Last month, BHP announced the long over-due consolidation of its 20-year-old dual listed (UK and Australian stock exchanges) structure (DLC).

As a result of this change, Index Investors (i.e. those whose portfolio matches a share index in its weight of each security) are likely to have 9% of their portfolios in BHP (Source: UBS).

Index Investing is touted as a low-cost, ‘diversified’ way of ‘owning the market’: matching the returns of a market that can be tough to beat.

BHP’s change prompted us to reflect on a fundamental truth about index investing.

The Index Portfolio is a simple beast, with only one strict mandate: track the market. This is the only rule of Index Investing.

Investors often forget that this ‘single minded’ focus may lead to perverse outcomes. We explore this below.

What is Index Investing?

Please note we will use the term “Index Investing” to describe funds that seek to match the performance of a market capitalisation weighted index, for example, the ASX200. While there are funds that seek to track indices constructed in a different manner, market capitalisation weighted index funds are by far the most popular (in terms of dollars invested).

Index funds are a relatively recent financial innovation.

In theory, these funds achieve an exposure similar to owning the constituents of an index, in an amount proportional to their size (i.e., market capitalisation).

For instance, as Commonwealth Bank is the largest company in the ASX200 (approximately 9% of the index), an index fund would seek to have an exposure of the same size.

In contrast to active managers (such as First Samuel) that aim to outperform the market, indexing is a form of passive management that seeks to match the return of the overall market at the lowest cost.

| Active Management | Index Investing | |

| Objectives | Aims to outperform an index | Tracks an index |

| Beliefs | Investors can be irrational, make mistakes and inefficiencies can be exploited | The market is ‘efficient’. Information is rapidly processed and incorporated in the price of all securities. |

| Technique | Stock picking and portfolio construction | Replicates the composition of an index |

| Decision maker | The fund manager | The index |

A ‘diversified’ exposure?

A frequently touted benefit of Index Investing is the ability to achieve a broad, diversified exposure. The theory being: what could be more diversified than owning a little bit of everything?

But this again, is a fundamental misunderstanding of the #1 (and only) rule of Index Investing: track the market. This does not always lead to a diversified portfolio.

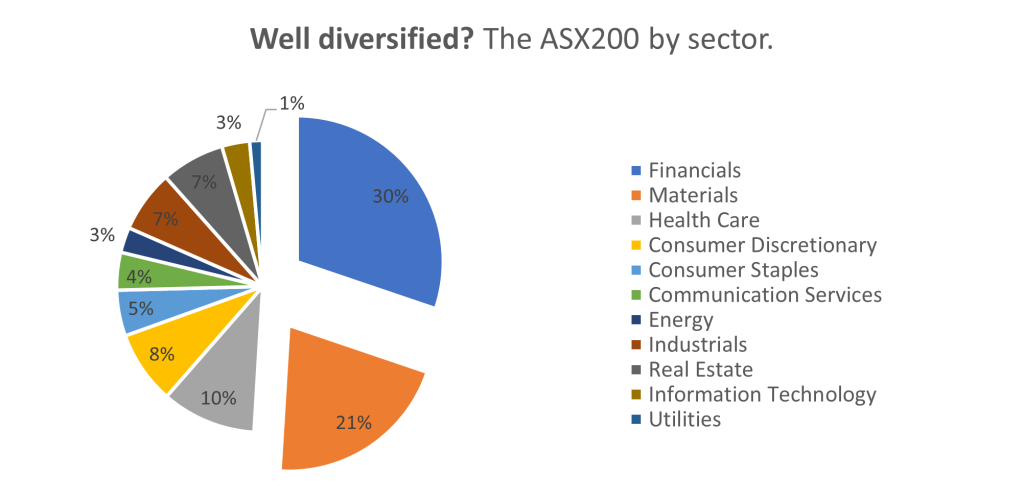

The Australian market provides a good example of this.

The ASX200 exhibits a large amount of concentration, relative to markets overseas:

Above: Largest 10 Companies’ share of total exchange by country interms of market capitalisation (2018) Source: S&P Capital IQ

While everyone knows our market is “bank” and “miner” heavy – it really hits home when looking at the top 5 holdings in the Index, and just how much of the Index they constitute.

After the BHP merger, the ASX200is set to become more concentrated: the 5 largest holdings in ASX are expected to constitute 33% of the Index (Source: UBS).

Furthermore, 3 of these holdings (the banks) are competitors in the same industry i.e., highly correlated!

| Holding | Weight |

| Commonwealth Bank of Australia | 9% |

| BHP Group | 9% |

| CSL Limited | 7% |

| Westpac | 4% |

| National Australia Bank | 4% |

| Total | 33% |

Source: UBS, First Samuel

The overall exposure of the Index (prospective) by sector tells a similar story of concentration, with more than 50% of the index belonging to the Financials (banks) and Materials (commodities) sectors:

Source: UBS, First Samuel

In contrast to Index Investing, diversification is an explicit aim for active managers: something that they can influence and vary depending on market conditions.

This includes downside protection and the ability to hold cash (noting the index always holds a nil amount of cash).

Owning ‘the market’ – always a sure bet?

Another question that should be asked– is owning the market a ‘sure bet’?

Put another way, are there times when by owning ‘the market’ you own a large number of expensive stocks?

The Index Investor assumes that securities are accurately and efficiently priced.

While prices are generally correct, even a casual observer can see that the market at times deviates significantly from fundamentals.

This is another peril of Index investing: it does not avoid owning expensive securities during these times or buying into manias and fads.

An example of this at its extreme is the TSE 300 Index (the Canadian stock market index).

In July of 2000, at the high of the tech bubble, one stock (Nortel Networks) accounted for 35% of the index! The stock has subsequently gone on to lose 88% of its market capitalisation.

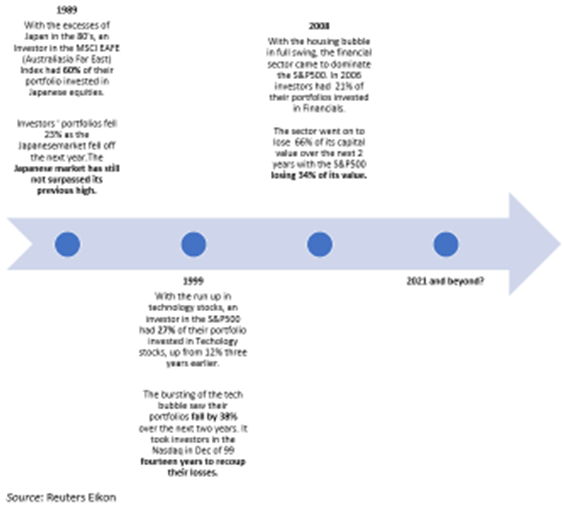

To illustrate this further, we will take a trip down memory lane to times when owning the market was not a ‘sure bet’.

Source: Reuters Eikon

The bottom line is Index Investing relies on market prices being sensible. That is, no judgement is made about price – you are invested regardless of price.

This means being fully invested when the market is both cheap and expensive. This can also mean owning certain individual companies regardless of their price (as the Nortel example illustrates).

Index Investors own the market during manias as well as wearing the downside during subsequent crashes.

Of course, Investing is about the ‘long term’ – and over the past 50 years the experience is that ‘markets always rebound’.

However, as we can see above, in some instances it has taken investors decades to recoup their losses. In the case of the Nasdaq in 2000 – it took 11 years!

Although difficult to do, at least Active Managers have the ability to recognise and respond to periods of change ahead of the broader market– the Index does not.

The takeaway

While Index Investing is conceptually sound, it comes with its perils.

Fundamentally an Index Investor is beholden to ‘tracking the market’.

This can make sense at times.

But at other times (when prices are high) or in particular types of markets (those that become highly concentrated) it can significantly deviate from a sound idea to a riskier proposition.

Caveat emptor!

As always, should you wish to further discuss investments, please call your Private Client Adviser.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.