© 2024 First Samuel Limited

The Markets

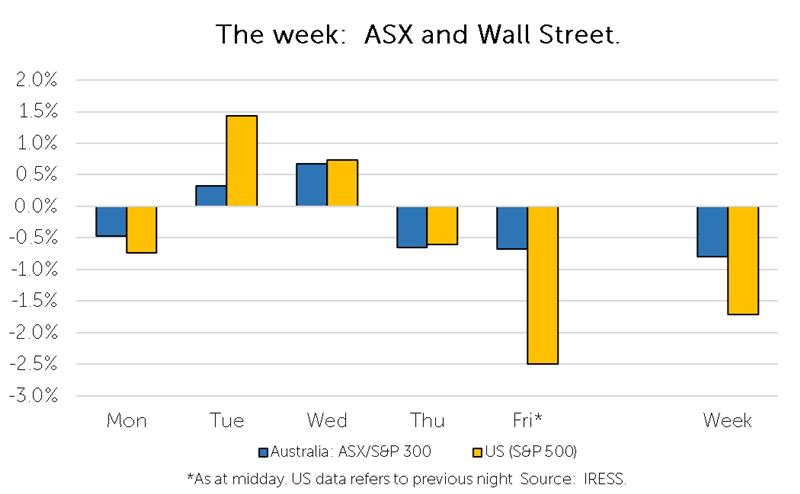

This week: ASX v Wall Street

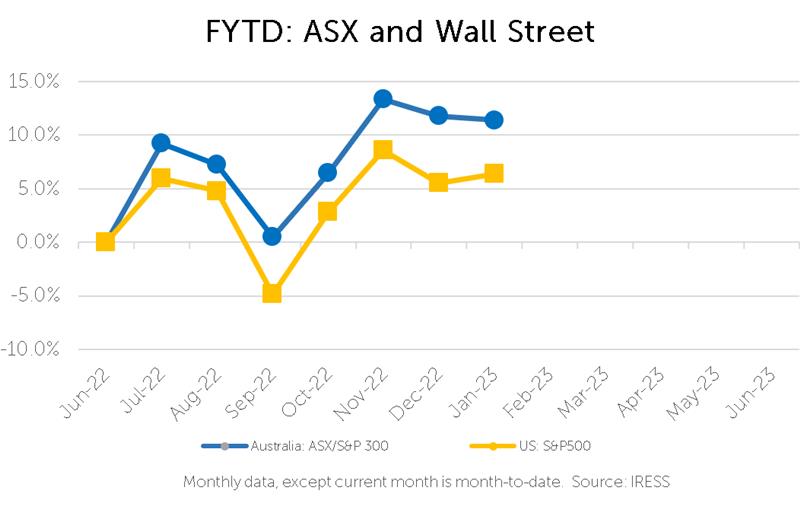

FYTD: ASX v Wall Street

As we rapidly approach the 31st of December, we are once again left scratching our heads asking: “where did the year go”?

A cursory glance at the scorecard would lead you to believe this year in markets could be met with a yawn. At the time of writing the ASX300 is set to end the year broadly flat, year on year (+0.4%).

Yet those that lived through it know that 2022 was anything but a “yawn”. The year has been marked by considerable volatility. And of course, its corollary, opportunity.

Even so, one could ask, have we travelled a thousand miles, only to return to the same spot, a little older and none the wiser?

Not quite. Underlying the year has been several important shifts that we see as shaping markets not only next year, but for years to come.

And so, in this week’s Investment Matters, a look at the year that has been in answering: What mattered in 2022?

Ukraine: beyond the headlines (And on the fourth day, a turning – published 25/02/22)

The re-emergence of war in Europe represented a tragic turning point.

However, it also was a visceral manifestation of slow moving, but ever-present global undercurrents:

- Increasing balkanisation and protectionism

- Supply chains being re-assessed and reorganised

- Energy independence and the energy transition becoming critical

- A renewed focus on resource sovereignty, critical minerals and materials

- An atrophying global rules-based order

The invasion of Ukraine brought these undercurrents to the surface and acted as a catalyst for action.

Subsequently, we saw governments double down on their commitment to resource sovereignty and supply chain diversification, most notably, Inflation Reduction Act in the US.

Supply chain disruptions and fragility (The “soft” side of supply disruptions – published 18/03/22)

War (and the toll of war) rippled through markets globally.

However, the “lucky country” was fortunate enough to benefit. Commodity prices soared – buoying our commodity heavy index.

It was a reminder that in times of conflict, the interlinkages bred by globalisation can resemble more of a tangled mess, and of the fragility that comes with interdependence.

This did not just impact hard commodities.

We only had to look at the move in the price of wheat to be reminded that this fragility exist in soft commodities too.

Supply chain fragility is likely to be a focus of corporates and governments alike over the coming years – reigniting investment in sectors such as mining (Synthesis from the state of Black Swans and Kangaroo Paws – published 09/12/22).

We were also reminded that this fragility extends to the financial economy, as the pound plummeted later in the year, triggering a broad sell off in assets (“Gilty” as charged – published 07/10/22).

At the end of the trip, it was clear that further work finding the beneficiaries of these changes is critical.

In part, we have secured investment in key minerals, and are confident that some of our services companies will exploit opportunities.

How will we apply these insights to clients’ portfolios?

We remain on the hunt for the nimblest, niche exposure to this along with the large companies that are leading is likely to create sources of strong performance in coming years.

Inflation: no longer “transitionary” (Stage 5 – published 16/09/22)

Central Bankers were left chasing their tails, as inflation proved far less transitory than expected.

Amidst the mea culpas, we saw a huge evolution of the underlying narrative and belief around inflation.

We thus entered a new stage of in the discourse around inflation, Stage Four:

- We will never see inflation again

- Inflation is transitory

- Inflation isn’t transitory but higher interest rates and supply chain blockages will pass, and inflation will fall

- Inflation is sticky and will last longer – the only solution to inflation may be a recession

- Inflation is endemic

Indeed, higher inflation for longer represents a paradigm shift that many are slow to accept.

Why was this important?

Firstly, the prices of financial assets are fundamentally underpinned by expectations around inflation.

And secondly, it is the broader expectations about inflation that form a part of the enduring elements of inflation.

As seen overnight (S&P500 -2.5%), the durability of inflation, and the course taken by central bankers to remedy it (Misstep or side-step? – published 14/10/22), is something markets continues to grapple with (Yanny or Laurel? – published 29/07/22).

Sinking of the “Ark” (Maydays – published 13/05/22)

The market looks set to end the year in a similar position to where we began.

However, observing the market this year has been a lot like observing a duck in water – a lot calmer on the surface than it has been underneath.

We saw heavy selling in certain pockets of the market.

Interest rates headed higher, faster than expected.

Consequently, investors are paid much more attention to price.

Broadly the “optimism” we saw over the last two years seeped out of the more speculative parts of the market.

The poster child for this was Cathy Wood’s famed ARK Innovation fund (-55% in 2022) and of course, various permutations of cryptocurrency.

The ASX is raided (Time takes over– published 11/11/22)

Takeover activity continued to be strong.

The pre-conditions for this were a volatile market, paired with ample capital chasing returns.

As such we saw several companies become the subject of takeovers, including portfolio companies Origin Energy, Ramsay Healthcare, Pushpay, Australasian Foods Holdco (Patties) and Perpetual.

We see that “takeovers” will remain an important way in which the latent value in clients’ portfolios will be recognised over coming years.

Corporate profits: at the margin (Profit reporting season wrap – published 09/09/22)

Corporates had to grapple with the re-emergence of inflation – a shock after after many decades of low, stable inflation.

Markets worried: how would they adjust? “Better than feared” was the answer.

Most companies were ultimately abler to pass on the increases in costs they experienced.

With the panic over margins subsiding, the focus turns to revenue next year.

What will be the lagged impact of tightened monetary policy and how will this flow through to revenue? (Infection, Inflation, Inflection – published 05/08/22).

And ultimately…there’s still value on offer (Value on offer – published 18/11/22)

Ending the year much where we began, we see that there is value on offer.

Whilst higher interest rates can lead to recessionary conditions, and hence affect all stocks, we are convinced that “value stocks” in general (excluding banks) had already incorporated a reasonable discount of future earnings.

Our view is that despite the risks of recession in the coming 12-18 months positioning in these stocks will prove profitable as the underlying earnings and market conditions improve in the medium term.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.