The Markets

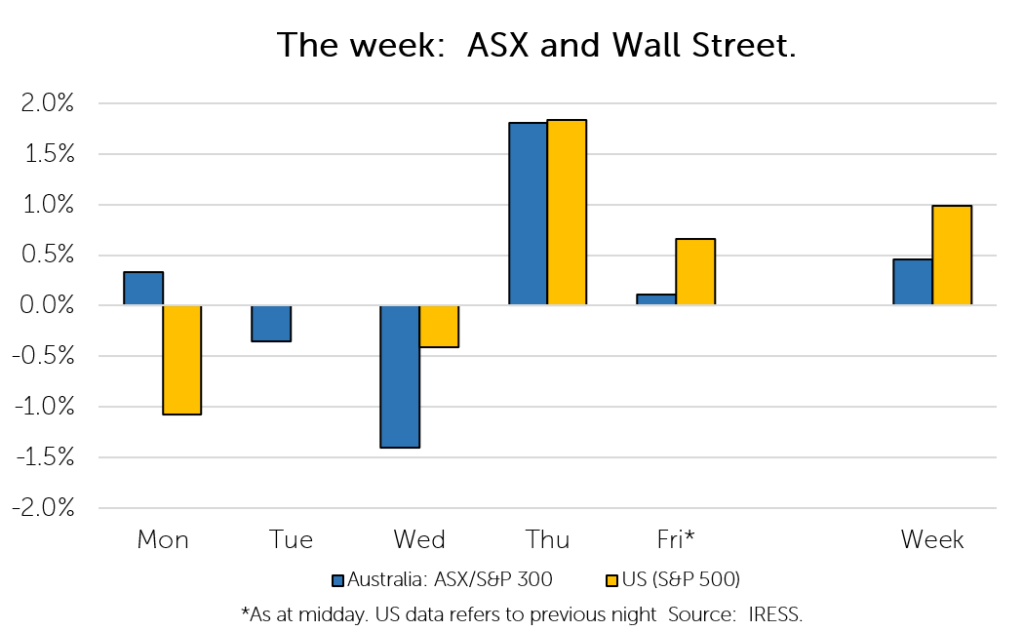

This week: ASX v Wall Street

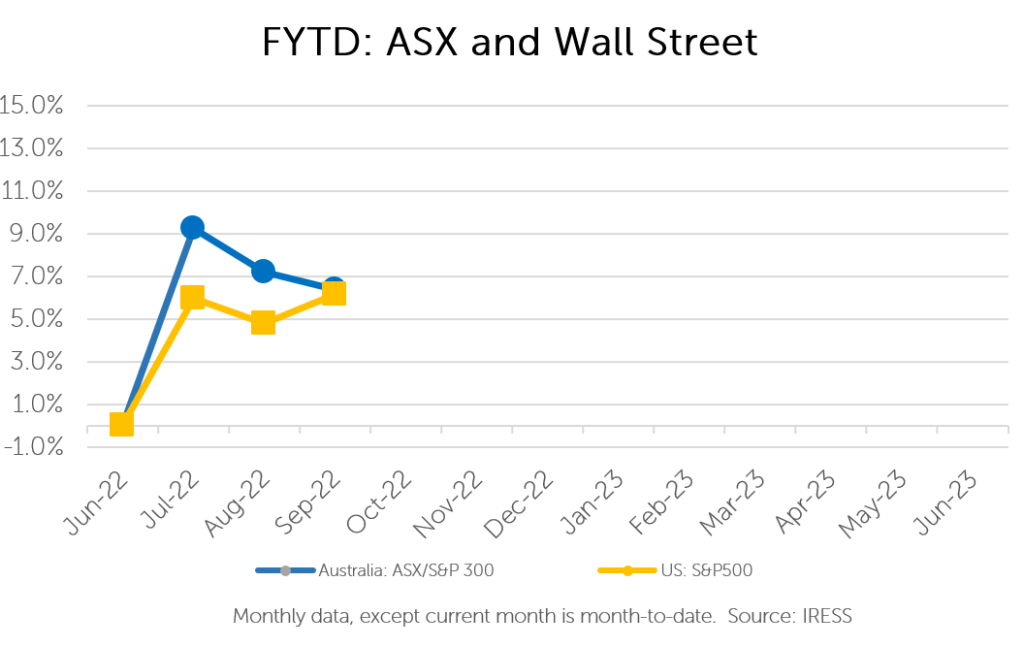

FYTD: ASX v Wall Street

The last week of company profit reports proved to be as busy as the week that preceded it.

‘Better than feared.’ That’s how several analysts have described the August reporting season in 2022.

This reflects the rather dour expectations many held leading into the season, with many questioning how companies have dealt with the disruption and cost pressures they have seen over the past year.

Companies have had to grapple with the re-emergence of inflation, something many have only experienced vicariously through textbooks and historical accounts.

August’s results showed that the market’s fears were excessive.

Despite these challenges, many companies were able to maintain profit margins, with strong end-demand allowing for costs to be passed through to customers.

We wrap up this year’s Profit Reporting Season as we ponder the outlook for 2023.

At the margin: better than feared

At our core, we are bottom-up “stock pickers”. However, in FY-22 it was hard to ignore the fact the rapidly shifting macro-economic environment had a huge bearing on company profit results.

In such an environment, it can be easy to get caught in company-specific minutiae and miss the forest from the trees. We see that the doom and gloom around cost pressures for individual companies was an example of this.

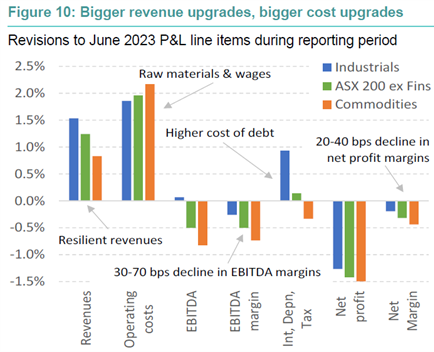

We can approach this year’s profit reporting season from a different angle by looking at overall profit results, in the form of a profit and loss statement.

The chart below depicts the revision to investment analysts’ forecasts in aggregate across the broader ASX.

Source: MST Marquee

What the chart highlights is that costs were higher than expected, but so too were revenues.

The net result is that for Industrial companies, the overall level of operating profit (EBITDA) was generally in line with analysts’ estimates.

In our view, the market continues to grapple with the concept that many companies can ultimately pass on increases in costs. FY-22 profit results showed that companies were able to do this.

Furthermore, for many companies, revenues reflect costs with a lag and thus cost pressures this year are likely to be recovered next year.

We see this as a key benefit of owning shares in an inflationary environment.

The pessimism around cost recovery has provided us with a strong opportunity to increase our holdings in a number of key names over the past year, which we see will ultimately be rewarding over the longer term.

Clients’ Portfolios

We were generally pleased with the performance of clients’ Australian Equities portfolios over the reporting season. Of course, not every company managed to “hit it out of the park” per se.

However, on a holistic, “portfolio” level, we were pleased with results, with higher conviction positions such as QBE, Paragon Care and Emeco performing strongly.

Clients’ Australian Equities Portfolios returned +2.5% during the August reporting season, compared to the +1.2% return of the broader Australian Share Market (ASX-300).

Our scorecard for FY-22 can be found below, detailing our rating of each company’s result and how the market reacted on the day of its announcement (please note: not all companies in client portfolios report during August).

For a detailed analysis of each result, please refer to previous editions of Investment Matters.

Standout results included:

- QBE: Strong premium growth, stronger anticipated investment returns, no nasty surprises.

- Paragon Care: A clearly articulated strategy, better delineation of business pillars and strong guidance for profits next year and beyond.

- Emeco: A renewed focus on cash flow generation and a strong outlook for cash flow next year.

- HT&E: Strong cost control, the outlook for FY-23 remaining positive, strong outlook for “sustainable” cash flow generation relative to share price.

- Origin Energy: Strong operational execution in challenging conditions, articulation of broader energy transition strategy.

Weaker results included:

- Sandfire: Higher costs at MATSA as a result of elevated electricity prices in Europe, less financial flexibility as a result.

- Inghams: Cost pressures compounded by negative margin mix as a result of labour challenges.

- Aurelia Metals: Labour challenges and mine disruptions. Disappointing value realisation from Dargues.

- Newcrest Mining: Continued cost pressures yet to be offset by a higher gold price.

In general, many of the weaker performers continue to be victims of the market’s disbelief when it comes to cost pressures, and their ability to be passed on.

While these cost pressures have impacted profitability in the short term, we have more confidence in the ability of these companies to recoup their costs and see the market’s cognitive dissonance as an opportunity over the long term.

The outlook for FY-23

With FY-22 in the books the focus turns to next year.

In one sense, FY-23 looks to be a year where companies are driving into “clean air” so to speak, with direct COVID impacts largely in the rear-view mirror (we hope).

By the same token, it will be a year when we will better understand the impact of the huge shifts we have seen in monetary policy recently. The impact of a higher cost of debt will begin flowing through to corporates and households alike.

Thus, while FY-22 was all about “margins”, there is likely to be a stronger focus on revenue over the next year.

Given this uncertainty, fewer companies have been willing to provide guidance for next year’s profits during August.

We expect they will gain a clearer picture by the time they update shareholders at Annual General Meetings over the next two months.

On balance, we are confident that Australia, and Australian equities, are well placed over the coming years.

However, with the fundamental shifts we have seen in the economy, we are cognisant to limit exposure in the portfolio to companies that are not well placed, should the environment become more challenging.

Company News

Hastings Technology Metals (positive impact) announced that they will be raising capital.

As detailed in this month’s CIO Video, Hastings is a miner focused not only on the production of Rare Earth metals, but in becoming a company that spans the length of the rare earths supply chain, from “mine to magnet”.

The company is looking to raise A$110m to fund the development of its Yangibana Rare Earths project, its rare earths deposit located in Western Australia.

Funds will go towards further advancing the project, including the development of the processing plant for the project and early work development costs.

The raise was conducted at $4.40 per share, a 19% discount to the company’s previously traded share price.

We participated on clients’ behalves.

***

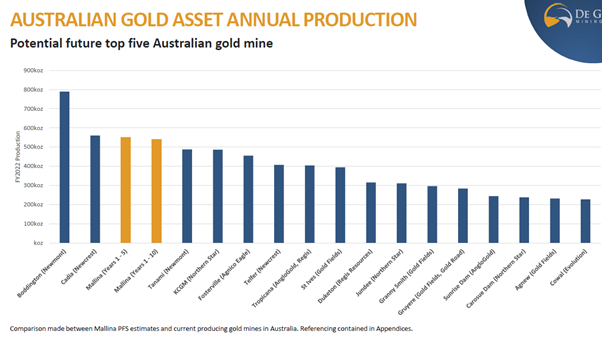

DeGrey (positive impact) released their pre-feasibility study for the Malina gold project.

The pre-feasibility study exceeded our expectations in several respects. Shares in the company ended the week 5% higher.

Firstly, the up-front capital costs of the project were below our expectations, despite the significant cost pressures that have been seen across the resources space.

Secondly, the project is expected to have a mine life that exceeds our initiation estimate by more than three years.

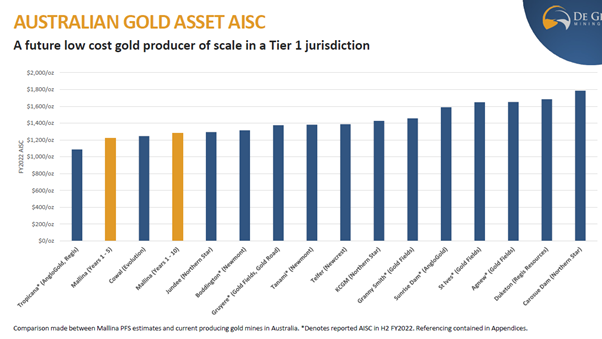

Thirdly, higher grades have meant operating costs (all in sustaining costs) are expected to lower than we anticipated.

In addition, the company elaborated on the considerable upside to the initial scoping study that was released.

This includes the potential to upgrade processing capacity through debottlenecking, underground mining of higher-grade resources, further conversion of resources to reserves and further regional exploration across De Grey’s considerable 1,500 square kilometre tenement package.

Above all else, the study re-enforces that the Malina gold project as a world-class tier 1 gold project, with significant upside.

The size and scale of the project is highlighted in the slides below.

The first shows that the project is expected to be the third largest in terms of annual production in Australia.

Source: De Grey Mining

The second shows that it is expected to be one of the lowest-cost operations in Australia.

Source: De Grey Mining

The next steps for the project include the application for relevant environmental approvals, completion of a definitive feasibility study (over the next 12 months), with construction expected to begin in mid-2023.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.