The Markets

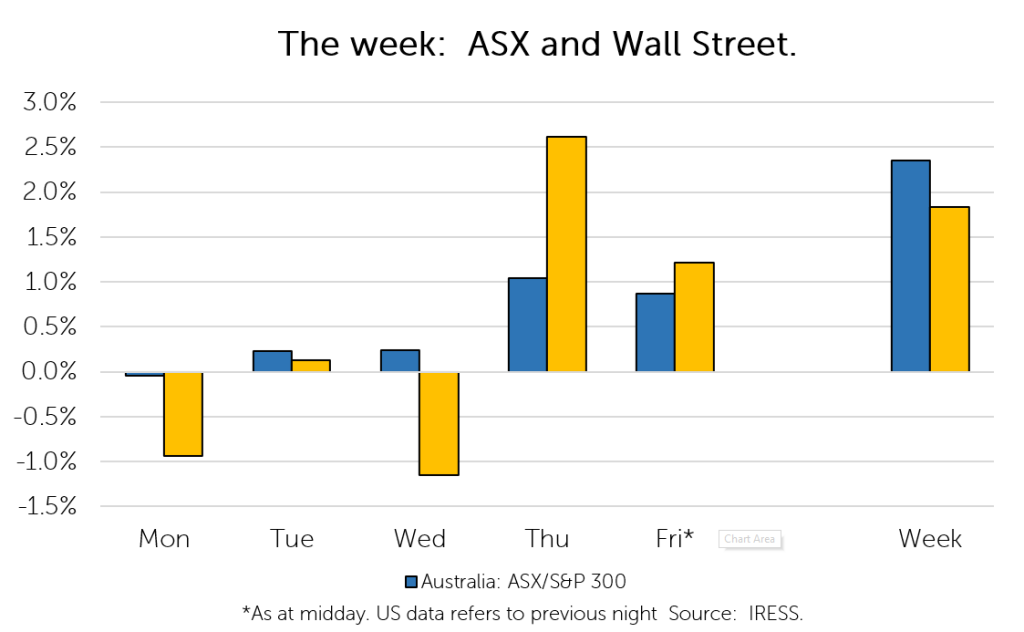

This week: ASX v Wall Street

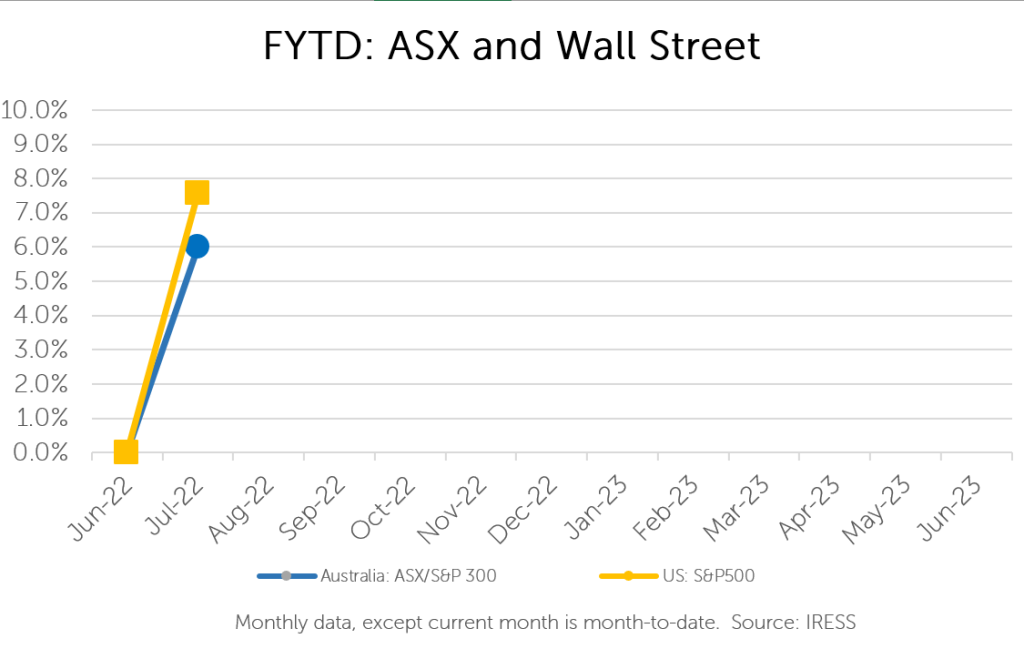

FYTD: ASX v Wall Street

It can be overwhelming: the sheer volume of news, data and opinions that get thrown at market participants daily.

Case in point, is this week’s cry of “technical recession” in the US. This, of course, ignores that the NBER’s (National Bureau of Economic Research) definition of a recession encompasses far more than just real GDP (such real income minus transfers, real spending, industrial production, and employment – which is white hot!).

We are currently experiencing a period where conditions are shifting rapidly. Synchronised easing (fiscal and monetary) has turned to synchronised tightening as central banks globally look to rein in inflation. And while there is nothing new under the sun, the pace and magnitude of interest rate rises over this year have been without precedent. This had led to considerable uncertainty and volatility.

A symptom of this is the curious leap in markets we saw on Thursday. The night before, Jerome Powell (chairman of the US Federal Reserve) intimated that interest rates may be at neutral (the theoretical interest rate where the economy is at “equilibrium” – where savings and investments are balanced, full employment is maintained, and inflation is stable).

We take a look at the market’s reaction in the context of What Matters for equity markets in the longer term.

Fingers in the air

So, what do the next six months hold?

Market strategists, an exalted cadre of truth-seers, will look to answer this question with what seems like complete certitude (armed with a plethora of charts and anecdotes). Talking heads will weave together narratives so wonderfully simple, yet compelling, that you can’t help but “believe”. And those most credentialled (at least on paper) will continually make erroneous forecasts, which are accepted with the same level of authority and wilful ignorance regardless.

It is the latter that caused markets to jolt ahead on Thursday. July’s meeting of the Federal Reserve (US) saw it lift interest rates by what is a now “standard” 0.75%. Yet, US markets leapt forward on the news: the S&P500 gaining 2.6%, Dow 1.4%, and Nasdaq a whopping 4.0%.

Why? The Federal Reserve’s chairman intimated that there was scope to reduce interest rate rises in the future, acknowledged that rate rises had the potential to impact growth and postulated that the US economy was “not yet in a recession”. And so, people became more optimistic that inflation will be quashed, with minimal collateral damage, and we will return to the pre-COVID normal.

Mind you, this is the same Federal Reserve that not too long-ago assured market participants that they were not even “thinking about thinking about” raising interest rates. Yet here we are 2.25% later.

And thus, we find ourselves in a curious position where markets are moving wildly from data point to data point, speech to speech and editorial to editorial. In parsing a plethora of data or equivocal speeches from central bankers it is often a case of do you hear “yanny or laurel”?

This volatility can be unnerving. However, as we have long flagged, it is to be expected when we are yet to settle on what the “new normal” of economic conditions is.

For the preceding two decades we have lived in a world of “secular stagnation” – where growth has been relatively muted and inflation below desirable levels. Now we are not so sure.

And while much of the noise we are inundated with looks toward what will happen in the next 6-12 months (will central banks engineer a recession?) it is really the longer-term economic environment that will determine returns for equity investors.

What matters: questions to be answered

The key questions remain to be: where will interest rates land? Will inflation die with a whimper or continue to be an uninvited guest? How will both variables be managed in a world where a significant amount of debt has been accumulated?

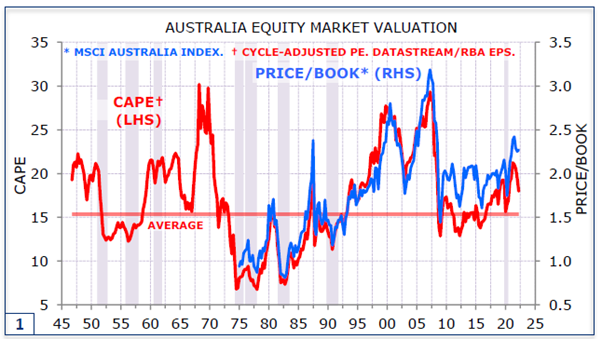

Breaking this down into more familiar terms, we can think of this in terms of the price-to-earnings ratio for markets globally.

As readers are aware, in recent years low-interest rates have caused market price-to-earnings ratios to hover far above their historical averages. In a world where interest rates and inflation are low, investors are willing to pay more for earnings.

Yet the current environment of rising interest rates and inflation has challenged this. Should inflation remain high, as well as interest rates, investors may pay less for the same earnings. We have already seen the market begin to price this in last year as it fell.

Source: Minack Advisors

The second component, of course, is earnings. Earnings of late have been supported by unprecedented fiscal and monetary stimulus that kept economies off life support. Yet as this stimulus is taken away, we will begin to see what proportion of earnings were a “sugar hit” and what proportion are durable. The impact of rising inflation on earnings further complicates this – for some cases positively (for instance energy producers) and for some negatively (for instance, retailers in the US).

The question of “earnings” will begin to be answered over the coming months as we enter profit reporting season here in Australia which will help inform the longer-term outlook (particularly, how companies fare in an inflationary environment).

Source: Minack Advisors

We see that it is more likely that we are entering a new paradigm than a return to “lower for longer”. Yet, while the economic backdrop remains important our approach is to focus on individual companies.

Rather than focusing on earnings overall for the market (which may be higher or lower), we are focused on leadership changes within the market. That is, it is highly likely some companies will fare better in this new paradigm, or have stronger earnings, than others. We look to own the former and avoid the latter.

In this future, nimble, active management will be crucial in protecting and growing wealth.

Company News

Paragon Care (positive impact) provided an update to its earnings guidance for the full year.

The company expects to achieve an underlying EBITDA of approximately $30m, which is broadly in line with our expectations.

However, the statutory result is expected to be around $24 million and includes one-off costs, a write-down of inventory and some other adjustments.

As clients are aware, Paragon Care has recently appointed Mark Hooper (former CEO of Sigma Healthcare) as CEO of the company.

We suspect that the company’s share price weakness of late has been related to consternation around potential accounting adjustments for the financial year, a practice that is not uncommon for incoming CEOs.

This was put to a halt with the announcement, with shares in the company ended 10% higher for the week.

***

Ioneer (positive impact) announced that it has signed a binding Lithium offtake agreement with Ford Motor Company.

As a reminder, Ioneer is developing a lithium boron project at Rhyolite Ridge (Nevada, USA) which will become a key strategic source of battery materials in the future.

The offtake agreement secures Ford as a customer for 7,000 tonnes per annum of lithium carbonate (approximately 1/3 of production) for 5 years from 2025, bringing total contracted offtakes to 2/3 of production, with a further offtake agreement expected in the near term.

These offtake agreements are crucial in that they help underpin financing for the project (the company is currently in talks with the US Department of Energy for funding), which is expected to have a 26-year mine life.

Managing director Bernard Rowe spoke to the announcement in a recent podcast which can be accessed here.

***

Sandfire (positive impact) released an update for the June quarter.

The metric in focus was costs – particularly at the recently acquired MATSA mine (located on the Iberian Peninsula – in the South-West of Spain, close to the border with Portugal).

Costs at the mine continue to be higher than at the time of acquisition. The company has been impacted by inflationary pressures including higher electricity prices. These are to be addressed in the longer term through moderation of electricity prices in Spain (which we are already beginning to see) as well as the development of solar farms in close proximity to MATSA’s mines.

As we have mentioned before, costs can also move around significantly with a polymetallic despot – as the other metals present (aside from copper, the primary metal produced) serve as “credits” and are thought of as negative costs. The pricing and quantity of these metals relative to copper present can therefore lead to cost per pound of copper moving around significantly. Pleasingly, the company has provided a clear quarter-by-quarter production profile, which should assist the market in better forecasting costs.

Management has consistently re-iterated that the mine complex has been underexplored and under-developed, with down plunge drilling at Aguas Teñidas and Magdalena (the two higher grade mines) to be performed next year.

The company also anticipates capital expenditure at its soon-to-be-built T3 mine (Botswana) to be higher (in the order of 10%), although we note this level of inflation is far less than we have seen across resource producers more broadly (30-50%).

Sandfire continues to be an essential exposure to copper prices in the portfolio, which we believe will have to move to reflect recent cost pressures given future levels of demand.

***

IGO (positive impact) released an update for the June quarter

IGO updated the market with operational metrics for the 4th Qtr this week, and the result was universally received with positivity, and the stock price finished more than 10% up for the week.

Lithium (spodumene) production was higher than expected at their world-class Greenbushes mine (250km south of Perth). Pricing achieved for the critical battery mineral was also higher than expected.

Nickel production from Nova (located in the Fraser Range 160km Norseman at the West Australian end of the Nullarbor Plain) also beat expectations in a year in which nickel prices have reached stunning highs.

In addition, the company reported first production of lithium hydroxide from the JV chemical plant recently completed in Kwinana WA (in the southern suburbs of Perth).

Standing back from the company at a higher level it is truly clear that management has succeeded in developing a remarkably high-quality stable of critical battery minerals, all of which are performing weel, have a range of great partners and have been developed in safe stable jurisdications.

***

Aurelia Metals (positive impact) released an update for the June quarter

Aurelia’s update was positive in the sense that it put a floor on what has been poor share price performance as of late. The stock price responded accordingly.

The company has been challenged by a number of operational issues, amongst which COVID-related absenteeism and labor shortages was one. Issues at Hera (lodging of an underground loader, requirement of rehabilitation of ground support leading to reduced stoping) led to a reduction in mined and processed tonnes and lower grade. Likewise continued issues with the central shaft at Peak, as well as a stope blast misfire, resulted in a reduction of processed tonnes and a reduction in grade.

Dargues was a bright spot, with greater throughput and higher grades resulting in strong cash flow generation.

The current inflationary environment is causing the company to reconsider its development of Federation (located near Hera), with the processing of mined ore through Peak or Hera now being considered as lower capital intensity options. The company will provide a further update to its plans as part of its maiden resource estimate in late August.

We still consider the company’s share price as vastly undervaluing Federation, its existing projects and other growth options in the region.

***

We welcome an old friend back into portfolios: Mineral Resources.

As a reminder, Mineral Resources is a provider of mining services from “pit to port”, including mining, haulage, trucking and processing. It is also a part owner of several joint ventures – which gives it exposure to revenue from commodities including iron ore.

Recently, we have gained a greater appreciation for the company’s lithium assets. Mineral Resources two of the world’s largest hard rock lithium mines: Mt Marion and Wodgina through its joint venture with global player Albemarle.

We see greater potential in downstream refining (turning lithium rock or spodumene into lithium carbonate and lithium hydroxide) which is heavily concentrated in China, as companies look to diversify their supply chains from end to end.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.