© 2024 First Samuel Limited

The Markets

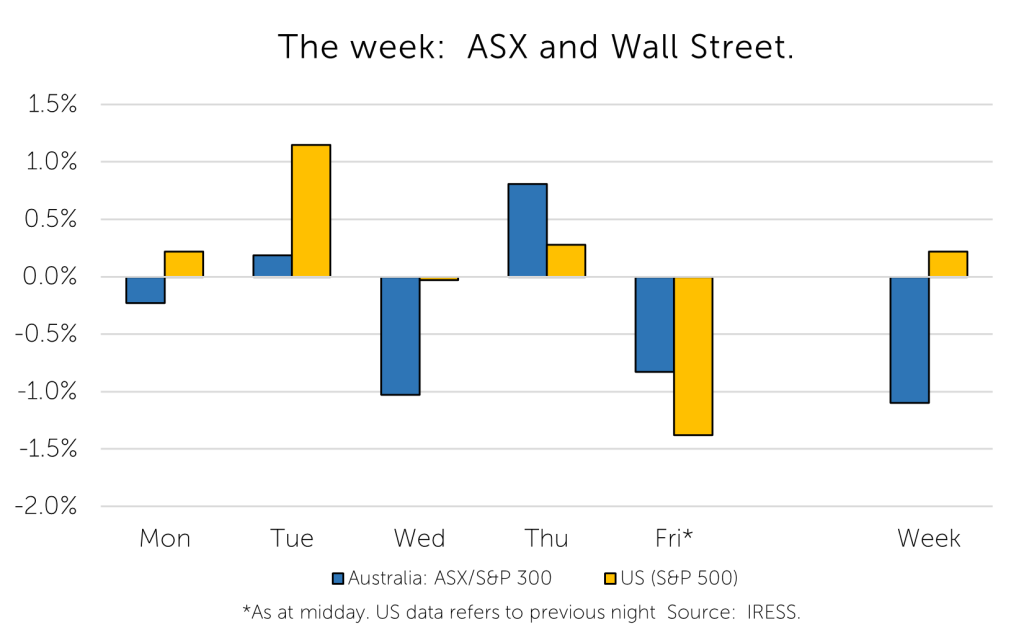

This week: ASX v Wall Street

FYTD: ASX v Wall Street

This week saw the first concentrated week of half-yearly results from the largest of the ASX-listed companies. Commonwealth Bank, Wesfarmers, Origin Energy and Seven Group, amongst others in client portfolios, updated the market.

Please remember that not all clients own all the stocks on which we report. Let’s dive in.

But first, a shallow dive into inflation and interest rates.

The important economic updates for the week included the US CPI (Consumer Price Index) release. This once again hinted at ongoing inflation at a higher level than the market currently expects.

In Australia, RBA Governor Lowe spoke before a Senate committee, giving an update on his thinking on interest rates and inflation. He largely reiterated comments made at the February RBA meeting and in the recent SOMP (Statement of Monetary Policy), but there is something to be said for learning from the plain speaking that Senate inquiries can sometimes evict.

We weren’t impressed. A more detailed discussion lay at the end of this week’s Investment Matters. However, to summarise:

- Lowe’s desire to control inflation was elevated to a level that could have implications for higher rates and higher unemployment

- Lowe noted widespread increases in demand in the economy – but continue to suggest that interest rates will need to do the work to not only drive down inflation but make sure wages growth expectations are not elevated

Company News

Seven Group Limited – a wow result

Last week, Boral results (73% owned by Seven Group) were released. And were followed this week by the release of the entire Seven Group Holdings results. Seven Group owns not only Channel 7 (which is a minuscule (~2%) part of the entire group, but also the Westrac business which is the authorised Caterpillar (CAT) dealer in Western Australia, NSW and the ACT.

Seven also owns the ubiquitous Coates Hire equipment leasing business, along with a prominent investment in Beach Energy and some smaller holdings.

Strategically, the Group’s results demonstrated canny asset selection, as each of the businesses are benefiting from the nature of economic growth with the Australian economy. Strong mining activity, increasing new mine development, and continued broad growth in infrastructure in all Australian cities is supporting demand across the board.

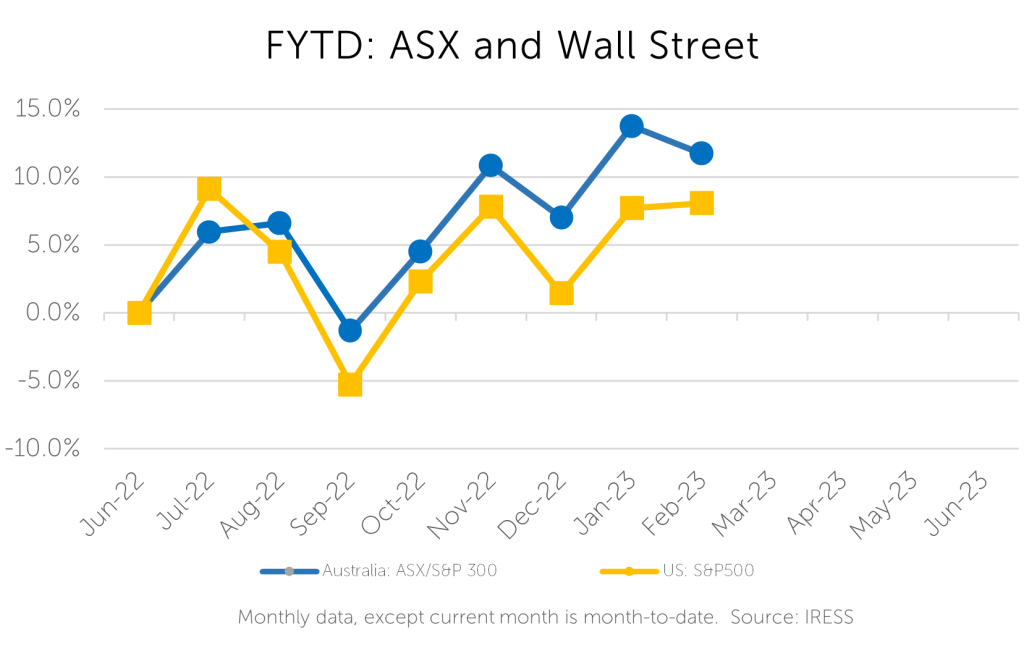

Turning to the individual business, we have included several diagrams to highlight the volume growth seen across some of these businesses. Figures 1 & 2 below highlight the long-run growth in revenue (both capital sales and product support revenue) the business has experienced for the past 8 years.

We understand from industry liaison that pricing growth (driven by local and global factors) is strong, so it was also pleasing to see volume growth in Parts (right hand chart below) also came through in this recent half. Such volume growth, despite the lack of availability of workers, bodes well for revenue growth in the remainder of the year.

Source: Seven Group

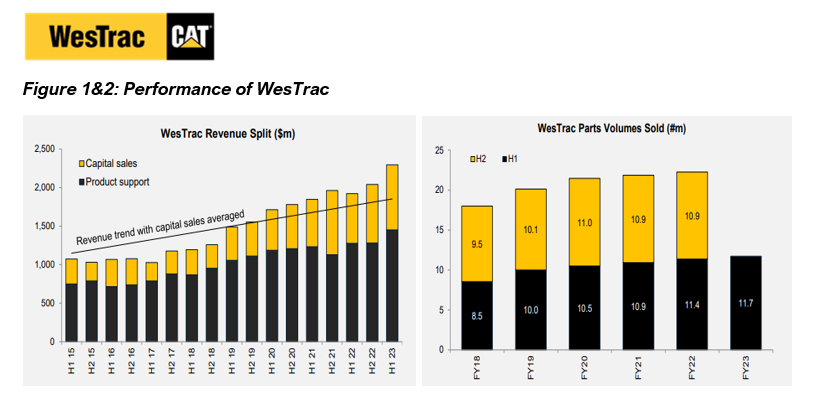

The next charts show the profit growth and capacity utilisation at Coates Hire. Unsurprisingly, if you run a business that holds equipment waiting for people to use it, the utilisation of this equipment (measured as ‘time utilisation’ in the chart below) is critical to operating performance. A hire company without strong utilisation could be very unprofitable.

When conditions are buoyant, however, it is just as important that relatively smaller increases in utilisation create quite large movements in profit (EBIT) margins. The charts demonstrate this was the case in the past 6 months. A 4% increase in time utilisation has led to an 8% increase in the EBIT margin.

Source: Seven Group

The combination of better-than-expected performance at Coates, Westrac and Boral Limited allowed the company to upgrade its profit expectations for the full year. The strong cash flow and profit expectations sees Seven Group looking to reduce its debt load in coming years.

Following the substantial increase in the share price over the past 6 months, the position is amongst the largest in portfolio. We still believe the stock offers value at current levels and are buoyed by the breadth of the operating income and cash flow growth. The diversity of the earnings profile and the exposure of Seven to very broad trends in the economy are compelling.

Critically, Seven Group remains one of the few routes through which to get leverage to the Australian infrastructure, mining services & construction thematic, all in one stock. And its shares are attractively priced at ~11x FY-24 P/E multiple.

***

Wesfarmers – mildly positive

Wesfarmers is the WA-based conglomerate business that owns names such as Bunnings Hardware, Kmart and Officeworks, along with exposures to industrial chemicals and an emerging lithium operation.

Clients in our more conservatively positioned portfolios have a small position in Wesfarmers.

The Wesfarmers’ result is keenly watched by many in the market due to its broad exposure to the consumer and local area construction markets. The range of retail offerings which spread from Kmart through Target and Bunnings provides an early insight into the way in which consumers are responding to higher interest rates.

Unfortunately for transparency, Wesfarmers is famous for providing very limited detail into the operation of these retail brands. As such, we struggle to see if pleasing results are driven by higher prices or through strong cost control.

Two trends of interest emerged from the result.

- The Kmart Group benefited considerably from consumers ‘trading down’ to their offer in both Kmart and Target, driving high revenue growth and strong profits.

- Bunnings, which is historically a resilient business, continued to see revenue growth (+6.3%) but at lower gross margins – resulting in a profit margin compression. Management chooses to refer to this as “investment in the customer”. We are wary and wonder if the very high margins in this business can be maintained.

Amongst Wesfarmers’ other businesses we were concerned with the losses from its Catch.com.au business and wary of additional costs in its lithium business (Mount Holland) which is readying itself for first production.

Overall, the Wesfarmers result was considered a mildly positive result.

***

CSL – better than expected

CSL, the great Australian biotech, updated the market with its 1H FY-23 result. The result was slightly better than the market expected; with improved plasma collection, moderate collection costs and well contained operational costs.

Clients in our more conservatively positioned portfolios have a small position in CSL.

Whilst CSL is a high-quality business, the share price had become exceptionally expensive in late 2019, reaching a similar level to today’s price (circa $300) more than 3 years ago. On an earnings and dividend basis the stock remains relatively expensive.

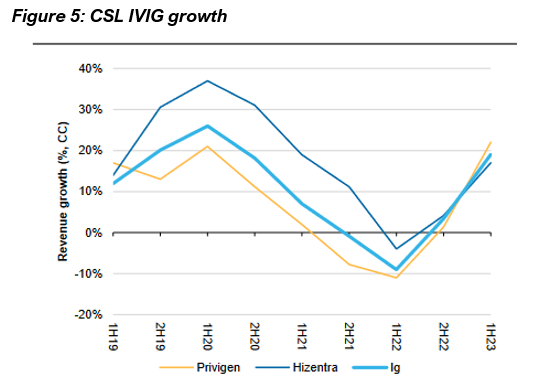

Expensive stocks need to deliver strong growth to support such an ebullient view, and for a blood technology and biotech company like CSL, the critical components of growth are the pipeline of new products and innovation, and the underlying demand for its core IVIG (Intravenous Immune Globulin) product.

Following disruptions surrounding COVID the core product portfolio is once again growing as shown in Figure 5 below.

Source: Company data, Macquarie Research, February 2023

Regarding the product pipeline, we have been underwhelmed in the past. However, several of its newer and stronger (in our view) innovations are reaching critical junctures. Macquarie Equities, in its result review, noted that CSL is currently expecting:

- the FDA approval of Hemgenix and US launch in the near term

- phase 3 data for Garadacimab (HAE) presented at the AAAAI conference in coming weeks.

- a response to the proposed label extension for Ferinject in the US (heart failure) in the near term; and

- a trial for a new plasma collection nomogram to commence in Mar-Q 23, with

potential approval later in CY23.

The company also has some additional longer dated development options that we continue to assess.

***

Bank sector – Commonwealth Bank 1H23 (and NAB 1Q23 trading update)

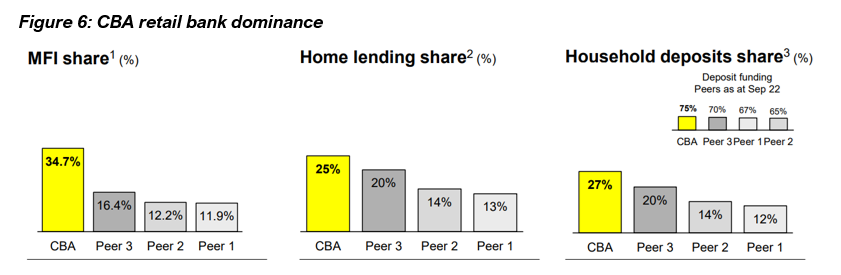

CBA’s 1H-23 demonstrated a strong operational performance with an uplift in earnings (9%) and dividend (20%) versus the prior corresponding period. This was built on the strength of its Retail Banking Division (which has twice the ‘Main Financial Institution’ relationships of its peers) and the ongoing success of a targeted drive into business banking (NAB’s traditional strength) in recent years.

Source: Company Reports

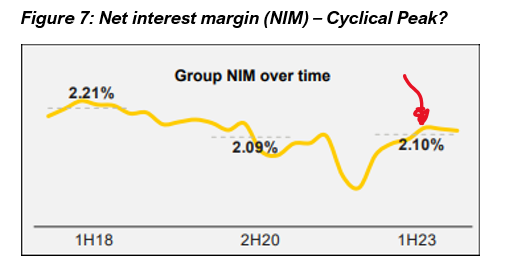

But the market, being a forward-looking beast, sold the stock off heavily (-6% on the day) in response to an expectation that sector Net Interest Margins (NIM – the difference between what banks earn on their assets versus what they pay to fund those assets i.e. deposits and borrowings from capital markets) may have peaked. CBA noted that its NIMs, which were up 18bps to 2.10% in the 6 months ending December, had a recent peak in October.

Source: Company Reports

In general, banks have lifted their NIMs as interest rates have increased by passing on the full increase on their lending but are lagging in the repricing of deposit rates. However, consumers in particular have become more rate sensitive and are hunting for the best price on mortgages as interest rates increase and household cashflows are squeezed. Additionally, a slowing rate of growth in mortgage credit is driving an increase in competitive behaviour between banks (think seagulls fighting over the last hot chip!). CBA CEO Matt Comyn declared that new business in the mortgage market is being written at returns below cost of capital (bad for bank shareholders!).

By contrast, NAB’s strong 1Q-23 trading update demonstrated that NIM performance was dependent upon the relativities of growth in the mortgage market. NAB’s decision to step back from chasing market share more latterly has proven to be a sound one.

Bank credit quality continues to remain pristine, with arrears still falling. However, CBA called out that assuming two more cash rate increases, mortgage customers had only really worn the impact of about half of the rising rate cycle on their household cashflows. We continue to remain cautious on the outlook for those businesses which have large exposure to Australian consumer spending.

***

De Grey Limited – promising drilling result

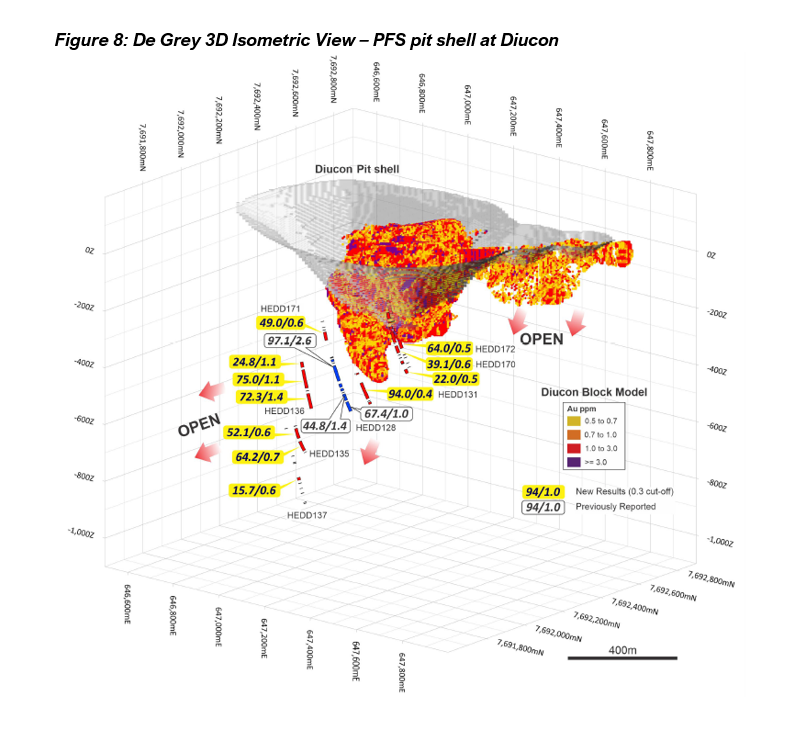

For the second time in a week De Grey Mining, a development-oriented gold miner in client portfolios, has released promising drilling updates.

DEG has released new extension and infill drill results for the Diucon deposit at Hemi. The drill results have extended mineralisation by 120m of strike and 400m down plunge and both deep and shallow mineralisation remains open.

For the uninitiated, one of, or perhaps the most, evocative term in mining development is the “open” or “open at depth”. This term refers to the fact that drilling has encountered mineralisation as far as it has currently drilled, allowing future scope for mining at lower levels.

Infill drilling at Diucon to upgrade portions of the current mineral resource from Inferred to Indicated to increase ore reserves for the Hemi definitive feasibility study (DFS) continues to support the resource model.

In the case of De Grey, the current mine plans are already extensive enough to justify current mine development. This development is of such high quality that the company has recently secured a large amount of bank debt funding for the project development.

Additional resource definition provides significant opportunities to extend the current mine plan or increase the planned level of production. Both options provide significant upside to our current valuation of more than $1.70 per share.

The company announcement included a wonderfully explanatory 3D isometric diagram of the current extent and future plans of the Diucon Pit. Included alongside the colourful representation of the grade of gold expected in the current pit extension are the details of the recent drill results.

We have shared this illustration below.

Economics – Implications of Governor Lowe Senate commentary

In Australia, RBA Governor Lowe spoke before a Senate committee this week. This is our perspective. We believe that the actions of the RBA in the next 12-18 months will be critical in determining not only the short-term path for the economy, but will also affect long term outcomes which will affect wealth for the next decade.

His responses demonstrated more anxiety than we expected, and in our view relates to a narrow focus the RBA currently has on the economy and economic drivers.

UBS noted in its review of the comments.

“Lowe did accept that monetary policy settings are now “restrictive” and “contractionary”; and cited that ‘house prices are falling’, ‘home building is slowing’, and ‘people are paying more on mortgages’. However, he added that “I’ve got to contain inflation. I’ve got to convince the community that we’reserious about that. That’s our job and it’s unpopular and I accept that.“

One wonders if being stout in the face of unpopularity could obscure the analysis of the most sensible path. Our concerns are simple; mortgage holders are not the only economic agents that should bear the cost of the economic transition from zero inflation to persistent moderate inflation. Higher inflation can be borne through diminishing purchasing power of all, or partly through asset prices, or through changes in the relative share of profits and wages in the economy.

Moving 1 or 2% of the population to the unemployment queues make even less sense. The Australian economy has huge opportunities to continue to invest in energy transition, digitisation and electrification, global opportunities in software and computing, not to mention the comparative advantage we have as a destination for global tourism, education and the migration of both the globally adventurous and needy.

So why do it? Lowe is now concerned that some of the rising prices are reflecting the strong levels of demand in the broad economy. But the strong demand in the economy is not simply generated by mortgage holders or the small business owners that would suffer from higher rates.

Strong demand is driven by global demand for lithium and iron ore, for copper and education, driven by companies with no diesel mechanics, and businesses that we see every day with signs out, advertising that work is available.

Strong demand is driven by the households that have benefited from the huge influx of money created by the COVID episode. The distribution of the funds is largely held by households that already have high savings, and lower levels of consumption. In this context purely driving demand down with rates rises tends to increase both wealth and income inequality. Monetary policy settings that aggravate these trends to reduce inflation may not be optimal.

The antidote is, in the authors opinion, wage growth, and support for investment, education, and skilled migration. Those younger households with high levels of debt, and those looking to afford to pay for higher mortgage costs in the future have the promise of wage growth to build affordability through time.

Bear in mind that the mortgages provided at high interest rates in the 1980’s and 90’s always assumed that wage growth would assist with the payments in the future despite the relatively higher nominal interest rates.

This is how an economy traditionally transfers assets from one generation to another and supports the investment intentions and expectations of young generations looking to build the business of the future.

Yet, to Lowe, even the risk of wage growth, let alone actual wage growth which has been tragically negative in real terms is at the forefront of analysis. Lowe stated, ‘if inflation expectations stay anchored, we can stay on the narrow path;’ and a ‘wage-price spiral is a relatively low probability, but the cost is very high’. He added “we don’t really see evidence of that occurring”; with wages ‘will get up to 4%, & probably not go much higher’.

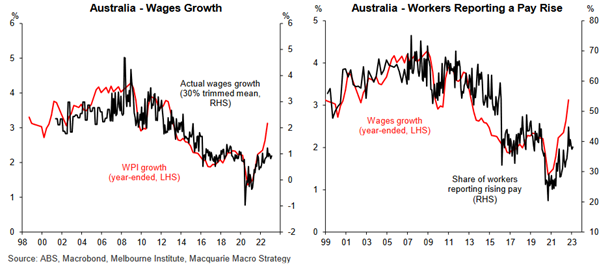

The chart below shows the latest wages growth, with the number of workers reporting a pay raise being only around 40%, and extraordinarily low level considering the pace of inflation.

So, despite limited actual wage growth, and wage growth that is substantially lower than inflation, interest rates will continue to rise in Lowe’s view. We suspect this view is not sustainable, nor wise. As such we are avoiding excessive exposure to retail banking (especially CBA and WBC) and to discretionary spending within the economy, which is now showing signs of weakness. Instead, we are positioned for growth in the parts of the economy that will be less affected or impeded by rising rates.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.