© 2024 First Samuel Limited

The Markets

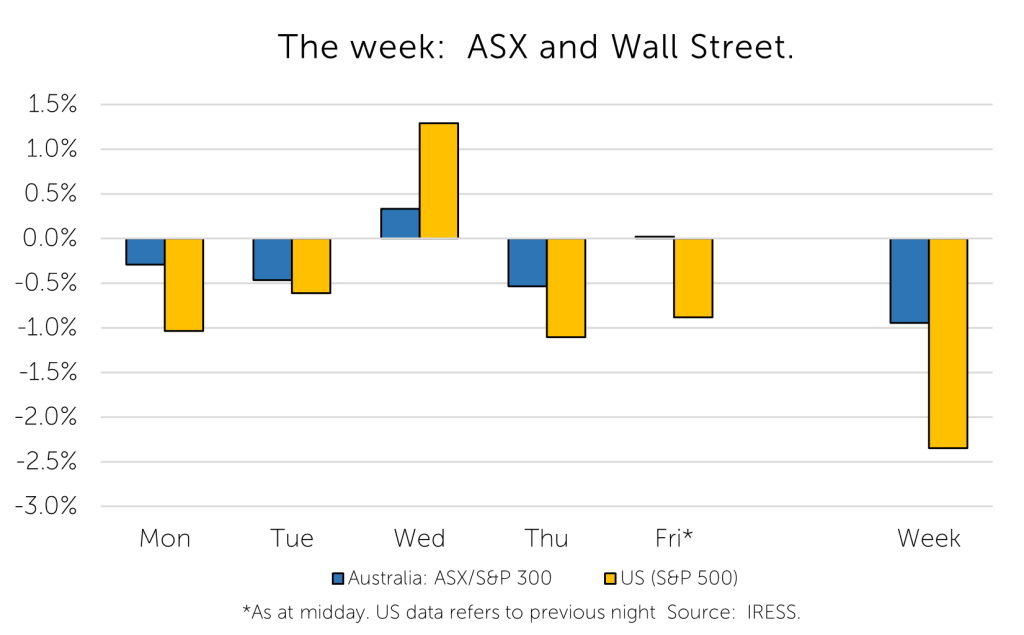

This week: ASX v Wall Street

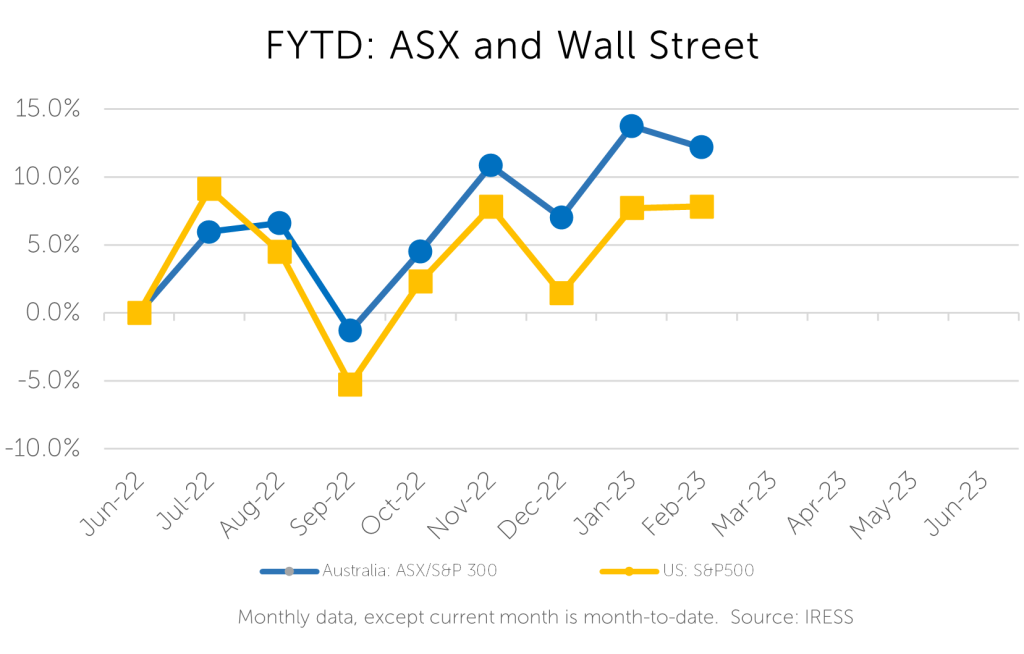

FYTD: ASX v Wall Street

Client portfolios benefited this week from another takeover bid this time for Newcrest Mining. A non-binding indicative offer came from another giant global gold miner, Newmont Mining, based in Denver USA.

The initial offer may not be the last, and we believe that it will need to be increased to secure the deal. We are not a seller of stock at these levels and expect the board to achieve a better result.

Clients will be aware that Newcrest has been a long-term holding. The rationale for our position has always been three-fold:

- general exposure to the gold price which benefits from global increase in money supply.

- exposure to very long-life assets (many years of ore already discovered) rather than mines with shorter lifespan; and

- portfolio benefits, the defensive characteristics of gold stocks in periods of market turmoil can be very valuable.

The bid by Newmont mining is very opportunistic; short-term movements in the relative share price of Newcrest and Newmont have advantaged Newmont shareholders. Newcrest is cheap is comparison.

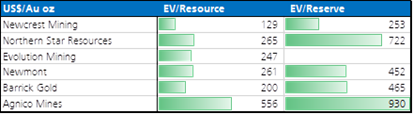

In our view, the real value of this bid lies in the longer-term value of Newcrest’s mine holdings. This long-term value of assets is clearly shown in the following table prepared by UBS on the day of the bid.

Table: Comparing the value of Newcrest Mining and Newmont Mining

Source: UBS

To explain:

- EV refers to Enterprise Value (the total value of the business including debt),

- Reserve is the amount of gold that the company has extremely high medium-term confidence in extracting positive value from,

- Resource is a wider definition that includes areas of possible mining that are either:

- require more drilling to confirm.

- are longer dated and less developed.

- are expected to be available but not with required confidence.

So, EV/Reserve is the amount Newcrest is worth (share market value plus debt) per ounce (Oz) of near certain gold it owns. At US$253 per ounce Newcrest was trading at a 40%+ discount to Newmont’s value of US$453 per ounce. On a Resource basis the Newcrest stock is trading at a discount of 35, so similar hefty discount on both measures.

This discount in the Newcrest share price has been symptomatic of the way the Australian market has recently treated gold companies in Australia. The market has heavily discounted (cheaper price) the long-run value of gold companies and promoted (higher prices) short-term operating profits and production. The negative trends have been further enhanced in Newcrest which suffered from weak management over the past decade.

Of course, the problem with the long-term is that it eventually becomes the short-term, and in the business of gold mining, there is no guarantee that companies will have new reserves to exploit in 7 plus years’ time.

If or when Newmont purchases Newcrest it will have effectively reduced its cost of future exploration and done so at a discounted price. They would have the effect of being able to increase near-term distributions or unlock capital for other purposes. Both outcomes could be valuable for existing Newmont shareholders.

New trends of take-overs?

The Newcrest offer represents another case of a highly conditional takeover bid which appears to benefit the bidders more than the target.

For clients, the risk inherent in Newmont’s offer for Newcrest is like previous scenarios experienced with Origin Energy, Ramsay Healthcare and PushPay Holdings over the past 12 to 18 months.

In each of these cases the news of a possible takeover, whether a conditional bid or a request for an opportunity to explore a future deal, has seen the market wary of the deal proceeding. Each has offered just enough wiggle room for the acquirer to learn of the risks, assess the impact of the market, understand the appetite for the conditional price discussed, and often given them the avoid the deal completely in the future.

In the case of Ramsay Healthcare the deal, which was first promoted at an enormous premium, eventually disappeared. In the case of Origin Energy a similarly lofty initial bid price appears to be in the process of recasting or lapsing entirely.

On both occasions selling a part of our stake in the initial excitement has proven prescient. At this stage, we suspect that the value unlocked by Newmont will trump the short-term risks. Nearing the end of the week, Newcrest shares were trading at $25.35, above last week’s $22.45 close prior to the announcement, but below the implied value of conditional offer at $26.45.

Company News

Macquarie Group

Macquarie Group released a well-received 3rd quarter update this week. Its earnings beat expectations, with a primary highlight being the favourable performance of its powerhouse Commodities and Global Markets business. This business generally benefits from volatility in energy prices, with most recent focus in US natural gas markets as well as the influences of an unseasonably warm European winter. As a result of higher earnings, we saw a range of upgrades to market earnings estimates and consequently valuations.

While we’d expect a tempering of revenues in the Commodities and Global Markets business over the coming year, Macquarie is a well-diversified business. The Group’s excess capital position (>$12B) provides management and the Board optionality for both inorganic and de novo growth opportunities.

Macquarie has a demonstrated history of profitability, supported by excellent balance-sheet and risk management capability. A culture of innovation is supported with appropriately long-dated staff remuneration policies and provides alignment between executive and shareholder interests. This helps the delivery of superior growth and returns for shareholders across the long run.

***

Seven Group – Boral

Clients hold a significant position in Seven Group (not the television station, but it owns 38.9% of the television stations’ owner: Seven West Media) in their Australian Equity sub-portfolio. Seven Group owns 73% of the outstanding shares in Boral Limited, the large Australian building products and construction materials company. Clients may recall that Boral was a longstanding position in the past, that benefited from a takeover by Seven Group. Boral represents approximately 20% of the value of the entire group.

Source: Boral website

Boral released its 1st half FY-23 results this week. The result was pleasing with the two key drivers of performance – price and volume both benefiting from current industry conditions. The share price responded accordingly, rising more than 10%.

The management call highlighted the evolution of the business and its operations under the new CEO Vik Bansal (formerly of Cleanaway). We share the markets optimism that the combination of a firm hand from Seven Group, new leadership, and the substantial scale and quality of Boral’s domestic operations, will deliver shareholder value.

The CEO suggested network optimisation holds further promise for lowering costs and improving deliverables. But having covered Boral as an investor for almost 20 years, this was not the first time we heard of great plans. So whilst scepticism abounds, the prize of reducing operating costs remains a lofty one. Outside of company operations, Boral will continue to benefit from tailwinds of inflation and domestic infrastructure development for the remainder of the decade.

Critically for a buildings product business, price gains (~8% average selling prices) were both in line with expectations and appear to have been maintained across a range of firms within the industry.

Of interest in the presentation, given CEO Bansal’s experience, was the focus on growing the recycling business within Boral. We also felt that the company had a good handle on capital expenditure which can be problematic at Boral, and enough near-term growth projects including in decarbonisation.

***

Mirvac Group

Mirvac is a fully integrated property developer, property manager and asset owner. It operates through several segments: office, industrial, retail, residential, and corporate. The office and industrial segments both manage the office and industrial property portfolios to produce rental income along with developing office and industrial projects. In residential Mirvac is responsible for the development of major urban residential land use developments, including Yarra’s Edge in Docklands, apartments in Doncaster and new urban areas in Melbourne’s North, North-West and South-Eastern suburbs.

Mirvac’s share price has been heavily discounted since the outbreak of COVID and in the increase in global interest rates. It is our view that…

- where the assets in Mirvac are appropriately discounted, and

- when we look to a medium-term view of the positive future of residential development (especially urban in-fill and strategic apartment development)

…Mirvac represents a quality holding in clients Property sub-portfolio.

We have taken the opportunity to increase our position in Mirvac over the past year, near current prices. Mirvac provides a solid dividend yield (>4%) and moderate prospects for medium term capital growth.

The result on Thursday was adequate:

- there was a notable fall in residential settlements as expected

- the company secured a range of positive operating outcomes in property development despite softening valuations

- operational success in both retail and industrial property management also provided some positive earnings momentum

The company currently trades at a 15% discount to its Net Tangible Assets, allowing significant headroom to falling prices for office and residential development.

***

ANZ

ANZ Bank released a brief 1Q-23 trading update, which provides significantly less disclosure than the traditional half and full-year financial results disclosures. This update is designed, in part, to correspond with a mandatory ‘Pillar 3’ Risk Disclosure that all banks are required to make to the market and their primary regulator, APRA, each quarter.

Notable features included strong asset growth in both the Australian mortgage market (continuing a restoration of an above system growth trend) and the Institutional Banking business (which is the largest amongst the four major Australian banks).

Improving credit quality drove a net release in bad debt provisions (a positive influence on Group profit) of $83m.

The 1Q disclosure will trigger analyst earnings upgrades for FY-23. Our portfolio position is supported by ANZ having the least demanding valuation metrics in the sector (~10x prospective earnings, 1.1x Price to Book Value with an accompanying fully franked dividend yield which exceeds 6%).

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.