The world doesn’t slow for Christmas. See below for some examples of the wheels of the weird world still turning. Enjoy Wry & Dry: a cynical and irreverent blend of politics, economics and life.

Qatar. Why are we not surprised?

As Readers count the sleeps to the 2022 Football World Cup Final on Sunday (Argentina v. France, for those living under a rock), more than a few questions are still being asked as to why Qatar was awarded the gig. Netflix subscribers might find more truth in its documentary “FIFA Uncovered” than they did in “Harry and Meghan.”

The Qatari government, of course, pleaded that it was awarded the event on its merits. Those merits included, of course, strong local participation in football, a history of the game being played and a successful national team.

And now, last Monday, the Qatari government denied any knowledge of another scandal. This one involves European Members of Parliament (MEPs). The allegations are, essentially, that lots of dosh was paid to these MEPs and others to grease wheels to ensure that Qataris could travel to the EU visa-free.

One of the three MEPs who has been charged has a history of lauding Qatar and its human rights record.1 Her husband has already confessed to managing cash payments.

[By the way, on 30 November, the Qatari official in charge of delivering the World Cup Final said that around 400 people died during the construction work. Actually, not quite. “The estimate is around 400, ” he said. “Between 400 and 500, I don’t have the exact number. That’s something that is being discussed.”

So, they will discuss what the figure should be, not state what it actually is?

And the 400-500 figure is only a little more than the previous figure the government gave. That number was three deaths. By next week the “discussion” might arrive at 1,000+ deaths.]

Is it forgivable that Qatar, essentially a third world country with non-western traditions, be expected to meet first-world western standards in so many ways?

1 Separately, MEPS are not allowed to accept gifts worth more than €150 and have to declare any gifts as well as attendance at events organised by third parties. There are 705 MEPs; the gifts’ registry has only 39 entries from eight MEPS since 2020.

Price caps I

“Nothing is more permanent than a temporary government program,” opined former US president Ronald Reagan.

So, Readers should wait for the expiry of Albo’s ‘one year’ energy price cap. It will be a long wait.

The three-legged stool that Albo’s government legislated yesterday was: (A) the $1.5 billion handout via energy distributors to low-and middle-income earners and small businesses; (B) wholesale gas to be sold at a ‘reasonable price’; and (C) a one-year price cap ($12-a-gigajoule) on uncontracted gas. A simplification of each leg is:

A is an almost forgivable device to reduce CPI (and thereby its flow-on to higher interest rates), reduce the increase in energy prices for the voter, and show that the government “is doing something.”

B is an absurd and vague sop that gives enormous and undefined power that will inhibit gas exploration.

C is unarguably, the worst kind of intervention in a free-market, especially in the resource industry, as it ignores all of the costs and risks in exploration and development.

Price caps II

And there is a ‘D & E’: The Death and Expensive hand of the Greens, which had Albo over a barrel in the Senate.

Albo was desperate to get the legislation passed before the sensible world woke up to how awful it really was. And the Greens milked it for all it was worth: an un-costed promise to encourage households to switch from gas to electric appliances and heaters. Really?

The ‘encouragement’ seemed to be based on concessional loans, but no details were given.

Forgive Wry & Dry for asking: what the **** is this government doing? Handouts to they-the-voter is a tool of government used by all sides of government since Roman emperors first lavished bread and circuses to keep the plebian mob happy.

But price caps and government directives (as distinct from regulation)? Really? Did Albo and his team consider the longer-term effect on energy prices and taxation revenue? And the precedent being set? Nuh.

Don’t worry about changing the date of Australia Day, change the name of Australia. To which name? Consider, paraphrasing an AFR correspondent:

“The government demonises an industry; then complains about shortages of its own making; then moves to control the industry; then subsidises the end-user.

The outcome: government expenditure increases, taxation revenue falls, productivity falls, economic activity falls, and reliance on government increases. The government then moves on to another industry.”

Which name? Austrezuela.

Cartoon note: Excise cap is one on the amount of tax the ATO can take from putting an ‘excise’ on a product, e.g. fuel. The ATO wouldn’t want a cap on any tax.

“The lamps are going out…”

…all over the UK2.

The land of hope and glory seems without hope and without glory. As soon as HM The Queen shuffled off this mortal coil3, the country drains down the gurgler.

Not only are its peoples freezing in the coldest December since the last cold December, but critical economic workers have downed tools. As only the British unions can do in unison. Those on strike include nurses, postal workers, train drivers, and public servants.

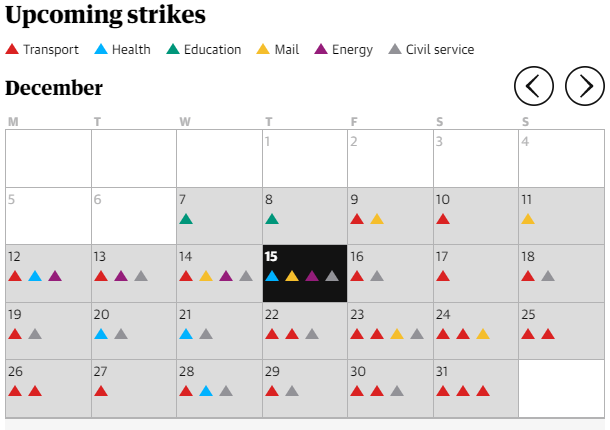

It’s got to the stage where newspapers are publishing a strike calendar. See below for a most helpful update from one of the UK tabloids:

There are not any strikes called, so far, for New Year’s Day.

Whew.

2 “The lamps are going out all over Europe, we shall not see them lit again in our lifetime.” British Foreign Secretary, Sir Edward Grey on the eve of the First World War.

3 Shakespeare: Hamlet

Unions: Trade

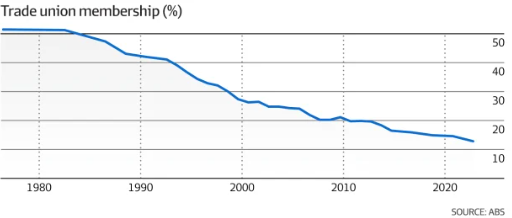

Wry & Dry has finally joined the dots as to why Albo’s recent multi-employer bargaining legislation was so, err, one-sided.

Yesterday’s AFR produced the following chart.

This is another piece of masterful government. If one’s greatest source of advocates and dosh is having membership problems, the least one can do is give them a hand to improve membership.

Unions: Company Directors‘

Meanwhile, the Australian Institute of Company Directors4, the union for, obviously, company directors, has egg-on-face.

Firstly, consider that its Corporate Governance Committee is the guardian of directors’ upright behaviour.

Then consider the irony that its chairman, Sally Pitkin, in her role as a director of Star Entertainment Group, has this week been charged by ASIC (the corporate regulator) with alleged breaches of her duties under section 180 of the Corporations Act. Ten other current and former directors of Star have similarly been charged.

The charges relate to money laundering and other illegal activity at Star’s casinos.

Ms. Pitkin has since resigned her AICD role. Wry & Dry wonders why the AICD didn’t take earlier action against her after she resigned in May from Star in the wake of the judicial inquiry into it? It was left up to her to give herself the DCM. But only after ASIC’s action.

Quis custodiet ipsos custodes?5

Just askin’.

4 Disclosure: Wry & Dry is a member of AICD.

5 Who guards the guardians?

Mood of the meeting

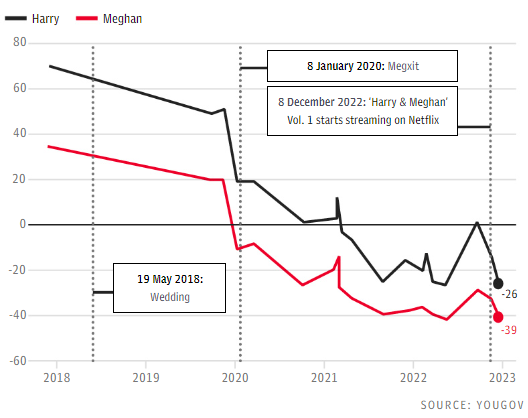

The following chart of UK public opinion is presented without comment. Other than it was released yesterday.

“Thinking about the royal family, for each of the following please say whether you have a positive or negative opinion of them? (Net score of two members shown).”

It remains to be seen what the chart will show next week.

Cartoon note: It’s all about propaganda. Lord Haw Haw was the nickname given to William Joyce, who broadcast Nazi propaganda during the Second World War. Joyce spoke with an upper-class English accent. And tee-hee is the “The really cute laugh a girl does when she feels like being cute.” Readers can join the dots.

A foreseeable problem not foreseen

Readers with an interest in investment markets will know that as part of central banks’ plans to save the world from covid, those banks undertook ‘quantitative easing’. In other words, they bought bonds (i.e. government IOUs that pay a rate of interest) in an effort to keep interest rates low.

The European Central Bank, having bought some €5 trillion of bonds, is going to start to ‘unwind’ its portfolio next year. ‘Unwind’ is code for either sell those bonds or allow them to mature and not refinance them.

So, some €300 billion of eurozone government debt will hit the market in 2023. This will be on top of the additional €500 billion required to cover the cost of governments shielding businesses and households from high energy prices.

The outcome is going to be higher interest rates. And big problems for governments that already are having trouble paying their bills.

Expect a mini-eurozone crisis in 2023, as, to pick a name, any name, Italy is going to be back in the news. For the wrong reasons.

Newbie Italian Prime Minister, the populist and nationalist Giorgia Meloni, is going to have her mettle tested.

Hats off

Albo’s government has peeled back its moderate skin to show a more radical side. Albo promised to be a different kind of ALP leader, and this week he has shown that he is not.

But there are signs of hope.

After the abject and neglectful shambles of Liberal Foreign Affairs and Defence ministers, it is relief to see, respectively, Jenny Wong and Richard Marles showing both competence and adeptness.

Wry & Dry dips his lid.

In particular, Ms. Wong has shown her woeful predecessors the importance of initiative, humility and gravitas at home and abroad.

Meanwhile, former foreign minister Julie Bishop continues to show a desire for self-publicity surpassed only by that of Princess Princess.

ZEV?

Chairman Dan’s government will now provide a $3,000 subsidy for purchasers of ‘Zero Emissions (sic) Vehicles’.

The latter presumably also applies to vehicles powered by wind6, as well as those powered by electricity.

Of course, the term ZEV is misleading, if referring to EVs (electric vehicles). If the electricity source is, say, coal, then it ain’t a ZEV. On average, 50% of Victoria’s electricity is fossil-fuel sourced.

They-the-Victorian-Taxpayer is thus providing a subsidy to support Chairman Dan’s farrago of renewable energy policies, rather than actually helping the environment.

6 Although Wry & Dry has yet to see a car with a sail.

Tsar Vlad 1 Sleepy Joe 0

Sleepy Joe has been handsomely out-negotiated.

The prisoner swap of a US basketball star for a Russian arms’ dealer didn’t seem a fair trade. And it wasn’t.

Sleepy Joe tried to get the deal done before the US mid-term elections in early November. So, his ‘rescue’ of Britney Griner would be as big to they-the-voter-who-could-be-bothered-to-vote as the smuggling from Tehran of the six American escaped hostages from the occupied US consulate in 1979.7 And, yee haw, even more votes would go the way of the Democrats.

So, he was happy with almost any swap so as to get Ms. Griner released. And Tsar Vlad knew he had Sleepy Joe by the gonads. And he delayed and raised the stakes.

The Russian arms’ dealer, Viktor Bout, also known as the ‘Merchant of Death’, had served 14 of his 25 years’ sentence. He is a nasty, nasty man.

7 Made into one of the great movies: Argo.

Day trading

What rate of return did the average individual US day-trader achieve in 2022, noting that the S&P500 returned about -17%? Was it:

a. 0%;

b. -10%;

c. -20%; or

d. -30%.

Close, but no cigar. The correct answer is d; minus 30%.

Bloomberg reports that “the share portfolio of the average day-trader in the US is down 30% in 2022, compared to the S&P’s 17% loss.” JP Morgan says that it’s actually worse than that: minus 38%.

This year, thousands of individual day traders will have finally realised that they are not better investors than Warren Buffett.

Sadly, thousands more will have not.

Extensive consultation

When the federal minister for superannuation8 announced changes to superannuation fund disclosure laws he was said to have had “extensive and ongoing consultation with stakeholders.” Readers might imagine many superannuation groups would be consulted.

Err, no. In fact, only one industry group was consulted: Industry Super Australia, the umbrella group for 11 industry superannuation funds.

The problem is that the minister wants to remove the existing requirement for all public superannuation funds to disclose certain payments, such as political donations and payments to members. Industry funds have furiously campaigned against the requirement, for reasons that Wry & Dry cannot fathom.

The changes hit a snag in the Senate, with some cross benchers delaying debate until next year.

The minister has been a passionate advocate for ‘progressive’ causes. But his push for the introduction of ideological issues in a financial ministry that compromises corporate governance undermines good work of his boss, the Treasurer.

8 Financial Services Minister Stephen Jones.

I had a dream

The muzzle on the average Russian is getting ridiculous. A Mr. Ivan Losev, from Chita in Eastern Siberia, has been fined 30,000 roubles (about AUD700) for “discrediting” his country’s army.

He had a dream about being conscripted, sent to the front and meeting Ukrainian President Zelensky.

The trouble started when he decided to describe his dream in a now deleted Instagram post.

Russia’s Federal Security Service found out. And was not amused. He was charged and fined by Chita’s Central District Court.

Wry & Dry might be forgiven for pondering what other dreams has he posted on Instagram?

Snippets from all over

1. Loan defaults up

The [US] Federal Reserve’s most aggressive pace of interest rate increases in decades is set to trigger a surge of defaults over the next two years in the $1.4tn market for risky corporate loans. (Financial Times)

Wry & Dry comments: The current default rate is 1.6%, and is expected to rise to 11.3% in 2024. This would be the highest since 2009 – post GFC. History doesn’t repeat, it rhymes.

2. A woman defined

The Cambridge Dictionary has been criticised for updating its definition of woman to include anyone who “identifies as female” regardless of their sex at birth. (The Times)

Wry & Dry comments: Wry & Dry now identifies as an elite athlete.

3. Iran gets personal

In the second public execution in just a few days, a 23-year-old protester was hanged from a construction crane at dawn in the city of Mashhad, galvanizing a new wave of demonstrations. (New York Times)

Wry & Dry comments: The lads in Tehran don’t seem to be reading the mood of the meeting.

4. It’s Russian. Err, no. It’s Chinese.

In December, 600 vehicles will roll off the production lines of the former Renault factory in Moscow. (Le Monde)

Wry & Dry comments: The car will be a ‘Moskvich 3’, a car brand from the Soviet era, upgraded. But that’s the end of the Russian-ness. Somehow, the car is identical to the Sehol X4 compact crossover made by China’s JAC.

5. EV sales drop

Demand for electric cars in the UK is falling for the first time since the pandemic as soaring electricity costs make the vehicles increasingly costly to run. (UK Telegraph)

Wry & Dry comments: The UK government has withdrawn subsidies for EVs, and EVs will be subject to road tax from 2025, as are ICE cars, currently.

6. Bitcoin blues

Investors are pulling record levels of bitcoin from crypto exchanges as the collapse of Sam Bankman-Fried’s FTX stirs fears over the safety of their assets. (Financial Times)

Wry & Dry comments: In November, punters investors withdrew over 91,000 bitcoin from centralised exchanges, a monthly record.

Data

- European Central Bank and Bank of England raised interest rates by 0.5% to the highest in 14 years.

- Australia’s unemployment rate was steady at 3.4%, a 48-year low.

- US Federal Reserve raised interest rates by 0.5%, to 4.25- 4.5%.

- US inflation eased more than expected in November, to 7.1%.

- Real wages in the UK have fallen 3% in 2022, the largest fall since 1977.

And, to soothe your troubled mind…

“I don’t think I will be arrested.”

- Sam Bankman-Fried, founder and former CEO of crypto-currency exchange company FTX, and a variety of linked companies, the value of which fell from US$32 billion to zero in two days.

He was arrested four hours later. Time to bring in the tailor to measure up his orange jump suit, with plenty of spares.

PS The comments in Wry & Dry do not necessarily reflect those of First Samuel, its Directors or Associates.

PPS Wry & Dry and Investment Matters need a break! Hence, the final 2022 and bumper editions will be on Thursday 22 December. The first edition for 2023 will be on Friday 3 February.

Cheers!

Anthony Starkins