© 2024 First Samuel Limited

The Markets

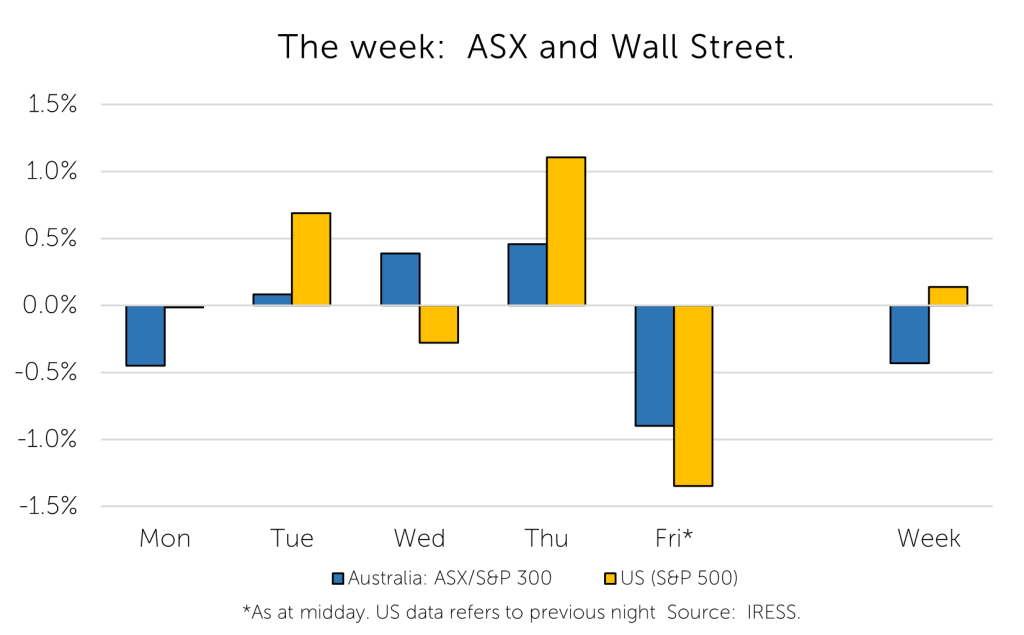

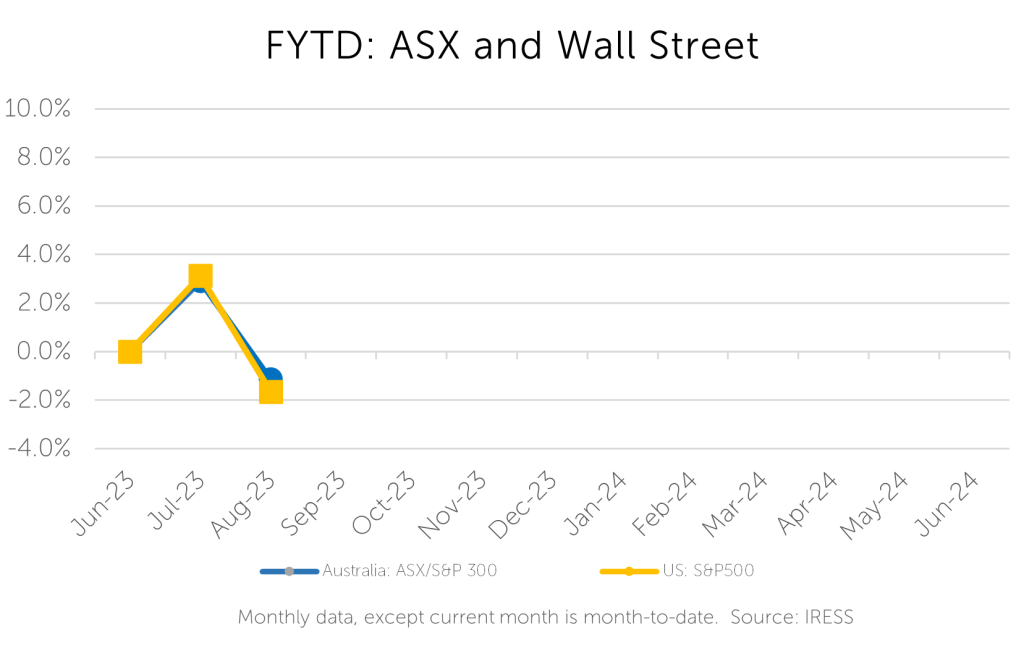

This week: ASX v Wall Street

FYTD: ASX v Wall Street

Note: not all clients will hold all of the securities we discuss.

The ‘peak’ week of company reporting season has just gone by. We provide some of the more relevant company-result takeaways:

- Reliance Worldwide

- EarlyPay

- Worley

- Woolworths

- Origin

The other major news for the week was a delay in the reporting of results by Costa Group, including notification of a deterioration in profitability in recent weeks, and subsequent risk that the bid by Paine and Schwartz would not be completed or that the bid price of $3.50 would be reduced.

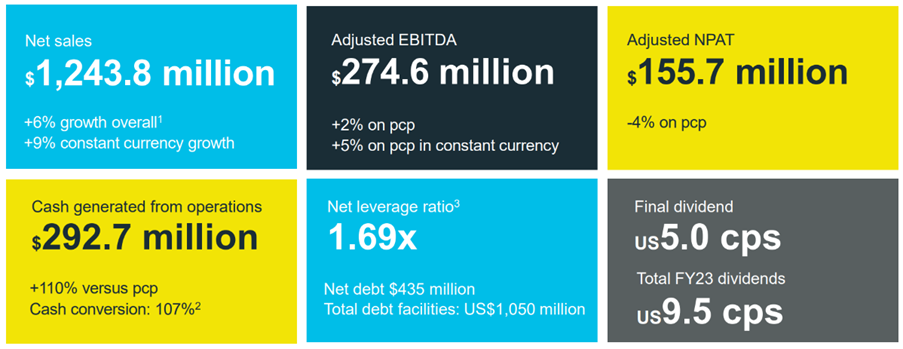

Reliance Worldwide (RWC FY23 result)

Reliance is a company that we really like. It is a market leader, operating in international markets, and supplying specialist plumbing-supply fixtures.

- A feature as usual was its strong cashflow, with cash conversion of 107%

- However, a history of conservative outlook statements has continued, which left the market a little underwhelmed and the shares sold off 7% on the day it reported its result

- By the end of the week however the stock had recovered ground to close around $4

RWC: An earnings snapshot

While the market concentrated too heavily in our view on the short-term earnings outlook, we were focusing on the more strategic developments. Of particular importance to us were:

- Successful launch of 2 new product ranges in the Americas – SharkBite Max and PEX-A

- Major investments in US manufacturing and reconfiguration of Australian manufacturing operations

- Consolidation of the RWC balance sheet, which now appears to provide ready capacity for further acquisitions

All three are critical to our positive view of the stock. Product innovation is crucial to any company successfully partnering with leading global hardware retailers such as Lowes, Home Depot, and Bunnings. Reconfiguration of manufacturing, facilitated by product growth and total sales, allows the company to stay ahead of developments in manufacturing efficiency and supply chain improvements.

Finally, Reliance has proven to be a very successful acquirer, and further acquisitions are also likely to add value. At 1.7x, it’s gearing remains towards the bottom end of its 1.5x to 2.5x net debt to EBITDA target range, suggesting balance sheet flexibility to pursue deals.

What the market said

“RWC is guiding to an FY24 group sales decline of low-single digits, which incorporates low-single-digit revenue declines in both Americas and EMEA. We think America’s guidance assumes mid-to-high single-digit volume declines based on our estimate of price/mix and new product contributions in FY24. This appears conservative to us given (i) 60% of Americas volume is repair, which should be a broadly stable/low-growing end-market; (ii) 20% of sales is “remodel”, where management expects a mid-single-digit decline; and (iii) the remaining 20% is new construction, which management expects to increase in activity. We factor in 0.6% sales growth in Americas for FY24, based on our 2.4% volume decline assumption.” (Barrenjoey)

EarlyPay (EPY FY23 result)

EarlyPay released its full-year results, providing shareholders with the first set of positive news in almost 12 months. As clients would undoubtedly be aware, EarlyPay was the weakest performing stock in client portfolios following the December 2022 revelations of significant losses associated with a single large client, RevRoof.

Six months of market updates on finalising losses from RevRoof created risks in the minds of the market regarding the remainder of the business. Whilst there were significant ramifications of the losses to individual personnel and operating processes, we remained confident that the underlying business remained fundamentally strong.

The results delivered this week provided significant reassurance of this fact.

The stock price rose by 20% on the day of the announcement.

What did we learn?

- The final losses associated with RevRoof will be in excess of $15m (against an exposure of $29m), a significant loss for a company with a market capitalization of only $120m prior to the news.

- The underlying business continues to operate profitably and is benefiting from increasing demand despite higher levels of conservatism displayed in its day-to-day operations.

- The company has taken the opportunity to increase its provisions for credit losses on all outstanding client positions. Whilst this is to the detriment of current earnings, it is ultimately both more sustainable, as well as providing upside should these provisions be too conservative.

- The balance sheet is now expected to in such good shape that the company has $20m of excess funds which will be deployed in a mix of:

- Share Buyback – with the share price at depressed levels, the highest returns for excess capital will be from buying back shares. The company has notified of a possible repurchase program extending to 10% of outstanding stock.

- Resumption of dividends – with consistent operating earnings expected in the coming 12 months, there is strong balance sheet support for the resumption of dividends.

- Repayment of outstanding corporate debt – First Samuel owns a small amount of this corporate debt, and the current interest rate we earn for clients is very attractive. But such rates are perhaps too expensive for a company with excess capital. Repaying this debt could save considerable amounts of interest.

- Small bolt-on acquisitions – With ongoing consolidation of the sector, there are opportunities for EarlyPay to acquire competing companies. This would be our least-favoured option.

A strong base for FY-24 earnings is provided by the successful reorganisation of some internal processes, the approaching resolution of outstanding issues from the earlier losses, and the impending restructuring of its funding program.

The company has provided a conservative view of the expected improvement in underlying earnings, with significant opportunities for this outlook to be upgraded through the year as more certainty emerges.

One of the concerns the market has had was how clients would respond to rising interest rates and what would be the impact on margins. The full-year results showed that on a pro forma basis, the margin contraction experience was more than offset by increases in the funds deployed.

Considering the increase in conservatism the company implemented, this was a great result.

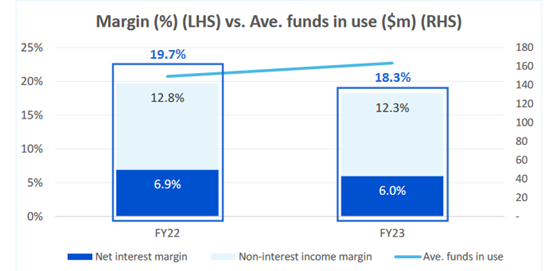

The chart below shows that despite the company not yet improving its funding program (due to be completed in September 2023) its net interest margin only fell 0.9% despite the more than 3.5% increase in RBA cash rates, i.e. the company successfully passed on cost increases.

Lower non-interest income margin (from 12.8% to 12.3% was more than offset by a 10% increase in funds in use, resulting in an increase in non-interest income.

EarlyPay: Margin outcomes for Invoice and Trade Finance Segment

The combination of underlying operating performance, strengthening of the balance sheet, and the announcement of plans for excess capital provides the team with strong evidence of the upside to the EarlyPay share price.

We remain confident that the company’s value remains a multiple of the current share price, which is currently trading at 18c.

What the market said

“FY23 pro-forma accounts highlight that the core EPY business remains profitable, and the RevRoof looks to be a genuine one-off, for which remedial action was taken some months ago. The keys from here will be a return to a growth focus at acceptable margins, more normal loss provisioning and lowering the average funding costs. Whilst it must be acknowledged that economic conditions are fragile, EPY looks to be well insulated by the short-term nature of Invoice Financing and the recent bolstering of loss provisions…” Henslow

Woolworths (WOW FY23 result)

Woolworths is a name that is well-represented across client Australian shares sub-portfolios.

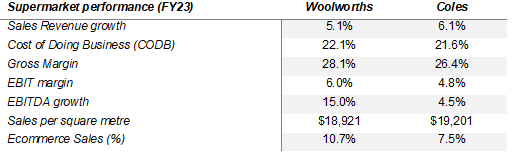

The back-to-back timing of the presentation of the Woolworths and Coles financial results provides the investment community with a fascinating opportunity each reporting season to judge the performance of the respective executive teams.

Once again in FY23, Woolworths executive team has outpointed their counterparts at Coles. While sales performance at Coles compares favourably (growth on pcp and per m2), Woolworths tighter execution around operational performance sees it delivering superior margins and demonstrably stronger growth in earnings.

Woolworths v Coles: Comparative supermarket performance – WOW runs a tighter ship.

Execution challenges at Coles

Ongoing difficulties with the supply chain and distribution centres has continued at Coles, with further delays and cost overruns on their Automated Delivery Centres (ADC’s) and Customer Fulfilment Centres (CFC’s). For example, the CFC in Truganina in Victoria has experienced construction delays that have set the operation back a further 12 months into 2025, around 2 years behind the original suggestion at the time of announcing the contract with Ocado in 2019.

Additionally, more challenging economic conditions have led to increases in theft/stock losses across the industry. Coles cited total loss as a cost headwind, increasing ~20% yoy.

EBIT margins at Coles contracted 15bps yoy versus a 70bps increase at Woolworths. In a fine margin business, differences in execution can have dramatic differences in returns to shareholders. Over the past five years, Woolworths share price has appreciated by greater than 50%, more than doubling the appreciation at Coles since it re-listed in late 2018.

Shopping behaviour in response to higher prices and resumption of life post-covid

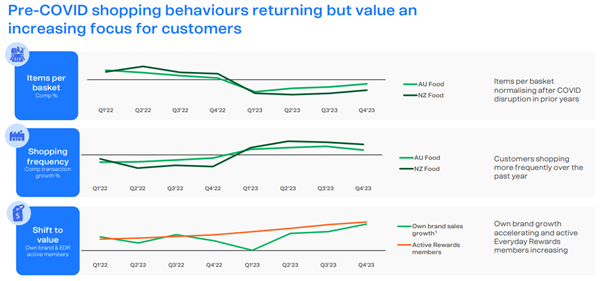

One of the slides in the Woolworths pack, which provided an interesting snapshot of consumer behaviour, has been included below.

The chart shows a combination of average items per basket since Q1-22 (Jul-Sept 2021) and Q4-23 (Apr-Jun 2023) in the top panel, and average shopping frequency in the 2nd panel. The 3rd panel highlights the purchase of own-brand products and the use of Everyday Rewards cards.

Following COVID, while prices remained low, shoppers filled their baskets, and, emerging from the COVID lockdown, shopped less often than in the past. As soon as inflation began to take hold, however, and the effects of COVID unwound, the natural response to a perception of poorer value is to shop more and fill smaller baskets with more own-brand products.

Your author wonders if the less efficient shopping behaviour created less efficient purchasing as well and contributed to the continued increase in Woolworth’s gross margins (profits per item before store cost and company overheads). There is nothing like a small shop to generate frivolous purchases in my experience!

Woolworths: Shopper behavioural trends

What the market said

“Woolworths result has showcased some of the benefits from past investments in supply chain, data and retail media capabilities. The company should have another good six months, but the likely fading benefits of food inflation prevent us from taking a more positive stance.” (MST Marquee)

“Multi-year investment by Woolworths has supported gross margin expansion and helped moderate CODB (“Cost of Doing Business”) as % of Sales expansion in recent years. Coles has under-invested over the last decade, making it disproportionately exposed to theft weighing on gross margins, while the reversal of under-investment in online & the supply chain, as well as underlying CODB pressures, have driven CODB/Sales higher with this to continue into FY24E.” (UBS)

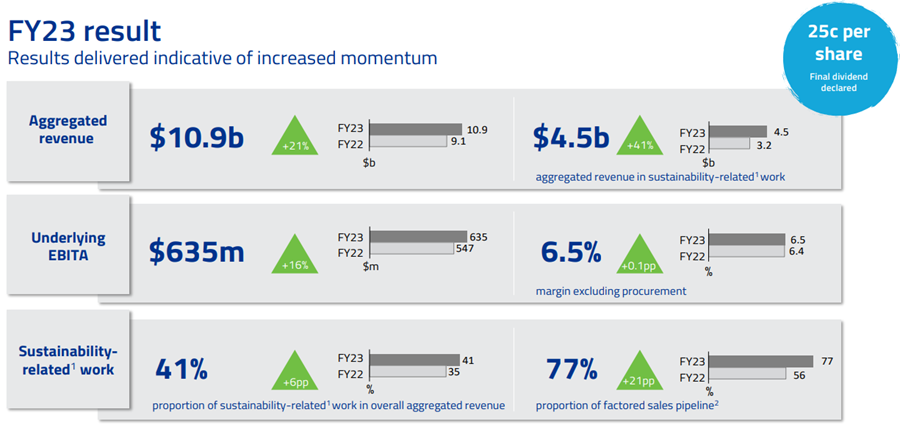

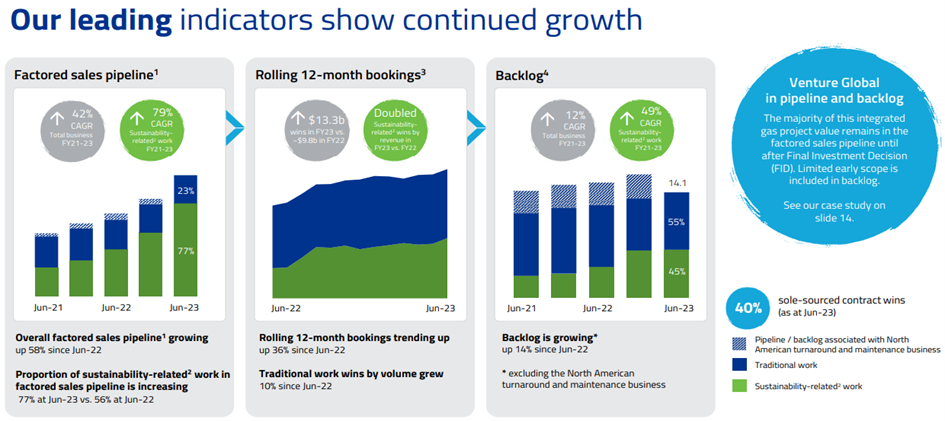

Worley (WOR FY23 result)

Worley is a specialist international mining services company that prioritises assisting companies in the Energy, Chemicals and Resources sectors. This leaves the business well-placed to meet the broader requirements of a global decarbonisation effort, in what the company itself terms as ‘Sustainability-related’ work. We consider this an important exposure in our portfolio. It provides access to this long-term megatrend alongside investments in resource companies that directly mine copper and rare earths (e.g. IGO and Sandfire) that will be used in the production of battery-powered technologies such as electric vehicles.

The critical aspects of the company update are threefold.

- How much is the underlying improvement in demand for global sustainability infrastructure translating into additional current work, and future backlog of committed projects?

- Is the additional work creating opportunities for Worley to increase the value-added components of its offer, resulting in higher margins?

- Is the existing business, excluding the sustainability segment, benefiting from higher oil prices and continued investment?

The answers to all three was resoundingly positive.

With strong fundamentals in place, a good deal of focus of the market was on what the market is willing to pay for a business with such an outlook. This remains to be seen, but recent share performance suggests that Worley is worth at least as much as its historically high price-to-earnings ratio, suggesting further upside to the current share price is deserved.

Worley: A business with excellent momentum

Worley: With prospects for rising margins too

What the market said

“We lift our revenue forecasts due to the stronger than expected backlog growth and now factor in revenue related to the Venture Global LNG project, which WOR said will more than offset the recently sold Americas Turnaround & Maintenance business. The margin expansion story is on track in our view, with rate improvement the key driver from rate improvement in FY24).” (Barrenjoey)

Origin Energy (ORG FY23 result)

After posting an excellent FY23 result, we met with a very relaxed Group CEO Frank Calbria in our offices.

It’s a good time for energy distributors, with rising prices for both gas and electricity driving big uplifts in profits at companies such as Origin and AGL. Each is a material position in our core Australian shares sub-portfolios. In addition, Origin has great operational leverage from its ownership of its 20% stake in Octopus Energy, a retail electricity distribution business in the UK.

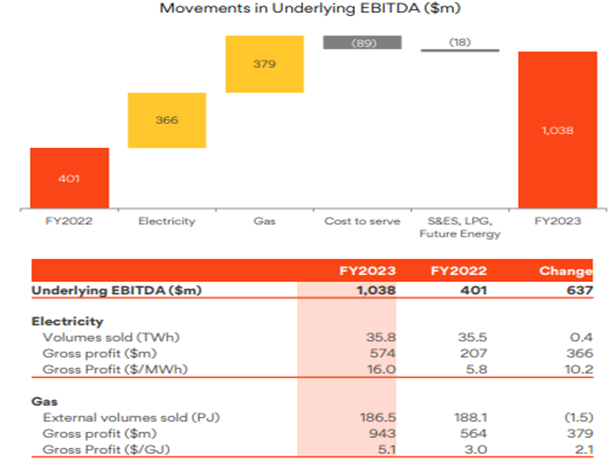

Origin: Energy price increases drove a big uplift in their Energy Markets Division

Subject to a takeover bid – on the right path

However, the medium-term outlook requires a big investment program due to the energy transition. It’s been an area where equity market investors have been reticent to back energy companies to successfully make the investment spend required while generating sufficient returns. This has meant that share prices in the past couple of years have suffered. However, the takeover bid, at $9 per share (plus adjustments for the time value of money in the event of further delays) by Brookfield and EIG Partners shows that patient capital sees opportunity if the custodians of equity market capital are too impatient.

Origin’s executive team has a strategic plan that it will execute in the event of the ACCC rejecting the consortium’s bid. However, it is commonly expected that the bid will be approved in the event that reassurances are made around access to Brookfield-owned Ausnet, an energy transmission and distribution services business with more than $11bn of assets, including the Victorian electricity transmission network.

What the market said

“Our current forecast conservatively assumes average wholesale electricity prices only rise ~10% across the National Electricity Market as Eraring power station retires (still planned Aug-25), leaving risk skewed heavily to the upside that prices rise faster due to scarcity of firm dispatchable capacity. We note that futures for capacity contracts are currently trading at ~3x the avg price over 2020-21 ($30/MWh for 2024 in NSW) and maintain that ORG’s electricity portfolio is best positioned to capture rising volatility in the market” (UBS)

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.