© 2024 First Samuel Limited

High assets and income allow for higher risk investing. And the opportunity for higher returns.

We focus on clients who have a high income, and a high capacity and willingness for investment risk.

The critical difference between First Samuel’s offering and general ‘financial planning’ services is that our advice is not just about suggesting an asset allocation and financial product which comprises a group of managed funds. Yes, we do advise on asset allocation. But we do so much more.

Through this case study we show how true ‘wealth management’ is a blend of wealth strategy advice and individual investment management.

Our clients

Michael and Pam have been clients since 2003. Both are medical specialists. They have two teenage children and live in Melbourne’s inner suburbs.

Pam is very knowledgeable but with little interest in investing. Michael does have strong investment interest. Both are aware of the wisdom of long-term investing.

What they sought

- To growth their wealth tax efficiently, using their high asset position and strong income

- To manage their investments separately

Critical client facts

Financially, their most recent and kay arrangements are:

| Item | Owner | Value | Comment |

|---|---|---|---|

| Home | Joint | $3.5m | No debt |

| SMSF | Both members | $3.4m | |

| Family trust | Both directors of trustee company | $2.8m | Securities |

| Family trust | Both directors of trustee company | $3.0m | Six residential properties |

| Portfolio | Michael | $1.5m | Significant unrealised gains |

| Portfolio | Pam | $0.5m | Significant unrealised gains |

| Portfolio | Pam | $0.4m | Bank shares |

| Salary | Michael | $0.45m p.a. | |

| Salary | Pam | $0.21m p.a. | |

| Loan Facilities | Each | $2m | Secured by residential properties |

Personalised wealth management -What we advised

- Both Michael and Pam to draw on their loan facilities secured against their property and invest in a high growth portfolio managed by First Samuel

- To structure their personal investment portfolios in a significantly different manner to the way in which their SMSF was managed. Their personal portfolios ought focus on longer-term stock holdings with higher capital growth potential (e.g. venture capital, alternative assets)

- Continue to access their loan facilities to capitalise on market conditions and buying opportunities

- Offset unrealised gains on the existing portfolio against any subsequent portfolio losses

- Continue to sell down Pam’s bank shares each year as her tax position allows, and diversify her portfolio

- Each to maximise concessional and non-concessional contributions to their SMSF

What was special

- Using a gearing strategy to grow wealth: accelerated wealth creation by investing a larger amount than they could have otherwise invested using their own money.

- Tax effective investment: interest and other costs of gearing were tax deductible and reduced taxable income.

- Effectively managed ongoing capital gains and losses: their investments have large unrealised capital gains; we can manage that by taking advantage of any capital losses in Pam’s portfolio and keeping neutral regarding future CGT, as well as avoiding triggering large CGT liabilities through substantially restructuring their existing investment portfolios.

- Have a personalised “core” strategy for their SMSF that is constructed according to First Samuel’s portfolio construction principles.

Client’s attitude to return & risk

Michael is a very experienced investor, Pam is less so, but she will discuss it with Michael. They have:

a) The capacity to take extra risk (i.e. considerable assets and income to cushion against market volatility);

b) The willingness to take extra risk; and

c) The time horizon which is commensurate with the market cycles for higher risk assets

They are aware of the potential for short-term volatility and the losses that may arise. They understand that their investments are not capital protected.

What was special

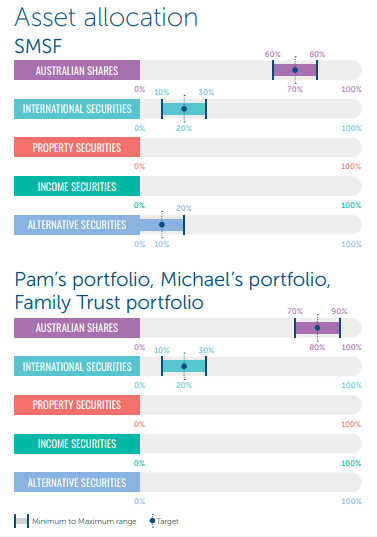

- Separate asset allocations for different portfolios, reflecting different growth and tax situations and time horizons for investing

- Geared portfolios comfortably outperformed, but with volatility

- SMSF was more stable

- Potential to use any later realised losses against gains in individual portfolios

- Long-term outperformance possibilities in place.

Conclusion

No two of our clients are alike. Of our over 250 clients, we manage over 100 different asset allocations (i.e. the mix of Australian shares, income securities, etc) with up to six different security themes within. These themes are:

So we:

- tailor the wealth strategy advice that we give, both initially and ongoing

- design, build and manage highly bespoke investment portfolios

Of course, we also wrap around our advice and investment an unparalleled reporting & administration service and an ethical and transparency regime.

How can we help you

Call us today and make an appointment to meet with one of our Private Client Advisers. There is no cost or obligation prior to your agreement. We’d like you to give us the opportunity to see how we can help you.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.