© 2024 First Samuel Limited

The Markets

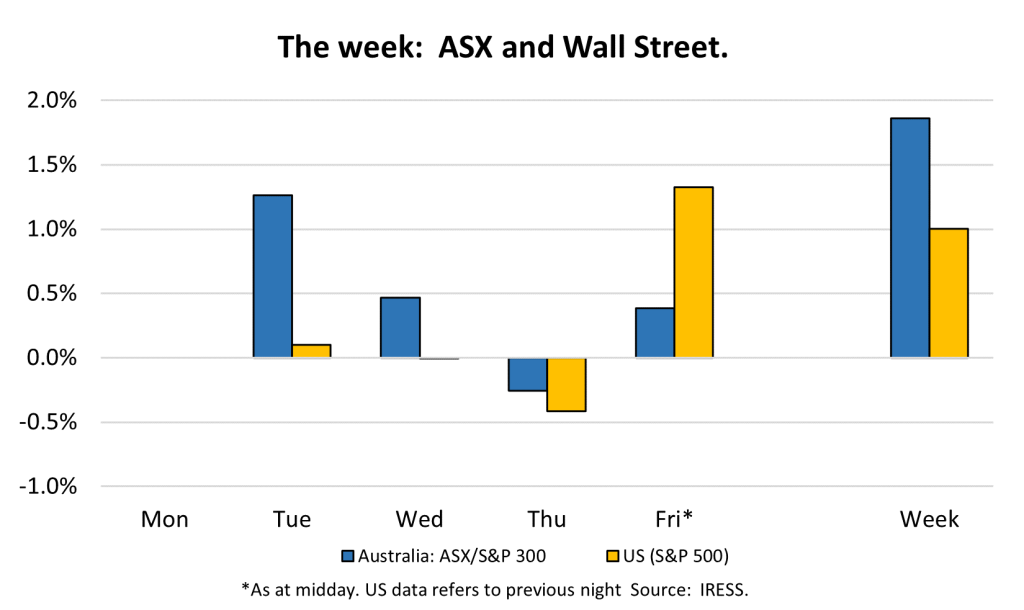

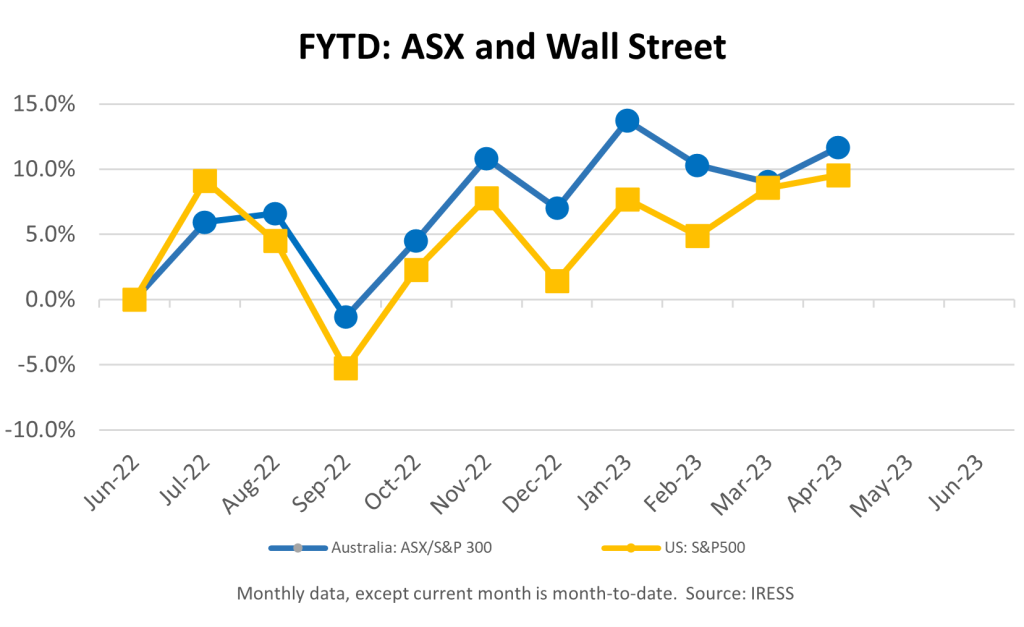

This week: ASX v Wall Street

FYTD: ASX v Wall Street

This week in Investment Matters we have two items relevant for client portfolios. The first is the revised takeover conditions for Newcrest Mining and the second is the pause in rate hikes announced by the Reserve Bank last week. Again, this week we have the much-needed assistance of Patrick Cooks’ cartoons.

The Newcrest Board delivers? – Revised offer from Newmont Mining.

On February 10th we reported that client portfolios benefited from another takeover bid, this time for Newcrest Mining. A non-binding indicative offer came from another giant global gold miner – Newmont Mining (NEM), based in Denver USA.

This week Newcrest Mining (NCM) has announced that it received a revised conditional and non-binding indicative takeover proposal from Newmont. The revised offer from NEM comes with an improved exchange rate of 0.40 NEM shares for each NCM shares held (prev. 0.38:1).

We noted at the time that “the initial offer may not be the last, and we believe that it will need to be increased to secure the deal”. Many have been sceptical about the ability of the Newcrest board to secure an improved bid, so the news was pleasing in that context.

Under the revised proposal, NCM is also allowed to pay a franked special dividend up to US$1.10/share on or around the transaction date. This will be important for Australian investors.

Using the last market close (14th April) price of US$50.94 for NEM, the revised offer has an implied total value of A$31.67per Newcrest Mining share, inclusive of the potential special dividend of US$1.10 per share.

The price of Gold as we reported in recent weeks has continued to march higher. Expectations of lower medium-term global interest rates and persistent inflation and central bank money printing are providing a great environment for the yellow metal.

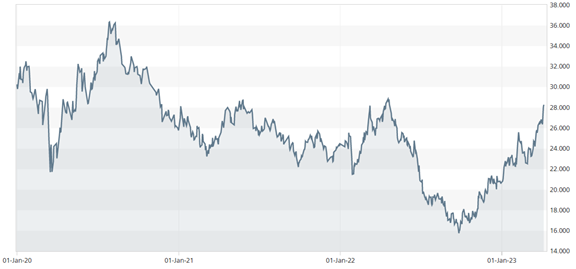

Figure 1: Newcrest Mining share from January 2020

Clients will be aware that Newcrest has been a long-term holding. The rationale for our position has always been three-fold:

- general exposure to the gold price, which benefits from global increase in money supply

- exposure to very long-life assets (many years of ore already discovered) rather than mines with shorter lifespan

- portfolio benefits: the defensive characteristics of gold stocks in periods of market turmoil can be very valuable

The revised offer by Newmont Mining still undervalues the longer-term value of Newcrest’s mine holdings in our view. The likelihood of securing an even higher bid however is relatively low. So much so the market still has reservations in getting this deal across the line, with the Newcrest share price trading at a significant discount to the deal implied price at the end of week.

RBA pauses interest rate hikes – likely reaching the end of rate rises.

A fortnight ago we noted that following the release of the February Consumer Price Index we noted that many economists thought it provided the Reserve Bank with an opportunity to pause raising rates, for a month at least.

Governor Lowe provided commentary which suggested that rate rises have not stopped, however.

“…[the] decision to hold rates steady this month does not imply that interest rate increases are over. Indeed, the Board expects that some further tightening of monetary policy may well be needed to return inflation to target within a reasonable timeframe. It decided, though, that it was prudent to hold rates steady this month to allow more time to assess the impact of the increases in interest rates to date and the economic outlook.”

We would note a couple of points from the paragraph above, the first being the opportunity to provide the Board and the economy some time for the impacts of past rate hikes to flow through to decision making. It is decision making at the individual level that changes in policy rates are designed to influence.

The second point to note however is the complete lack of perspective on whether “further tightening …. needed to return inflation to target” is a clever idea in itself?

Q&A from subsequent press conferences highlighted the Governor is at least aware of the existential difficulties faced by the RBA’s narrow set of policy tools. While far from rejecting the role of interest rates Governor Lowe did note.

“A primary task of any central bank is to preserve the value of money. And the tool we have to do this with is interest rates. In principle, different institutional arrangements could be designed, and non-monetary tools could be developed to help contain inflation. In practice, though, things are more difficult, and the use of other tools would raise a new set of complexities and operational and governance challenges. It is also worth recalling that the task of controlling inflation has been assigned to central banks following years of experience with other arrangements that did not work out so well.”

We believe that the first step in avoiding a policy mistake caused by the continued rise in interest rates is understanding the limitations of the policy tool itself, followed by a more nuanced analysis of the actual economic conditions faced by households.

Textbooks simply never envisaged the level of gearing that the Reserve Bank allowed to be created in the Australian household sector. They never envisaged the cyclical concentration of wealth and spending capacity, and equally textbooks never envisaged the lack of business investment or breakneck pace of population growth that the economy is digesting.

This nuance is vital in the face of persistent slightly elevated inflation, and it was Governor Lowes’ subsequent commentary regarding the peculiarities of the Australian circumstance that provides the best pointer towards rates peaking in this cycle.

Governor Lowe suggested that the RBA was willing to allow a longer time frame for inflation to return to their target, relative to other central banks, in order to preserve the gains of record low unemployment. He also cited relative to overseas, wages growth is lower, and there’s a faster/larger transmission via household leverage (too much debt means rates have bigger impact).

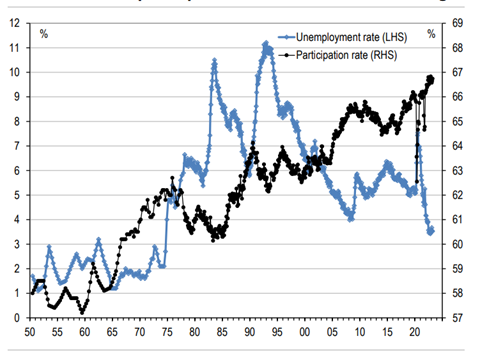

Quantifying the “gains in employment” that need preserving are worth special attention. The figure below highlights the strength of the labour market following the release of April Labour Force data this week. Our economy has exceptionally low levels of unemployment (people looking for work), but even more importantly historically high labour force participation (the share of the working age population who are either working or looking for work). Strong economies create the conditions for workers to make themselves available for work.

Figure 2: Unemployment held at 3.5% – around the lowest since 1974; with participation at 66.7% near a record high

Source: ABS, Macrobond, UBS

We believe a combination of the RBA approaching the end of its rate rising cycle mixed with persistent moderate inflation is very bullish for equities. The clearest evidence we see for this is in the continued appetite of foreign buyers to lob takeover bids for Australian-listed companies.

We are positioned in client portfolios for slightly higher inflation and continue to prefer companies with strong cash flows and pricing power.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.