© 2024 First Samuel Limited

The Markets

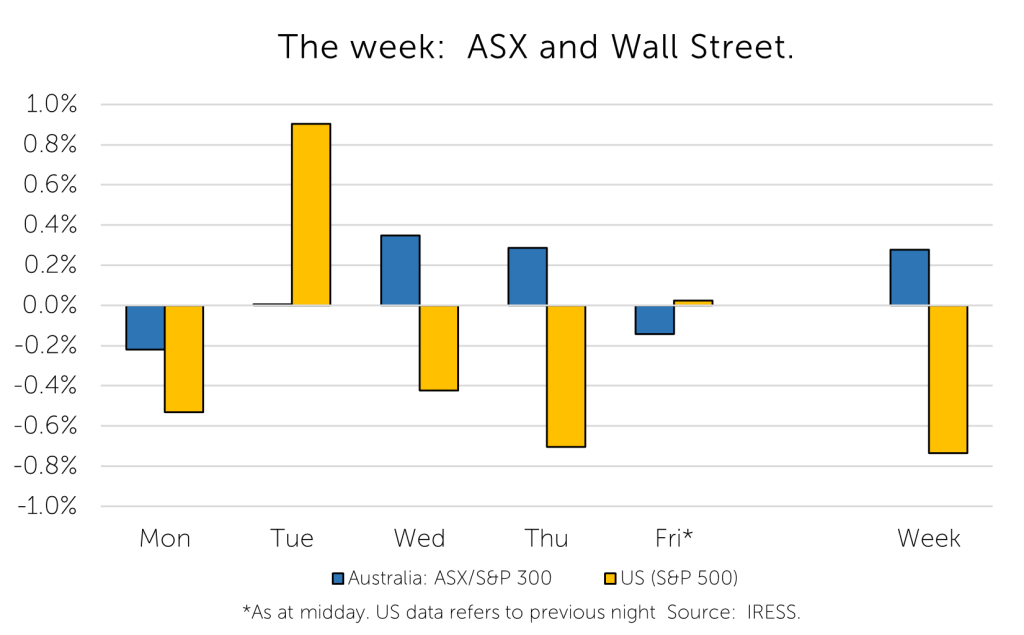

This week: ASX v Wall Street

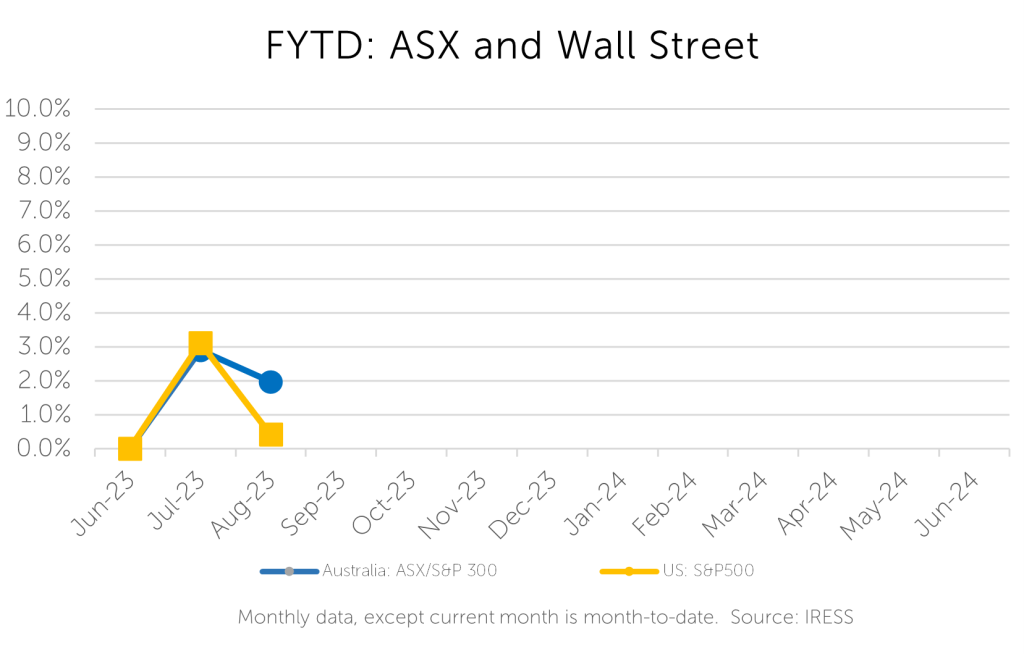

FYTD: ASX v Wall Street

The first substantive week of company reporting season kicked off last week. We provide some of the more relevant company result takeaways:

- CBA

- AGL

- Boral

- QBE

Commonwealth Bank (CBA, FY23 result)

When Matt Comyn, CEO of CBA presents to the market, it is worth listening. He is in command of Australia’s largest bank, with more than one-third of Australians calling CBA their ‘Main Financial Institution’, meaning his bank has the best ‘pulse’ on the state of the Australian economy and in particular its consumers.

As a ‘June balance’ bank, CBA is also the first of the major banks to announce its financial results (other banks have September year-ends), providing an insight into operational trends for the sector.

Insights into the economy and the consumer – things are changing quickly

Much has been noted about the impact of rising interest rates and the ‘two-track’ economy. CBA has been pointed in highlighting the disparate impacts of central bank policy changes upon consumer balance sheets and accordingly on spending patterns.

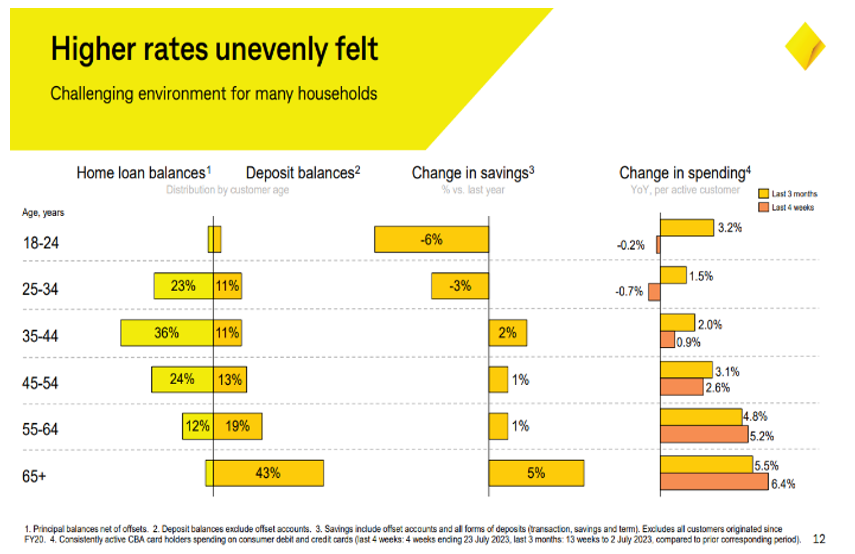

Figures 1 and 2 : Demonstrating the impact of higher rates. Household balance sheet positioning and effect.

Source: CBA

In short, younger consumers (under 34) are clearly suffering disproportionately as a result of the uplift in inflationary pressures and the subsequent material lift in interest rates in response.

Younger consumers, controlling only around 15% of total retail deposits, are having their savings’ bases quickly eroded by inflation. They are also having to make the most significant shift in their lifestyle/spending patterns and for which there are big questions being asked about their future capacity to participate in the share of financial assets controlled. This presents a major policy dilemma for our politicians and business leaders.

Defending their turf – super profitable or not?

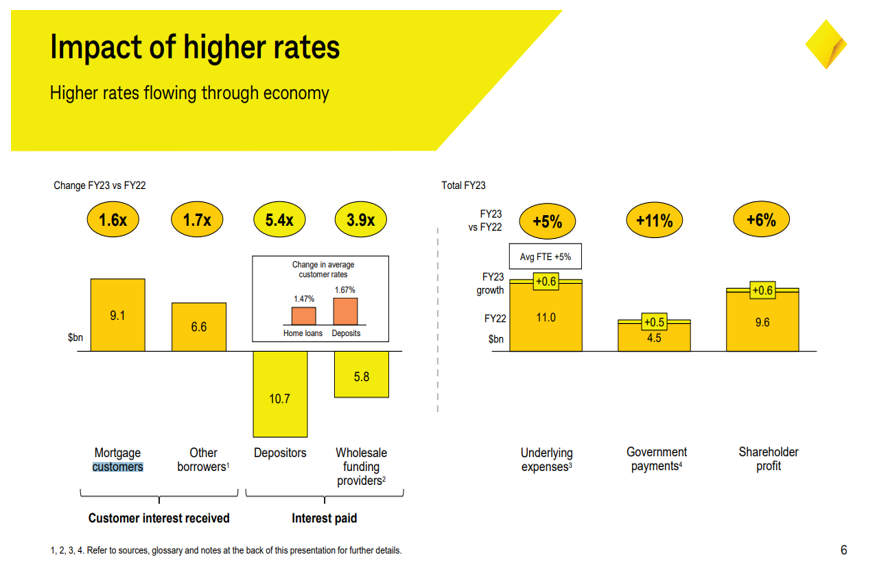

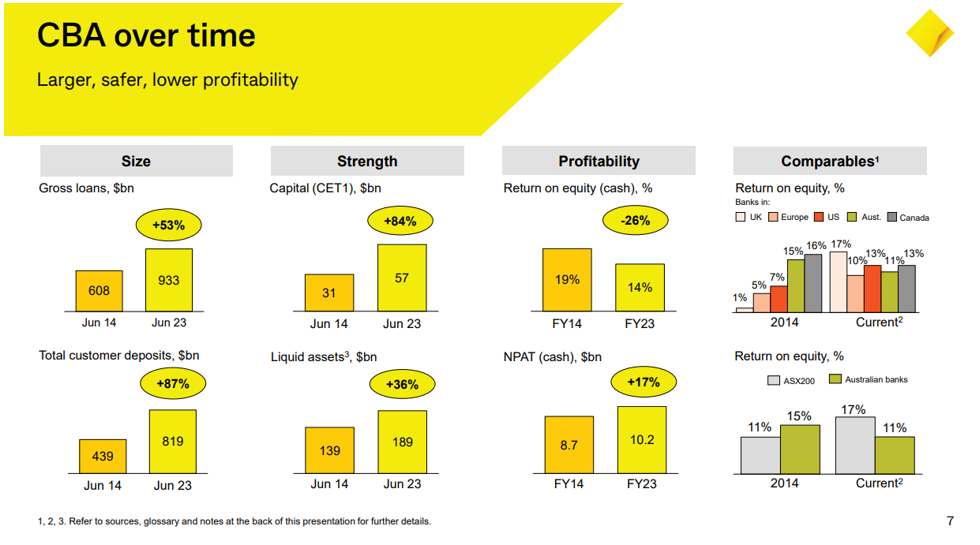

Figure 3: The case for avoiding a super-profits tax

Source: CBA

Coincidently, CBA presented its result on the day after the Italian government had announced a surprise windfall ‘super profits’ tax on Italian banks. The tax was equivalent to 40% of the ‘Net Interest Income’ earned in 2022 or 2023 (raising up to EUR3 billion). Massive outcry caused the tax to be scaled back the next day.

After CBA’s result, there were cries for the Australian government to also levy a super-profits tax. These were ignored.

The CBA made a salient point about the significant fortification of its balance sheet in the past decade and the resultant hit to profitability (Return on Equity) that had occurred. While official cash rates have increased from 2.5% to 4.1% over this time, CBA’s Group ROE has declined from 19% to 14%.

At an industry level, the sector has also experienced a relative decline in profitability relative to the broad listed universe of the 200 largest companies on the ASX: some 4% points fall in ROE while its listed peers improved by about 6% points.

The relative profitability of the Australian banking sector has also fallen relative to international peers in larger countries such as the UK, US and Canada.

It’s true that the Australian major banks occupy a somewhat privileged position in corporate Australia, having access to government support and preferential funding terms at times of global stress. While the concentrated industry structure of the sector lends itself to higher profitability than in more contested markets or industries, it is difficult to mount a case that the current level of profitability generated by the Australian banking sector is egregiously high and worthy of a higher than ‘regular’ tax burden.

The author would also argue that it is vital to have a banking sector that generates a return at least as high as the cost of capital (presently ~10-11%). It is the regulatory capital generated that allows a bank to extend credit to customers and fuels economic growth. In turn, adequate levels of profitability (and resultant AA credit ratings) support Australian banks’ balance sheet capacity to tap international capital markets and help fund the current account deficit of the country.

In turn, sufficient profitability allows investment in systems that provide a modern payments architecture, convenient digital banking services, and to invest in fraud prevention.

Those arguing for a lower-return alternative may look to the example of Members Equity. In that case, the prudential regulator, APRA, was forced to find a buyer after several years of low returns had resulted in its industry fund owners refusing to provide any more equity capital to support its lending activities.

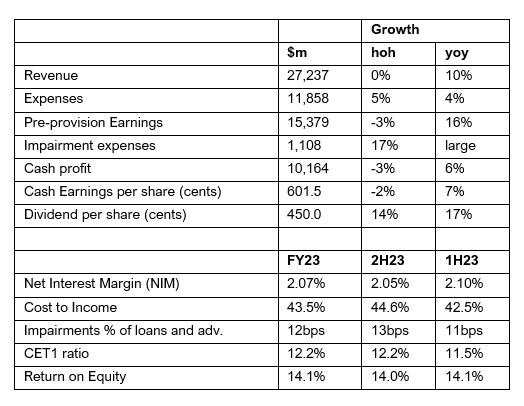

Figure 4: CBA results snapshot

Source: CBA

A 20-basis points expansion in CBA’s Net Interest Margin, underpinned by the rise in market interest rates, drove a 6% increase in group profits over the year. Within the year, however, rising deposit costs and significant competition in the mortgage market saw earnings momentum slow.

Investors responded favourably to the result, most particularly the stability in NIMs and the strength of balance sheet and capital (including a dividend surprise and ongoing $1 billion share buyback).

AGL (FY23 result)

AGL had announced a refreshed strategy to the market in September 2022 and had also presented at a recent company-hosted Investor Day in June 2023. The path of transition within a decarbonising world towards a portfolio of renewable energy assets has accordingly become better understood by the market.

Rising energy prices have been a source of improved company profitability in recent months and shareholders have been the beneficiaries of this, including First Samuel clients.

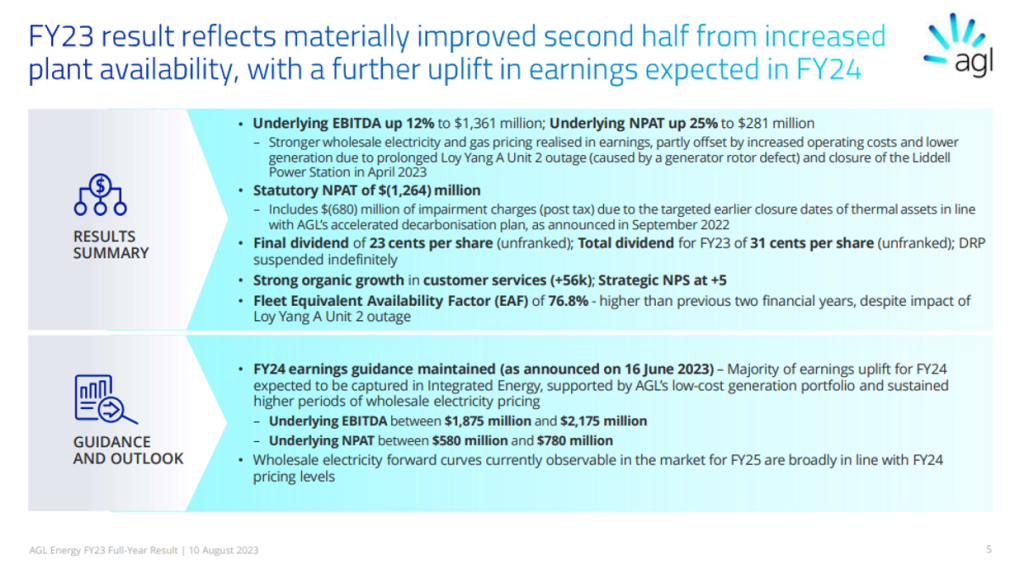

Figure 5: The result in short

Source: Company reports

Underlying EBITDA (Earnings Before Interest Tax Depreciation and Amortisation) in FY-23 was up 12% to $1,361 million and underlying NPAT up 25% to $281 million. These were at the top end of company guidance. Stronger wholesale electricity and gas pricing reflected in higher earnings. But these were partly offset by increased operating costs and lower generation due to prolonged Loy Yang A Unit 2 outage and closure of the Liddell Power Station in April 2023. Cashflow generation improved in the second half, driving the cash conversion rate above 80% for the full year – a pleasing outcome.

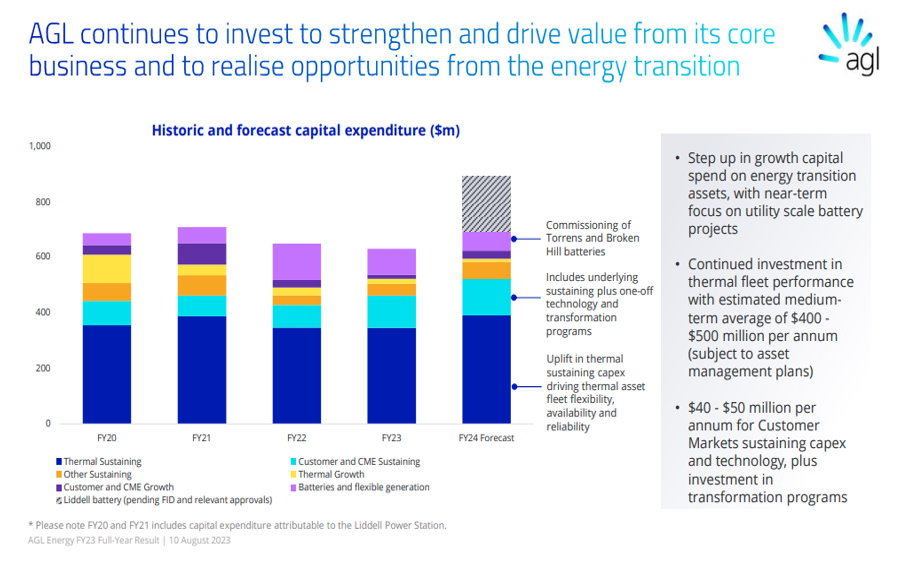

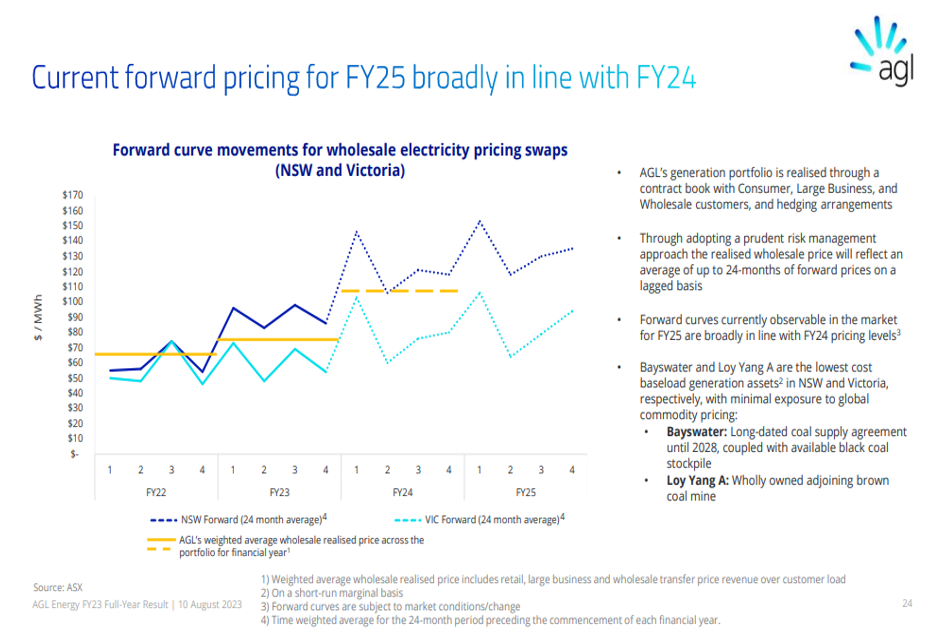

Figures 6 and 7 : Adding renewable energy capability comes at a cost, with forward price increases required to offset this

Source: AGL

However, the absence of management identifying ongoing electricity price rises beyond FY-24 was enough to temper market enthusiasm for the stock on the day. By contrast, a step up in capex, commencing next year, will be required in order to build the new Liddell Battery project.

What the market said

“AGL retained its guidance but flagged the warmer winter reducing gas demand, stronger competition in retail and costs inflation as a challenge” (Macquarie)

“While FY24 guidance remains unchanged, investor focus today has been on the absence of upgrades to FY25. We remain positive on electricity prices in summer, which we think will then drive up forward pricing and FY25 earnings outlook.”

Boral Limited (BLD) – 73% owned by Seven Group (SVW)

Boral FY23 Results – 10th August

Seven Group Holdings (SGH) is among the largest holdings in clients’ sub-portfolios and one the strongest performing stocks in FY-23. A major asset in the SGH portfolio is Boral Limited, a listed ASX company of which it owns 73%.

Clients may recall that First Samuel owned Boral Limited when Seven Group completed the effective takeover of Boral.

Since the takeover, the appointment of a new CEO, Vik Bansal, and the sale of its US assets, the remaining core Australian business has gone from strength to strength. We suggest that Seven Group’s commitment to capital and operational efficiency is having an impact on the way Boral is run.

The company reported that it had experienced significant improvement across all key metrics. Challenging cost environment offset in part by price, improved cost discipline with cost base adjustments.

EBIT is a financial measure of Earnings Before Interest and Tax and the most accurate way to measure an industrial company’s performance. Borals’ EBIT margin in 2H FY-23 of 7.7% is up 200bps on 1H FY23 and up 566bps on 2H FY-22.

Cash generation is the next most important measure after EBIT, and these results saw improved cash generation.

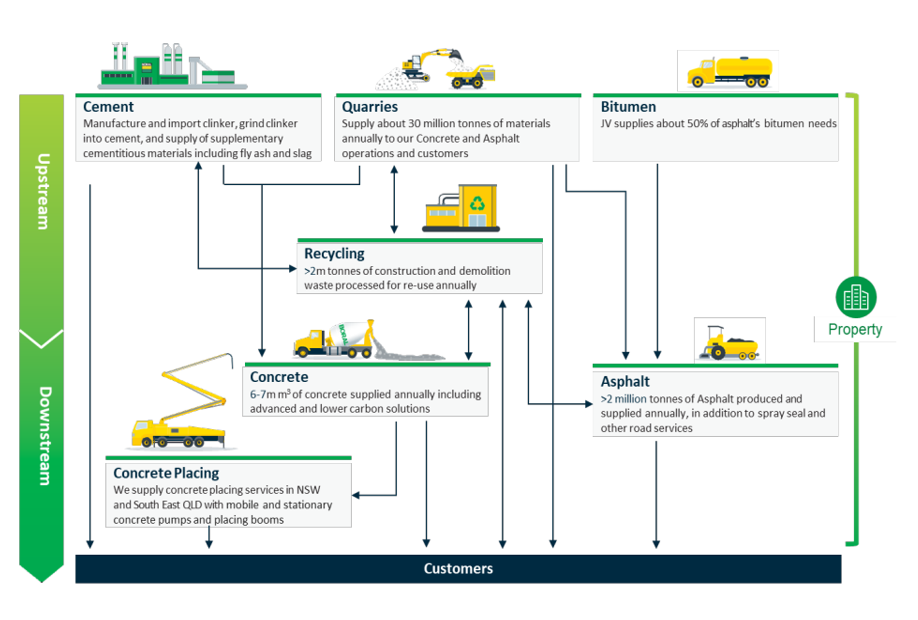

Among all the charts presented, we were particularly drawn to the clarity provided by the chart below. As an analyst covering Boral for 15 years, a key attraction of the business is the vertical integration of its assets. This vertical integration includes the land it uses for its manufacturing plants, which once past their useful lives often become valuable land for residential development, reaping additional profits.

When the benefits of vertical integration are harnessed, higher profits emerge, so much so that the competition regulators keep a keen eye on the domination of vertical markets. We would argue that Boral is better placed to capitalise on these benefits. Vertical integration benefits now also include recycling, waste and other environmental assets.

Figure 8: A vertically integrated business model

Source: Boral

At the core of its assets lay quaries, not only because of their central role in the supply chain of construction material. Replacement of these quarries with new sites is increasingly challenging in the modern ‘ socially-responsible’ backdrop, making legacy assets a valuable commodity.

Quarries also are faboulous inflation hedges, the rocks are already there, and in the face of inflation and lack of new supply become more valuable each year, with little effort expended.

We continue to see value in Seven Group and this is driven in part by the value in the Boral asset.

What the market said

“Boral reported FY23 results that beat our and the street’s expectations, driven by a strong profitability improvement. While price traction has improved, the group is managing controllables well and a broader cultural improvement is underway. (Macquarie)”

QBE Insurance Group Ltd (QBE)

QBE 1H23 Results – 10th August

QBE provided a 1HFY-23 profit update at their June Strategic Updated. This update guided the market to a narrow range of expected outcomes.

There were few deviations from the June update, although changes in taxes and dividends created some market uncertainty before the management conference call.

The conference call was exceptional, with the understated tone of the CEO Andrew Horton, and the precision of CFO Inder Singh providing assured guidance regarding a couple of critical points:

- Why was the 1H dividend lower than expected? The answer: we remain confident of delivering a full-year dividend payout but felt that short-term uncertainty and the range of current initiatives required a more circumspect approach to capital

- Is the current guidance (which is excellent) adequately incorporating some weaknesses we are seeing in current crop conditions and allowing for enough uncertainty in other variable parts of the business? Answer: yes.

In other good news, long-tail reserving was zero and losses from catastrophic events (cat losses) were in line with the recent update. FY-23 guidance items are unchanged, which ought to foster confidence in the near-term operating outlook.

We have written extensively about the complexity of both the operational and financial tasks of running a global insurance business with more than $25 billion in premiums. In a world where long-tail (rare but expensive) events such as earthquakes, fires, floods, and hurricanes are a monthly occurrence, the capacity to correctly price such events is highly specialised.

As global inflation rises and as the costs of both catastrophic events and run-of-the-mill claims rise, companies such as QBE have been able to increase premiums substantially – by more than 10% this year alone. Keeping in front of claims growth is critical; this has been the operational standout for the past two years.

Excellent insurance companies must assess the likelihood of these events occurring and the payouts they are willing to risk. In return, they collect a relatively small margin. If they are slow to see changes, it can cost significantly. QBE has kept pace with such changes for many years.

Insurance companies also earn interest or investment income on the funds you provide the company at the beginning of the insured period. Higher interest rates have seen a continued increase in QBE’s underlying profitability.

Clients benefit from QBE’s share price and dividends, delivering a 50% return since June 2021, versus a market return of 8% and twice the market return since June 2018.

What the market said

“Despite its share price being up ~20% from the recent result six months ago, QBE is trading at a 41% PE discount to the ASX200 on a 12-month forward basis, 43% on 24-month forward. This is at the bottom of its historical ranges and with the earnings quality improving and consensus forecasts at a reasonable level. We continue to see further share price upside to QBE on an absolute and sector-relative basis” (Barrenjoey)

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.