© 2024 First Samuel Limited

Q: Why do Australian petrol prices (‘at the pump’) sometimes rise faster than the price of oil?

A: The ‘crack spread’.

The term ‘crack spread’ tossed around at a cocktail party might make people feel uncomfortable. Some would consider that it might have something to do with the price of cocaine. Others, other things.

Well, it might. But for those in the energy industry it is a critical term. For oil refiners, it is essentially their profit margin.

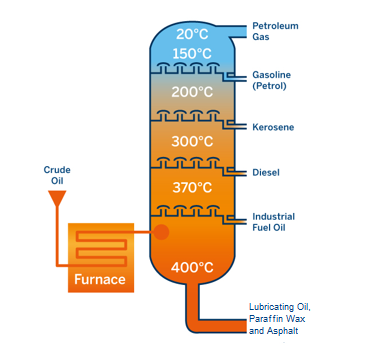

The crack spread is the difference between oil refiners’ input costs – i.e. the price of oil – and its output revenue: essentially the prices of up to seven products of oil refineries:

By the way, ‘cracking’ is the process of distillation. It is more complex than boiling oil and vapourising it: a modern steam cracking plant costs over one billion dollars.

So, the crack spread is why the price of petrol in Australia sometimes rises more quickly than the price of oil (in A$ terms).

How are petrol prices determined in Australia?

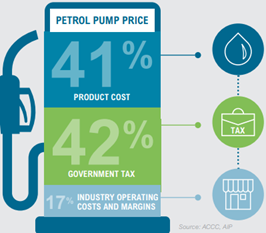

Not surprisingly, the principal component (about 42%) of the price of petrol at the pump in Australia is government taxes:

The government taxes are mainly fuel excise of $0.442 per litre, which is indexed to CPI twice a year1. In the recent budget, the excise was temporarily cut to $0.221 per litre for 6 months.

The ‘product cost’ (about 41%) is the A$ equivalent of the price of petrol, ex-refinery, in Singapore. This is called MOGAS95 (slang for motor gas to distinguish it from avgas – aviation fuel; 95 is 95 octane).

1. The excise is indexed to CPI as much of the government’s expenses (e.g. pensions) are indexed to CPI or similar price indices. If the index were not indexed, government expenses would rise faster than revenue, thereby widening the budget deficit and increasing government borrowing.

MOGAS95 and the crack spread

So, what determines the price of MOGAS95? This takes us back to the crack spread.

A refiner’s cost is essentially the price of oil in US$. But the prices of the products it sells are determined by a range of different factors e.g. seasonal petrol demand, proportion of petrol sold compared to other products – e.g. diesel, heavy oil, etc; economic growth, taxes, environmental regulations, refinery costs, etc.

A significant component overlaying these industrial costs is currency. For Australia, for example, the weaker the A$ the more expensive is MOGAS95 in A$ terms.

The difference between the price of oil (input) and the price of petrol (output i.e. MOGAS95) is all of those factors. That difference is called the crack spread (for petrol).

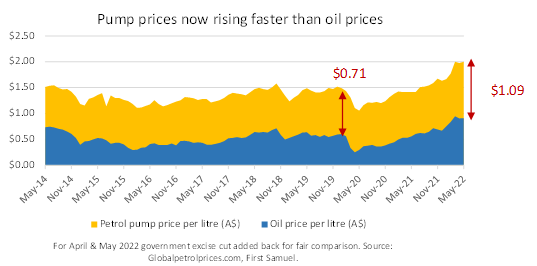

But because the crack spread changes, oftentimes the Australian pump price will rise faster than the corresponding change in the price of oil in A$.

The changing crack spread

Historically, the Australian crack spread averages about A$0.82 per litre (this includes the Australian government’s excise, GST and wholesalers’ and retailers’ costs). Since January 2019 it has risen from A$0.71 to $1.09. And in the last 4 months has leapt $0.18 leap, the highest for at least a decade.

Why is the price at the pump rising faster than the price of oil?

Firstly, demand for oil derivatives, especially petrol, has risen faster than oil prices because of economic growth (for now).

Secondly, globally, refinery capacity has been shrinking for some years, principally because of environmental regulations and a fear of ‘peak oil’ and declining demand (that reality is in the future).

Thirdly, the sanctioned withdrawal of Russian refineries from the market has reduced the global supply of refined product, especially petrol (or gasoline).

Summary

The crack spread has been widening for over two years, exacerbated recently by the invasion of Ukraine. Refiners are profiting comfortably.

Of course, increases in Australian petrol prices, ‘at the pump’ have been moderated by the budget cut in excise.

However, even before that cut, prices had risen higher than the increase in the price of oil would have suggested.

Should motorists care? Yes, the petrol price is currently about $0.25 per litre higher than it otherwise should be (excise cut notwithstanding). But there is nothing that can be done about it, until the factors outside of motorists’ control revert to the long-term normal.

In the meantime, motorists’ hopes are confined to a weaker oil price and/ or a stronger Australian dollar. It would be a brave person to predict either.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.