© 2024 First Samuel Limited

The Markets

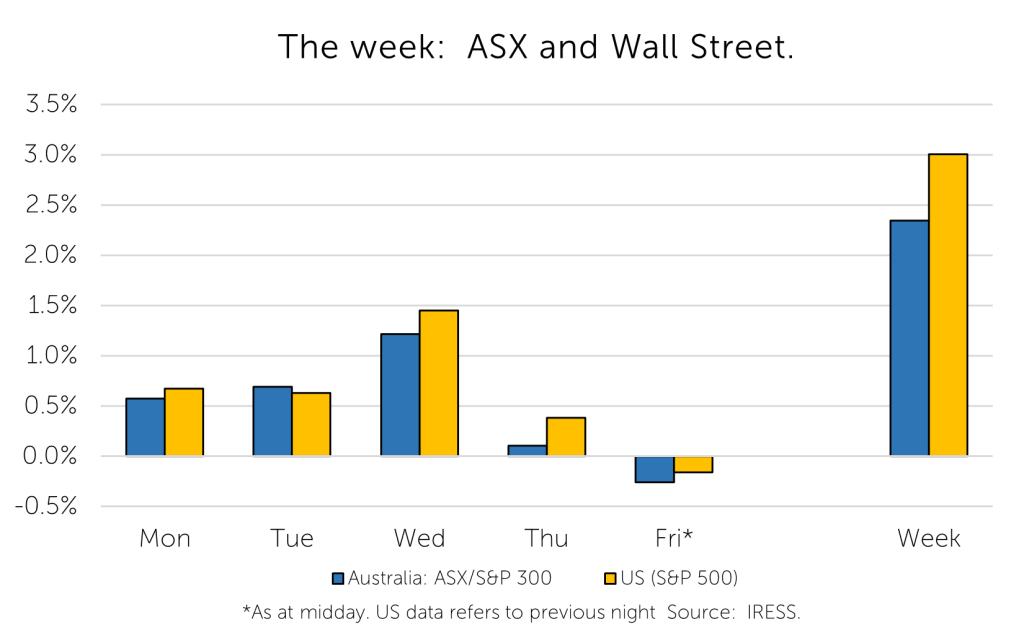

This week: ASX v Wall Street

FYTD: ASX v Wall Street

Note: not all clients will hold all of the securities we discuss.

As the curtain closes on the end of August, ASX reporting season also comes to a conclusion. We provide some of the more relevant company-result takeaways:

• Perpetual

• Home Consortium (HMC)

• ARN Media (A1N)

• MRM

MMA Offshore (MRM FY23 result)

MMA Offshore is a long-standing position in many client portfolios. First Samuel was involved in the restructuring and equity refinancing of the business in 2020 after the company found itself overlevered upon replenishing its fleet of boats.

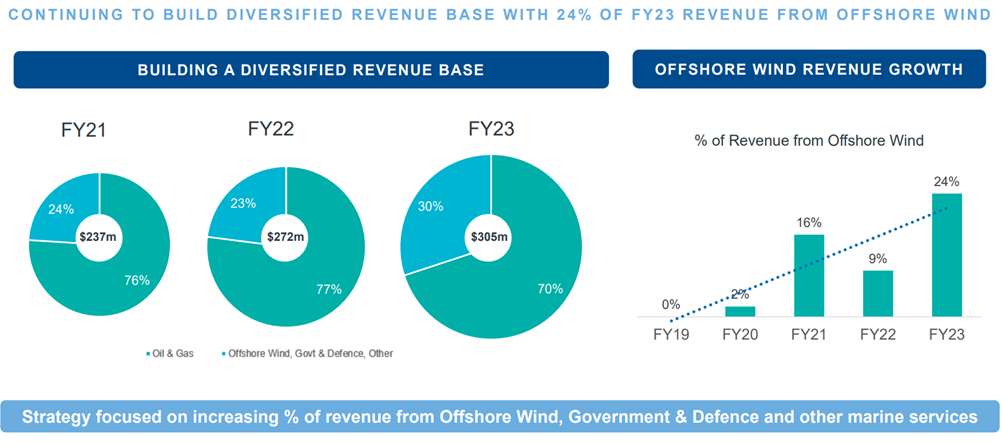

Today, the business is in a much healthier position, reflecting an opportunity for the company to assist oil and gas companies to transition their business (including decommissioning of rigs) as well as increasingly helping with the build and maintenance of offshore wind energy capacity.

Under current management, Mermaid has been a story of progressively excellent execution.

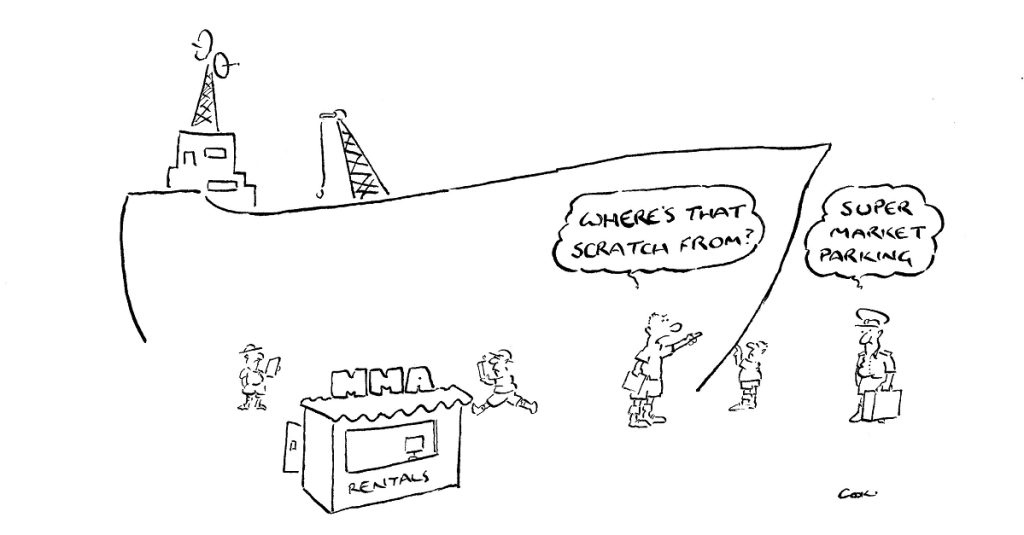

Features of this result included:

- Improving cashflow generation, with operating cashflow of $50.5m, up 233% on the pcp as a result of improved trading conditions in all of their key markets and businesses

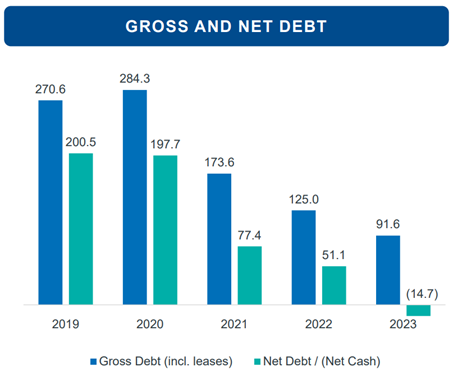

- Shift to a net cash position ($14.7m), providing the company with a de-levered, stronger balance sheet from which to pursue growth

- Entered into an agreement to refinance its existing (higher cost) term debt into a revolving debt facility, adding significant capital flexibility and liquidity for growth

MMA Offshore: Solid execution reaps the financial benefits

Source: Company reports

While deleveraging the balance sheet, MMA Offshore has increasingly benefited from the writeback of previously written-down assets. Asset revaluation of operating assets is a nuance of modern accounting that demands that large assets be tested for their capacity to generate enough income to justify the current price. In a period of weakening demand, such as between 2015-2021, the net result is that the value of the vessels succumbed to almost continuous lower revision of their carrying value.

In recent periods, however, as the outlook improved MMA Offshore has increased the values of its vessels. This continues in this result, and we suspect additional increases (albeit modest) are likely.

MMA Offshore: With an evolving strategy offering new revenue sources

Source: Company reports

What the market said:

“The outlook for MRM seems to get better and better, in our view, and its FY23 results showed a stronger-than-expected balance sheet alongside earnings that exceeded our forecasts. We expect further rate and utilisation increases as we see demand being driven by the large increase in investment in offshore wind, decommissioning work, and substantial oil and gas capex. The demand growth is accompanied by a lack of new supply of vessels, which we expect to continue, and we believe day rates should move materially higher. We also now forecast an FY24 net cash position of ~$48m, which provides optionality to pursue further growth drivers and has led us to now forecast a reinstatement of dividends in FY24.”

Cannacord

Perpetual (PPT FY23 result)

Perpetual is a once revered, but now a somewhat maligned, corporate trust, asset management and wealth management firm.

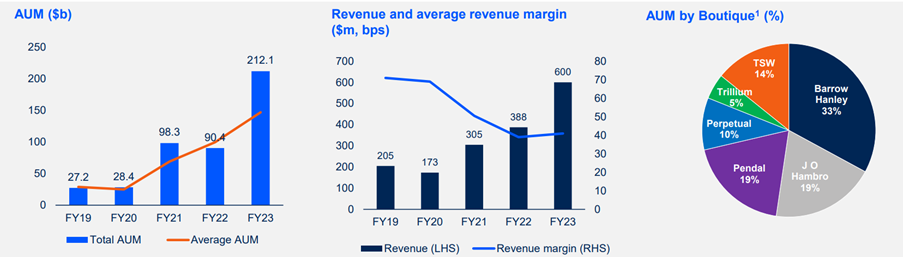

The purchase of the Pendal Investment Management business (formerly BT Asset Management) has added considerable scale to its asset management franchise, but the business is currently suffering significant outflows. Accordingly, both the sell-side (brokers) and buy-side (investment managers) investment community have elected to spurn the stock, with it now trading on a lowly 4-5x forward earnings multiple.

It was a pleasure to host the CEO and CFO at our office this week to discuss the outlook for their business, and the broader global environment for asset managers.

Perpetual: Asset Management – scale, diversification but declining returns

Source: Company reports

We think there is an opportunity for management to break up the business in the event that the market doesn’t recognise the fair value of the company over the next couple of years.

Our meeting confirms to us that this path is potentially part of the thinking at Perpetual, should the market continue to fail to assess the overall value in each component of the business. In the meantime, management is committed to bedding down its recent acquisitions with a view to stabilising outflows and realising synergies.

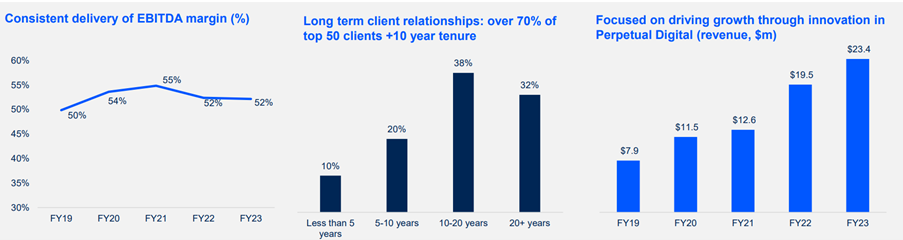

Perpetual: Corporate Trust – an undervalued business

Source: Company reports

For example, the Corporate Trust business, the jewel in the original Perpetual Trustees business, has strong and stable margins, a sticky customer base and continues to grow. Our standalone valuation for this business is in excess of $1bn within a total market capitalisation at present of $2.35bn

What the market said:

“Management confirmed they don’t intend to pursue inorganic opportunities with a heightened focus on executing their refreshed strategy. We believe this is appropriate, given the balance sheet position and below expectations performance from JOHCM and TSW since acquiring Pendal. It’s vital that management can address the outflow issues that so often dilute any synergy benefits that arise from such transactions. Our target price moves to $30.00 (current price ~$21) based on our SOTP valuation, which we move out to FY25 to better capture the synergy benefits”.

Macquarie

HMC Capital (HMC FY23 result)

HMC Capital is an alternative asset manager that invests in high-conviction and scalable real asset strategies. Much of its managed fund portfolio assets are in real estate and the stock is contained within clients’ Property sub-portfolios.

It’s original and largest investment to date was the purchase and development of former Masters Hardware sites from Woolworths in 2017. These were turned into Home Co, multi-purpose shopping centre sites.

HMC have some of the sharpest minds in real estate in this country within its ranks.

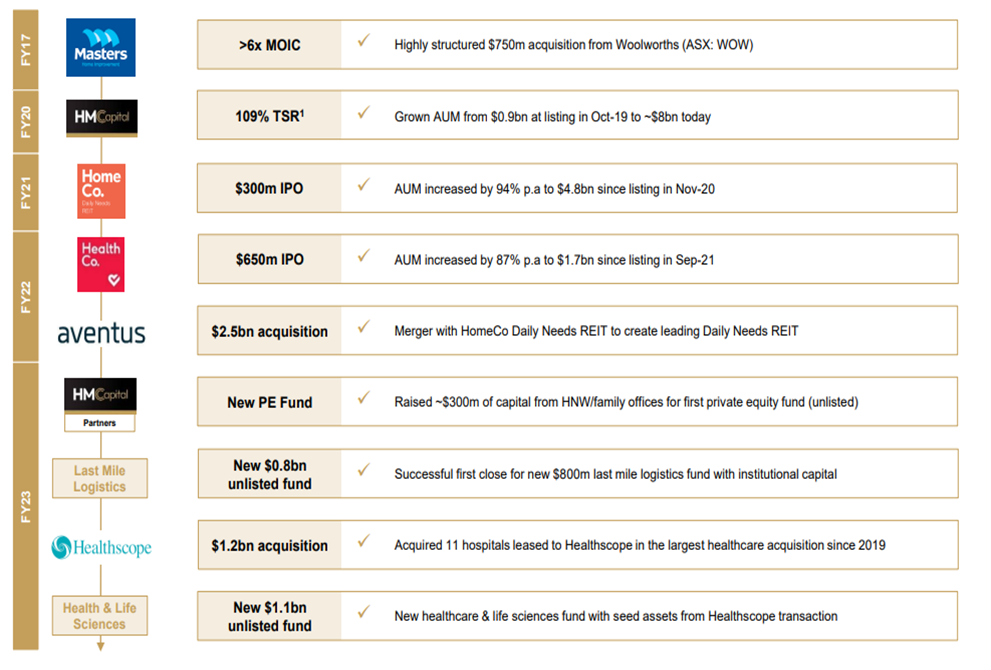

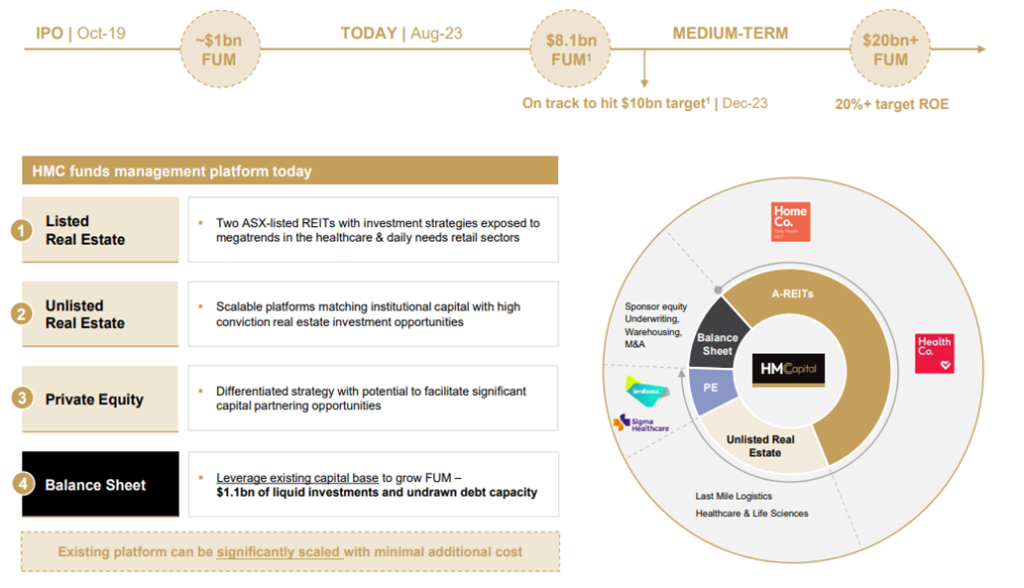

HMC Capital: The HMC story so far… with a high growth and high return business model being pursued

Source: Company reports

While this is a relatively new entity, there is no shortage of ambition within this organisation. The executive team are astute operators with significant plans for growth.

Growth aspirations are increasingly being met by new investment outcomes and a focus on opportunities that have few peers. The range of unlisted investment funds that Home Consortium has been able to seed and source large-scale investment has exceeded our expectations. Their medium-term plans, if executed upon, would only increase the value we see in the existing assets and franchise.

What the market said:

“HMC have a scalable platform, substantial growth aspirations ($20bn AUM) and 20%+ ROE ambitions which investors are willing to support despite short-term earnings volatility. No earnings guidance was provided except for “strong underlying earnings growth”. On our classification of underlying earnings (ex HMC-CP), we estimate growth of ~10% in FY23-26 with upside from executing on the emerging strategies. Despite the lofty valuation, we prefer HMC vs. peers CNI/CHC given less legacy AUM, a better capitalised business and clearer strategy for growth.

UBS

ARN Media (ARN 1H23 result)

ARN Media Limited is an entertainment company in Australia and Hong Kong. The company operates the Australian Radio Network, a small outdoor advertising business in Hong Kong, and a small range of investments that it has sold over the past 2 years. The stock was formerly known as Here, There, and Everywhere (HT1) until a name change in May 2023.

The Australian Radio Network operates under the KIIS, Pure Gold, iHeartRadio, and The Edge brands. For better or worse, it employs radio talent that includes Kyle and Jackie O.

The stock has underperformed in the recent 12 months as the market become concerned with a slowing consumer outlook, combined with a 12-month period in which government advertising is known to be weak (fewer elections, fewer indirect electioneering campaigns, and limited public service type demand).

Government advertising tends to be the “cherry on top” for media company earnings, and this was especially important to ARN Media as it digested a significant regional acquisition (Grant Broadcasters) in FY23.

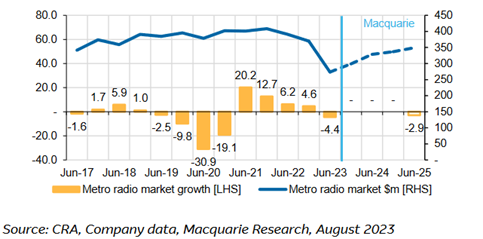

The chart below shows the growth rate of metro advertising on a half-yearly basis. The impact of the previous Federal election in May 2022 can be seen in the June 2022 quarterly growth of 6.2% – the previous period of high growth was the rebound from the COViD lows of June 2020.

Figure ARN Media: Growth in metro advertising

The impact of weakened short-term market conditions, we suspect, clouded the view of a stronger underlying performance in ARN Media. Having said that, short-term profits were weak, with revenue down mid single digits and earnings down 30+%.

We spoke with the CEO, Ciaran Davis, and CFO, Andrew Lye, earlier this week. We were impressed by the plans they outlined to continue to drive value creation from the assets they have recently integrated.

The stock is especially cheap at its current level, with an expected dividend yield (fully franked) of 10%, and our valuation significantly higher than current levels.

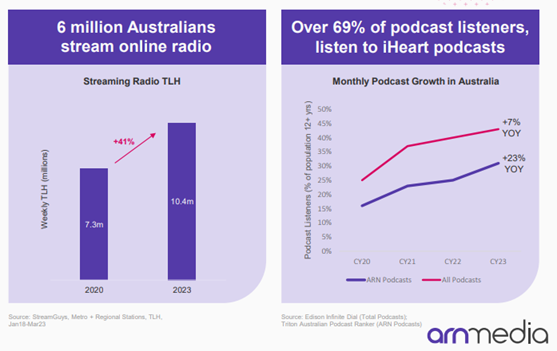

Other aspects of the business we like include the fast-growing digital business, the outlook for ongoing consolidation, and the strength of the balance sheet. CEO Davis spoke last week, noting “ARN Media is seeing people are consuming its radio content whenever and wherever they want, which includes an increasing range of digital platforms including iHeartRadio, DAB+, desktop or mobile devices”.

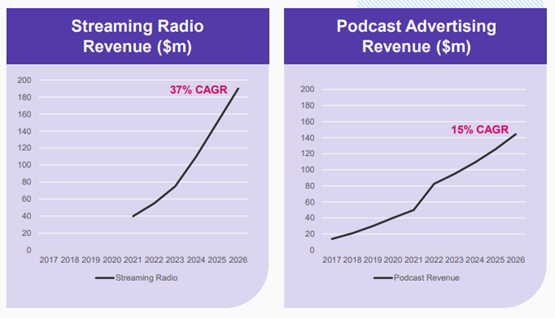

The trends converted into digital audio advertising revenues up 37% to $8.8 million, and ARN’s podcast network increased its listener base by 23% and downloads of programming by 25% for the first half of 2023.

The company results presentation included several interesting charts on the growth of digital opportunities that are worth highlighting. Note the exclusive relationship that ARN Media has with iHeart Radio and their dominant position in this emerging market.

ARN Media: Emerging demand for radio streaming

Higher demand is already leading to very strong growth in revenue for streaming radio, despite the business’s infancy. We are pleased that ARN Media has both an extensive presence in the streamed version of its existing terrestrial content, as well as new podcast material and income.

ARN Media: Growth in advertising revenue is exceptional despite early phase of adoption

What the market said:

Near-medium term potential for EPS downgrades is elevated in a soft ad market, but A1N has shown its flexibility in managing the cost base accordingly. An attractive DPS yield of ~9-10% and buyback potential is positive, but does not offset the macro issues in our view.

Macquarie

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.