© 2024 First Samuel Limited

The Markets

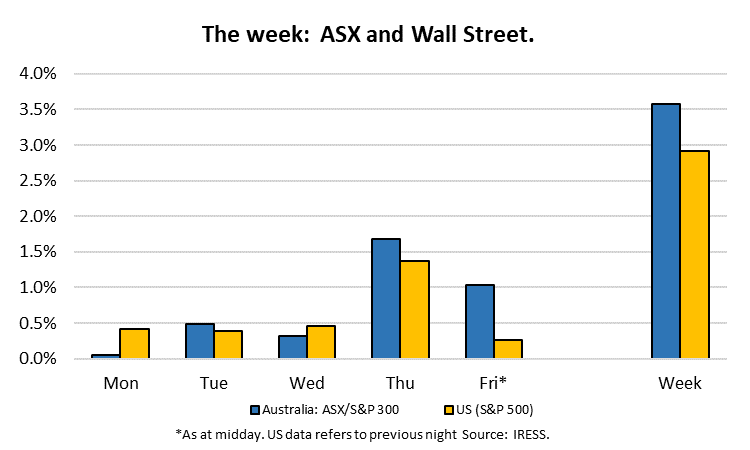

This week: ASX v Wall Street

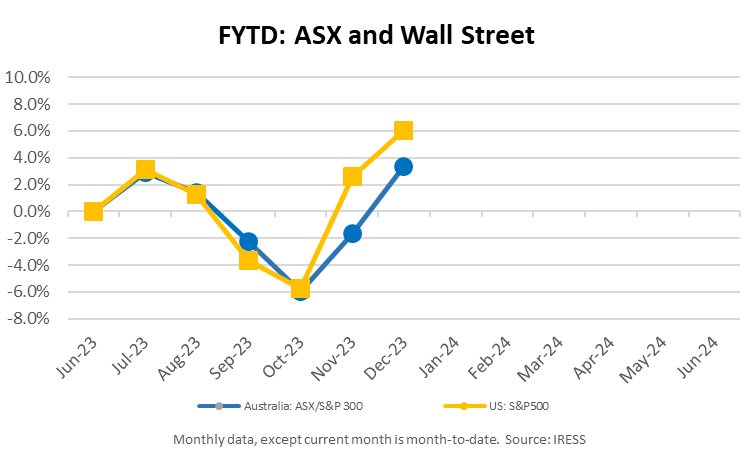

FYTD: ASX v Wall Street

Another stock added to portfolios

As a raft of stocks in the portfolio have been taken over or have successfully met our internal price targets, we’ve been on the hunt for new names to replace them.

A history

Judo Bank was the first non-digital bank in several years to be issued a banking licence by APRA when granted a licence to do business in April 2019. Just two and a half years later, in November 2021, Judo’s successful development of a specialist business banking franchise had allowed it to become the first bank listed on the ASX for 15 years.

The banking professionals who established the organisation, primarily Joseph Healy and David Hornery, had witnessed the emergence of similar organisations in the UK and were well versed in the Australian banking landscape. Each had occupied executive roles at ANZ Bank and National Australia Bank, in addition to roles at offshore financial institutions.

Like many SME customers of the banks, these executives had also become frustrated with the industrialisation of banking in Australia. This industrialisation had resulted in impersonal service and a ‘dumbing down’ of banker credit skills as bank processes became more centralised.

What makes Judo Bank different?

Like the martial art from which its name originates, Judo’s strategy is the art of using size and agility to outwit larger opponents.

We consider Judo’s major positive differentiating factors as

- Portfolio skew – It concentrates on Commercial/SME customers – which is a less contested market than the mortgage market and where customer gearing levels in aggregate across the economy are lower, offering more capacity for future growth

- High Service at Low Cost – It has less customers per banker, to assist with a higher service offering but also ensuring better customer economics (both higher retention and being able to charge a premium). In addition, it has an absence of branches, which assists with the business’ economics

- Technology – having been built in a contemporary environment and having not made a number of business acquisitions, Judo’s tech stack is cloud-native and easier to adapt to change, for its bankers and customers to interact with

- Credit – while it remains somewhat untested given the short period of operation, the investment which Judo makes in its bankers (testing new hires for credit skills, banker university for young bankers incl Chartered Banker qualifications).

How has financial performance been since obtaining its license?

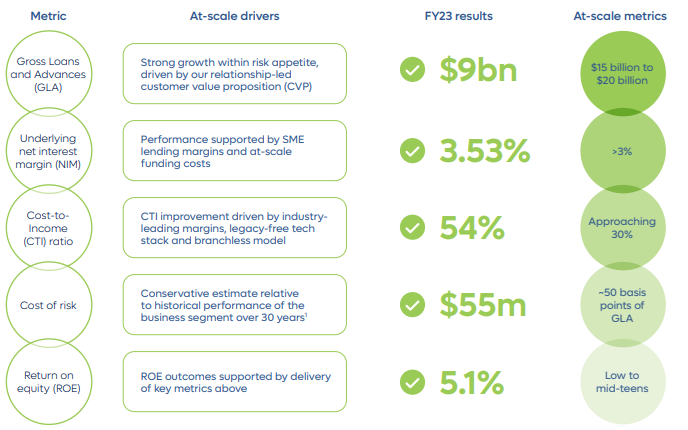

Judo Bank has targeted a number of financial metrics as the franchise reaches a sustainable operating position.

Known as its ‘Metrics at Scale’ measure, these are considered the foundations of financial success at the Group and, in our opinion, will see the business well positioned to be able to compete with its major competitors in the Australian banking landscape.

Judo’s ‘at scale’ business drivers

Source: Company reports

Pleasingly, Judo has made consistent progress against each metric since becoming listed.

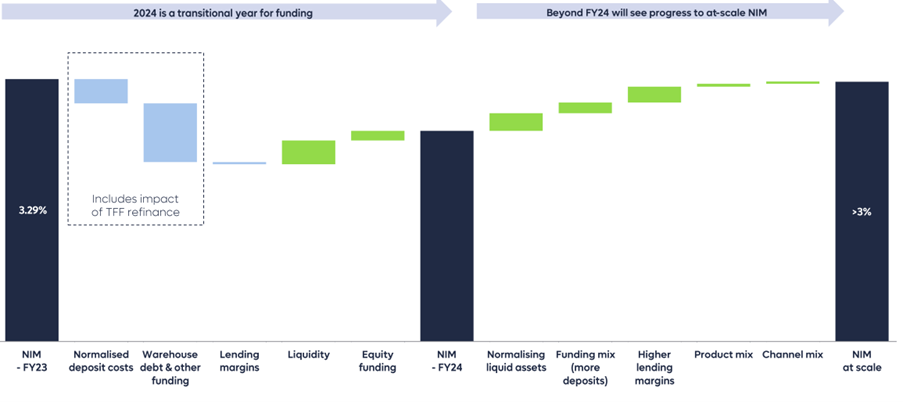

Net Interest Margins – the near-term question mark

Source: Company reports

A source of negative share price surprise

Judo’s share price came under significant pressure after reporting its FY23 results in August. Despite making excellent progress right across its business, management flagged that it was expecting its Net Interest Margin to fall below 3% (it’s long-term target) in the coming year. This was from a level close to 3.3% in FY23.

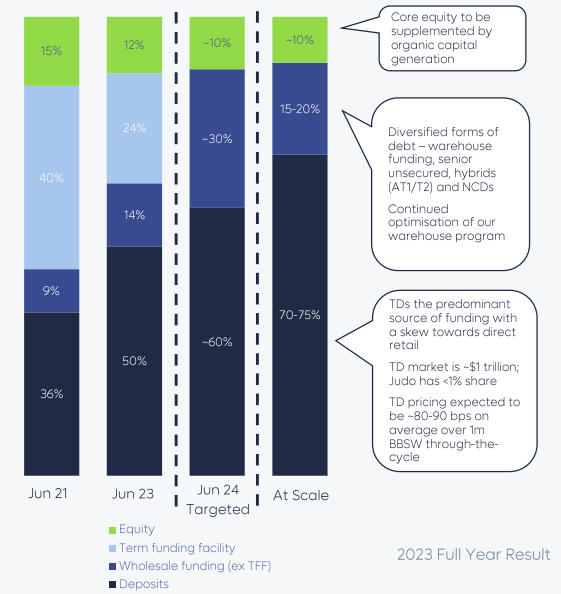

As an eligible bank, Judo had taken advantage of the generous funding sources available to it from the Australian government through covid. Known as the Term Funding Facility (TFF), the government provided significant backstop 2-3 year funding to the banking system in 2020-2021 to ensure that the economy remained ‘well-oiled’ with credit in order to support the housing market and businesses. Judo liberally took up its share of this availability, with 40% of its funding sourced in this manner by June 21.

A funding profile transition is underway

Source: Company reports

Judo reaped the benefit of this cheap source of funding. While paying ~10bps over the benchmark Bank Bill Swap Rate (BBSW) to access this funding, Judo lent this money out to SME customers at a rate more than 400bps over BBSW, expanding portfolio profitability as a result. It’s Net Interest Margin (NIM) exceeded its ‘at scale’ target 3% level.

Typically, a bank treasury function would elect to employ sophisticated hedging programmes (executed via a series of purchases of interest rate swaps across various expiry dates) with which to smooth out the impact of movements in profitability associated with different interest rate settings. It appears that Judo Bank has elected not to hedge its balance sheet in this manner, instead accepting higher near-term profitability.

This means accepting a larger, more variable impact on NIM/revenue as this cheap funding source is progressively and necessarily replaced. This adopted approach had been not well understood by the broader investment community as it was out of step with generally accepted market practice.

Many other banks are also making similar directional adjustments to their funding stacks Accordingly, a number of these banks are competing more aggressively for term deposit funding, in particular, in the broader marketplace. While the near-term outlook is for an unwinding of the TFF and resultant replacement with higher cost sources of funding such as term deposits and other capital instruments, it is anticipated that the Group NIM at Judo will fall back below 3% in FY24.

This was a negative surprise for professionals in the investment community and resulted in a savage ~40% fall in the JDO share price. Accordingly, we believe that this share price retracement represents a good buying opportunity in the stock and have added the stock to clients’ Australian shares sub- portfolios.

Investment Thematics

Referring to our standard set of “Themes and Structural Drivers” that we use to assess good opportunities, Judo provides the following access to these themes:

- Technology – As discussed, Judo’s contemporary tech stack provides it with a more flexible infrastructure in order to necessarily navigate regulatory and product changes as well as better customer and staff experience

- Market support – as a licenced and regulated bank, Judo, from time to time, is able to gain access to Federal Government assistance in times of crisis. It’s access to cheap funding during covid is an example

- Cheap – Judo’s Net Tangible Asset backing (NTA) per share is around $1.30 but the stock is trading at an NTA of ~$0.85 cents per share

- Growth – Judo is consistently gaining market share in its target lending segment, growing at many multiples of system. As the business improves its returns to its ‘at scale’ benchmark, it will generate sufficient capital to be able to support above-system revenue and earnings growth.

Valuation

As stated above, Judo Bank’s NTA per share is around $1.30 per share, meaning the bank trades on around 0.65x NTA. That implies that the business will only continue to earn around 2/3rds the rate of its cost of capital on a sustainable basis. This seems too conservative an assumption.

If the bank can earn 21c per share by 2027, by which time it should be running at close to optimal scale and performance, then analysts believe the stock should then be trading around 14x this multiple or $3 per share, which is 3x the current share price.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.