Wry & Dry #36 FY-24 From the Murray to… “That would be the Euphrates”. Rats.

In the most flagrant breach of responsible government since that which caused then PM Whitlam to give Federal Treasurer Jim Cairns the DCM in 1975, Victorian Premier Allen has not given state Treasurer Tim Pallas the DCM.

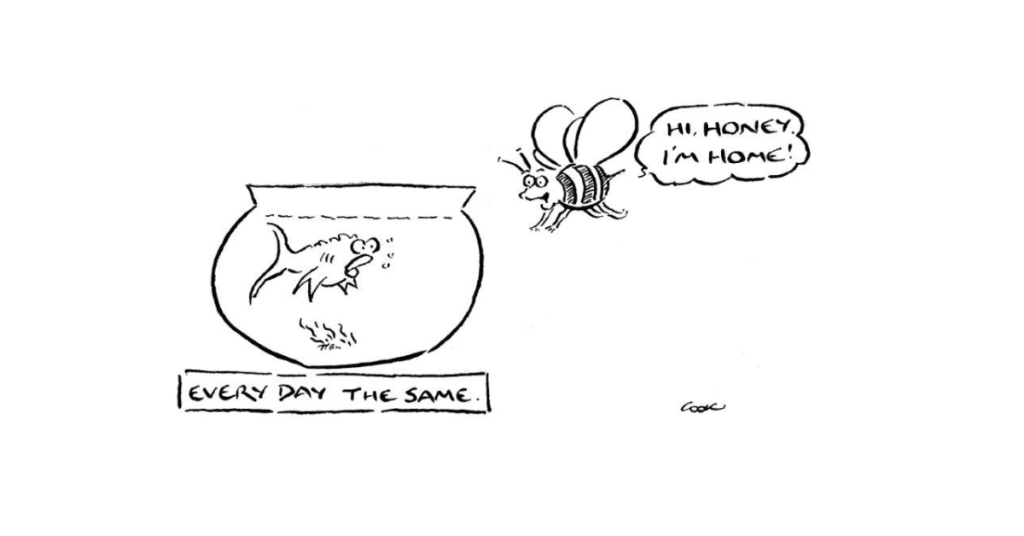

And in abject bovine indifference, the financial media chewed the cud spewed out by the government’s PR machine and effectively said “Tut, tut. Must do better.”

Even the state opposition leader (err, bowler’s name?) couldn’t bring himself to ask for the head of Pallas to be impaled on a spike at the city gates.

New Financial Year, New Opportunities Part II – Energy sector

Beach Energy, is a leading Australian independent oil and gas exploration and production company. While the energy sector is subject to volatility given underlying commodity prices, Beach Energy’s strategic positioning, future cashflow outlook and growth prospects make it an attractive investment within the sector.

Read this week’s Investment Matters as Craig explains why we think Beach Energy presents a prospective investment opportunity. Many investment banks’ Energy-sector experts see excellent value in Beach Energy at current prices.

Read why we are predominantly interested in owning exposure to movements in the price of gold, both as an insurance policy against global uncertainty or conflict and as a hedge against inflation. Plus, Craig explains why we suspect that the Mining Services and Industrials sector is likely to continue to outperform despite tough conditions.

New Financial Year, New Opportunities – Pathology and Healthcare

Part four of the year-end stocktake will outline our exposure to a final basket of stocks, the gold basket, our mining services exposure, three large industrial companies and two long-held smaller companies.

Read why we are predominantly interested in owning exposure to movements in the price of gold, both as an insurance policy against global uncertainty or conflict and as a hedge against inflation. Plus, Craig explains why we suspect that the Mining Services and Industrials sector is likely to continue to outperform despite tough conditions.

Year-end stocktake part 4: Gold, Mining and Industrial companies

Part four of the year-end stocktake will outline our exposure to a final basket of stocks, the gold basket, our mining services exposure, three large industrial companies and two long-held smaller companies.

Read why we are predominantly interested in owning exposure to movements in the price of gold, both as an insurance policy against global uncertainty or conflict and as a hedge against inflation. Plus, Craig explains why we suspect that the Mining Services and Industrials sector is likely to continue to outperform despite tough conditions.

Year-end stocktake part 3: Non-bank financials and technology

Part Three of the year-end stocktake will outline our exposure to non-bank financial stocks and several technology and medical device companies our clients own.

Discover why we have chosen to invest in areas of the non-bank financial sector, including business banking, global and domestic insurance, invoice financing, and insurance.

Year-end stocktake part 2: Lithium and Domestic economy

This week’s investment sought to highlight the logic and investment fundamentals we are creating in our lithium basket. Once again, the impact of baskets is to increase the number of stocks clients see in their portfolio, from a purely numeric perspective, but not from a thematic perspective.

The stocktake also highlights the economic outlook for our domestic economy exposure by referencing how current conditions mix with the type of management and asset features we are looking for to create an overall exposure.

Understanding Portfolio Diversification: a year-end stocktake

Each week in Investment Matters, we discuss the types of thematics that are crucial in building portfolios. We aim to combine these thematics with thorough bottom-up company research to create a well-diversified portfolio that can outperform in the medium term.

Over the next four weeks, leading into the end of the financial year, we will go towards a more detailed level, looking at individual positions. We will present an update on the portfolio companies, a year-end stocktake.

Is gold the new haven? The mystery behind the price surge

This week’s Investment Matters will shed light on the surge in the price of gold and gold stocks in the past few months.

We hold gold stocks in our clients’ sub-portfolios for several reasons. It is therefore useful to understand why increases in the gold price warrant special attention.

The task for First Samuel is to profit from such price increases.

In discussing this, I have split this week’s Investment Matters into two lengthy sections. I urge you not to skip straight to the second section (on how we profit from gold prices increases).

Optimistic optimism: strong returns to both Australian and global equities

This week’s Investment Matters will focus on different asset classes, their relative performance, and our broad thoughts on the implications of tactical asset allocation decisions.

When we survey benchmark performance, we see that Australian and Global equities portfolios have delivered returns well above expected long-term returns for those asset classes this financial year.

Revisiting takeovers

we’ve maintained higher weights in cash holdings within property sub-portfolios with an expectation that a significant rises in interest rates would necessitate an increase in cap rates (implied returns on property values), a resultant reduction in property book valuations and trigger a resultant slew of equity capital raises at discounted share prices in order to restore balance sheets to within bank funding covenants.

While the dull shine of copper comes in focus, we shed little light on BHP. Similarly, our focus this week on financial services dives deeper than the four major banks.

Profit Reporting Season – Stockland, Mirvac, Garda and Lendlease

we’ve maintained higher weights in cash holdings within property sub-portfolios with an expectation that a significant rises in interest rates would necessitate an increase in cap rates (implied returns on property values), a resultant reduction in property book valuations and trigger a resultant slew of equity capital raises at discounted share prices in order to restore balance sheets to within bank funding covenants.

While the dull shine of copper comes in focus, we shed little light on BHP. Similarly, our focus this week on financial services dives deeper than the four major banks.

Profit Reporting Season – Sandfire, Perpetual and Judo Bank

This week’s Investment Matters will continue to focus on the recent reporting season.

While the dull shine of copper comes in focus, we shed little light on BHP. Similarly, our focus this week on financial services dives deeper than the four major banks.

Profit Reporting Season – Cleanaway, Emeco, ParagonCare and Worley

This week’s Investment Matters will concentrate on key company results as the reporting season winds down. On balance, market strategists have noted that earnings revisions have been neutral across the board, which is better than historical outcomes of net negative earnings revisions by optimistic investment banking equity analysts.

Profit Reporting Season – Ventia, Johns Lyng, Earlypay and Nanosonics

Read key company results as the reporting season winds down. On balance, market strategists have noted that earnings revisions have been neutral across the board, which is a better than historic outcomes of net negative earnings revisions by optimistic investment banking equity analysts.

Profit Reporting Season – Week 2

This week’s Investment Matters will concentrate key company results as the reporting season ramps up.

Profit Reporting Season Update

This week’s Investment Matters will concentrate key company results as the reporting season ramps up.

Early profit reporting season and news update

In last week’s Investment Matters we concentrated on the confession season, the period in which companies make early announcements to the market surrounding material changes to upcoming earnings.

This week’s Investment Matters will also concentrate on news flow and early reporting season results.

Confessions of a corporate earnings season

Most ASX-listed companies in Australia have a June fiscal/financial year-end. Accordingly, those with June and December balance days will tend to present their (half-year/annual) financial results to the market in each of the months of February and August.

Judo Capital – back to the future of banking

As a raft of stocks in the portfolio have been taken over or have successfully met our internal price targets, we’ve been on the hunt for new names to replace.

Perpetual – finding a way to unlock value

In the past year, we have often commented that we’ll exhibit due patience as part of our investment approach. This is required as we often seek to invest in businesses that are significantly unloved and misunderstood and where assets may, therefore be mispriced.

Premier Investments – A deep dive into a new opportunity

In recent weeks, clients will have seen the addition of Premier Investments to their Australian equity sub-portfolios. Famously partly owned and operated (whether formally or informally) by Solomon Lew, Premier Investments is amongst the most successful discretionary retailers in Australian history.

Steadfast in its approach

© 2024 First Samuel Limited The Markets This week: ASX v Wall Street FYTD: ASX v Wall Street Steadfast Group Limited is an Australian insurance broking network that provides insurance broking services to businesses and individuals across Australia and New Zealand. The company was founded in 1991 and has become one of Australia’s largest insurance […]

Growing – in two very different ways

In recent weeks, we heard the mildly alarming statistics that the ASX had fallen to a low in October 2023 of 6703.2, lower than the levels seen in the broad market index at the close of October in 2007 (6770).

Falling share prices – An opportunity (not) to be wasted

This week we highlight a new addition to the portfolio.

Inghams: laying golden eggs

Inghams is the dominant supplier of chicken products in Australia. It is also amongst the largest positions in client portfolios. In the past week, it delivered an update on progress within the business across the first half of the fiscal year.

Lynas gets a rare (earth) licence reprieve in Malaysia

This week, we discuss developments in the critical minerals sector and take a look at Woolworths Q1 trading update and what it may reflect with respect to the Australian consumer.

When should we be worried about worrying? Consumer confidence.

This week we look at Consumer Confidence and Consumer Sentiment and hope to relate it to longer-term historical trends and current portfolio construction.

RBA Speaks – more nuance, slightly less ideology?

On Wednesday, RBA Assistant Governor Christopher Kent gave a speech to a Bloomberg gathering with a title that would surely only excite economists: “Channels of Transmission.”

Consolidation of Newcrest/Newmont – Do we continue to hold?

To provide a more complete investment picture, we will continue to provide some updates on the prospects of our sub-portfolios’ companies as gleaned from our coverage of the ASX Company Profit Reporting Season.

Company Profit Reporting Season – the final instalment

To provide a more complete investment picture, we will continue to provide some updates on the prospects of our sub-portfolios’ companies as gleaned from our coverage of the ASX Company Profit Reporting Season.

Understanding the rise in mergers and acquisitions

When the share-market does not see value or investment merit in a particular stock the stock’s share price will recede. This could be because the company’s earnings (i.e. profit) outlook is poor (e.g. Bega Cheese Ltd) or perhaps the industry in the which the company operates is struggling (e.g. ARN Media Limited).

But often someone or a company will see value where the share-market does not. The logical outcome of this is one of the more interesting aspects of investment: the merger or the acquisition. Or, in jargon: M&A.

CIO Update – The Market Who Cried Recession

Volatile times call for calm, considered action. But how does one stay calm when the market news suggests that everything is on fire? Context provides calm.

Wry & Dry #43: The Sky Is Falling…

Australia has arguably the world’s most diverse and abundant supply of energy, with the exception of Tsar Vlad’s empire. But somehow, this abundance has gone pear-shaped this week