© 2024 First Samuel Limited

The Markets

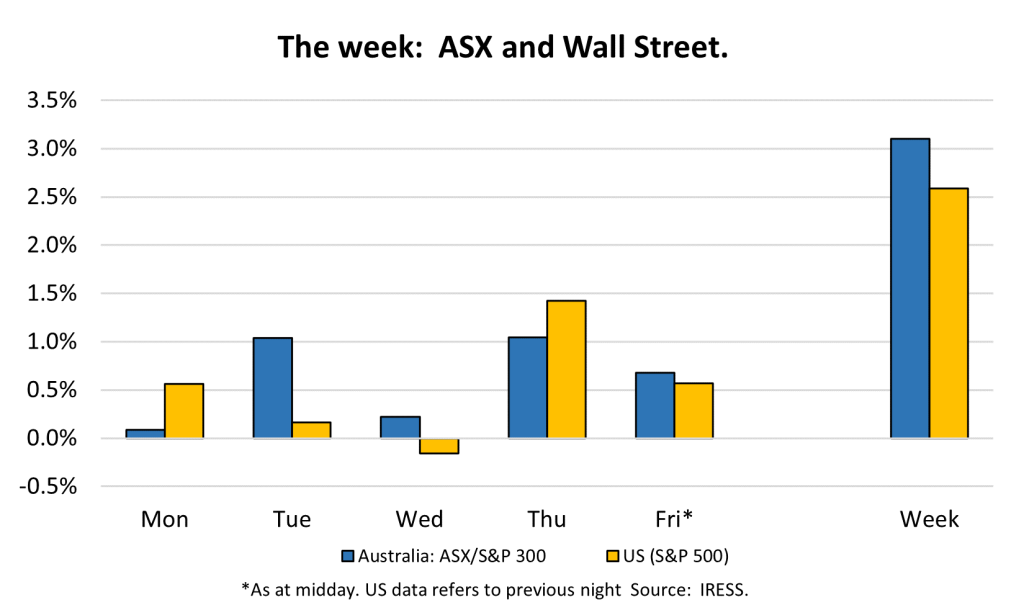

This week: ASX v Wall Street

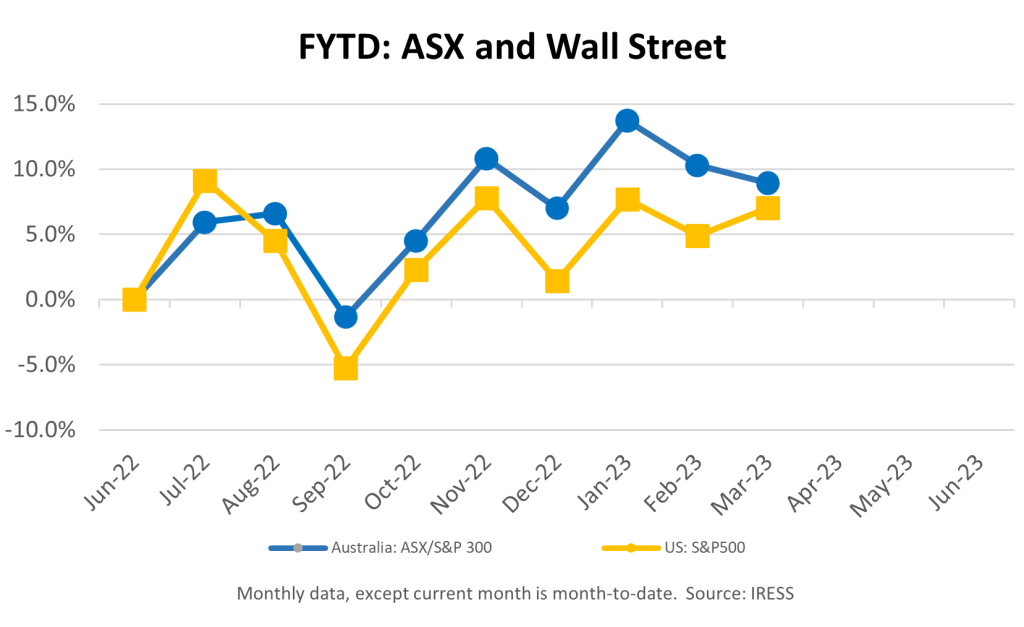

FYTD: ASX v Wall Street

This week in Investment Matters we have highlighted three news items relevant for client portfolios. Similar to the previous week, is the enhancement of these stories with the sensational Patrick Cook cartoons.

Cheers! Another takeover – United Malt Group

The sixth takeover bid for portfolio positions in the past 2 years arrived this week.

United Malt announced on Monday that it entered into a process and exclusivity deed with the privately-held French malt company, Malteries Soufflet, a company backed by the huge private equity firm Kohlberg Kravis Roberts & Co (KKR).

This follows the receipt of a conditional, non-binding, and indicative proposal to acquire all the ordinary shares in UMG for $5.00 per share. This represents a ~45% premium to the last closing price on 24 March.

United Malt group is amongst the largest positions in clients’ Australian Equity Portfolio, and First Samuel owned approximately 1% of all equity in United Malt.

Is it the right price?

Regarding the mooted price of $5.00 per share we suspect that the first conditional, non-binding, offer slightly undervalues the business. A final price per share of between $5.25 and $5.40 may be required to complete the sale process.

An increased offer may emerge from the exclusive access period (10 weeks) that United Malt has granted to its suitors. During such time other interested parties may also emerge with a higher offer, and of course the deal may fall through if the investigation uncovers major concerns. United Malt’s Board is reported to support the potential transaction in the absence of a better offer.

Consistent with our trading strategy surrounding takeovers, we have trimmed the size of the United Malt position this week at levels around $4.55. Recent experience suggests that conditional offers represent a far-from-certain positive outcome (for instance, the Ramsay Health Care takeover which ultimately failed to proceed).

Another takeover concentrating on assets.

In the past 18 months, we have positioned the portfolio towards companies that have productive assets with significant long-run value, rather than simply companies which are currently operating well.

Instead of companies that promise future cash flows that don’t exist today (growth stocks), or investments based on the contingent success of future possible enterprises (speculative assets), we have preferred to concentrate on existing assets that generate current cash flows.

In valuing these assets, we have found a range of opportunities to buy great assets at discounted prices. These have included Origin Energy, United Malt, Costa Group, Seven Group, Inghams and Newcrest Mining.

The reason we can buy such assets cheaply are varied but can include:

- Weak short-term sales growth

- Short-term operational challenges such as higher input costs

- Weak management teams or large management errors, and

- Changing economic or business conditions, including Covid.

Our view is that the stock market can excessively penalise stock prices based on short term concerns, while forgetting that most aspects of a company’s operations, including management expertise, can be changed quickly.

If the assets a company owns last long enough, we can assume all other features can change, leaving only the assets themselves to be valued. United Malt’s manufacturing infrastructure has amongst the longest lasting assets in the market. A large part of its capital base has a 45+ year useful life, not to mention the sustainability of the beer brands that these manufacturing assets support, which can be centuries old.

Recent calls with experts in the malt industry have only highlighted the shortcomings of existing United Malt management. So we were not surprised to see the suitor is another management team already operating successfully. Indeed, Malteries Soufflet is the largest commercial maltster in Europe and 2nd largest globally, with operations also in Latin America and Asia. The takeover looks logical from a geographic expansion perspective given United Malt’s leading position in North America. This management team wanted the assets and are confident that, when joined with their own assets, they will create value the Australian share market couldn’t see before the deal was announced.

Our shareholding will be partially retained as we look for alternative bids in coming weeks. Wait for an update on the final price over the next three months.

Inflation – persistent and high – but may be enough to see the RBA pause interest rate hikes.

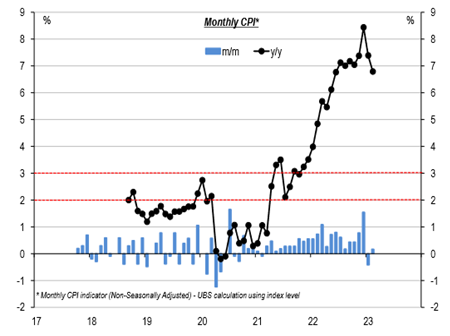

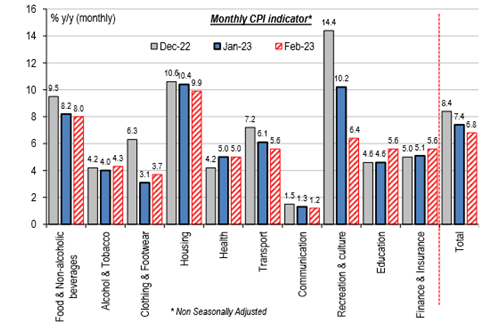

This week saw the release of the ABS monthly consumer price index (CPI) measured at 6.8% YoY in February. (Figure 1)

Headline inflation has clearly shown a deceleration from 7.4 per cent in Jan and 8.4 per cent in December. The primary driver of this slowdown over the past two months has been travel and accommodation prices.

Economists, of course, disagree on the impact on interest rates of this falling inflation. For some, the slowing provides the RBA with the opportunity to pause the rate hikes. In support these economists note a combination of

- the global banking dislocation of recent weeks,

- the softening trends in household spending,

- the fact that inflation has peaked (Figure 1) and,

- the notion that the impact of previous rate rises has yet to fully be incorporated into current economic activity

Figure 1: February 2023 CPI lower than expected, but yearly CPI remains high

Source: ABS, Macrobond, UBS

Other economists however point to analysis that suggests the underlying headline inflation figure hides persistent inflation in key areas of our economy. For the Reserve Bank, which is particularly sensitive to short-term inflation, such persistence may well see the RBA continue to raise interest rates, at least once more.

Figure 2: A wide range of categories of expenditure retain high levels of inflation.

Source: ABS, UBS, Macrobond

Figure 2 highlights the 5%+ inflation in categories such as Housing (Rent), Health and Education. The difficulty for the RBA is that high levels of inflation in these groups in turn tends to persistent high inflation.

Unlike the price of more volatile items, such as supermarket goods or transport costs, the many agents operating within the health or education sectors build their expectations for future prices over a longer period. In health and education, they “get used to” expecting inflation in prices to be similar to the inflation they witness in recent periods. Economists refer to this as increasing “inflationary expectations”. For those expecting inflation to come quickly under control, high inflationary expectations dampen such optimism.

We remain in the camp that inflation will be more persistent, not at levels above 5 per cent, but equally not at the 2%+ levels of pre-Covid. We are positioned in client portfolios for slightly higher inflation, and continue to prefer companies with strong cash flows and pricing power.

Origin Energy – Parties sign documents – increase offer and now wait…

Back in November the portfolio benefited from the huge premium takeover announced for Origin Energy by interests aligned with Brookfield Asset Management. Origin was trading in the mid $5 range at the time, and the purported offer was suggested to be circa $9.

Following a number of months of negotiation, ironing out the details and structuring the takeover, the final Scheme Implementation Deed (SID) with Brookfield/EIG was signed this week.

The conditions and price have improved slightly.

The price will include a AUD$ cash component being at least $5.78ps and the USD$ cash component a maximum of US$2.19. At current exchange rates this equates to more than $9, including an already paid dividend.

The deal will take the remainder of the year to complete, and as such the stock trades at a discount to the final price to account for a range of factors, including:

- The time value between now than the completion date – perhaps worth $0.40c per share.

- The possibility the deal is not completed by 30th Nov 2023, although a “ticking fee” paid to ORG shareholders of $0.045ps per month will begin to accrue.

- Risks associated with scheme conditions include FIRB and ACCC approval.

- Exposure to the deal falling in the wake of possible catastrophic events impacting operations over the next 8 months at critical Origin assets including APLNG (Gas), Eraring Power Station and other key generators.

On a more positive note, there is the possibility of additional franking credits to Australian shareholders being distributed prior to completion of the deal.

We are likely to retain a small share of our original holding through to completion.

Amongst the news of the week we were once again drawn to the press and public relations campaign that accompanies this deal. The commitment by Brookfield to be at the forefront of investment in Australia’s energy transition will be critical to passing the scrutiny of government in coming months, and in unlocking of value for Brookfield over the next decade.

Unlike the short-term focus which lingers over the ASX and saw Origin Energy shares discounted whenever short-term conditions were challenging, the emphasis of Brookfield remains growing the value of the core assets in the long-term – the same story as United Malt above.

We remain disappointed that such a powerful, optimistic and investment led outlook now postulated could not have been delivered by Origin as a listed public company. In listed form, the benefits of this investment could have been captured by Australian market owners. So, whilst we are pleased with the huge premium paid for our stock, we wonder if more returns will flow to Brookfield in the long-run.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.