This week’s Investment Matters will concentrate on key company results as the reporting season winds down. On balance, market strategists have noted that earnings revisions have been neutral across the board, which is better than historical outcomes of net negative earnings revisions by optimistic investment banking equity analysts.

This is a selection of portfolio investments featured this week; we will cover more in coming weeks.

Read previous week’s Investment matters about Profit reporting season.

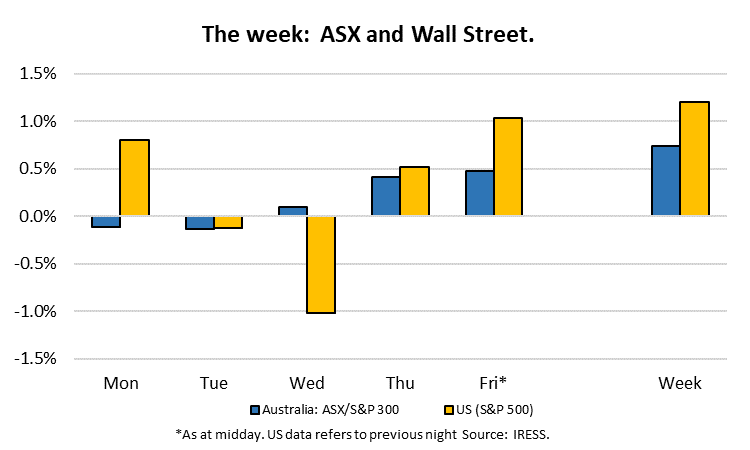

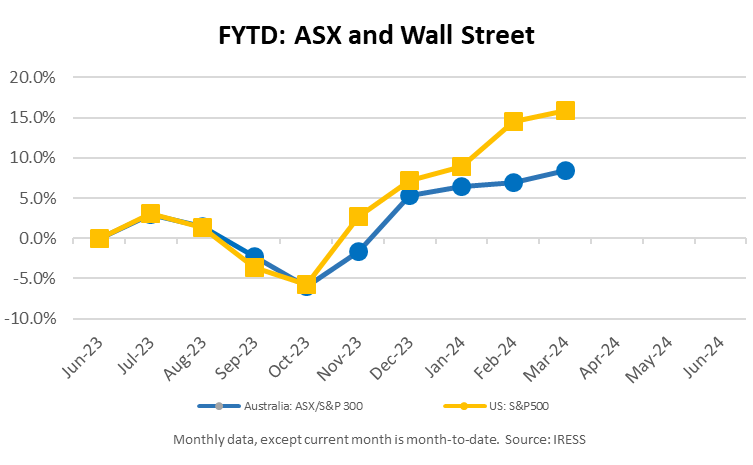

The Markets

This week: ASX v Wall Street

FYTD: ASX v Wall Street

Cleanaway Profit Reporting – (1H23 result, Mixed stock down 3% post results)

The company

Cleanaway Waste Management is Australia’s leading waste management and environmental services provider. Its primary business is collecting, processing and landfilling/recycling municipal, commercial and industrial waste. The company also carries out the safe and proper disposal of more individualised industrial, liquid and health waste.

The results

The company reiterated an expectation for FY24 EBIT of approximately $350m and continues to promote changes and growth investment designed to lift EBIT to more than $450m in FY26. We anticipate that this profitability goal represents a feasible return for the combination of assets at contracts the company owns. According to management, its FY26 ambition is still on track, but the biggest test of improving margin remains.

However, given a flat half-on-half (2H23 to 1H24) and the market assuming $460m EBIT, there was concern that a more sustained momentum would be needed to support a higher share price. We will choose to be patient and confident in the quality of assets that underpin the 2026 expectations.

The detail

Cleanaway generates strong financial returns from its Solid Waste Services division, which accounts for more than 60% of revenue and generates higher-than-average margins. A significant component of the value created is attributable to its landfill assets. We consider landfill assets especially powerful in periods of strong population growth and inflation.

They are scarce assets that require significant pre-investment, and their returns only improve in times of high demand. In recent years, we have seen a significant increase in returns to similar assets, such as Boral’s quarries. We think that Boral’s majority shareholder, Seven Group Holdings, would also see the parallels with Cleanaway.

Labour availability

As all high-quality businesses appreciate, it is one thing to have great assets and another to have staff who can productively generate the available returns. Over the past couple of years, Cleanaway has suffered from a general lack of labour availability.

This has been felt in high vacancies, higher voluntary turnover, and a general decline in productivity. For example, one of the keys to increasing productivity is reducing voluntary turnover, which decreased from 21.5% to 20.2% since 2H23 but remains well above management’s targets of low-mid teens.

It is possible that Cleanaway’s productivity metrics will not significantly improve over the next six months, putting further pressure on the margin outlook. In the medium term the cyclical fall in productivity is likely to be reversed.

But these are short-term considerations, and our investment process concentrates on the medium-term asset quality independent of short-term management changes. Short-term concerns like these will likely provide opportunities to add to our position.

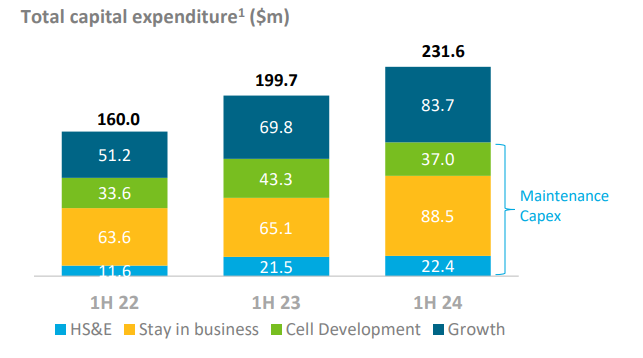

The medium-term value is driven by the maintenance of existing assets and the amount growth capex employed. The following chart highlights the increase in growth capex, along with increases in maintenance required. The quality of the growth capex remains high, with significant resources devoted to new sustainability investments.

First Samuel Impressions

Solid result from a medium-term perspective for this newly added position. We will be looking for ongoing improvements in upcoming results and are likely to add to our position if the stock trades at a significant discount to our valuation.

What they said

“This was a good result, pointing to gaining operational momentum. The thesis is underpinned by a solid growth outlook and an elevated discount to US peers on an FY2 basis, now standing at 13% (5-yr average discount of 5%).” Macquarie

Emeco (EHC) Profit reporting – 1H24 result (improved result but price down 3%)

The company

Emeco provides heavy equipment rental solutions and contract mining primarily for mining industries. The Rental segment provides a range of earthmoving equipment solutions to customers in Australia. The Force Workshops segment involves providing maintenance and component rebuild services to customers in Australia.

The results

Emeco delivered a 1H24 result that demonstrated improved operating outcomes, moderate strength in underlying business conditions, and a range of benefits from the self-help programmes instituted over the past 18 months.

The improvements led to higher margins in 1H24 than 1H23 on only moderate revenue growth.

The detail

Emeco finalised a deal in December with fellow mining services company Macmahon Holdings (MAH) that extracted itself from its unsuccessful Pit N Portal business. This deal may prove the cornerstone of continued improvements. Pit N Portal, a predominantly underground services company, is better placed with Macmahon, and the sale agreement secured by Emeco provides ongoing benefits to both companies. A strategic rental agreement now in place between the companies provides a platform for Emeco to continue to grow earnings in both surface and underground rentals.

Macmahon’s capital-light business model represents a potential source of equipment rental demand. In the medium term, we believe that Emeco should merge with MacMahon.

The core rental business is likely to generate only moderate margins and returns on capital in the medium term. However, with the integration with the Force, and selective, high-quality purchases of second-hand equipment for refurbishment, can generate long-term upside.

First Samuel Impressions

We were pleased with the operating performance of the business and continue to note the significant discount to NTA ($1.15) at which the company’s share price trades.

Discussions with the CEO and CFO this week highlighted the critical nature of 2H24 and beyond in proving up the value in Emeco’s share price. Put simply it is no longer simply the operating cash flow and margins that Emeco generates that is important to us as investors, but the excess cash the company can generate.

In 1H24 the company once again chose to reinvest its operating earnings in a large amount of “growth capex”. Ostensibly to capture the opportunities presented by both the second-hand goods market, and improving demand, this investing cash flow obscures the economic returns possible from the existing base of plant and equipment.

Proving the value of your exiting assets by generating free cash flow to equity is the surest way of demonstrating superior business viability.

In the company presentations to the market following the 1H24 result, management highlighted the necessity to deliver returns on past growth capex programmes. In addition, the business continues to focus on cost efficiencies and contract repricing. A commitment to a lower FY25 growth capex bill was also sensible.

As a famous movie once yelled “Show Me the Money”.

What they said

“Solid 1H24 result with a positive outlook for earnings growth in the 2H. EHL is making good progress refocusing on the core rental business, improving returns on its assets and reducing contractual risk.” Macquarie

Paragon Care (PGC) – 1H24 result & merger (+ve stock up 32%)

Background

Paragon Care, a longstanding portfolio position, has disappointed the market recently. Execution challenges have included an overly ambitious Asian expansion strategy and cost overruns ($12m) at the construction of a new Mount Waverley corporate headquarters and manufacturing facility.

In September 2023, CEO John Hooper resigned after 18 months in the seat. He was replaced by John Walstab, the previous owner and CEO of one of the Quantum businesses, representing the most significant part of the company’s Asian operations. Walstab is also the single largest shareholder of Paragon but did not have ambitions to run the company in the longer term.

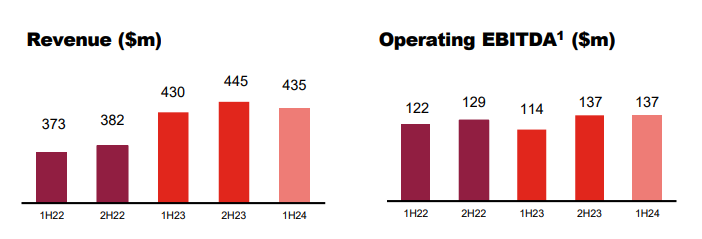

The result

It was disappointing. Despite revenue growth of 6%, this did not translate to improved earnings, with EBITDA falling by almost 30% and Reported NPAT by 55% compared to the previous corresponding period.

Q. Got any good news?

A. Yes. A merger with CH2 was announced!!

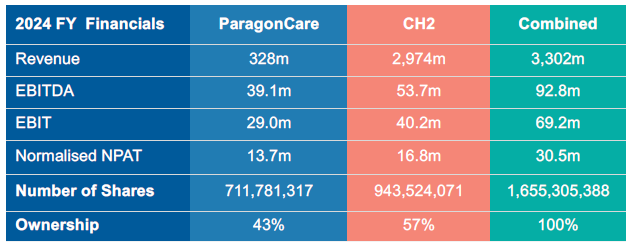

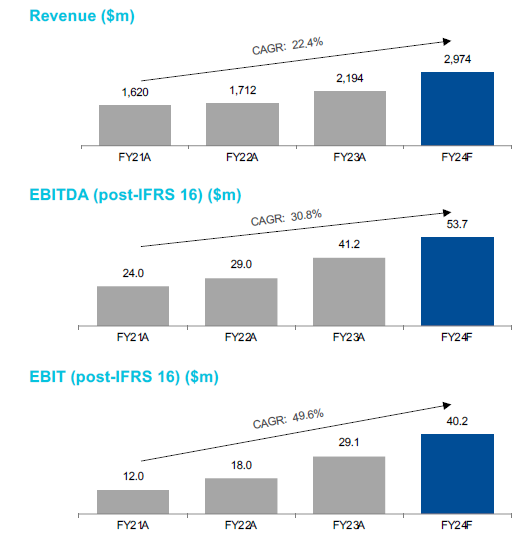

In conjunction with the release of interim results, the company has also announced that it is to merge with CH2 (Clifford Hallam Healthcare) an unlisted, integrated distributor and wholesaler of pharmaceuticals, medical consumables, nutritional, Over the Counter, medical equipment and medical supplies.

CH2 services all healthcare sectors including Hospital, Retail and Community Pharmacy, Primary Care and Aged and Community Care.

Merger terms – favourable

Under the terms of the merger, CH2 management will have their shares acquired and will be issued Paragon shares, entitling the CH2 founders to 57% ownership of the combined entity.

Accordingly, First Samuel’s stake in the company will represent ~1.8% of the combined entity, down from 4.3%.

The implied valuation of the merged entity to existing Paragon Care shareholders is favourable. This view was backed up by the 40%+ rise in the Paragon share price when the company began trading again on Tuesday.

The new entity – a stronger and more meaningful business

Clearly, the combination of the two businesses creates a stronger, more diversified business.

CH2 management has a strong track record of delivery, and the new proposed Group CEO, David Collins, appears an astute choice to run the business.

CH2 Financials

Both Paragon’s Board and Executive have expressed their admiration for the acumen and operational performance of the CH2 team to us.

We anticipate that enunciated merger synergies of $5m will prove conservative. There will be considerable benefit from the consolidation of premises, and we anticipate that there will be an opportunity to cut costs out of the senior executive ranks of the combined entity.

With meaningful revenues exceeding $3 billion per annum and an enhanced level of profitability, restructuring finances on more favourable terms also presents an opportunity, although already the balance sheet is in better shape with lower gearing.

Worley Profit Reporting 1H24 result (+ve – up 7% since result)

Background

One of the most powerful investment trends globally has related to the sheer quantum of investment required for the energy transition. From the obvious, solar and wind farms, to retrofitting solutions in oil & gas, and finally to the vast and complex requirements of a new electricity grid for many nations, the scale of this investment extends to many trillions of dollars.

Finding winners from this thematic for client’s portfolio has led to First Samuel investing in companies engaged in funding the transition (Macquarie Group), to companies investing themselves (Origin Energy), and also in the vast number of miners and processors of the materials (lithium, mineral sands etc) used in the transition (IGO, Lynas & Sandfire as examples).

But the most transparent winner from the perspective of increased demand, higher margins and sustainable growth is Worley. Just like the stories of selling pots and pans to gold miners in the 1850s, Worley provides a modern example. Worley is providing a skilled workforce and technical services to the sector. Instead of owning the projects or providing the low-margin building products or finance, Worley retains an increasing workforce and skillset that can be used repeatedly.

Over the past five years, the company has pivoted from an oil and gas heritage to one that now does most of its new work in the transitional and sustainability sectors.

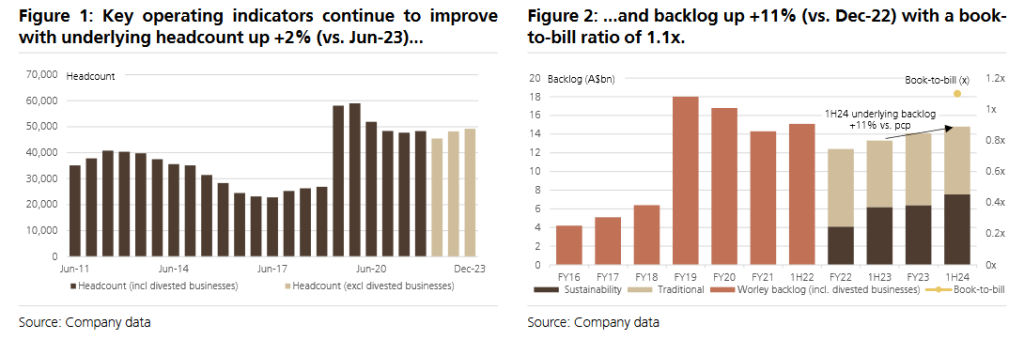

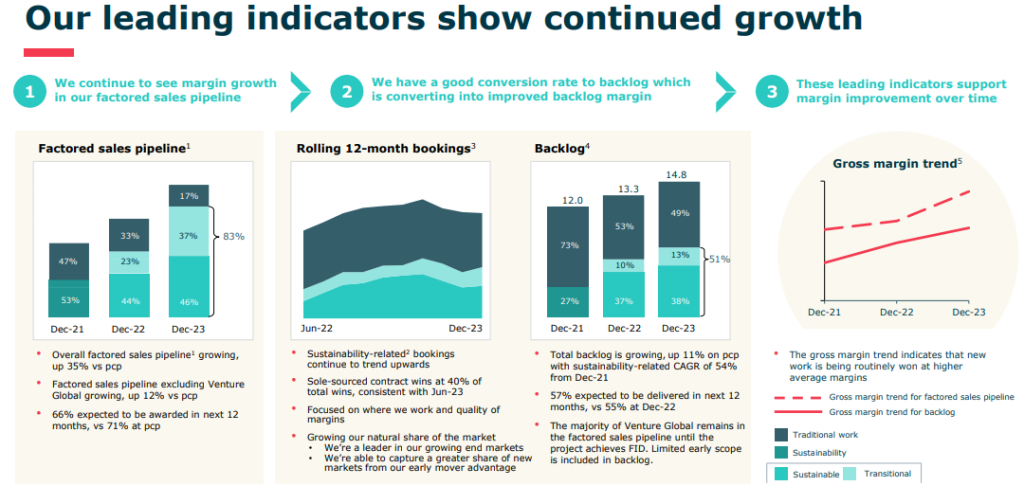

For this increased demand to generate real shareholder value, it must continue to report three features in its results.

- Increased backlog of sustainable work

- Increased share of sustainable work done and, critically

- Higher margins generated by this specialised work

The result

The 1H24 results demonstrated each in spades.

An indicator of demand that has proven a reliable precursor for margin expansion has been improving headcount. Figure 1 below shows strong growth in recent periods (excluding divested businesses).

Margin expansion was attributed to both rate improvements given elevated engineering demand, and favourable mix, with Worley undertaking a higher proportion of professional services work. The higher the level of professional services work is expected to drive sustainable margin expansion for a number of years. Recent divestments have concentrated on a lower skilled, lower margin workforce, so seeing the benefits of this change come through is pleasing.

We have repeated a slide from the research investor presentation, which highlights some of the indicators of growth.

Source : Company reports

As a core holding in the portfolio, we have been pleased to continue to upgrade our expectations and valuation in recent periods. This result saw a similar upgrade and some opportune additions to clients positions.

What they said

“We reiterate our Buy rating on Worley, with the stock offering significant earnings leverage to a potential four-fold increase in global energy investment and decarbonisation projects. This underpins our long-term positive view on Worley..” UBS

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.