© 2024 First Samuel Limited

The Federal Government announced in March changes to the taxation of superannuation. The Department of Treasury has commenced the process for implementing these changes. The New taxes on superannuation, if implemented, will reduce the tax effectiveness of superannuation as an investment vehicle for members with higher balances.

Recent Developments

In March, the government announced its intention to introduce a tax on individuals whose total superannuation member balance were in excess of $3 million. Treasury has now provided for public consultation, the draft legislation and accompanying Explanatory Memorandum.

Who is taxed?

Individuals with superannuation member balances over a $3 million threshold will be subject to an additional tax.

What is the rate of additional tax?

15%

What is the basis?

The portion of ‘earnings’ of any balance that exceeds the $3 million threshold.

What are ‘earnings?’

The increase in the member’s account from 30 June in one year to 30 June in the succeeding year, ignoring contributions and withdrawals. This clearly means that unrealised capital gains are taxed.

When does the new tax commence?

1 July 2025.

Will the $3m threshold be indexed?

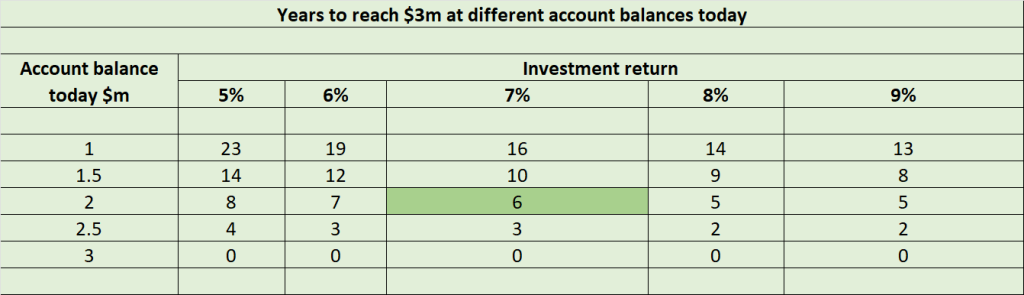

No. So, assuming no withdrawals or contributions, a balance of say $2m today, returning an average of 7% p.a. would be subject to the additional tax in just 6 years (see dark green box, below).

Examples based on a range of current balances and rates of return are shown below. The $3m threshold may be closer than you think!

What if investments cause negative ‘earnings?’

They will be carried forward and able to be used to offset the tax in future years. The government will not repay notional tax on any unused negative earnings.

Who is liable for the tax?

The liability is with the individual member, not the superannuation fund. He/ she will be able to pay the additional tax personally or can have the amount of the tax released from their superannuation balance.

When is the tax payable?

- Within 84 days of the ATO giving the notice of assessment

- Defined benefit funds may defer the tax for payment until 21 days after a member begins to receive their benefits

The problems

Liquidity

For example: An individual is assessed for the additional tax, but cannot readily liquidate investments in his/ her fund (because, for example, of having a large exposure to real property) and has no investments outside the fund. The individual is forced to sell what might be a large and valuable property in what might be a poor market to pay what may be a relatively small amount of tax.

Tax on unrealised capital gains

For example: This compounds the example above. Particularly where large exposures to unlisted assets are held, the values of which are not readily ascertainable, and the valuation was not previously completed by a qualified independent valuer. Such assets are more likely to give rise to sizable changes in valuation over time, as recognition of the change usually occurs in jumps which lag actual market conditions.

No tax back if ‘earnings’ fall

If ‘earnings’ fall in a year, the individual does not get a tax refund. But instead can carry-forward the loss. The problem is if ‘earnings’ do not rise enough to recoup tax paid. This is more likely to be of concern once in the drawn down phase, particularly for individuals with higher minimum pension drawing requirements.

Only 84 days to pay

What if an individual has to sell real property to pay the tax? Real property generally has a settlement period of 90 days, on top of the marketing period, etc.

What now?

If you have $2m or more in your superannuation fund (remember that $2m in 6 years is $3m @ 7%) or a large amount of real property or other unlisted assets in your superannuation portfolio your Private Client Adviser will start discussions with you.

We can assist you to navigate through the complexities of this aspect of wealth management.

The aim is to better secure your family’s future – financially and otherwise, by reviewing your structures and developing a personalised strategy well ahead of the commencement date of the proposed changes.

Note: The above is not personal financial advice. It does not consider your personal financial circumstances or objectives. Before acting you should take personal financial advice.