© 2024 First Samuel Limited

The Markets

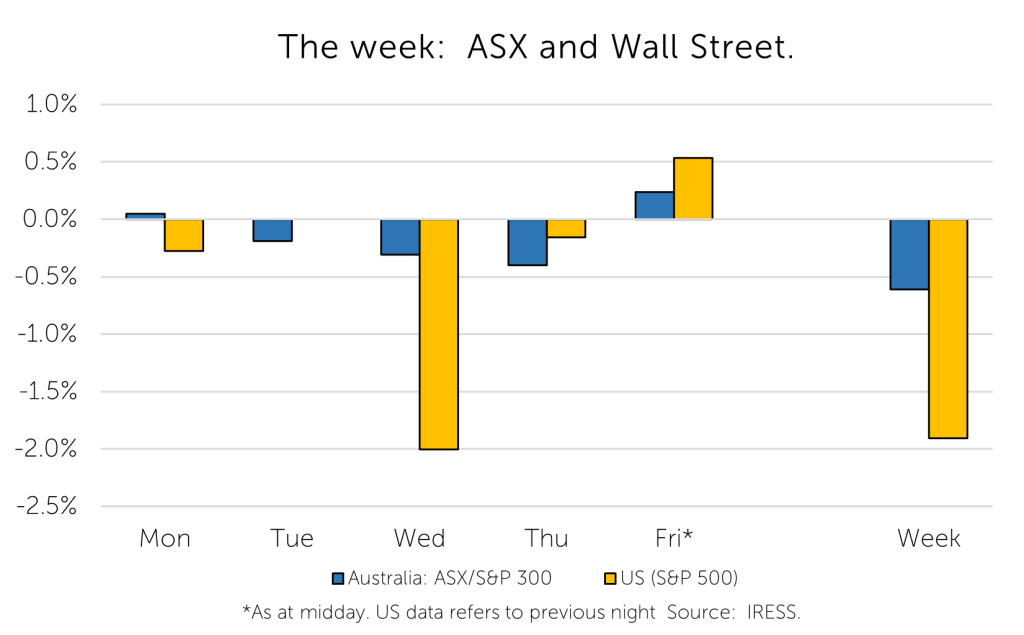

This week: ASX v Wall Street

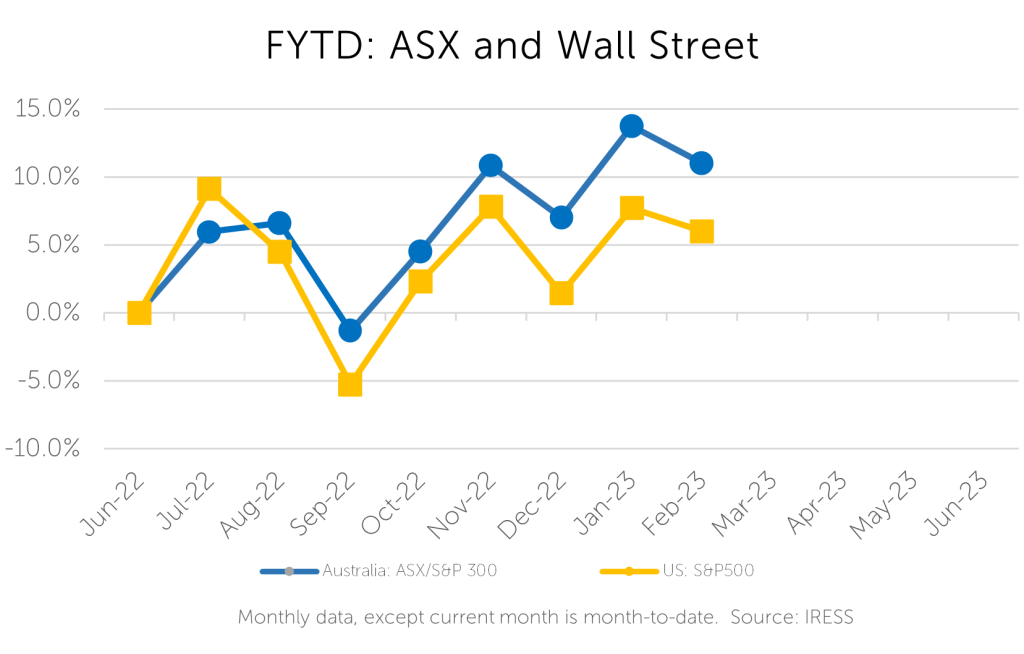

FYTD: ASX v Wall Street

This week

The third week of company profit reporting season is traditionally the busiest, with a range of large companies presenting updates to the market. We have provided some detail on those results important to client portfolios in today’s Company News section. By way of summary, they are:

- QBE: good

- Costa: disappointing

- Origin: very good

- Worley: very good

- Woolworths: very good

- Inghams: very good

- Homeco Daily Needs: good

Next week

Next week will have several updates including for Paragon Care, Emeco Holdings, and MMA Offshore.

CEOs come to First Samuel

This time of the year provides an opportunity to personally catch up with CEOs and management teams of the companies in which we invest.

Over the past week we have had the pleasure of Seven Group CEO, Ryan Stokes, and Origin Energy CEO, Frank Calabria, in our offices.

In a sign of the times, many more interactions now occur over Zoom. But, regardless of the medium, the opportunity to discuss strategic issues with CEOs remains a critical part of investing.

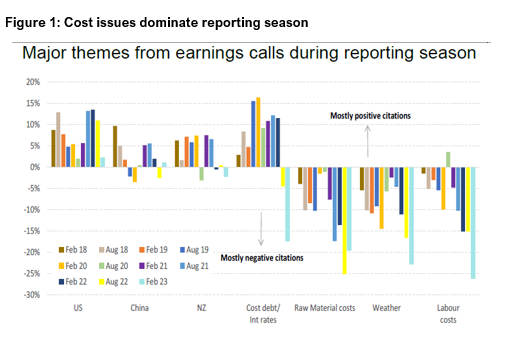

Broad trends from company presentations so far

The clearest trends affecting companies to emerge were:

- Labour costs, rising interest rates and the weather (according to MST Marquee analysis, see chart)

- Evidence of slowing consumer demand and households ‘trading down’ – even Pizza delivery weakened according to Domino’s Pizza.

Regardless of the perspectives of the companies themselves, the statistics from last week’s Labour Force Survey and this week’s Wages Price Index suggest that labour is far from being the risk identified by the Reserve Bank in their deliberations.

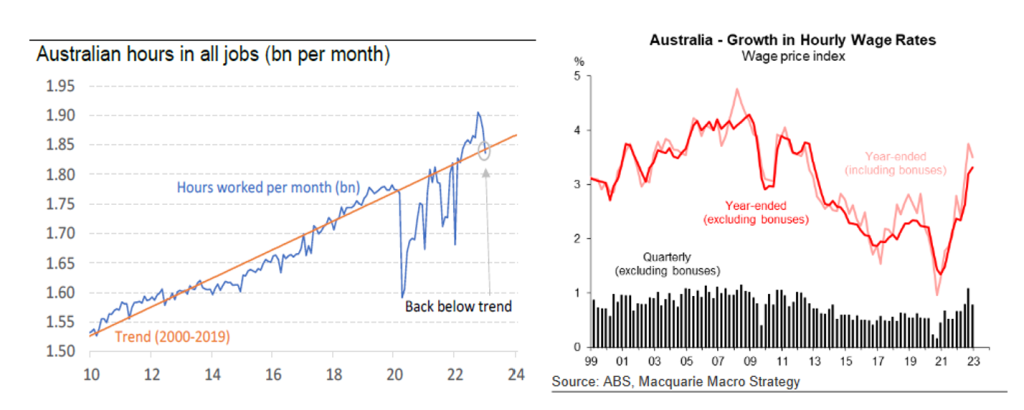

Wages and Hours

The above charts show that the strong surge in both wages growth and hours worked from the middle of 2022 has begun to fade. Wages growth was disappointing with the market expecting 1.0% growth for the final quarter of 2022.

In the face of inflation running at 7+%, wages growth that remains barely above 3% should concern policy makers. As should possible aggravation from further cuts in disposable income because of higher mortgage payments.

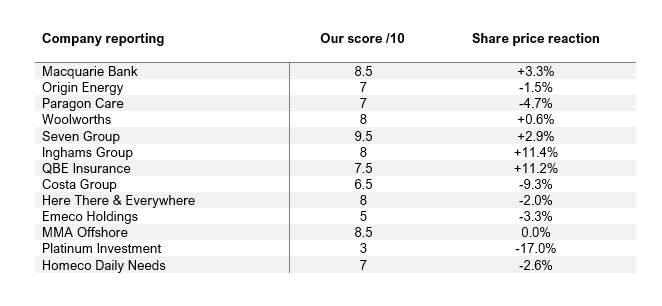

Portfolio trends – a snapshot of company results – our view and the markets.

With a large number of companies having reported already, we have created a simple table to assess our view of the results. Companies have been rated on a scale from 1 to 10. We also note the movement in stock prices in the two days of trading following the result.

Standout results came from Seven Group and MMA Offshore.

Company News

QBE Insurance Group (QBE) – Positive FY-22 Results

Rising insurance premiums drove improved performance for QBE in FY-22. While the underlying premium increase was 8%, QBE grew revenues (aka Gross Written Premiums in insurance lingo) by 13% on a constant currency basis.

While QBE insures corporate customers across Australia, it also is a leading global insurer. This exposes it to a range of insurance catastrophes like weather events (e.g., crop exposure insurance against hurricane damage) and even military conflicts (e.g. Russia/Ukraine conflict).

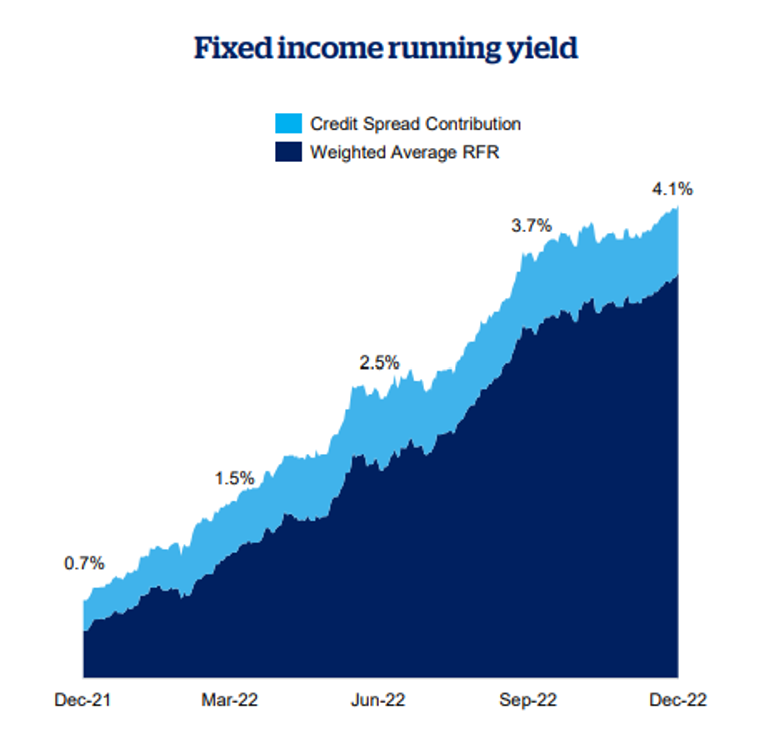

In order to meet insurance claims, QBE has a large $28 billion investment portfolio of primarily fixed-interest securities (e.g. corporate and government bonds). The company has therefore been a relative beneficiary from a rising interest rate environment and higher yields earned on this portfolio.

QBE is one of our largest equities positions across client portfolios.

The market responded positively to the removal of many of the risk factors. Risk factors often lead to QBE trading at a discount to the market.

***

Costa Croup (CGC)

The conference call that accompanies Costa Group’s regular reporting to the market is always amusing to your CIO. For most accountants and dour financial types, getting their heads around growing seasons, fluctuating prices, the vagaries of growing living things, and discussions of investment horizons that relate to the physical growing of trees and plants can be fraught.

To someone who grew up on an orchard, not so much.

On balance, however, there is little doubt that FY-22 (December year-end) was a disappointing result. Significant capital investment has materially increased production volumes, but at unattractive returns. Citrus was weak as expected; however, some analysts were disappointed by the earnings of the remainder, including berries and tomatoes.

We continue to focus on the value of the assets at hand and the long-term earnings power of the businesses that Costa Group owns.

We see a growing business that is leading the industry in branding, production and pricing. It is expanding globally and seeking to make the most of its access to liquid capital for innovation and development, two features often lacking in agricultural enterprise.

In the coming years, an ‘on’ season for citrus, we expect higher profits associated with the higher level of citrus volume that accompanies an on year. [Citrus alternates between an ‘on’ season and an ‘off’ season.] We see improving trends in avocado pricing, and stabilisation of the berry business, which has been hit hard by climate vagaries and pests in recent years.

The one cloud on the horizon remains the appointment of a new CEO, and risk around a capital raising to address the level of debt the company carries. We believe the current amount is appropriate. A new CEO may think otherwise.

An enormous opportunity exists to buy the entire business at a huge discount to its long-term value. This is because of the disjointed phases between earnings growth and uncertainty; CEO uncertainty and balance sheet uncertainty. The risk of a takeover is very high.

***

Origin Energy (ORG) – takeover offer affirmed, and terms remain favourable

In the past week Origin has updated the market on its past six-month performance.

We have held Origin in client portfolios as an exposure to the growing energy transition theme. More recently, we have been patiently awaiting an updated takeover offer from a private equity consortium including Canadian-based global infrastructure asset management experts Brookfield.

With government intervention in energy markets placing some pressure on operator profitability, we foresaw some risk of a notable reduction in terms for Origin shareholders.

Thankfully, the revised takeover offer remained on favourable terms with only a modest diminution of value (from $9 per share to $8.90 per share).

***

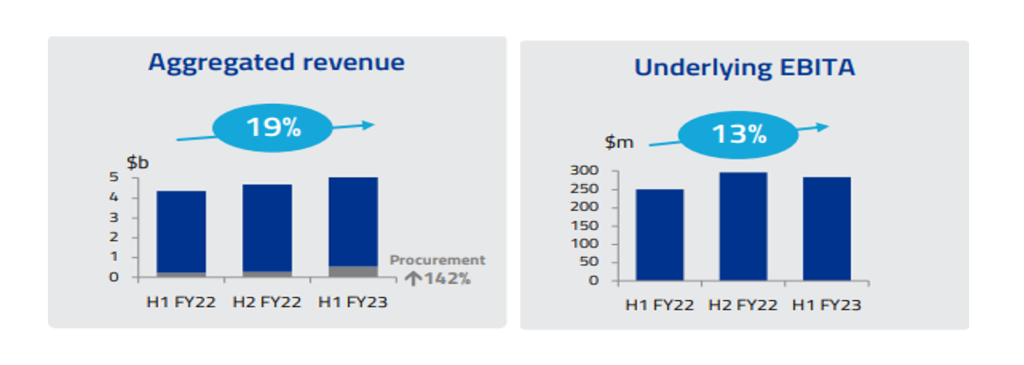

Worley Parsons (WOR) – (showed) what it is good for

While Origin will likely soon move on from our client portfolios due to a takeover, Worley provides another successful exposure to the energy transition thematic.

The company, which provides resourcing and operational assistance to a range of energy, chemicals and resources companies around the world, has a growing proportion of its portfolio in what it describes as ‘Sustainability-related work’. This work represents almost 40% of its revenues (and growing). This includes projects in solar power, wind power, lithium, carbon capture and low-carbon hydrogen.

***

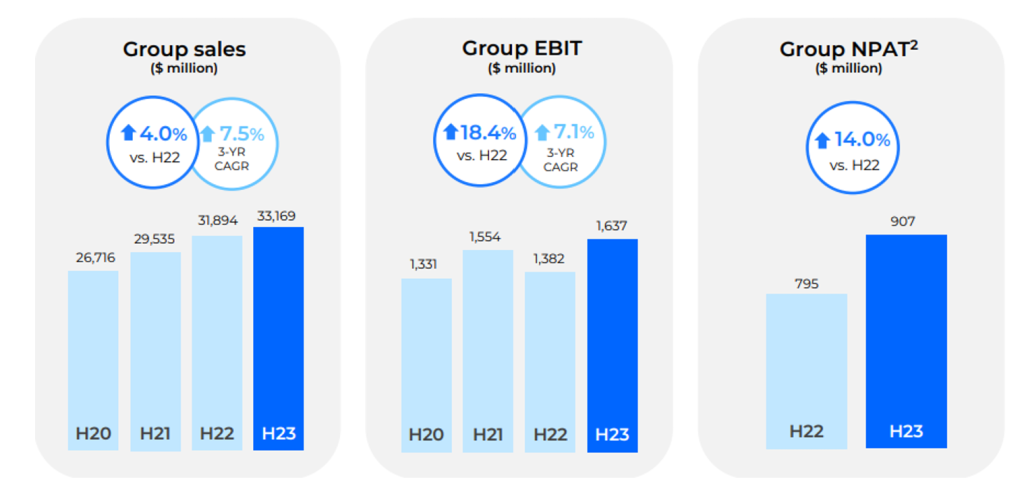

Woolworths (WOW) – WOW indeed

Both Woolworths and Coles (COL) demonstrated their market power and ability to withstand inflation in their cost base, by raising product prices. While some consumers will undoubtedly be feeling the strain of rising mortgage servicing costs and have become more selective in their buying behaviour, the big supermarket chains have for now been able to protect their margins.

Additionally, for Woolworths the BigW chain benefited significantly from a return to normalised trading conditions versus the prior period which was impacted by Omicron disruption.

***

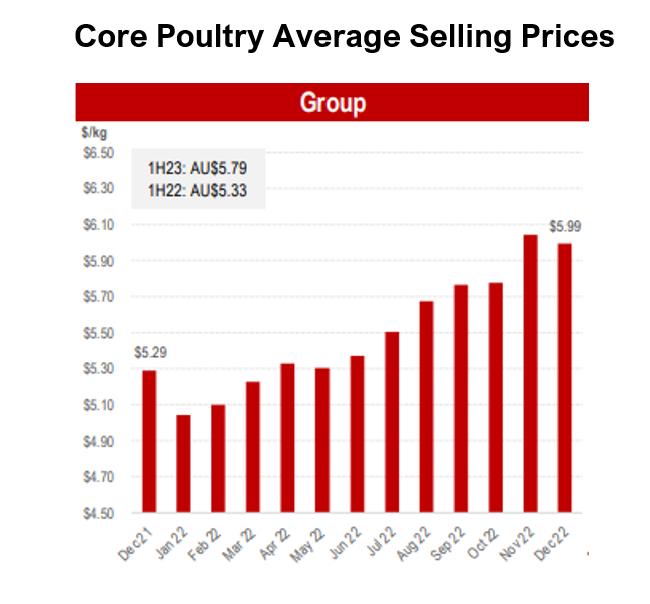

Inghams (ING) – Chicken prices on the rise

Despite delivering weaker earnings than the previous corresponding period, it was clear to markets that Inghams is a business with an improving trajectory of returns.

Numerous operational challenges are being overcome and chicken prices have been lifted sufficiently to offset underlying cost inflation being experienced in the business.

The strong medium term pricing outlook, and the capacity to increase prices in response to short-term rises in input costs is the primary reason we own Inghams.

Source: Company reports

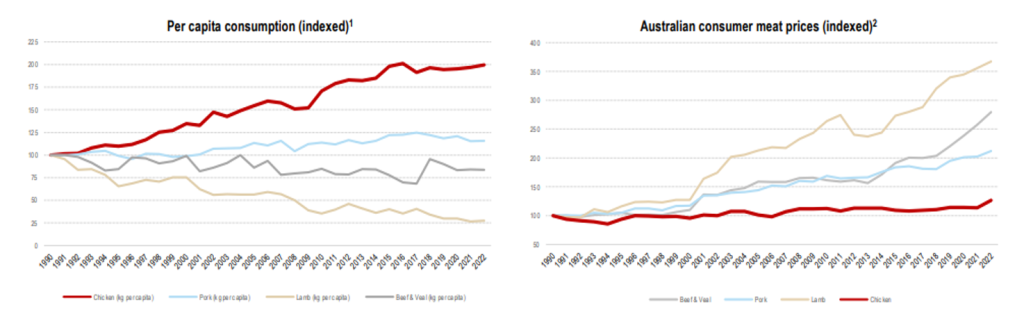

Given inflationary pressures and rising mortgage rates in response to the RBA’s efforts to curb inflation, domestic consumers are expected to face a challenging environment in terms of household cashflows. Chicken is a protein source that remains both popular and affordable, (see charts below), and is likely to be substituted increasingly into diets in times of higher inflation. In addition, chicken farming remains more environmentally friendly than other meats, meeting consumer consciousness of environmental issues.

Source: Macquarie, OECD, ABS

***

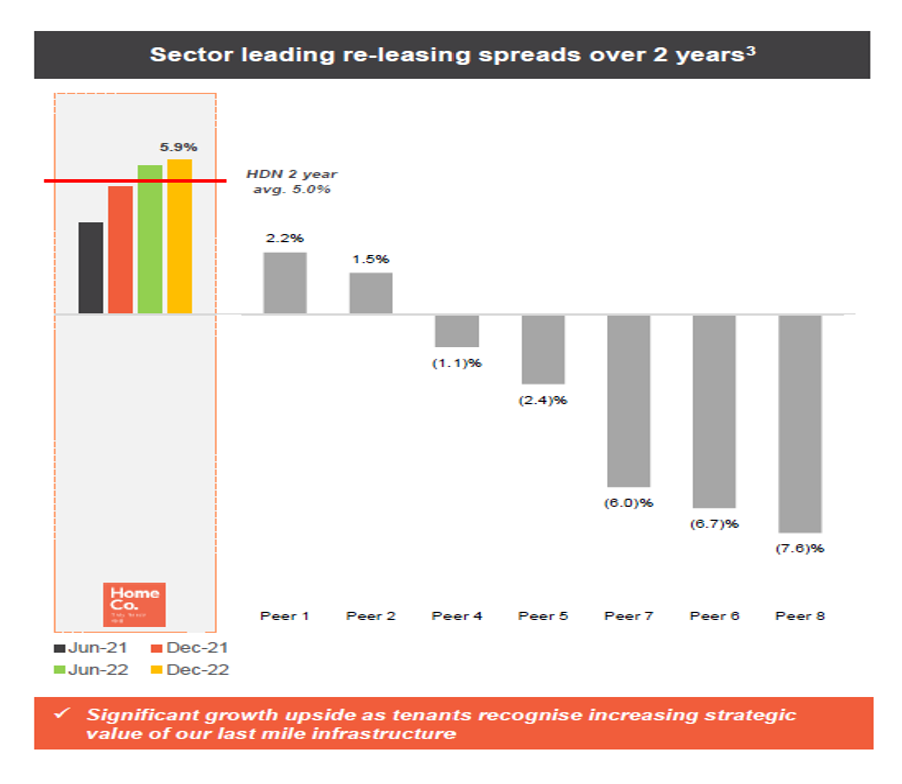

HomeCo Daily Needs REIT (HDN)

A smaller position within our property sub-portfolio is HomeCo Daily Needs. This REIT (Real Estate Investment Trust) was spun out of the broader HomeCo business in 2021, and comprised a range of neighbourhood retail assets, with the majority developed using the shell of the former Masters sites (Masters was the short-lived competitor to Bunnings launched by Woolworths almost a decade ago)

The sites are fabulous locations that provide superior access for “Daily Needs”. Despite our misgivings on rising interest rates (higher interest rates reduce the value of property, all things considered) we were confident that these sites would in the long-term provide development potential and rental growth in excess of the more established regional retail centres.

Recent results have demonstrated this trend. We have included a chart below showing the recent trends in rents charged by HomeCo Daily Needs in its properties as leases were renewed. They have been rising, a distinct difference to eight peer group property owners. These property owners have generally seen re-leasing spreads fall in recent years.

This comparative advantage is likely to remain throughout the coming decade and hence HDN may remain (subject to share price) a core part of the property sub-portfolio.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.