© 2024 First Samuel Limited

The Markets

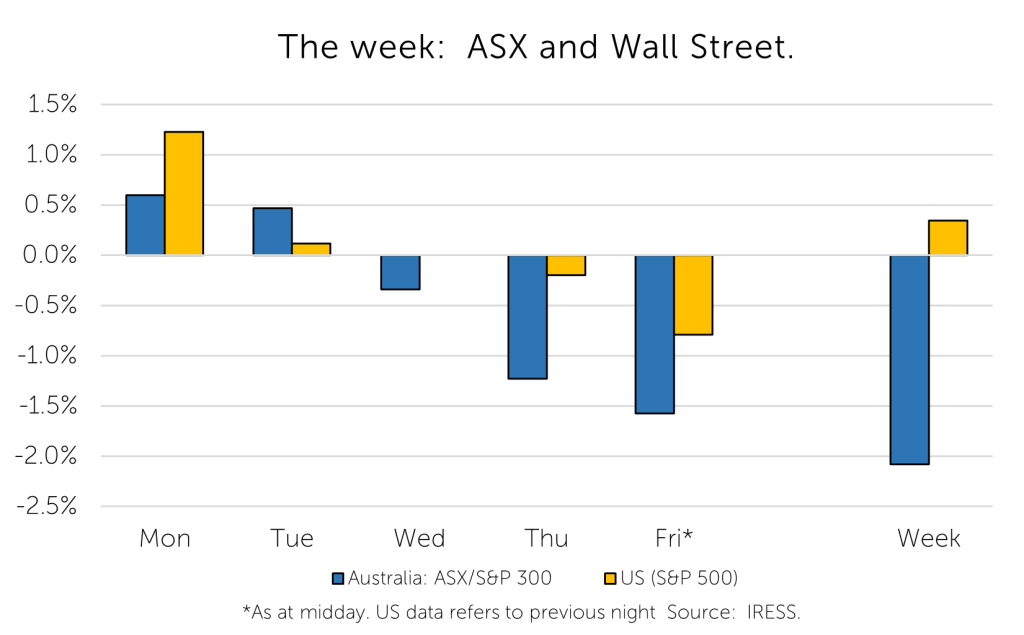

This week: ASX v Wall Street

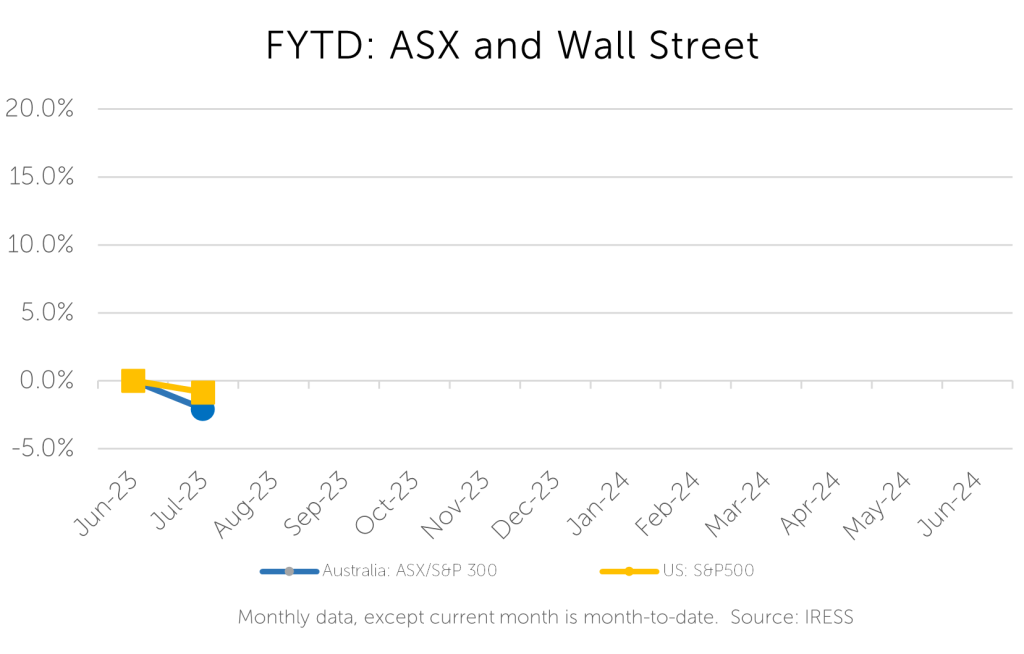

FYTD: ASX v Wall Street

A performance comment

FY-23 ended on a good note for clients, consolidating our strong three-year returns.

Remembering that all portfolios are different and made up of different mixes of sub-portfolios that themselves are different, over the past three years, clients have benefitted from:

- Strong returns (well above benchmark) in International Securities, Income Securities and Alternative Investments;

- Good returns (comfortably above) in Conservative Australian Shares and Australian Shares; and

- Modest returns (below) in Property Securities.

Clients will be pleased, as we are, to see overall performance generally more than our major competitors for comparable asset mixes.

A good start to investment performance in the new financial year…

Two of our investments, Costa Group and United Malt, received confirmation relating to takeover bids this week.

Both takeovers provided support for our investment strategy. This strategy concentrates on finding opportunities where the market fails to price either the long-run asset or the franchise-based value of a company, and instead focuses on short-term earnings fluctuations. In such cases it is often an external party, via a takeover, that unlocks the value.

The Costa deal promoted additional reflection for market participants due to its suitor. We discuss this further below.

As a catalogue of the extensive interest received by, mainly foreign, companies in First Samuel positions, we highlight recent takeover activity in the portfolio has included the following:

- Costa Group

- United Malt

- PointsBet

- Origin Energy

- Newcrest Mining (merger with Newmont Mining)

- PushPay Holdings

- Cardno Group

- Intega Limited

- Australasian Foods Holdco (Patties Foods)

- Boral Limited

We suspect that several additional holdings in client portfolios will be subject to bids in the coming 12 months, based on the experience of similar periods of de-equitisation, and the nature of the investment strategy we pursue.

United Malt (UMG) – $5 per share offer confirmed

News of the finalisation of the takeover offer for United Malt was announced on the first day of the new financial year. The $5-a-share official bid from Malteries Soufflet matched the indicative price given in March. With most of the hard work done in owning a stock that can attract a 45% premium, the confirmation of the deal proceeding at such an offer price came as a relief to our team and, we suspect, most shareholders.

As the AFR noted “United Malt has avoided the possible fate that the French suitor Malteries Soufflet would lower its bid, despite the Australian-based supplier of a key ingredient in beer having posted disappointing earnings during due diligence.”

We sold approximately 40% of client holdings on announcement in March, for an average price of $4.60. The stock traded as a low as $4.15 during May when uncertainty regarding the completion of the deal was at its highest.

The timetable for the completion of deal does not include any roadblocks in our view. Standard conditions such as an Independent Expert Report, approval by the majority of shareholders, anti-trust / competition-related regulatory approvals, Foreign Investment Review Board (FIRB) approval, and safe passage through standard legal proceedings are all that await.

As a result, we have seen the stock price trade to $4.80 in recent days.

Costa Group (CGC)- a takeover that prompts reflection

Additional reflection is prompted by the fact that Paine & Schwartz, the likely purchaser of Costa is none other than the same Paine & Schwartz that sold Costa to the ASX (along with the Costa family) in the 2015 Initial Public Offer (IPO).

In a classic Kerry Packer and Alan Bond scenario[i], the US agricultural expert has been able to buy the company back for little more than the average price they sold it, despite almost a decade of additional investment make by equity owners in the interim.

Importantly Paine & Schwartz retained a board member representation at Costa Group for almost four years of stock market listing, and have clearly maintained a close relationship. It snapped up 14% of the company late last year at rock-bottom prices.

For our clients, the investment in Costa, first made in January 2020, has returned more than 60% IRR and will be significantly higher if the deal is completed. This compares to market growth in the same period of only 5 per cent.

Following the announcement, Costa is now one of the largest investments in client portfolios and First Samuel as a whole owns approximately 1% of Costa shares outstanding.

What made Costa attractive to Paine & Schwartz and First Samuel?

Sometimes it is difficult to ascertain the motivations of others, and the presumption of understanding can be foolish in general. However, in the case of Paine and Schwartz we have their own investment materials to follow. The firm suggested in 2017 in its Investment Strategy documents that they had:

“Focused strategy of investing in food & agribusiness allows Paine Schwartz Partners to actively manage through cycles while capitalizing on positive long-term fundamentals.”

“Generate attractive, value-oriented investment opportunities through primary research-driven efforts”.

The core success story the firm promoted was its investment in Costa Group. Following a complicated buyout of part of the Costa family interests, the cleaning up of various structure and the preparation of the company for sale, Paine & Schwartz retained approximately 12 per cent of the register when the company listed in 2015.

Post-IPO, Costa has continued to execute a series of growth initiatives that would usually underpin strong financial results and broad outperformance in the public markets

- Investment in the ‘5th pillar’ – avocados

- Ongoing signficant investment in core operations in China, Victoria and Morocco

- $100m total investment in the Monarto mushroom facility

- Extensive fundamental reearch in genetics, growing and harvesting technology

- Total investment since listing is more than $700m

However, despite ongoing investment, consistent earnings did not emerge, and the growth trajectory that the company pursued became increasingly difficult to explain to a market that wanted instant gratification and grab-bags of simple stories.

There is nothing simple about agriculture and long-term investment in agriculturual supply chains and technology. This is why agriculture has often been the interest of wealthy families and long-term investors globally, rather than public markets.

In recent months the First Samuel investment team has spent time discusssing the cutting edge investment that Costa has made with key staff and former employees. The consistent themes that emerged from these discussions was the tremendous dedication to staff and technology that senior management engenders.

In addition it is our view, shared by analysts, that Costa was likely to achieve a critical combination of earnings momentum in the coming 3 years:

- It would benefit from overall pricing cycles and global inflation

- The earnings power of the investments made over the past 3 years would arrive.

Why didn’t the market see what we did?

Short-sighted equity markets refused to value the investments Costa made, worrying instead about the cyclicality of weather and its impact. This has ultimately played directly into the hands of Paine & Schwartz, which is committed to “riding out the cycle in favour of the long-term fundamentals”.

The AFR this week noted in a review of Costa’s listed company experience that:

“What they (Costa investors) do know is that despite the bankers’ “AgTech” pitch all those years ago, Costa is agriculture and its earnings are volatile. Listed markets do not like volatility – just ask GrainCorp, Incitec Pivot or Nufarm – particularly when it is paired with debt on the balance sheet.”

We agree! However, we noted that weather-related earnings volatility is not a feature that should be as heavily discounted by the ASX as it is. Clients have in recent year appreciated the profits made by purchasing companies such Incitec Pivot or United Malt in such circumstances.

Such volatilty is at the heart of agricultural investment throughout the world. Critically, the weather is unrelated to other factors that drive financial markets. That is, it is lowly correlated – which is a good thing.

Costa is just as likely to have favourable weather (and earnings) in a year the market is up as it is in a year the market is down. This feature should underpin its value, yet the ASX has consistently thought otherwise. Until this week when Paine and Shawtraz yet again set the market straight.

But did Paine & Schwartz bid enough considering the value of the assets Costa Group owns? We doubt it. Will the deal be blocked? We doubt that, too.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.