© 2024 First Samuel Limited

The Markets

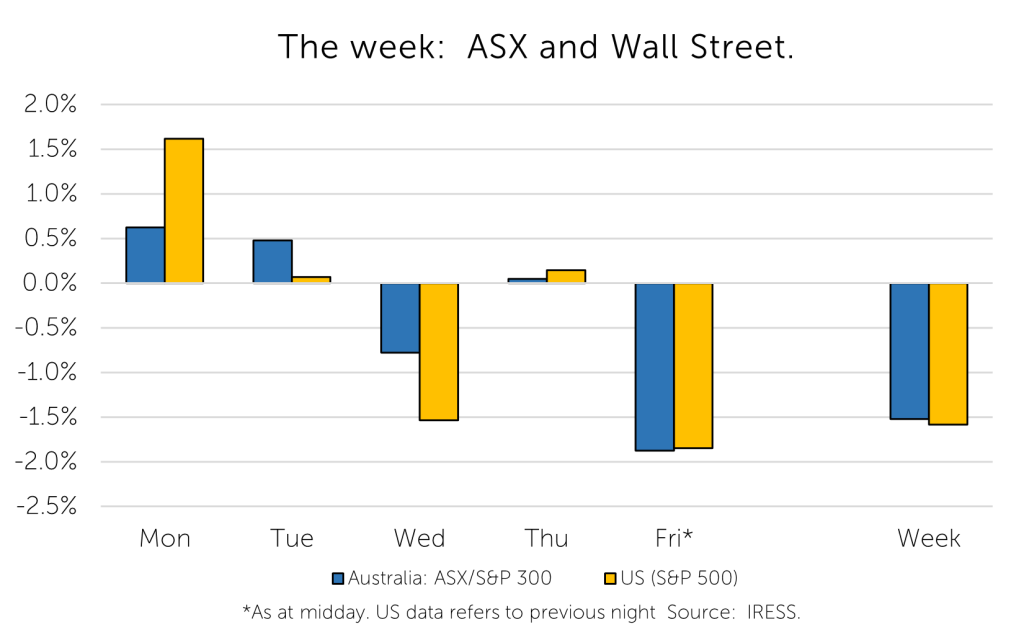

This week: ASX v Wall Street

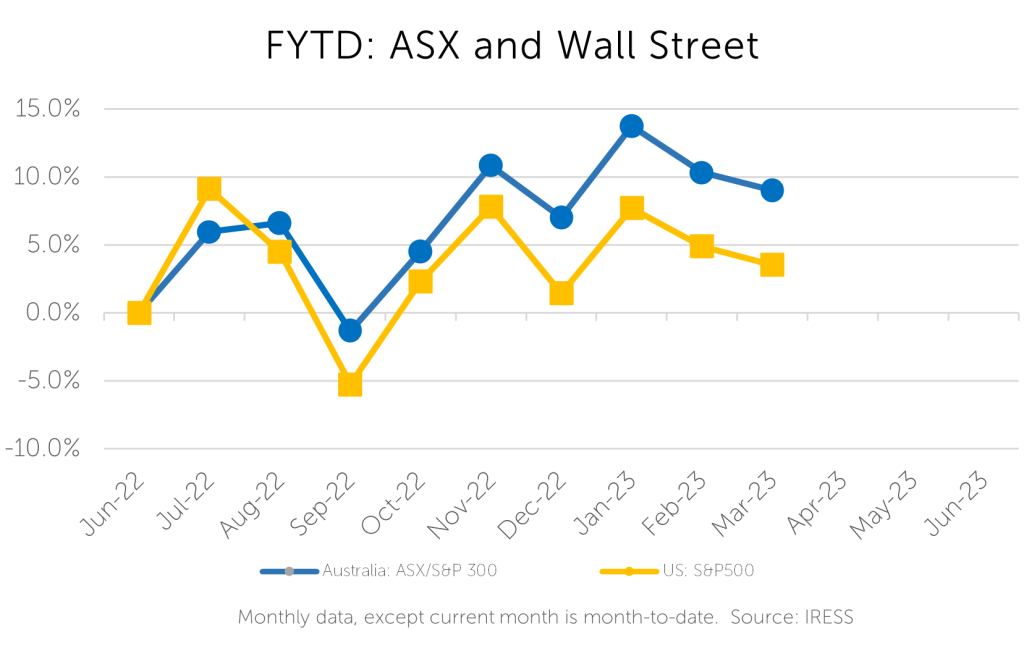

FYTD: ASX v Wall Street

With reporting season now behind us, Investment Matters returns to cover off on three companies in slightly more detail than would have been possible in recent weeks:

- For the Australian equity sub-portfolio, we review the results of two relatively new additions, TPG Telecom and Ventia Services. Both results were impressive and well appreciated by the market.

- For property sub-portfolio we discuss Garda Property Group, a longstanding and profitable position.

And finally, we discuss the ongoing impact of RBA interest rate rises.

Company News

Ventia Services (VNT) – positive update and partial sell-down by Cimic & Apollo

Ventia is a company that provides infrastructure services in Australia and New Zealand. These encompasses asset management (including utilities, mining and oil and gas), telecommunications support, engineering services along with remediation services and staffing for public services. Its property maintenance services support more than 650 properties for Commonwealth departments alone.

Ventia is a relatively newly listed company (November 2001), and its recent financial results provided a comparison to the forecasts provided in the prospectus issued to new investors. Share prices often suffer considerably if the company is not able to achieve the forecasts presented in a prospectus.

The result last week showed the company has navigated well through a challenging backdrop over the past 18 months (including Covid, weather, tighter labour market). It has delivered a result slightly ahead of Prospectus forecasts.

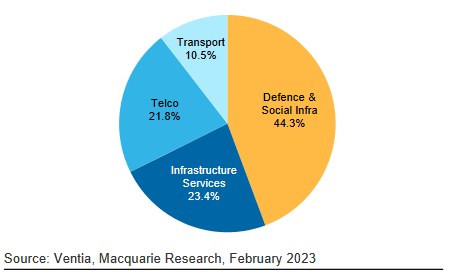

Ventia is fundamentally a people business, with their workforce of more than 15,500 workers being responsible for executing service contracts across a range of industries. The figure below shows the breakdown of revenue between four broad classes of clients.

Figure 1: Ventia (VNT) – Breakdown of FY22 revenue

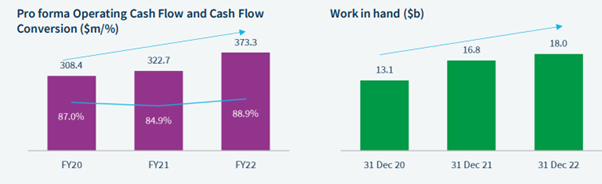

With a significant reliance on long-term contracts, it was pleasing to see Work-In-Hand rise by more than 7% in the financial year. We are attracted to the strong cashflow generation of Ventia. Although businesses such as this are sometimes only as good as their next contract, we suspect that current conditions provide a supportive backdrop for pricing new contracts conservatively.

Figure 2: Three-year operating performance – Cash Flow and Work in hand

Source: Company presentations

Since listing, the profit growth expectations for the company have continued to rise, and the February update provided further evidence of these earnings.

Selldown:

Cimic (formerly Leightons) and Apollo (private equity) each still owned 32.8% of Ventia up until the result, with the full numbers of shares held under escrow (not able to yet be sold) until the release of these results.

The share market had been wary of buying the stock too heavily with such a large amount of new stock likely available, almost regardless of the prospects of the company. We chose to build a position into the selldown of the Cimic/Apollo position. A partial selldown occurred this week, and we were able secure a small parcel of this stock at an attractive discount.

Both Cimic and Apollo companies still own 21%, and we would expect these shares to be sold throughout the next 18 months. The stock trades at a relatively low price to earnings ratio (circa 10x FY-23), at a significant discount to the market. This discount is excessive, and we suggest the stock will trade to $3.00 per share (currently $2.25) in the medium term.

TPG Telecom (TPG) – Four core drivers of value are highlighted

TPG Telecom is one of the major telecommunication companies in Australia, along with Telstra and Optus. It provides the full range of mobile, broadband, NBN, business and wholesale infrastructure services. Built through ongoing mergers and acquisitions, TPG is a combination of businesses that have included, SP Telemedia, Total Peripherals Group, PIPE Networks, IntraPower, AAPT, iiNet and finally Vodafone Hutchison Australia.

The four core value drivers that propel our investment are:

- Higher revenue growth in the short-term due to the return of both higher immigration, and short-term visitors. This growth will replenish customer numbers lost due to the Covid exodus of 2020. TPG benefits from higher market share amongst these new-to-country customers.

- Inflation led increases in average revenue per customer (ARPU) from a combination of increased prices on mobile phone offers for new customers (‘front book’) and progressive increases in plan rates for existing customers (‘back book’).

Pricing power is critical for a business like TPG insofar as higher revenue meets relatively fixed capital costs, driving high returns from existing assets. - Upside from the possible (but far from certain) approval of a proposal for Telstra and TPG to share spectrum (mobile phone coverage) in certain regional and urban fringe areas (covering approximately 17% of Australia’s population). This will increase the value of TPG’s product offer through better coverage, especially with respect to the Optus offer, as well as reduce total capital costs.

- Additional market share gains from customers trading down from more expensive plans offered by Telstra and Optus.

The results released on 27th February provide evidence of customer growth (beating expectations) and revenue growth through increased prices. The market appreciated the result, sending the share price 9% higher over the past 10 days.

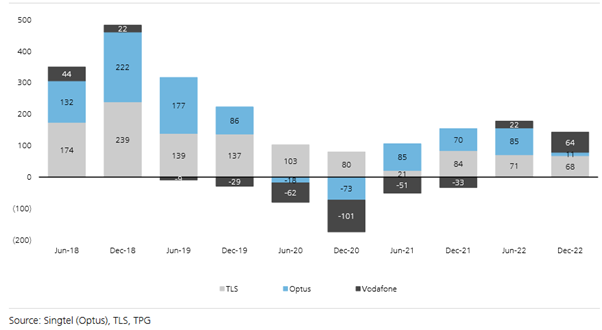

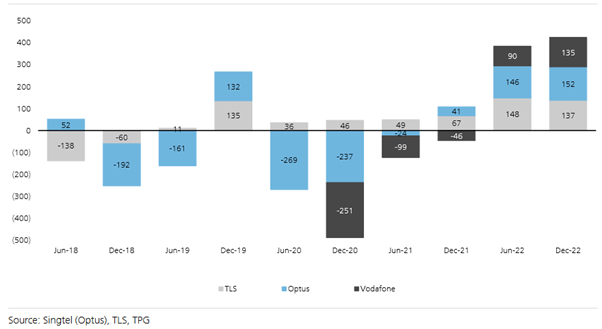

We have included below two charts included in the UBS analysis of customers numbers. The first shows the Post-paid market changes in customer numbers across the 3 major providers since June 2018. In the critical Covid periods of June and December 2020, more than 100% of the net losses of customers came from Vodafone (TPG). It has only begun to recover lost growth as migration sprung back in the past six months.

Figure 3: Industry Post-paid net additions (subscribers, ‘000s)

Figure 4: Industry prepaid net additions (subscribers, ‘000s)

Garda Property Group

Garda reported its half-yearly results in early February, and it had some important news in recent weeks. We discussed all of this with management (CEO and major shareholder Matthew Marsden and Paul Brown, Head of Treasury) when we met with them this week.

Garda is a real estate owner, manager and developer concentrating on Eastern Australia. It is exposed to a large portfolio of industrial assets, many with growth and development opportunities and a set of high-quality suburban offices. Melbournians may be familiar to the companies Botanica office assets in Swan Street, Richmond.

For many years, we have been impressed by the decision making of Garda in the face of changing economic circumstances. In 2023, higher interest rates are creating change, and Garda is actively managing the impacts, rather than passively watching from the sidelines. In the past week, Garda sold an office property in Box Hill. The impressive aspect of the transaction was the company’s willingness to sell as a price below the “book value” of the asset.

- The sale price of $40.3 million represents a 5.9% initial yield and a 14% discount to book value of $47 million. i.e., Garda sold the property at a notional loss.

- However, the Box Hill asset was initially valued at $18.5 million on a 9.0% capitalisation rate at the time of the GDF IPO in July 2015.

- Such is the extent to which theoretical prices have moved in recent years. But there is a significant difference between the theoretical price in a spreadsheet and what any asset can be sold for. Companies that address this difference the fastest will have the capital to deploy on new project the earliest.

Since listing in 2015, Garda property has returned (including dividends) a return of 9% p.a., vastly in excess of the broader index returning 6% p.a.

We expect that the company will continue to exploit the opportunities it has in industrial development, especially in a period in which industrial rent growth remains exceptionally strong. We are also confident that it will continue to recycle assets in this environment. We believe this is a critical component of a well-run property portfolio at the moment. Less emphasis on exaggerated capital value, especially in office, and more emphasis on income, asset turnover and listed vehicles that are deliberately freeing up capital for the next cycle in 5 to 10 years’ time.

Turning to the relevant numbers.

- Garda currently trades at a significant discount to its NTA ($1.34 vs $2.01). Whilst the $2.01 NTA figure will fall as the valuer profession “catches-up” to rising interest rates, we suspect the buffer between the finalised value in 2-3 years’ time and the current share price is significant.

- Garda expected to generate a 7.2 cps dividend (unfranked) in FY-23.

- The company retains a 160,000 sqm development pipeline of which 25,000 sqm is in construction.

Economics: The consenting adults’ view of the economy and its downside

We have included a short piece this week that combines information drawn from last week’s GDP numbers, some independent analysis that supports our internal research and some references to historical analysis of similar circumstances.

Our contention

Our contention is relatively straightforward:

- Moving rapidly from near-zero interest rates to elevated levels, creates non-linear risks that a slower path of adjustment may not create

- Associated risks

- are larger, more localised and potentially more destabilising in Australia than other economies due to our excessive household leverage

- are exacerbated, if central bankers assume that aggregate (overall economy) conditions are replicated evenly throughout the different cohorts of the economy

- are entirely misunderstood, if the RBA is assuming that younger households have successfully negotiated the fraught experience of Covid, wildly fluctuating interest rates and house prices, in a manner expected by “rational economic agents”

- are counterproductive, if higher interest rates further consolidate the explosion in intergenerational wealth inequality observable in the past 5 years.

- Given these risks, we are of the view that whilst interest rates will eventually be lowered, the cost of recent rates rises, let alone future rises may be more problematic than is currently envisaged.

What others say

We have seen market participants equally concerned in recent weeks. The 4th Quarter GDP result strengthened a consensus that Australia faces a recession should the RBA make a mistake with monetary policy in the coming twelve months.;

– (Jo Masters – Barrenjoey)We see downside risks to the economic outlook emerging from this data as household buffers – savings and interest payments – continue to dwindle and consumption is constrained by falling real incomes

Monetary policy in Australia is already restrictive, although its impact is being delayed by an unusually high take-up of fixed-rate mortgages and an income buffer from unspent pandemic stimulus. However, real wages are falling, house prices are falling, and consumer sentiment is falling. At the same time, labour supply is rising, and lead indicators of labour demand are inflecting, albeit from high levels. I expect clear signs of growth slowdown in the current quarter. In my view, the RBA risks recession if it delivers on recent hawkish rhetoric.

– (Gerard Minack)

We understand that monetary policy is inherently a blunt tool, and many other actors have a critical role within economies and societies transitioning between monetary regimes. Governments can spend, businesses can look through the short-term, automatic stabilisers in government transfers such as unemployment benefits soften the impact, and the Australian dollar depreciating can all play a role.

Our concern

Our concern is that few individuals have been in a position since 2019 to forecast the full range of economic drivers required to make excellent decisions. Few people foresaw inflation, even the RBA said rates wouldn’t rise so quickly, few forecast house prices surging one year and falling as rapidly the next, and even less people pictured household incomes not keeping pace with inflation.

No-one foresaw that almost all the medium-term economic benefits of the massive government stimulus would indirectly go almost entirely to households with the least need for additional wealth.

Whilst individuals did the best they could with major economic decisions such as mortgage debt or housing purchase in this period, they couldn’t see the bigger picture. We were reminded of commentary regarding the GFC from more than a decade ago.

On the one hand, it is reasonable for the regulatory regime to make allowance for private transactions amongst “consenting adults”. And the issuance of small amounts of any type of security cannot possibly jeopardise stability. On the other hand, it is reasonable for public policy regimes to address the externalities – in this case, the potential systemic effects – of thousands of large private transactions that take place away from public markets. My concern is not that sophisticated investors cannot fend for themselves. And I do not want to deny that private transactions can aid stability, as indeed has been the case with much recent private-market debt issuance by banks. But nobody can assess the risks they are incurring in some transactions without much more information about the totality of risks out there and the network of exposures within the financial system.

Mr Paul Tucker, Deputy Governor for Financial Stability at the Bank of England May 2011

Whilst he clearly wasn’t talking about Australian housing and the banking system in Australia in the 2020’s, he could have easily been doing so. His point was that policy should aid this process, not exacerbate it.

Different levels of resilience

The RBA, banks and APRA have created a set of externalities (costs) that are yet to emerge, and the size of which is uncertain. In our, and others’ view, there are now vastly different levels of resilience in the economy between different household cohorts.

Instead of being exceptionally careful, instead of suggesting fiscal and taxation changes that could assist with the risks, RBA cash rates have surged successively.

The lag between interest rate rises and behavioural change hasn’t been given enough time to yet play out and many households are still benefiting from fixed rates at very low rates in the short-term. The bulk of the low, fixed rate mortgages which were taken out in the Covid period, are yet to transition into contemporary-priced mortgage product reflecting the now much higher RBA cash rate.

This is the context of this week’s RBA decision to raise again, yet based on recent GDP data, it isn’t even clear that the economy is particularly strong looking backwards, let alone looking forward.

George Tharenou the highly respected UBS economist, noted that:

“Household disposable income actually fell quarter on quarter (-0.7%) and only rose 3.3% in the year” (despite more than 7% inflation).

“Income was dragged by household interest payments surging again, but given the lagged impact from RBA rate hikes and expiry of fixed-rate mortgages, ongoing massive increases in interest payments still lie ahead.”

His assessment is “households need to continue to rapidly draw down savings to a record low, to avoid a ‘cliff’ of consumption.”

But of course, this isn’t the case/need for all households. The households that are affected the most by higher costs of living are those that spend the most (poorer and younger) and those that have the highest amount of debt relative to income (younger to middle-aged).

Those at most risk

The view that rate rises can be managed is partly due to the view that the economy has vast savings buffers, that households could spend more and save less, and that in aggregate debt servicing costs remain manageable. But those most at risk, and those who will need to constrain their consumption the most, are not in this position.

Tim Toohey (Yarra Capital Management) writing in Livewire Markets expressed this view perfectly.

“In our opinion, though, the biggest error (of the RBA) thus far was …… However, all these criticisms will pale by comparison if the RBA merely buries poorer and younger households based on a flawed assessment of ‘excess savings’ long after the inflation battle has already been won.”

Within this context your Australia equity sub-portfolio remains much less exposed to banking, consumer discretionary spending, consumer services, real estate development, and domestic housing construction than the overall share market.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.