The Markets

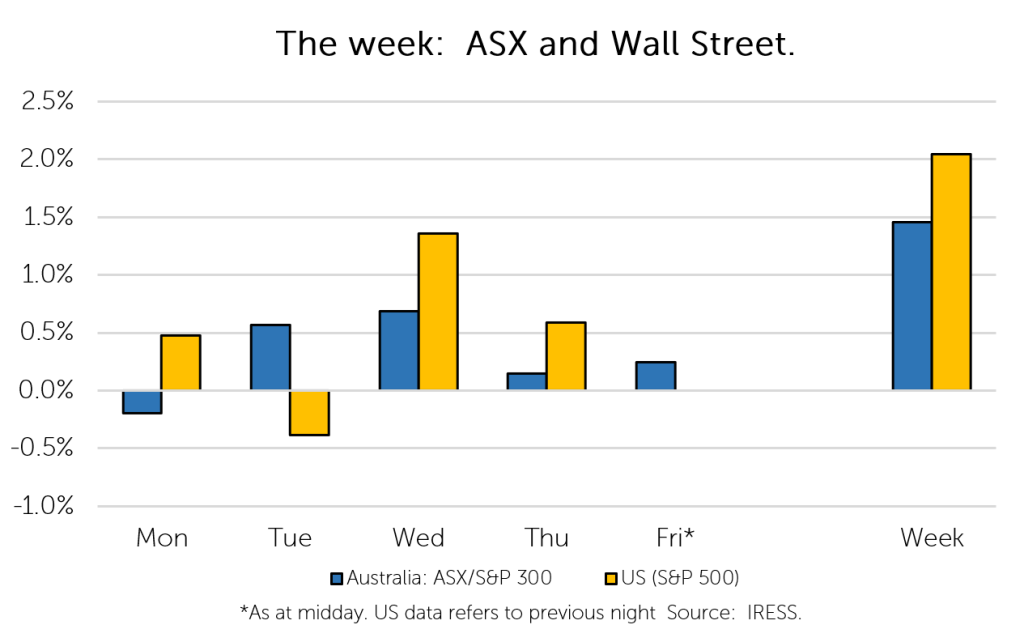

This week: ASX v Wall Street

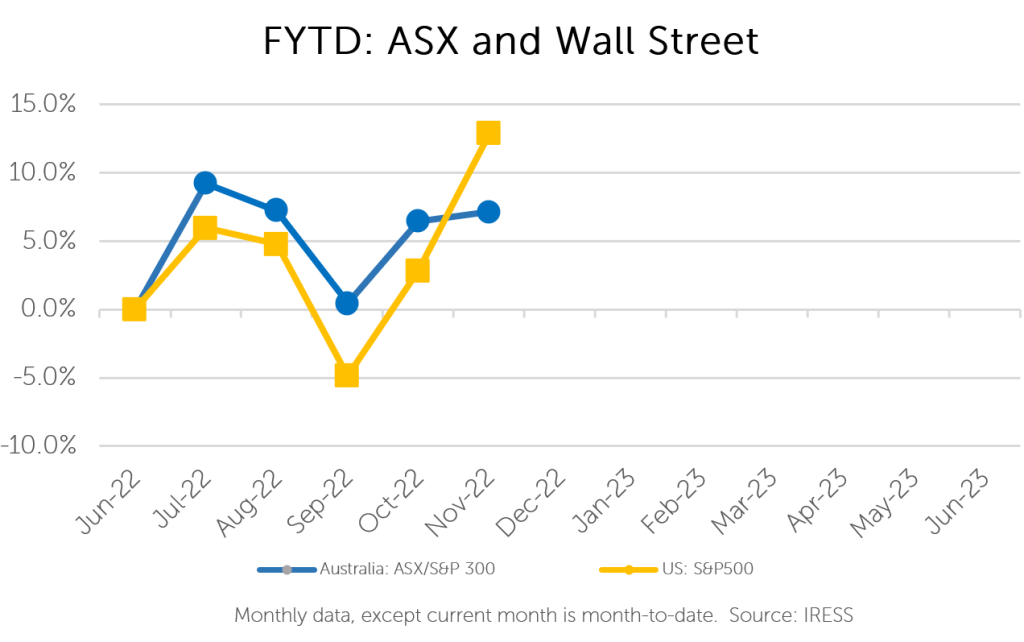

FYTD: ASX v Wall Street

Good decision, good outcome? Not necessarily.

Poker players would term this type of thinking “resulting”.

Resulting is the tendency to equate the quality of your decisions to the outcomes, particularly over a short time horizon.

The poker players amongst us have no doubt experienced the frustration of playing a hand near perfectly, only to suck out (lose badly) to a single stroke of bad luck – a highly improbable card appearing on the river (the last card dealt).

But what about the alternative history? The one where your pocket aces weren’t beaten by pocket kings on the river.

Surely in these alternative histories, your optimal playing would have been rewarded. It can’t all just be luck? Can it?

A bad beat is not necessarily a function of a bad decision. And in the long term, it is the quality of the decision-making that counts.

Think poker, not chess

There is a reason why professional poker players win tournaments at rates well higher than simple probabilities would imply. This man would certainly tell you so.

His name is Phil Helmuth Jr., considered by many (which unashamedly includes himself) as one of the best poker players of all time. His resume boasts live tournament winnings which exceed US $23,000,000.

So, what makes Phil a great poker player? Don’t let the gold glasses and matching headphones fool you – he is a master decision-maker.

Why? Well, poker is not chess. In chess, all pieces are on the board and all possible moves can be seen. There is always an optimal strategy or play for any given board.

Poker is in fact a little more complex (despite carrying less prestige). It requires decision-making given incomplete information and uncertainty – this is where the skill lies.

This includes an assessment of your opponent’s range (hands they are likely to hold), the probability that they have a given hand, but also a decision of how much to bet, when to bet and the potential payoff.

And don’t forget the all-important qualitative factors: What mood is your opponent in (tilted, calm, hungry, slightly intoxicated)? What type of player are they (aggressive, conservative)? How have they played similar hands in the past? Are they telling the truth, or bluffing?

And worst of all, at the end of the hand you often don’t get to see your opponents’ cards to know if you made the right decision – win or lose!

This has some important parallels to investing.

Parallels to investing

We are reluctant to compare investing to any form of gambling. However, given only two choices, we would say it is more like poker than chess. At a basic level, it involves making decisions with incomplete information.

Of course, much like hole cards in poker, there are factors we are able to easily quantify and observe (the Rumsfeldian known, knowns). For instance: How much did the company earn last year? What has their return on invested capital been?

However, the more pertinent factors are those we know are important but are difficult to quantify (known unknowns). For instance: What will the long-term growth rate of their industry be? How long will they be able to maintain their margins? What new products or verticals could they enter in the future and how will this impact its value?

Perhaps the most perilous of all are the factors we are unaware of and therefore have not considered (unknown unknowns). A pandemic the scale of which we have not seen in 100 years has provided a very real reminder of this.

And, much like poker, it’s not all about the numbers, odds or statistics. There is a large qualitative aspect to investing – financial statements will only tell you so much. Is management honest? Do they have the knowledge and ability to identify and capitalise on new trends and opportunities in their industry? Do they behave pro-cyclically (i.e. acquiring and investing during the good times) or counter-cyclically (i.e. acquiring companies when they are they cheap)? Does the company have a culture which fosters value creation, and inclusion and pursues broader social imperatives?

There often isn’t a single answer to these questions, but rather a range of possibilities.

And much like the poker player – the quality of decisions made may not always be reflected in the outcome.

Resulting and long-term results

In 2017, several days into a disastrous performance at the summer poker festival, Phil Helmuth stormed out of the Rio casino and into the car park. “I have lost every day since I have been in Vegas” he exclaimed. He promptly lit his shoes on fire (which for the record were also golden) to “get the spirits out”.

Even the self-proclaimed “best in the world”, who has a demonstrated history of quality decision-making and made over $23 million in his professional poker career can fall into superstition and “resulting”. He went on to finish the year with $1.13 million in winnings.

A great poker player is ultimately defined by the quality of their decisions and decision-making processes, not necessarily their performance in the short term.

It is this process and sound decision-making that pays dividends over the long term.

Company News

We are now well into what many refer to as “AGM season”.

While quarterly reporting of profits is the norm in the US, here in Australia there is no formal requirement for listed companies to report profits on a quarterly basis.

However, as we have mentioned before, there are several events on investors’ calendars that serve as a “mini” profit reporting period, including the Macquarie Australia Conference in May.

The “AGM season” is one of these. November is when companies typically hold their annual general meetings. While items on the agenda typically include the re-election of directors and adoption of remuneration reports, companies also take the opportunity to update the market on how profits are tracking in FY-23 (before they report their half-year results in February).

A number of portfolio companies have provided updates over the past few weeks, which we share below:

***

Emeco (negative impact) provided an update regarding trading in FY-23.

The company has been impacted by the wet weather on the east coast which has resulted in lower operating utilization of its equipment (i.e. equipment out on hire has been used less).

Pleasingly, the company has seen higher utilization of its equipment in the West, as labor constraints have eased (readers will remember that the company expected its customers to shift towards “double shift” operations as labor constraints eased).

In addition, Pit N Portal (the company’s underground mining services division) has renegotiated a key contract with miner Mincor, which we estimate should bring a material future uplift in profitability (assuming the contract was renegotiated in line with the businesses’ other contracts).

Disappointingly, the company does not expect to recover $32m owed by a longstanding customer which has also impacted earnings in the first half.

The short of it is that the business expects to earn between $245 and $260m in operating profit (EBITDA) for the financial year (FY-22: $250m).

Emeco had not explicitly guided towards a profit figure for this financial year, however, this figure was below the market’s expectation of around $280m.

While we were disappointed that FY-23 has not proved to be a “clean” year in which Emeco can demonstrate its cash generation ability, we see that as this is proven up the company will be recognized as undervalued.

***

EarlyPay (positive impact) provided guidance for profits in FY-23.

There were several moving parts to the update, with a change of the guard as newly appointed CEO (and former COO) James Beeson comes on board.

These included a more conservative approach to provisioning, a change in tax rate and some headwinds from a temporary mismatch between interest earned on factoring facilities and interest paid.

The net result is that the company expects that net profit before tax will be broadly in line with last year.

We were incredibly pleased with the company’s intended revision to the presentation of its results. This will effectively present its profits much like a bank would present theirs – highlighting the underlying economics of the business and the relative value on offer.

What was surprising was the share price reaction on the day, (although we do note the company’s share price can often be moved by a small volume of shares – as low as $100,000) with the company now trading at an 8% dividend yield, fully franked.

***

QBE (positive impact) provided an update that helped alleviate investors’ short-term concerns.

The company has, unsurprisingly, been impacted by the wet weather we have seen of late.

It has flagged that it estimates that claims due to recent wet weather will exceed its catastrophe claim insurance, which will reduce its earnings.

As always, catastrophe claims (often weather-related) are a volatile factor that impacts insurer profitability.

However, there were some positive trends with regard to underlying performance.

In line with our investment thesis, QBE continues to benefit from a higher interest rate environment, with the yield on its investment portfolio rising to 3.9% and has also had strong premium growth at or above loss trends, indicating underlying insurance writing profitability is improving.

The stock ended the week more than 4% higher and provided a good example of why seemingly “bad news” can be good news, that is, share prices impute company performance relative to expectations.

***

Sandfire (positive impact) announced it will be raising capital through an entitlement offer.

The company is looking to raise A$200m via a 1 for 8.8 entitlement offer at a price of $4.30 per share (a 10% discount to its previous closing price).

We elected to take up these rights on clients’ behalves (adding approximately 11% to their current position).

Proceeds will be used to strengthen the company’s balance sheet.

We have recently seen pressure on Sandfire’s share price during a period where we could describe the company as “asset rich” but “cash flow poor”, as DeGrussa winds down and MATSA experiences elevated costs.

The raise will help alleviate some concerns about upcoming debt payments due as part of the debt package used to fund the acquisition of the MATSA complex.

Subsequent to the announcement we have seen a significant bounce in the company’s share price (+10%).

We note that with a take-over of Oz Minerals imminent, Sandfire stands to be the only pure copper producer of scale that remains listed on the ASX, which is likely to have several investors (and potential suitors) running their rulers over the company.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.