© 2024 First Samuel Limited

The Markets

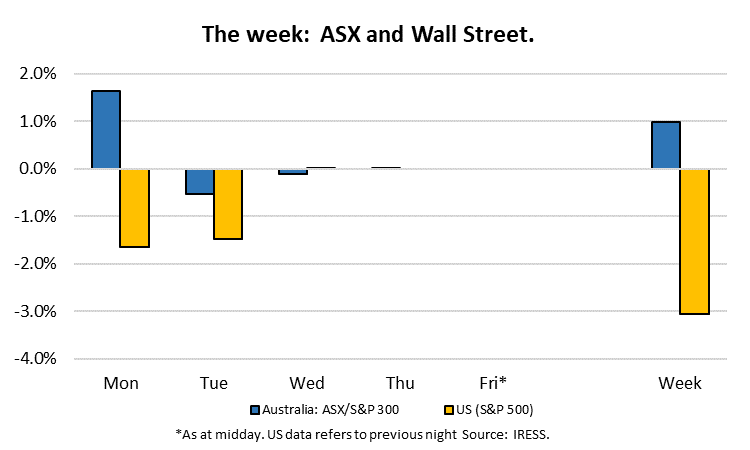

This week: ASX v Wall Street

FYTD: ASX v Wall Street

Note: not all clients will hold all of the securities we discuss.

To provide a more complete investment picture, we have continued to provide some updates on the prospects of our sub-portfolios’ companies as gleaned from our coverage of the ASX Company Profit Reporting Season:

- Lynas Rare Earths (LYC)

- Aurelia Metals (AMI)

- Impedimed (IPD)

- Ioneer (INR)

Mercifully for our readers, and the authors, we will shift gears next week to another topic!

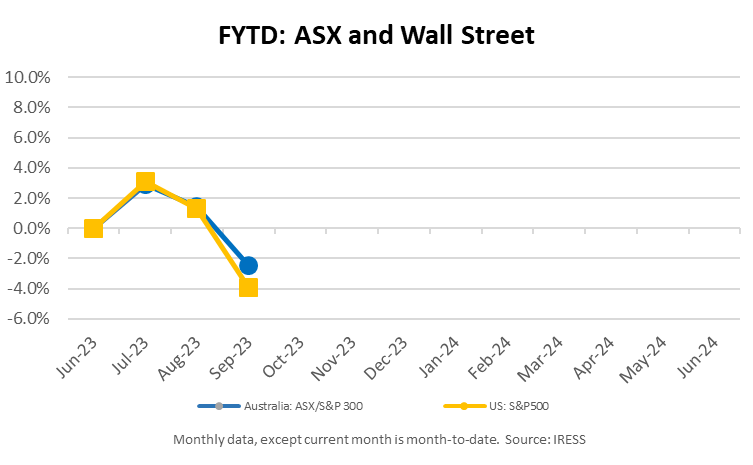

Lynas Rare Earths (LYC FY23 result)

Lynas Rare Earths (Lynas) is a ‘rare earths’ company focussed on the mining of critical minerals (such as lithium) that are considered the next generation of materials used in battery production for electric vehicles. Lynas holds a unique position as the only significant producer of scale of separated rare earths outside China.

The Mt Weld Central Lanthanide Deposit (CLD) is one of the highest-grade rare earth deposits in the world. Mt Weld also hosts the undeveloped Duncan (rare earth), Crown (niobium, tantalum, titanium, rare earths, zirconium) and Swan (phosphate) deposits. Lynas processes the CLD ore at the Mt Weld Concentration Plant to produce a rare earth concentrate that is sent for further processing at Lynas Malaysia’s Advanced Material Plant.

Via the company’s quarterly production report, the company had effectively pre-announced its result to the market. A significant fall in the price of some rare earth elements (e.g. ~60% in Neodymium and Pseodymium – NdPr and 23% in Rare Earth Oxide) has caused a fall in revenue and net profit.

Lyans: FY23 By the numbers – rising production but failing commodity prices

Source: Company reports

Outlook

The market’s focus, come result day, was on capex expectations for the coming year, in particular for its Kalgoorlie lithium processing facility, which remains on track for production this month, but this has come with a 27% increase in total project capex announced.

Similarly, capex spend on its nearby Mt Weld mine is 20% higher than initial project guidance. In addition, the company has also acquired land in Texas, USA to construct a ‘heavy rare earths’ separation plant in conjunction with the US Department of Defense. This will help to offset a tougher regulatory backdrop in Malaysia, where the importation and processing of lanthanide concentrate will cease from January 2024. Another solution is required.

In September, the Chinese Ministry of Natural Resources announced a flat quota target for REO mining and refining targets, which was below consensus expectations and should be supportive to commodity prices. Having bottomed in July at ~US$60kg, the NdPr price is now over US$70, suggesting an improved outlook for lithium company revenues.

Lynas: Lynas Rare Earths Processing Facility about to launch

Source: Company reports

What the market said:

“An investment in Lynas is buying into rare earths with the commodity price nearing cost support and below a sustainable incentive price for non-China supply which we estimate at >US$100/kg. Over the next 12 months, Lynas will be ramping up a new and diversified industrial footprint, highly strategic in being the only integrated capacity outside China. We expect this to enable further brownfield expansions, with a pathway from the ~6ktpa of NdPr production of recent years to ~17ktpa within 5 years to service a growing market driven by EVs and Wind. Our Price Target suggests ~45% upside.” Barrenjoey

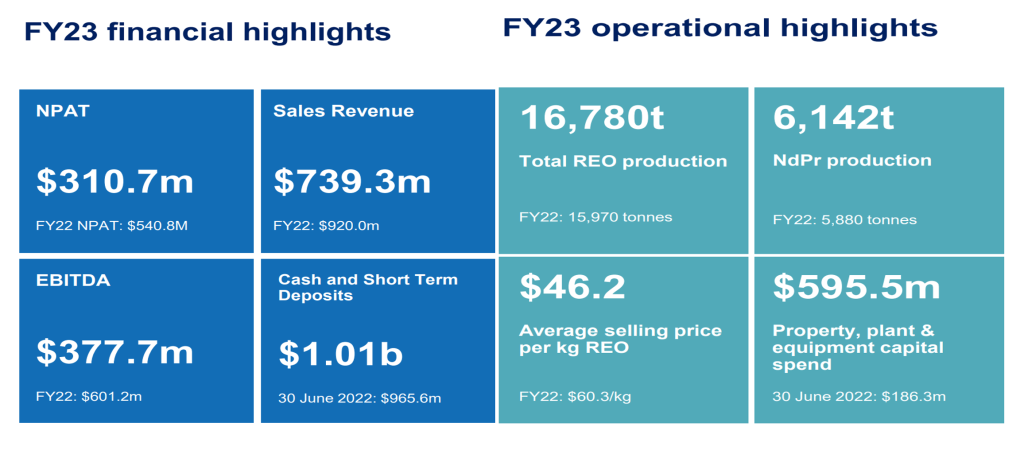

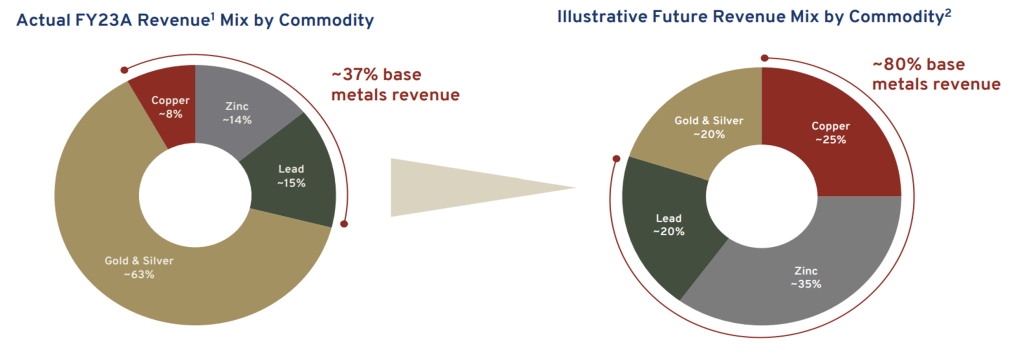

Aurelia Metals (AMI FY23 result)

Aurelia is a prospective mining company, operating three mines in NSW, of which two are in the Cobar Basin as well as the Dargues mine, south of Canberra.

The most prospective of these mines, Federation mine near Cobar, recently commenced development and is forecast to stope ore in 1QFY25. First Samuel recently participated in a A$40m equity raise to help fund this facility coming on top of a $100m finance facility provided by large international commodities trading company Trafigura. This mine will be able to leverage infrastructure from the nearby company-owned Hera mine and will also utilise processing facilities at its Peak project, which will assist with mine viability.

We’re excited that the company has a new CEO, Bryan Quinn having joined the company as CEO in June 2023. He enjoyed career success at Oz Minerals and BHP.

Aurelia: Financial results – an improved second half

Source: Company reports

The collective resource-body offers high quality ore in Zinc, Lead, Gold, Silver and increasingly Copper, of which Federation has high-grade zinc, lead and gold.

Aurelia: Shifting commodities mix

Source: Company reports

What the market said:

“With equity and debt funding secured, the main focus in FY24 is bringing Federation into production with A$70-80m of growth capex allocated. Federation the highest-grade deposit in AMI’s portfolio with a zinc and lead grade of 9.0% and 5.3%, respectively.” (Macquarie)

Impedimed (IPD)

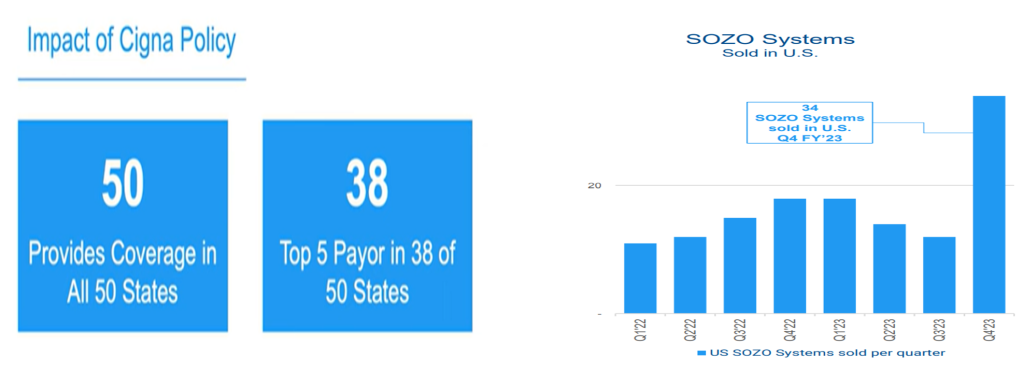

ImpediMed is a small, but highly prospective company that produces a family of FDA-cleared (US) and CE-marked (Europe) medical devices. These include SOZO® for multiple indications, including heart failure, lymphoedema, and protein calorie malnutrition, sold in select markets globally.

Game changing development

Most significantly, in March 2023, the US National Comprehensive Cancer Network (NCCN) Clinical Practice Guidelines in Oncology for Survivorship were updated and reference bioimpedance spectroscopy as the recommended objective tool to screen at-risk cancer patients for early signs of lymphoedema, which is a secondary health condition associated with several cancer-types. Approximately 20% of patients treated for breast, melanoma, gynaecological or prostate cancers will develop lymphoedema.

Impedimed is the only company to offer-FDA-cleared technology using this approach and is now available for use in all 50 US states, with the first Top 5 National Payor insurance company (Cigna) having now accepted this standard. We believe that this is a game changing breakthrough for the business, likelyleading to widespread payor companies to adopt this approach to treatment.

We, in turn, are excited that the appointment of a new CEO, Rick Valencia, in December 2022 will enhance the company’s ability to execute on a commercial strategy that will capitalise on the growing opportunity. Our recent meeting with Mr Valencia and the corresponding NCCN Guideline change enticed us to add a small investment position for client portfolios.

Figures 1&2: Insurance companies are adopting this standard…. and hospitals are now signing up

Source: Company reports

What the market said: “It’s only a matter of time before the other payors start following” (Wilsons).

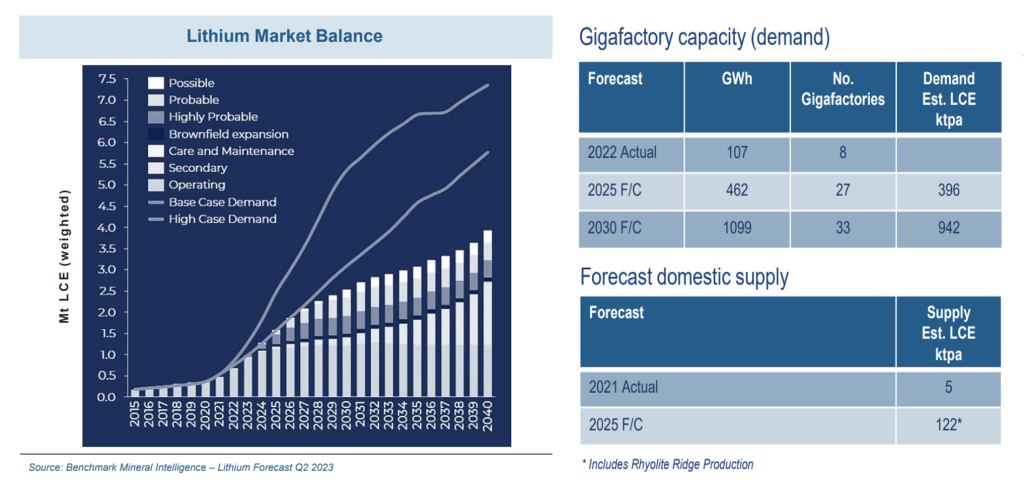

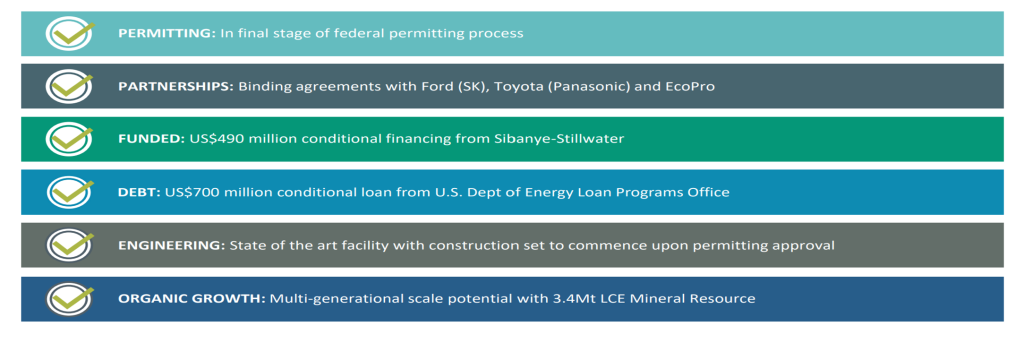

ioneer (INR FY23 result)

An additional sub portfolio position focussed on next-generation resources, Ioneer is developing a U.S.-based source of lithium and boron. The U.S. electric vehicle industry currently imports all of its lithium. That must change if the U.S. is to meet global decarbonisation goals and keep pace with soaring demand for EVs and the components that power them, providing Ioneer with a significant market opportunity.

Ioneer’s Rhyolite Ridge project is based in Nevada, which is a well developed location in terms of mining talent and equipment. Supply of minerals from its projects will be easily digested in the domestic market, being the world’s second largest car market.

Ioneer: Global and US lithium shortage requires new projects

Source: Company reports

Ioneer’s mine is still pre-production, but also remains only partially drilled, which offers significant opportunity for an increase in the potential resource base. Already, it is estimated that the Rhyolite Ridge will produce enough lithium to power ~400,000 EV’s per year.

Ioneer: What differentiates Ioneer from other emerging lithium companies?

Source: Company reports

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.