© 2024 First Samuel Limited

The Markets

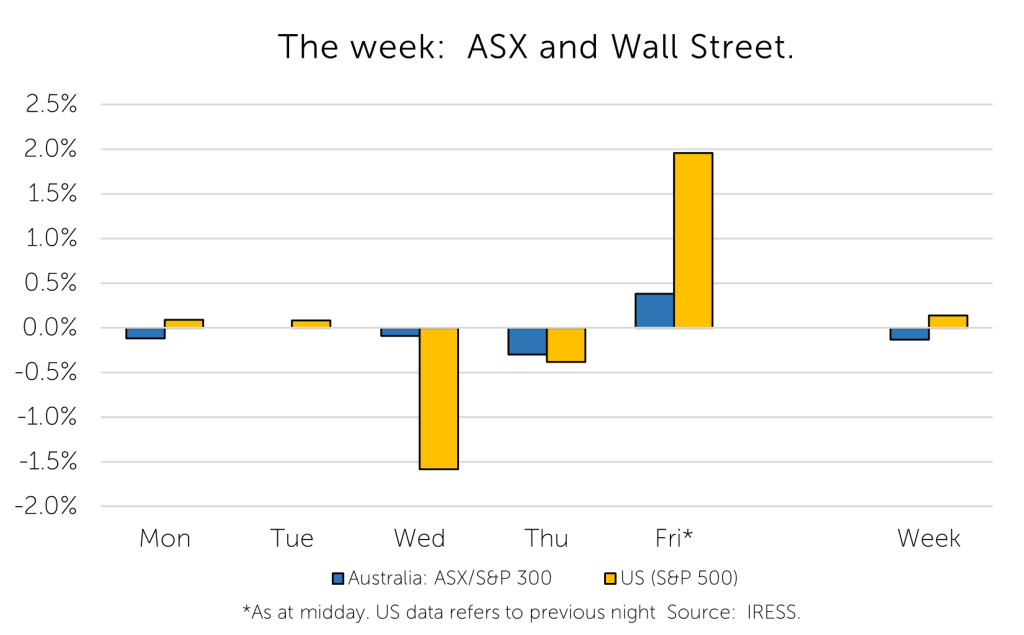

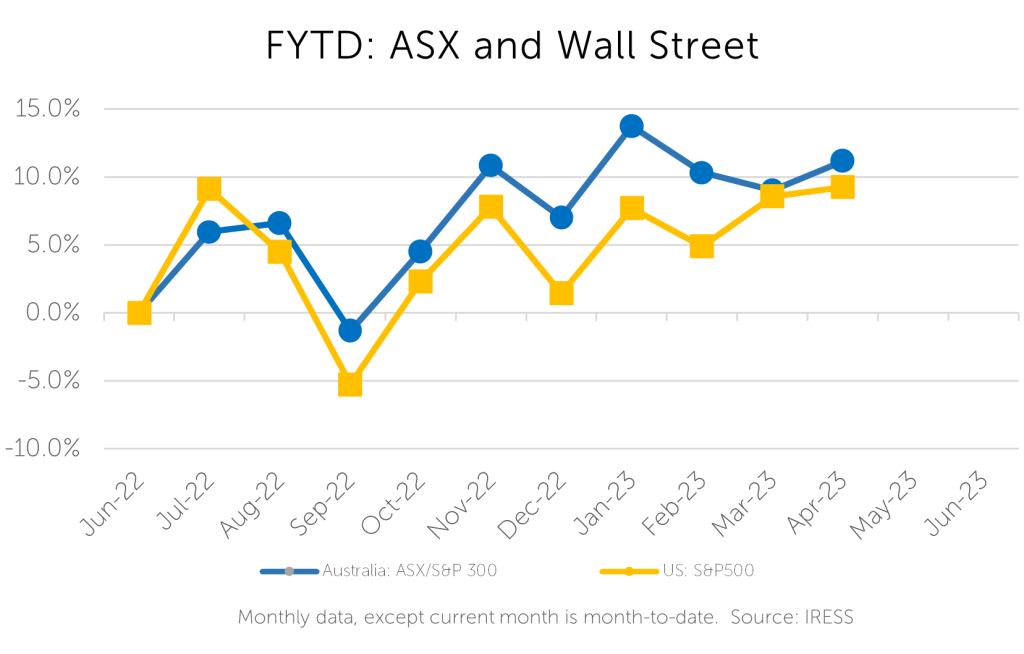

This week: ASX v Wall Street

FYTD: ASX v Wall Street

This week, we have three sections that provide important updates on clients’ positions in Eildon Capital, Reliance Worldwide and Mineral Resources.

Over the course of the latter part of this week and next, many companies will provide updates to the market, including mining companies, smaller companies and those presenting at upcoming investor conferences. We will cover as many as possible of these updates in coming weeks.

On the economic front we discuss the impacts of the review into the RBA that goes beyond the changes mentioned in the headlines.

Eildon Capital (EDC.ASX) – saying sayonara to a long held position

Eildon Capital is a small, illiquid, ASX-listed property company which has been in clients’ Australian equity sub-portfolios since listing in early 2017. The company was subject to a takeover off this week by Samuel Terry Asset Management Ltd.

It’s been a holding that the current Investment Team have been slightly wary of given significant executive turnover in recent years, and a corporate restructuring that has resulted in a somewhat complex capital structure.

On 24th April, the company became the subject of an off-market takeover bid for its stapled securities by Samuel Terry Asset Management at a price of $0.93 per security. While the EDC Board of Directors considers the bid as undervaluing the company, we believe that the bid offers sufficient value for the company’s portfolio of assets at a time of high uncertainty in property market valuations and have elected to accept the terms on offer from Samuel Terry AM.

Over the six years that clients have held their investment in Eildon Capital, the return has been 51 per cent (and slightly higher after tax), versus the ASX Property Index return of 37 per cent over the same period. Altogether a pleasing result, a bump in returns for this year and the opportunity to purchase more liquid, less complicated exposures in the Property sub-portfolio.

Reliance Worldwide (RWC)

Reliance Worldwide is a globally significantly supplier of products and solutions for the plumbing and heating industries. Its core products include SharkBite, a proprietary push-to-connect plumbing brand that is a major product in both DIY and professional markets in the United States and Australia.

We own Reliance for three significant reasons:

- Its strong cash flow generation and pricing power;

- Its exposure to global demand growth; and

- Its proven capacity to buy additional business to add to its portfolio of products and manufacturing.

The company gave an update on trading for the nine months of FY-23 on Thursday.

We were pleased with the results, especially the strong evidence of pricing power in key markets. We were also pleased with moderation in input costs which were peaking in mid-2022 (including copper). As we approach year end this moderation in costs will support higher margins across many markets.

We suspect that as the market continues to appreciate the pricing power that Reliance has in major markets for its key brands, the implications for margin expansion, cash generation and earnings resilience will continue to rise.

Considering Reliance Worldwide (RWC) has sold off since the beginning of 2022 due to concerns about higher interest rates and slower global growth, a clearer picture on the resilience of earnings, may see significant price appreciation in the stock. The stock rose 4% across the week and more than 10 percent in April.

Mineral Resources (MIN.ASX) – a soft 3rd quarter

Mineral Resources is a successful, vertically integrated resources company. It’s also been a profitable portfolio position for clients, with the share price having almost doubled since the middle of calendar 2022.

Those who recall our write-up of the February company results reporting season will know we were comfortable with this company’s progress as presented at the 1H-23 result.

However, the 3Q-23 trading update released on Wednesday has subsequently disappointed the market on a broad range of factors given:

– a reduction in Mining Services production volumes in Q3, being about 30% below analyst estimates, with delays in approvals in joint venture projects. Additionally, there has been delays experienced in bringing on new project work, meaning a cut in budgeted full year divisional volume guidance of ~10%.

– a delay in completion of the Mt Marion mine expansion project (now completed in May) will lead to lower-than-expected spodumene volume and lithium battery chemical volumes. Additionally, the cost to mine spodumene at Mt Marion is expected to be 40% higher than previous guidance.

– Wodgina mine hydroxide shipment guidance was also lowered by ~40%. As the most significant component of Group revenue, the disappointing guidance for Mining Services divisional volumes is likely to have the greatest influence on the direction and magnitude of the share price performance.

Getting neighbourly

In addition, the company has also indicated in the past week that it has interest in taking over Essential Metals (ESS.ASX), which owns the Pioneer Dome mine, MIN’s neighbour at its Mt Marion lithium mine. It has emerged with a 19.55% stake. Intriguingly, ESS is already subject to a board-recommended takeover from Tianqui Lithium Energy, which is a joint venture between IGO (IGO.ASX) and Tianqui Lithium. Readers would be aware that IGO itself is a significant Australian Equities sub-portfolio position.

Reserve Bank Changes

Last week the Federal Treasurer Jim Chalmers released a major review into the Reserve Bank of Australia titled An RBA fit for the Future (March 2023). Headlines concentrated on the ‘split’ of the RBA Board, encouragement for more debate within the ‘ideologically constrained’, and the appointment of external experts.

In all there were 51 recommendations. We would argue that the most impactful in the long-run probably didn’t get the immediate attention it deserved but by weekend, it ramifications were beginning to be discussed.

In a section entitled “A clear monetary policy framework” the review recommended:

There should be more formalised cooperation arrangements for financial stability policy including by the RBA providing formal advice to APRA for its use of macroprudential tools.

As a reminder, ‘macro-prudential tools’ are settings within the banking system that limit directly, or regulate indirectly, the volume and type of loans created by our banks. Type of macro-prudential policy in the past have included limits to the growth in lending for investors in 2014 and share of interest-only mortgages in 2017.

The aim of the change, where any concerns the RBA may have regarding the rate of growth in debt or the types of debt feeds directly into the body regulating banks (APRA), so that the RBA can “promote addressing concerns about financial vulnerabilities through macroprudential policy, where possible, so they do not constrain monetary policy.”

Or in layman’s terms, if the bank simply wanted to reduce the amount of leverage in the economy, but didn’t want to do it by simply bludgeoning existing borrowers, it could directly influence the amount of lending – instead of just the price of lending. As noted in the press without the change there was risks of unintended consequences afflicting the economy if interest rates targeted housing-related debt.

And just in case the authors of the review weren’t clear enough about where the policy failure in this area was, the review noted that, one, since 1998 there had been no review of the relationship between APRA and the RBA, and two, that the importance of coordinating the price and volume of lending was clear because ..

….macroprudential policy can help reduce the build-up of financial vulnerabilities that might otherwise happen when interest rates are low for a long period, by reducing excessive risk-taking among financial institutions.

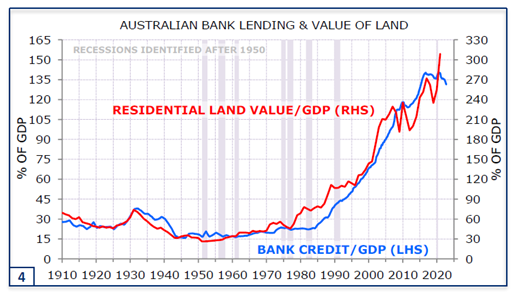

That is, the RBA should have never relied on the banks alone to decide the risk-taking behaviour of Australian households. Twenty-five years on, what has the impact been? See Figure 1 below.

Borrowing in Australia – compared to the size of the economy – has moved from approximately 60 per cent of GPD in the late 90’s to 135% of GDP today. The price of residential land as a %of GDP has grown in lockstep.

Figure 1: RBA changes seek to modify the relationship between then amount of lending and the price of money – current arrangement in place since 1998!

Over the next 25 years we suspect that the control of the volume of credit and ultimately the direction of lending within the economy is likely to become the dominant monetary policy tool – hence the important of the review and subsequent implementation of the changes.

For the next couple of years, the changes proposed will be a critical positive for equity investors. On the one hand the probability of the RBA making a policy mistake is reduced. And on the other, the likelihood of a scenario in which the non-housing / population growth portion of the economy can prosper without the impost of excessive interest rates, at the same time as mortgage lending is slowed, increases considerably.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.