© 2024 First Samuel Limited

The Markets

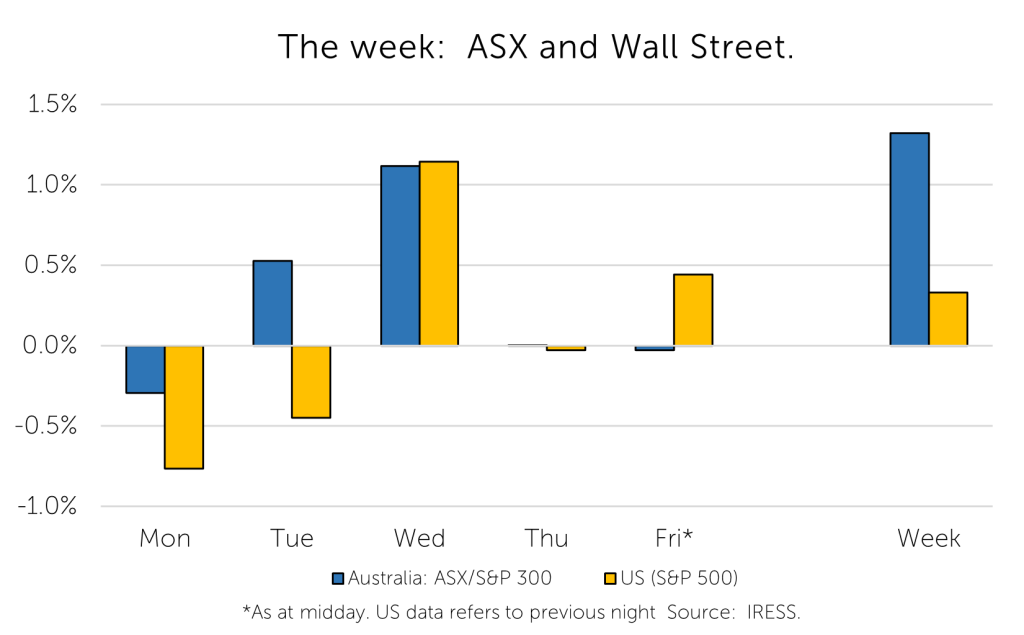

This week: ASX v Wall Street

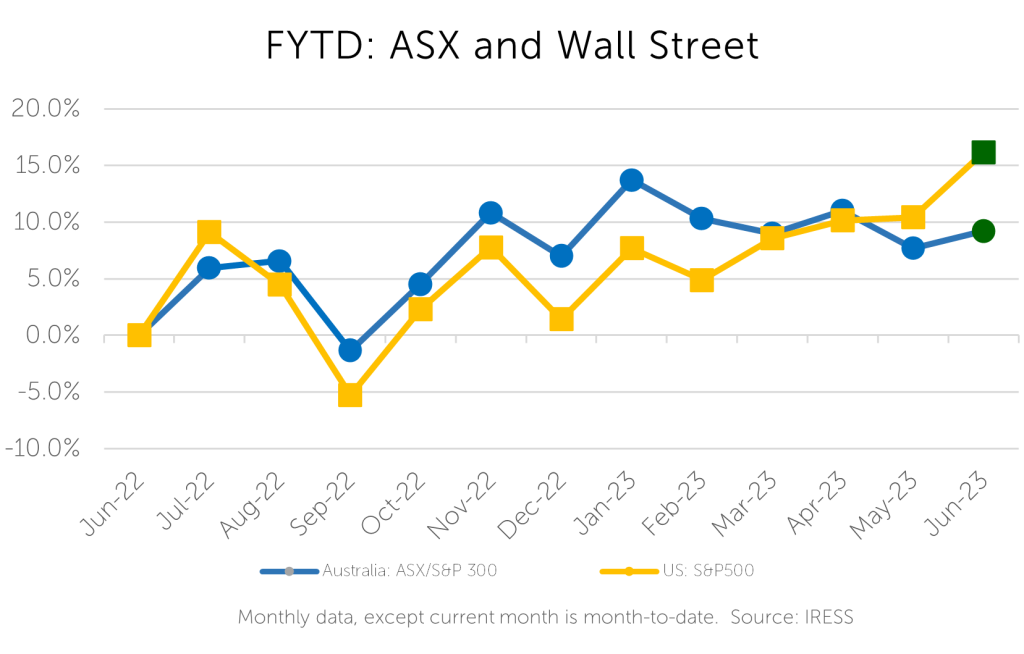

FYTD: ASX v Wall Street

A very good year

The curtain is about to fall on another financial year. FY-23 has been a year of very good investment performance across First Samuel various portfolio strategies. As clients are aware, portfolios are constructed of from one to five ‘sub-portfolios’.

Australian shares had a good year, benefitting from takeover activity, lithium miners, gold producers and strong outcomes for industrial companies such as Seven Group.

Income securities benefitted from the return of higher interest rates, which provided strong nominal returns (above 5%).

International shares performed well throughout the year, assisted somewhat by a lower Australian dollar and strong return from European, Japanese and large cap US equities.

The lower exposure of First Samuel clients to property securities and fixed interest bonds (as distinct from floating interest rate income securities) in general has assisted with performance.

Alternative Investments, for those clients who held them, had a strong year.

Clients should expect their Flash Performance reports within 10 days, always noting that all portfolios are individually managed, with different asset mixes and security selections.

‘Wall of worry’ & riding out interest rate rises

Four overarching trends emerged through the year that are worth noting:

- The ‘wall of worry’ and riding out increases in interest rates

- The difference between equities and other financial assets

- The lucky country

When the world began to emerge from Covid in 2020, we referred to share markets climbing a wall of worry. It was clear following the sharp sell-off of March 2020 that equities (i.e. Australian shares) were cheap, but some of the existential risks remained (Covid variants, the success or otherwise of vaccines in development, lockdowns etc).

Buying equities at that point made sense on a long-term view but the day-to-day uncertainty was best described as climbing a “wall of worry”. Things were getting better, companies were adapting, governments were responding, but each day retained the same fears.

Financial year 2023 has had a similar tone, this time the risks weren’t viruses, but rather inflation and response of central banks. Higher inflation had begun to appear in the latter half of FY-22. The relationship between higher interest rates and equity prices is clear (the higher the rates past a particular point, the lower the equity prices). But the benefits of inflation to some or most companies’ revenue growth as they expanded their margins were less clear.

Higher rates and aggressive central banks responses appeared to create new existential threats in the form of recession risks. This was especially so for those companies with exposure to the domestic economy and household consumption.

Whilst a minority of households have mortgages, and even less significant interest earning deposits, the share-market responded to future recession risks. And imputed a near certain recession in parts of the market.

Companies exposed to the consumer or domestic demand have been hard hit. Smaller companies that had already suffered towards the end of FY-22, continued to underperform the rest of the share market throughout FY-23.

A Primer: The difference between equities and other financial assets

As an investment manager, and after pursuing a lifelong interest in companies, micro-economics, technology and innovation, I suspect that I am a little biased towards investing in companies rather than other financial assets.

However, it is during years such as FY-23 that some of the lesser appreciated aspects of equity investment can come to the fore. One of those aspects that I appreciate is adaption and evolution.

Consider purchasing a term deposit or a financial product such as a pension, or worse still a single house in a single street. These are surely all financial products similar to shares, and they may well prove profitable, but what you buy is what you get.

Companies however are organic creations, not in the Year 12 biology sense, but complex systems armed with the ability and often necessity to adapt and change. Often the best place from which to drive change is from a position of incumbency and/or market power.

In periods of transition companies should outperform simple financial products.

Successful transitions

Just some of the examples that come to mind from the portfolio.

Worley Limited

Now among the world’s leading oil & gas construction firms and is at the global forefront of sustainability projects.

Woolworths

The company continues to evolve its product offering well past the limitations of the store, or the confines of shopping basket of old. Whilst bagged lettuce or trellised tomatoes won’t win a Nobel Peace prize, the capacity to increase profitability is available.

Mineral Resources…

… was once simply the best on-mine crushing contractor, building a reputation for delivering best-in-class mining services. It used its experience of how to operate mines successfully into leverage of purchasing the mines themselves when other companies faltered. Its adaptive culture in turn sought out opportunities in lithium and energy which form the new growth drivers of the company today.

Seven Group…

… through its concentration of ownership by the Stokes family interest provides a perfect example of how the impact of human decision-making affects the capacity to adapt. In this case, the company’s ability to concentrate on owning high quality cash generative assets through the cycle was highly rewarded this year. In fact, much of the increase in value it created was directly due to opportunities that mere financial investors had consistently failed to appreciate.

MMA Offshore…

… literally battened down the hatches on its fleet of highly specialled marine vessels. The management team ensured that following a decade of weakened demand it was well-placed for the opportunities ahead. These included an upsurge in demand and higher prices for ship rental. It is now competing for new projects globally.

Not so successful transitions

On the flip side, consider some of the companies that First Samuel clients have less exposure to, and are much more constrained by their culture, their product range or external forces such as global demand or domestic interest rates.

Banks…

… may well have near cartel characteristics that drive high levels of profit, and command significant political protection. But they are not known for innovation, are tightly constrained by regulations and geography, and are most at risk during recession during which time they can do little to reverse their fortunes.

BHP and RIO…

… both have in situ iron ore in quantities only dreamed of by other miners and entire nations alike. This starting position provides comfort but does not guarantee they adapt to change or respond well to changes in the iron ore price, future alternative supply or changes in demand.

The problem of companies that breed stagnation is best evident in the extraordinary dedication their closest competitor Fortescue Metals is taking to innovation and investment through Fortescue Future Industries. Fortescue simply refuses to be the company that doesn’t change. BHP doesn’t even own a lithium mine.

Pitfalls

Adaption and evolution are, of course, not without their pitfalls, as is equally apparent in some of least successful positions in clients’ portfolios this year, including EarlyPay and TZ Limited. However complex organic enterprises have the ability (not the certainty) to adapt and respond to pitfalls and mishaps.

We look forward to such adaption in FY-24. Otherwise, businesses that are more adaptive will acquire the assets or their markets in due course.

The lucky country

Donald Horne’s famous and now most often misinterpreted statement went as follows;

“Australia is a lucky country run mainly by second rate people who share its luck. It lives on other people’s ideas, and, although its ordinary people are adaptable, most of its leaders (in all fields) so lack curiosity about the events that surround them that they are often taken by surprise.”

Far be it for me to disagree with the sentiment or otherwise. The critical phrase to an investment manager is “who share its luck,” as though the luck was a given. But who could argue against Australia’s lucky streak in FY-23 as the world moves through another energy revolution that Australia finds itself well placed in. Again.

FY-23 saw (a) the continued development of a range of critical minerals (both mining and downstream); and (b) massive investment from global players. Clients’ portfolios benefited from lithium producers, copper miners, rare earths companies and the development of other battery minerals such as nickel.

And foreign players have emerged in the places in which our politicians (or the peoples’) political savvy had failed to keep up with opportunities in plain sight. For example, Brookfield Asset Management offered to purchase our largest integrated energy company (Origin Energy) and commit to the billions of dollars of investment required to profitably transition our economy.

We continue to position client portfolios to face innovative companies that have exposure to the luck that Australia has. And at the same time trying to avoid the incumbent players such as BHP that, just as Donald Horne suggested, “so lack curiosity” that they are taken by surprise.

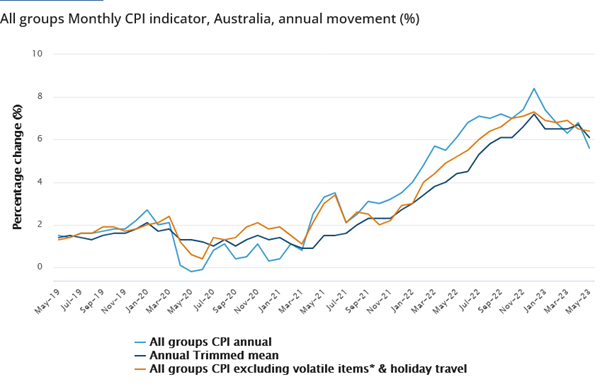

Inflation

The monthly reporting of Consumer Price Index (CPI), has only increased in importance. This notwithstanding inflation returning as a key issue for monetary policy, and its noticeable impact on our daily lives.

Consumer Prices, which were once measured only quarterly, now have an interim monthly measure (note there is some differences between the depth and accuracy of the monthly compared to the quarterly series),

The monthly CPI release is critical to consumer and markets alike because of the high level of concern expressed by the RBA for its elevated levels. Signs of inflation moderating at a pace faster than expectations is good news for those hoping that interest rates are approaching their peak also.

With this background in mind, the release on Wednesday of the monthly CPI was greeted with positive surprise by markets. The headline monthly CPI indicator rose 5.6% annually in May, down from 6.8% in April. Instantly the chances of an RBA interest rate rise in July were judged to have reduced.

Figure 1: Inflation measures points to a peak in inflation, but still running at high levels

But it wasn’t all good news. Yet again the elements of inflation that risk becoming sticky, for instance house prices and rents, household services and insurance remain higher than the RBA’s goal. And are showing signs of stickiness.

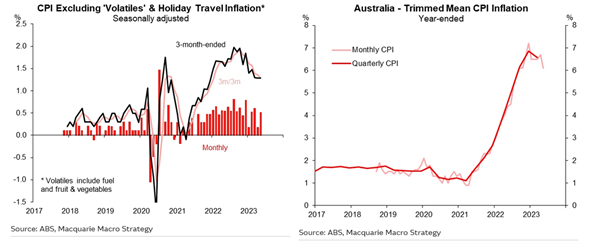

Figure 2&3: Underlying inflation remains sticky based on less volatile components of inflation

One highlight, if I might call it as such: beyond the statistics, it would be no surprises to most readers that insurance prices rose 14.2% in the twelve months to May, up from 8.7% in April. This is the strongest annual rise on record, reflecting higher premiums for house, home contents, and motor vehicle insurance. This is supportive of our position in QBE but not appreciated in the consumer’s back pocket.

Assorted news

There is a favourite episode of a favourite TV Series The West Wing. In it, the protagonists concentrate on small slightly negative tasks, in preparation for the Friday night briefing for the Saturday papers and news broadcasts. It was nicknamed “take out the trash day” because it disposes of all the stories the White House doesn’t want heavy coverage on.

A similar trend appears to exist in the UK, at least according to the Guardian newspaper. In 2015, reporting on the release of information at the end of the parliamentary term in December, the Guardian commented: “government has wrapped up malevolent nuggets of news and released them all on the last day of term – in the hope that we’ll be feeling too festive to notice”.

This week’s Investments Matters shares some the characteristics as a grab bag of new information. Two small downgrades to valuations occurred in the final month of FY-23.

In the Australian equities sub-portfolio the price of Innovate Access group fell 12.3%. In the Alternatives sub-portfolio our investment in Seer has been reduced in value by 35% in anticipation of a change in price during FY-24. In both cases the prospect for the investments remains positive, despite the change in price. Together, the changes resulted in less than a 0.3% change to annual returns across a representative client asset allocation.

On a more positive note, we read with interest in the Australian Financial Review on June 18th “Healthcare tech biz Enlitic eyes $300m ASX listing”. First Samuel has been a shareholder in Enlitic since 2019 and it is held in clients’ Alternatives sub-portfolio. The price suggested by the article would be very substantial uplift (+100%) on our current valuation.

Whilst the AFR report was not confirmed by the company, we would note that interest in Artificial Intelligence (AI) has been enormous in global markets throughout the past six months. The Australian share market has a dearth of truly AI companies anywhere near the calibre of Enlitic, and we would be pleased to see clients benefit from a listing, if that eventuates.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.