific partners (AP4) – Australia, South Korea, New Zealand and Japan. The NATO chief Stoltenberg spoke of:

- The world is “now much more dangerous, unpredictable and violent.”

- China “propping up the Russian war economy, delivering key parts to the defence industry, and in return, Moscow… mortgaging its future to Beijing.”

- “… an alliance of authoritarian powers such as North Korea, China and Russia is working more closely against Western democracy.”

These are strong words, and perhaps not consistent with a global economy that currently relies upon massive capital flows between authoritarian nations and savings and investment plans of liberal democracies.

Those with a careful eye on the portfolio will note our reluctance to match the concentration of the index in iron ore stocks, including BHP and RIO.

The wariness extends from short-term concerns regarding weak Chinese demand and elevated current iron ore prices through to the implications for trade and capital flows consistent with a bipolar world.

4. Central banks’ buying

Changes in central bank behaviour relates directly to the polarisation noted above, and also the dominance of a set of monetary conditions dominant for the past 50 years.

- Processing trade surpluses from Asia, especially China, and oil proceeds from Russia and the Middle East through the US treasury market has been the core of monetary policy since Bretton Woods.

- The pegging of the Yuan closely with the US dollar was a symptom of such a system. China drove down global inflation with its extraordinary excess production and purchased the debt of the US government to store the nation’s savings.

- In an environment in which this flow of Chinese surpluses buying global government bonds, especially US bonds, is subverted or reduced, the demand for independent stable stores of value such as gold can be magnified.

- China and Russia would appreciate having a store of value in their own currency, a so-called de-dollarisation of their trading surplus and national wealth. The “de-dollarisation” argument behind the rent surge in gold then starts to emerge. For example, China may be keen to buy gold as a diversifier away from US government debt.

- Russia’s story is similar—though even more marked. Citizens of both countries may also see gold as one of the better ways to store wealth outside of a financial system they don’t necessarily trust.

5. Chinese devaluation risks

- To add to Chinese frustration, especially during internal deflation and rising external friction both direct in the South China Sea, and indirectly in proxy conflicts in Ukraine and the Middle East, the risk of significant disruption in global currency markets is rising.

- China may need to break the Yuan’s peg to the USD to restart its flagging economy.

- The problem is that the weakness in the Chinese economy, capital leakage, excess production, and weak demographic trends are structural. The geopolitical implications of a devaluation dominate the short-term impacts.

- A Chinese devaluation will export deflation to the rest of the world—their currency falls, their goods become cheaper, and consumers in the US and Australia buy more for less and switch further away from domestic goods and services.

- This would occur while US Treasury Secretary Janet Yellen already argues that China risks creating another shock to US manufacturing similar to the early 2000’s that cost millions of jobs. In meetings this month Yellen told Chinese officials in meeting after meeting that the country’s export-driven economic model is again creating imbalances that threaten the global economy.

6. Post-GFC ‘money printing’

- Gold has historically outperformed when investors lose faith in the value of the currency they trade. For the past couple of decades, the increase in money printing by central banks and the episodic turmoil of markets have increased the opportunities for gold to outperform.

- Those that follow the centuries-long history of the gold price point to the volume of modern creation-driven price level using such analysis could justify a gold price that is at least 50% higher than today’s level.

- In simple inflation-adjusted terms, as shown in the chart below, today’s price is similar to the peaks achieved after the failure of Bretton Woods in the 1970s and the peak reached in 2011 following the introduction of zero-interest rates two years earlier.

Figure 2: Gold price, inflation-adjusted – the past 100 years

Source: Macrotrends

7. Years of increased production costs

- Whilst the stock of already mined gold is vast (more than 210,000 tonnes), the demand for new gold is strong enough to ensure that the price of gold in the medium term, at least partly the costs of producing the new supply of gold.

- The world produces about 3,000 tonnes of gold annually, or approximately 1.5% of the existing stock. The growth in the stock of gold is similar to the increase in the world’s population, supporting the notion that gold could have a fixed per capita value over time.

- Within this context, the recent experience of Australian miners, which operate worldwide, has been dominated by rising costs. In Australia, excess demand for construction and infrastructure drove up the costs of new mines and the operations of existing mines. High wage growth and shortages of skilled workers have only added pressure.

Summary

All of the reasons are possible. We tend to believe that the combination of higher prices, stickier inflation and the beginning of central banks buying have contributed to recent rise.

The task for First Samuel is to make money from such a move, so the remaining section concentrates on translating higher gold prices into higher stock prices.

Section 2: Turning higher USD gold prices into profits on the ASX

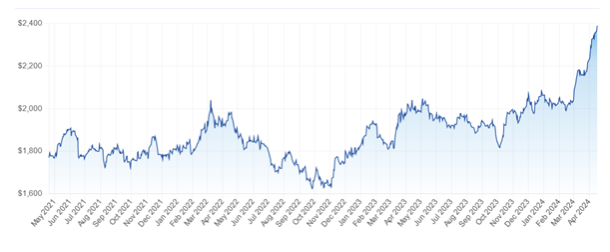

For several years on the ASX, the gold stock sector hasn’t delivered the returns an investor would have generated from simply buying gold alone. This result has been counterintuitive (gold stocks are more leveraged to the gold price than the gold price itself) and surprising, given the general quality of Australian gold miners and their assets.

Gold miners offer operational leverage to gold price upside, potential growth, and dividend yields and, therefore, should theoretically outperform gold in an upcycle.

However, as discussed in the previous section, gold miners face headwinds from higher operating costs and the cost of developing existing and new mines. They also face persistent pressure to replace the depletion of reserves from current mining and the natural desire to grow future production volumes.

In early February 2024, mining analysts from UBS produced the following chart, highlighting the underperformance since 2016. The price of gold had risen by more than 45%, while the price of gold stocks (GDX) had only increased by around 30%.

We believe such a spread is unjustified, so we have added to our positions in Newmont Mining, Aurelia Metals, Catalyst Metals, and De Grey Mining.

Figure 3: Gold price vs gold stocks price (GDX Index)

Source: UBS

Gold stocks finally producing strong results

We do not hold physical gold or a near-gold derivative in client sub-portfolios. However, we choose to maintain a suitable level of gold exposure for clients within our investment portfolios via direct equity holdings in gold producers.

We wish to hold exposures with high-grade deposits, long mine lives, and ample liquidity. Newmont looms as an excellent example on each of these measures.

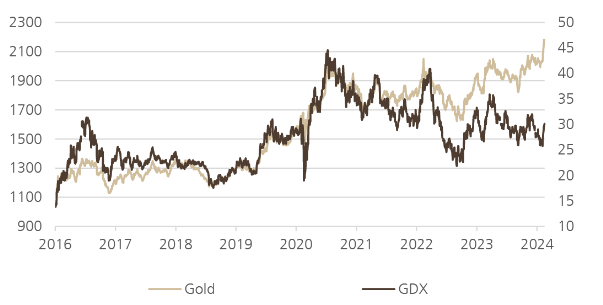

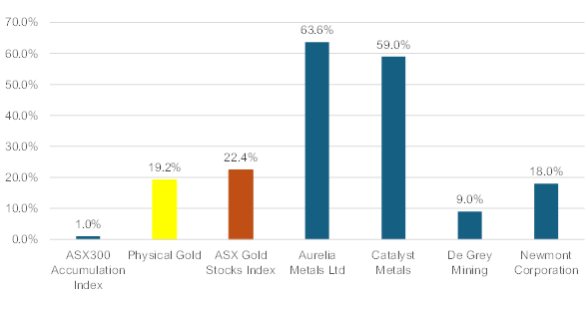

Figure 4: Gold and gold stocks – movements since 20th February

Source: IRESS, First Samuel

The chart above highlights market moves since the sharp move in the USD gold price. Unlike previous periods, the ASX Gold Stocks index has risen slightly faster than the USD gold price (22.4% vs. 19.2%).

The differences in the performance of the stocks we hold, from stellar changes in Catalyst and Aurelia (more than 50%) to the muted growth in De Grey and Newmont, may relate to our markets’ views on the long-run value of gold.

Higher current gold prices can only create value for a miner by selling as much gold as possible today while their costs are low. A mine with (a) high current production, (b) a limited mine life, and (c) relatively high costs can see a big current profit uplift, one that is relatively large compared to the total amount the mine was expected to make. It turn, this leads to a higher share price. This is the case for Aurelia and Catalyst.

A mine that is not currently built (De Grey Mining) or a company such as Newmont, which has long-lasting mines worldwide that are generally lower cost, will see less percentage uplift in current profits.

If the market perceived that the price of gold was permanently much higher than before, then those which have already found huge reserves of gold that will last for many years, such as De Grey and Newmont, would have seen a more significant rise.

This distinction is important to note when reviewing recent moves in the gold price.

Whilst there are many reasons the current price may be elevated, and we believe many reasons that these themes can remain important for the medium term, the market is still discounting that gold will once again fall in value considerably.

As short-term issues become more long-term, gold stocks with long-term production and long-life assets will also outperform.

This is why we maintain a portfolio of gold stocks, some that benefit from the short-term, some that benefit in the long-run, and all that provides insurance for the unexpected.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.