The Markets

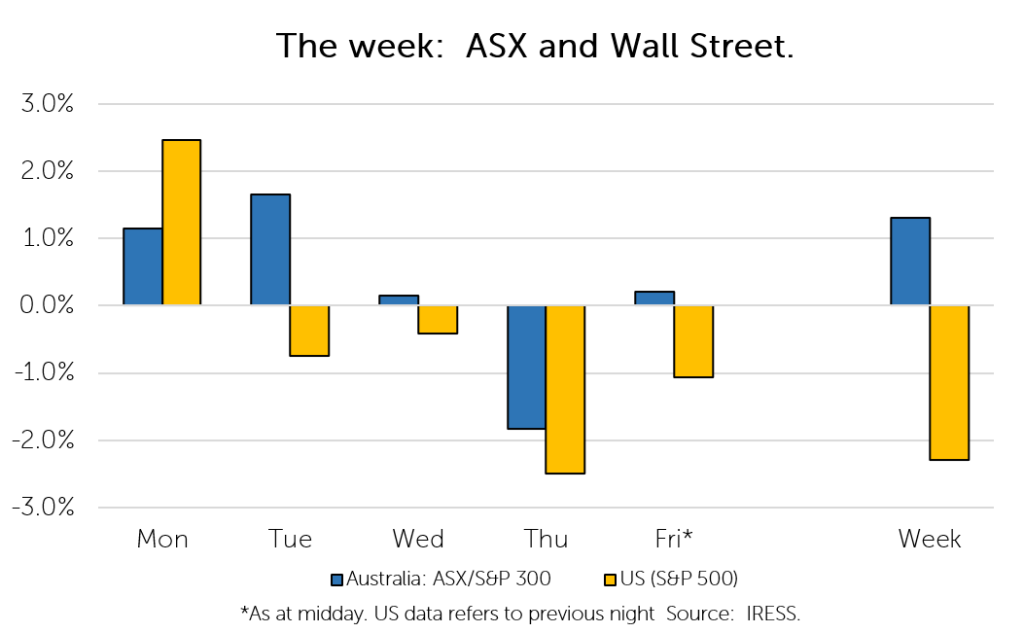

This week: ASX v Wall Street

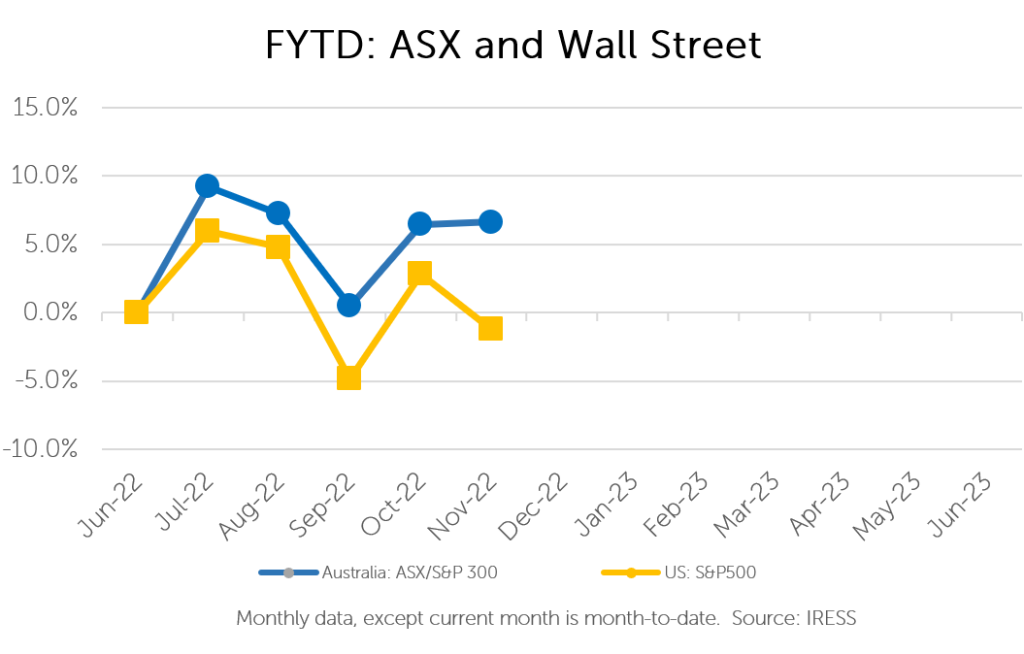

FYTD: ASX v Wall Street

Patience is becoming a scarcer resource in today’s market.

Our clients’ investment journey with us has often spanned more than a decade.

Why is this relevant?

While many managers are left juggling institutional capital whose time horizon can be measured in quarters, our longer-term journey with our clients allows them to enter patient, unique, positions.

First Samuel’s Alternatives sub-portfolio is where this is best highlighted.

Consisting of several unique investments spanning all things idiosyncratic and traversing the world of private equity and venture capital alike, the portfolio is a unique blend of proprietary deal flow, big ideas and above all patience.

We recently received good news about a long-standing position in this portfolio: HoldCo which has reinforced the benefit of being able to take a long-term view, particularly in today’s market.

HoldCo?

While the name may not ring a bell, the business no doubt does.

The company (Australasian Foods HoldCo) has served as the vehicle for Patties Foods, producer of Australian icons such as Four’n’Twenty and Nanna’s amongst others.

In 2016, private equity firm Pacific Equity Partners (PEP) took Patties (then listed on the ASX under the ticker PFL) private. Then shareholders, clients of First Samuel went along for the journey into private ownership.

The business has been under the grill over the past 6 years, being firmed up under private ownership.

And after much patience, it is now out of the oven, with some sauce on top for its owners.

Moulding an outcome

In the intervening period, the business underwent a significant transformation, including the sale and leaseback of two of its factories in Bairnsdale and bolting on of several adjacent businesses (including New Zealand group Leader Foods and gourmet pie business Boscastle).

Admittedly, during a period of private equity transformation, it can be difficult to see operational changes translate to value creation in a company’s statutory accounts. Complicating this can be various tax strategies employed by private equity companies such as thin capitalisation1.

“Don’t ask how the sausage is made” they say. Or in this case the meat pie.

How the business would eventually take shape was a relative unknown. So to, how long it would take for the investment to be realised, whether further capital would be required and how an exit will be facilitated.

However, the knowns were clear and perhaps of more consequence. We knew there would be an eventual realisation at some point and that the investment managers were aligned to produce an outcome that resulted in not only a satisfactory return, but a satisfactory return given the time taken to realisation.

And of course, we had a degree of comfort in the knowledge that over the past 6 years, Patties’ pies and pastries remained on shelves and continued to sell!

Out of the oven

Evidently, Australasian Foods HoldCo raised capital three times over the course of its ownership of the business.

There were rumblings about the sale of the business which began last year, with several news outlets reporting PEP was negotiating a sale.

The return of a portion of shareholder’s capital this year (approx. $0.24 per share) was another clear sign to us that the business was close to being sold.

While we have held the investment at what we consider a conservative valuation given by PEP, we have waited with bated breath for further news.

The eventual outcome exceeded our expectations.

The business has been sold to Asian private equity firm PAG – owner of Cravable brands, the company behind Red Rooster, Oporto, Chicken Treat and the Cordina Group.

Currently held at a value of $0.66 per share, we anticipate a payment will be made of between $1.18 and $1.24 per share over the coming four to five months.

In addition, there will be a final payment made of between $0.21-0.25 in the year post the completion of sale.

The total consideration expected to be paid for the business is therefore between $1.39-$1.49 per share, an uplift of 110% at the lower end of the range and a return that has exceeded the sub-portfolio’s objective.

Contrasting time horizons

The investment in HoldCo was the outcome of six years of patience.

However, a “six year” view, seems worlds apart from the time horizon of today’s market.

In our two-week absence, it hasn’t surprised us that we have seen more of the volatility we have become accustomed to this year, which has centred around the outlook for the next few years.

Ultimately, the same questions are being asked:

- The P/E question: where will interest rates and inflation land? What multiple of earnings investors should pay for the broader market?

- The earnings question: where will earnings land? A case of pick your mountaineering analogy. Are we at the peak, a cliff, or still halfway up the mountain?

As highlighted at our CIO events – these questions are highly relevant for those managers managing with a 6 or 12-month horizon and who are looking to buy and sell the market.

But they are less relevant for those managing with a longer time horizon in mind, looking to buy individual stocks for the next 3-5 years. This remains our focus.

The realisation of clients’ investment in Patties provides a good example of this.

Looking back at the last six years, we have seen several significant events and subsequent market gyrations. A walk down memory lane includes the election of Trump, tariff war, taper tantrum of 18, COVID sell-off of 2020 and the subsequent recovery.

Over a six-year period, these events came and went.

Ultimately, it is questionable how much they changed the business of selling pies and the positive outcome we are happy to share with clients today.

1 Thin capitalisation is where assets are purchased with a notionally high amount of debt and a relatively small amount of equity.

Company News

News you may have missed while we were away:

Perpetual (positive impact) received an unsolicited, non-binding indicative takeover offer this week.

The offer from a consortium comprising fellow fund manager Regal Partners and EQT Group (who have long been eyeing Perpetual’s Corporate Trust business) values the company at $30.00 per share – materially higher than the $24.50 per share it traded at just last week.

While the board has indicated that the offer “materially undervalues” the company, we see that the offer at the very least puts a more realistic price on the business, closer to what we see it is worth.

We expect that there will be further discussions to be had from here that may lead to a higher, revised offer.

***

Not to be outdone, Pushpay Holdings (positive impact) also received a takeover offer last week.

The offer, tendered by shareholders Sixth Street and BGH Capital equates to AU$1.23 per share, represents a 17% premium to the company’s previously traded price.

While the offer highlights some of the value we see in the company that the market did not recognise, we still see that a significant amount of value has been left on the table.

Nonetheless, the board has the company has entered in a scheme of implementation for the takeover which is subject to shareholder and court approval, with the board recommending shareholders vote in favour of the scheme.

***

Costa (neutral impact) has delivered mixed news over the last few weeks, which can be summarised as negative in the short term, but reinforcing the company’s value in the longer term.

In the short term, recent flooding in Victoria and New South Wales is expected to impact this year’s citrus harvest, leading to reduced crop quality and added costs (labour costs relating to harvesting, as well as higher costs for pest and disease control).

As a result, the company has revised its expected earnings downwards.

Investments in agriculture come with an expectation of weather-related volatility in earnings (both negative and positive). We note that structurally Costa has been moving towards a greater proportion of its produce coming from protected cropping.

While Costa’s share price has imputed this shorter-term hit to earnings, we don’t see that the company’s longer-term value has materially changed.

It appears that Paine Schwartz Partners, former private owners of the company, agree with us, acquiring a ~14% stake in the company last week at a 17% premium to its previously traded price.

While it is not entirely clear whether this will lead to an offer for the company in the near term, at a minimum the purchase reinforces that the gyration in Costa’s share price in response to recent events has been overdone.

***

Reliance Worldwide (negative impact) provided an update on trading for the first quarter of FY-23.

While pricing has remained robust (partly due to implemented price increases) the company has seen a slowing in sales volumes, particularly in North America.

This is on the back of double-digit growth in volumes over the past three years.

The company has also seen higher operating costs, resulting from a mix of lower volumes and higher expenses.

The update has been compounded by the backdrop of a slowing US housing market, given a rising rate environment. The company has subsequently looked to re-invigorate its cost-out program.

We are more confident than the market is in the resilience of Reliance’s sales moving forward, given its weighting to repair and maintenance, value proposition to retailers and end users alike and ultimately its pricing power.

***

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.