The Markets

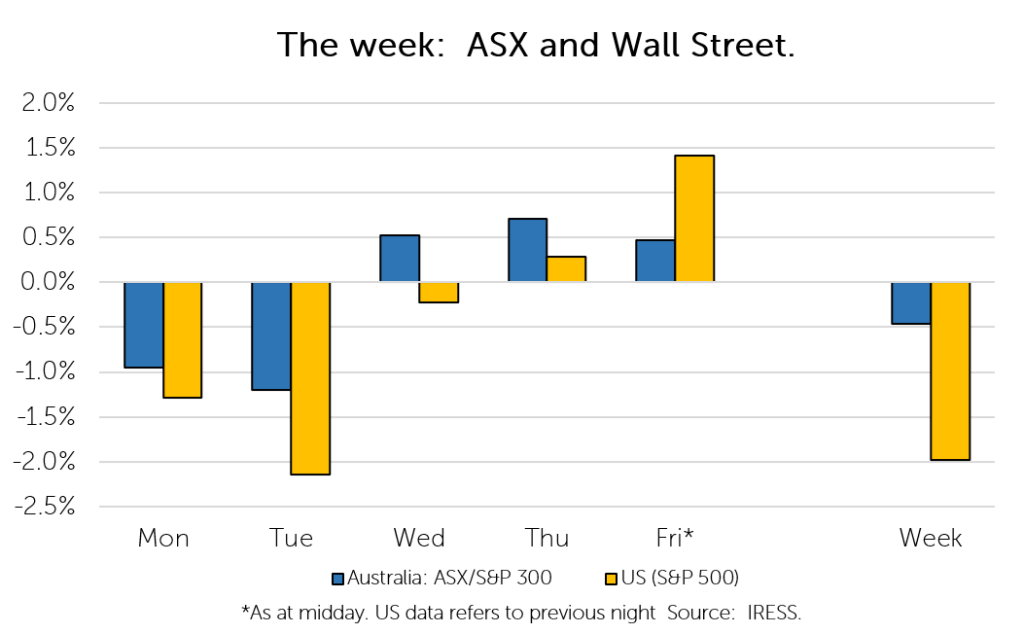

This week: ASX v Wall Street

FYTD: ASX v Wall Street

The last week of company profit reports proved to be as busy as the week that preceded it.

In the interest of brevity, we will once again keep our pre-amble short.

Our scorecard for this year’s profit reporting season will be provided next week along with the general themes and trends that we have observed across the listed corporate landscape.

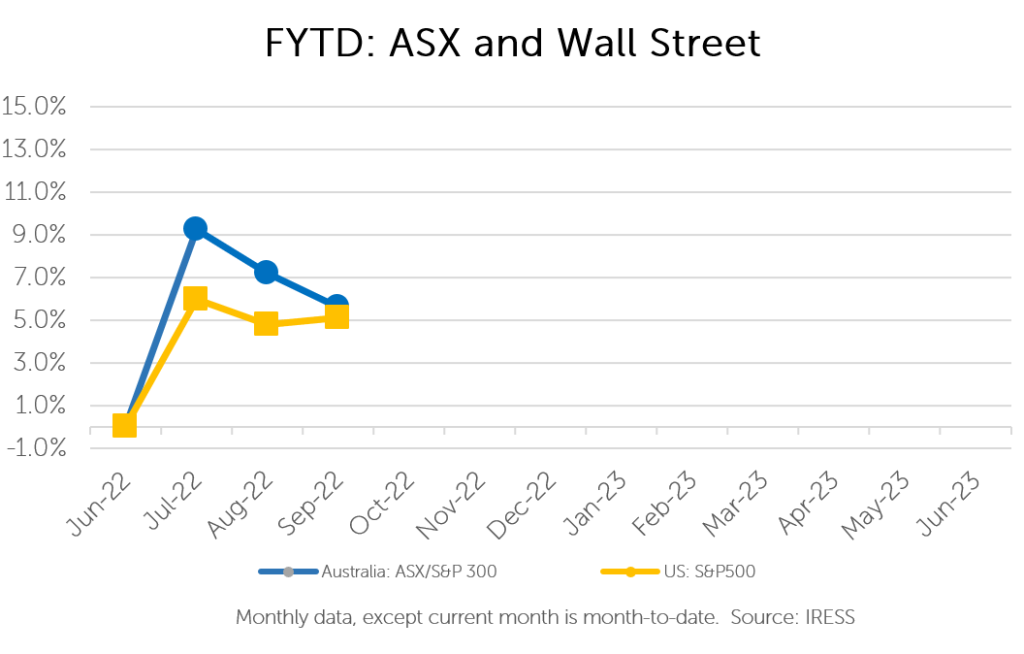

Company Description

Costa Group Holdings Limited produces, packs, and markets fruits and vegetables to food retailers. It operates through three segments: Produce, Costa Farms and Logistics, and International. The company offers mushrooms, raspberries, strawberries, blackberries, tomatoes, citrus, avocados, bananas, grapes, and other fruits. It also provides chilled logistics warehousing and services, as well as wholesale and marketing services. In addition, the company engages in licensing blueberry varieties in Australia, the Americas, China, Africa, and internationally; and berry farming activities in Morocco and China.

The result (shares returned +1.8% on the day of announcement):

Costa released its result for the first half of FY-22 (it reports on a calendar year basis).

The company delivered an operating profit in line with its guidance range of 10-15% profit growth. Costa’s domestic Produce division drove the earnings growth benefitting from favourable pricing (Mushroom, Tomato & Berries) as well as significantly improved production from its Vertical Farming products (with Tomato & Mushroom volumes +20%).

The company’s international division delivered strong earnings growth, with strong revenue growth in China (+34%) more than offsetting a weaker result from Morocco Berry production, which was impacted by lower European Berry prices as a result of sales drifting later into the European berry season.

Citrus (mandarins and oranges) production has been impacted by rain which is likely to result in lower quality produce in the second half of the year. Much of the market’s focus is on this, and higher costs (energy and labour) in the short term, which are prevalent industry-wide.

However, Costa is Australia’s leading commercial-scale farm operator. We are confident that these costs are ultimately passed on in the short term, while in the longer-term Costa will continue to benefit from advancements in genetics, productivity and protected cropping, which position it with a cost and quality advantage over smaller-scale producers.

A snapshot of Costa’s operations and Brands

Source: Costa Group

Company Description

Hastings Technology Metals Limited engages in the exploration and development of rare earth deposits in Australia. It holds 100% interest in the Yangibana rare earths project comprising fifteen tenements/exploration licenses, one prospecting license, and six mining leases covering approximately 590 square kilometers located in the Gascoyne region of Western Australia.

The announcement (shares returned +15% on the day of announcement):

We were pleasantly surprised on Friday, with Hastings announcing a monumental deal that represents a welcome strategic pivot.

The company announced it will acquire a 22.1% stake in Neo, a Toronto Stock Exchange-listed downstream producer of rare earths and related products.

Neo manufactures advanced materials, including magnets, that incorporate rare earth and rare metal elements. It owns a number of production facilities globally, but critically, the only commercial rare earth separation and rare metals facility in Europe.

We see the acquisition as a step along the way to Hastings becoming a fully integrated producer of rare earths (from mine to magnet). This has increasing relevance in a world looking to diversify supply chains away from potential sources of geopolitical risk – enhancing the value of a company that has a fully integrated supply chain independent of processing in China.

We will cover this in more depth for the monthly CIO video for August.

Company Description

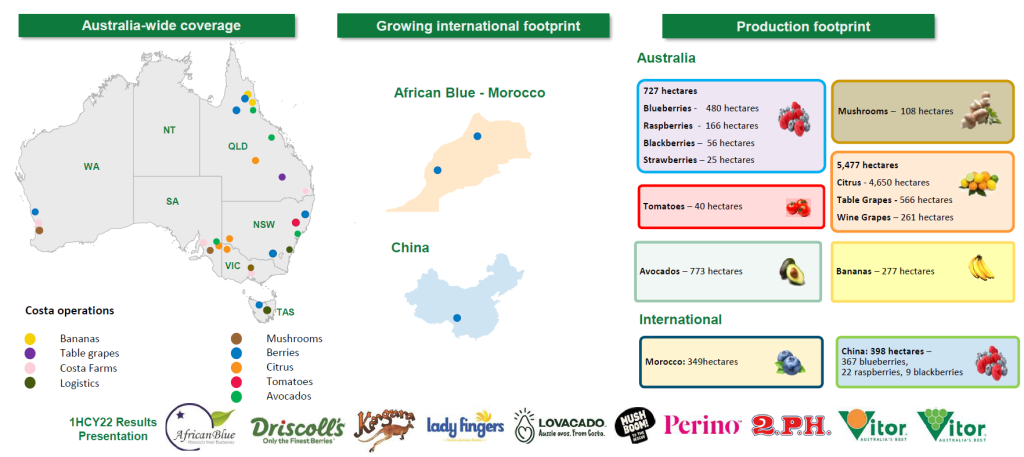

PointsBet Holdings Limited provides sports, racing, and iGaming betting products and services through its cloud-based technology platform in Australia and the United States.

The result (shares returned -11.9% on the day of announcement):

It was a busy year for PointsBet, with the launch of iGaming and product launches across four US states. This included key populous states such as New York and Pennsylvania. The share price will likely remain quite volatile, and we reflect the risk with a small position in client portfolios.

Revenue from sports wagering in the US (Net Win) grew by 83%, with the company ending the year with a 3.7% share of betting in the states it operates in.

The critical value that a business such as PointsBet can add in the US market is their experience in Australia. This has provided the company with real-world experience developing products, apps, and marketing campaigns. Their app is consistently highly rated amongst early adopters in the US market.

The company’s Australian business also continues to grow strongly, seeing a 29% growth in revenue in FY-22.

A long runway for growth: PointsBet’s presence in North America

Source: Pointsbet

Company Description

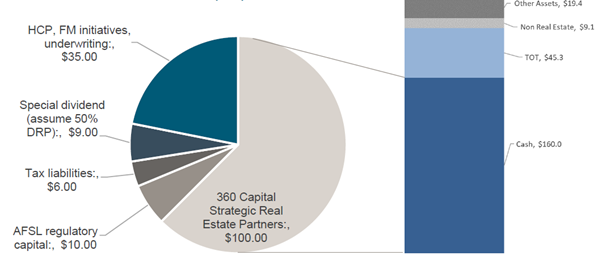

360 Capital Group is an ASX-listed, investment and funds management group, focused on strategic and active investment management of property assets.

The result (shares returned +9.5% on the day of announcement):

360 Capital has a strong history of making strategic acquisitions of partial or full stakes in undervalued property assets, or fund managers and realising value from them.

The most recent example of this is its stake in Irongate Group (a listed property manager) to Charter Hall from which it achieved a 34% return.

After a brief change in strategic direction, the company will now focus solely on property assets and is planning on realising its non-property-related holdings.

In returning to a property-focused manager, 360 will look to partner with capital providers to set up the Strategic Real Estate Partners fund, where it will solely focus on strategic real estate investments. We see that it is doing this at an opportune time, given the dislocation in listed and unlisted property assets in a higher interest rate environment.

The group paid a full franked dividend of 6 cents per share for FY-22 (a 7% dividend yield at its current share price) and will pay an 8 cent per share fully franked special dividend in FY-23 (a 10% dividend yield at its current share price), in addition to approximately 80% of its operating earnings.

360 currently holds a significant amount of cash, which it expects to deploy over the next 12-18 months

Source: 360 Capital Group

Company Description

Perpetual Limited is a publicly owned investment manager. The firm offers a range of financial products and services in Australia. The company provides funds management, portfolio management, financial planning, trustee, responsible entity and compliance services, executor services, investment administration and custody services, and mortgage processing services.

The result (shares returned -9.5% on the day of announcement):

Following on from last week’s commentary around Perpetual’s proposed acquisition of Pendal, we move to look at its result for FY-22.

Perpetual consists of a fund management business (spanning international markets – PAMI and the Australian market – PAMA) as well as a wealth management business (Perpetual Private) and corporate trust business (Perpetual Corporate Trust).

Fund management

The company’s international fund management business (PAMI) has significantly grown its assets under management in recent years, through the acquisition of US-based “value” manager Barrow Hanley and specialist ESG (ethical investing) firm Trillium.

This has complemented what was a strong Australian-based investment platform (PAMA).

When judging the performance of fund management businesses investors often look at three things: investment performance, fund flows (the value of the cash that flows in or out of the underlying funds – are more funds being placed with the manager?) and the fee mix of these flows (are funds flowing into higher fee or lower fee strategies).

Perpetual’s underlying funds have demonstrated sound investment performance relative to their benchmarks, with 79% of all funds outperforming their benchmarks over a 3-year period.

This has seen fund flows improve significantly in Australia and strong inflows for Trillium. We did not expect an immediate turnaround in performance in Barrow Hanley’s flows, which have been weaker, however, flows into its Global Equities strategy have been strong.

Wealth management and Corporate Trust

Perpetual Private and Perpetual Corporate Trust are strong complements to the company’s fund management business. They provide stable, less market-related revenues and have consistently grown their funds under administration over a number of years.

Perpetual Corporate Trust grow its operating earnings by 12% in FY-23 while Perpetual Private grew its earnings by 20% (aided by the recent acquisition of Jacaranda Financial Planning).

They continue to be core parts of the business that serve as growth engines and diversifiers.

The share price reaction

Perpetual’s share price sold off heavily on the day of its profit announcement. We suspect this centred around its acquisition of Pendal. The revised offer price for Pendal has put greater weight on Perpetual being able to extract synergies from the combined company, which it estimates at approximately $60m per annum.

However, the company has a demonstrated history of successfully integrating acquisitions and in our view remains cheap even if these synergies are not fully achieved. Furthermore, there are clear benefits to be gained from the consolidation of fund managers with efficiencies in distribution, diversification of revenue, support functions and technology investment.

Company Description

Ramsay Health Care Limited owns and operates hospitals. The company also offers health care services to public and private patients. It operates facilities in approximately 532 locations in the Asia Pacific, the United Kingdom, France, and Nordics.

The result (shares returned -3.3% on the day of announcement):

Ramsay’s operations globally continue to be impacted by COVID-related costs, disruptions and staff shortages.

The company’s FY-22 operating profit (EBIT) of A$876mn included COVID-19-related impacts of A$320mn (disruptions to activity levels, additional costs).

Activity levels have continued to be impacted into FY23, with inflationary pressures also impacting margins, however, the company expects a gradual recovery and easing of these pressures into FY24.

The market’s primary focus was on the update provided on the KKR consortium’s proposal to acquire the company.

As a reminder, the original proposal was a cash offer of $88 per Ramsay share. However, this offer has been withdrawn due to a failure to come to a due diligence agreement for Ramsay Santé – the company’s French hospital operator, which is a competitor to a hospital operator in KKR’s portfolio.

The consortium has posed an alternative proposal which is not contingent on receiving non-public information on Ramsay Santé. This includes a combination of a cash payment and shares in Ramsay Sante, which has an implied value of $85 per share (vs the consortium’s original offer of $88 per share in cash).

The board has stated that it considers this offer “meaningfully inferior”, and we anticipate a revised offer will be required to get the deal across the line.

However, clients have still benefited from the original proposal. This has been through the sale of a large portion of their position at prices meaningfully higher than the current share price, at a time when the original $88 per share offer was in play.

Company Description

Aurelia is a gold and base metal producer with tenements located in the Cobar Basin (Orange, NSW) as well as the Lachlan Ford belt (60km southeast of Canberra).

The result (shares returned +1.9% on the day of announcement):

Aurelia provides quarterly updates on its activities, and thus there wasn’t much mystery around its FY-22 profit result.

The year was marred by challenges relating to labour availability, constrained mine volumes and operational challenges. However, we do not see that these disruptions have reduced the long run value of the company or the assets it has in the ground.

In terms of the outlook for FY-23, the company will provide its forecasts for next year pending an update on its new project (Federation) sometime this month.

The release of the definitive feasibility study for Federation will provide an update on its economics and, importantly, detail about how the project can leverage Aurelia’s existing infrastructure in the Cobar basin.

Company Description

Sandfire is one of the few large-scale ASX-listed copper producers. Its foundational mine Degrussa is located in Western Australia. It recently acquired MATSA, a large complex of mines on the Iberian Peninsula and holds a number of other growth projects.

The result (shares returned -3.6% on the day of announcement):

The detail provided in quarterly activity reports from miners generally means there aren’t many surprises in resource producers’ end-of-year reports. The focus, therefore, is generally on guidance for next year’s production and costs. In Sandfire’s case, this had already been provided.

What filled the gap was the release of the Definitive Feasibility Study for the Motheo project. As a reminder, the project is a medium-sized copper project based in the Kalahari copper belt in Botswana. The belt is thought to be a highly prospective region with exploration upside.

It has been a year since the last update on the Motheo project. What has transpired in between has been further definition of the resource and more work to gain greater confidence around the project’s economics.

What has also happened in between in cost inflation – lots of it. We have seen projects across the resource space with cost blowouts as high as 25-35% (sometimes more). It was therefore pleasing that the project’s costs have not escalated materially. The project is expected to have a value of around $805m, with production beginning late in the current financial year and upside available from further exploration.

The second focus was on dividends, or the lack of them. Sandfire announced it will pause its dividend and thereby not pay a final dividend for FY-22. While there is clear value in the distribution franking credits, as investors we are generally not too focused on dividends. In fact, in many cases we would rather the cash stay with companies, providing it can be invested at an acceptable rate of return.

And this is largely what Sandfire has done. It has paused its dividends to fund growth projects, including Motheo (as outlined above) and debt payments for the recently acquired MATSA complex. We consider this prudent while it is juggling the relative unknown of European power prices, a short-term factor that may be a drag on its profits in the near term.

We are willing to look through short-term factors to the long-term value the company is looking to create.

Company Description

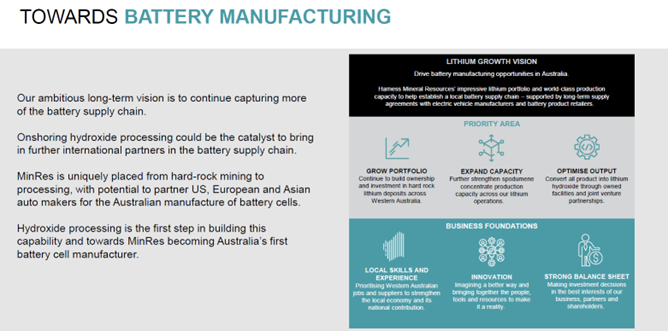

Mineral Resources is a provider of mining services from “pit to port”, including mining, haulage, trucking and processing. It also participates in several joint ventures – giving it direct exposure to revenue from commodity sales – primarily in iron ore and lithium.

The result (shares returned -3.6% on the day of announcement):

Much of Mineral Resources’ result was preannounced.

The company produced an operating profit of $1.0bn, compared to $1.9bn in the previous year, with higher volumes across mining services, iron ore and lithium production offset by a moderation in commodity prices (particularly iron ore), as well as shipping and rail costs.

FY-23 will be a year of strong investment for Mineral Resources, with the company expecting to invest A$2bn (vs A$800m in FY-22) as it develops its Onslow Iron development. The development, a joint venture between Mineral Resources and three steel producers will produce and ship between 30 and 35 million tonnes per annum of iron ore.

The company also gave additional clarity on the restructure of its Lithium joint venture with global chemicals producer Abermarle. Mineral Resources is set to lift their ownership stake at spodumene mine Wodgina to 50% (currently 40%), in exchange for a sell down in their stake of lithium hydroxide plant in Kemerton (from 40% to 15%). Alongside this, and a jointly funded JV will be established between the company and Albemarle to develop lithium hydroxide plants to convert Wodgina spodumene.

Which brings us to the highlight of the company’s presentation (in our view), in the form of the following slide:

Source: Mineral Resources

In a similar vein to Hastings, Mineral Resources has expressed a clear ambition to develop into a fully integrated producer of lithium, from mine to metal, to battery. We see the move from Australian resources producers to capture the resource full value chain as incredibly important, not only for the benefits it brings to the Australian economy and employment but for a global energy transition which is occurring at a time of heightened geopolitical instability.

Company Description

Lynas is the largest rare earths producer of scale outside of China, with a fully integrated supply chain – from ore to refined concentrate.

The result (shares returned +1.2% on the day of announcement):

Lynas achieved several milestones in FY-22 that have cemented it as one of the most significant rare earths producers outside of China.

These included (a) the awarding of a US$125m contract to build a heavy rare earths processing facility in the US (sponsored and funded by the US Department of Defense); (b) approval of its processing facility in Kalgoorlie which is currently 40% completed; and (c) progress in building its permanent disposal facility in Malaysia (d) the announcement of a A$500m project to expand capacity at Mt Weld.

The company reported free cash flow of A$270m in FY-22, in line with strong NdPr pricing and production which was ~8% higher (year on year).

While weaker NdPr prices in the short term may put Lynas’ share price under pressure, we continue to see Lynas as a beneficiary in an environment where governments are looking towards “friend-shoring” supply chains and are willing to commit public funds to do so.

Company Description

IGO is one of Australia’s premier battery metal producers, through assets such as Greenbushes (Lithium), Nova (Nickel and Cobalt) and assets recently acquired with its purchase of Western Areas (WSA).

The result (shares returned 3.8% on the day of announcement):

Clients purchased a position in IGO shortly after its transformative acquisition of a 49% stake in Tianqi Lithium.

The purchase gave IGO a stake in Greenbushes: one of the world’s largest, lowest cost and longest-life lithium mines as well as a key lithium refining asset in Kwinana.

This proved fortuitous, with strong Nickel, Cobalt and Lithium pricing resulting in pleasing cashflow over the year. IGO reported a record underlying operating profit (EBITDA) of A$717m for FY22 and a record free cash flow of A$574m from its Nova Operations for FY22.

During the year the company purchased 100% of Western Areas, which has significantly expanded the life of its Nickel portfolio, along with the acquisition of the Silver Knight deposit from the Creasy group.

A number of growth options continue to be explored, including work on the Silver Knight feasibility study and a scoping study at Mt Goode. A downstream nickel sulphate feasibility study is also progressing – with IGO looking to capture more of the nickel value chain. IGO also expects to release the Cosmos revised development plan in October 2022 (acquired as part of the Western Areas transaction).

The investment thesis for IGO is in line with that of Lynas. It owns strategic commodities, which are likely to experience demand many multiples of current levels in a world where supply chain sovereignty is becoming increasingly important.

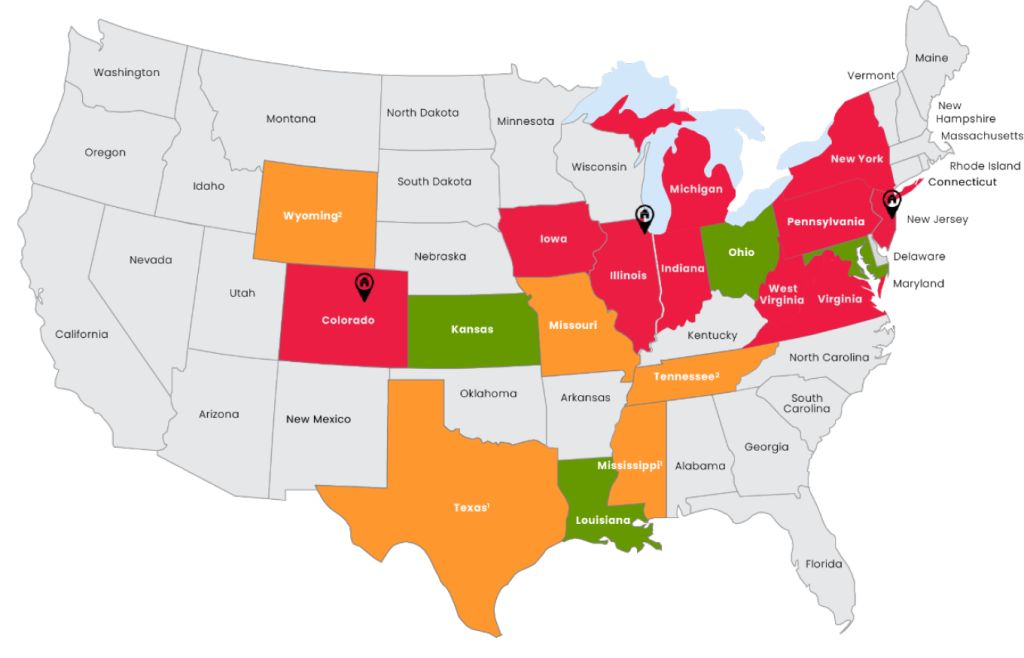

IGO recently acquired the Cosmos nickel deposit (below)

Source: IGO

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.