The Markets

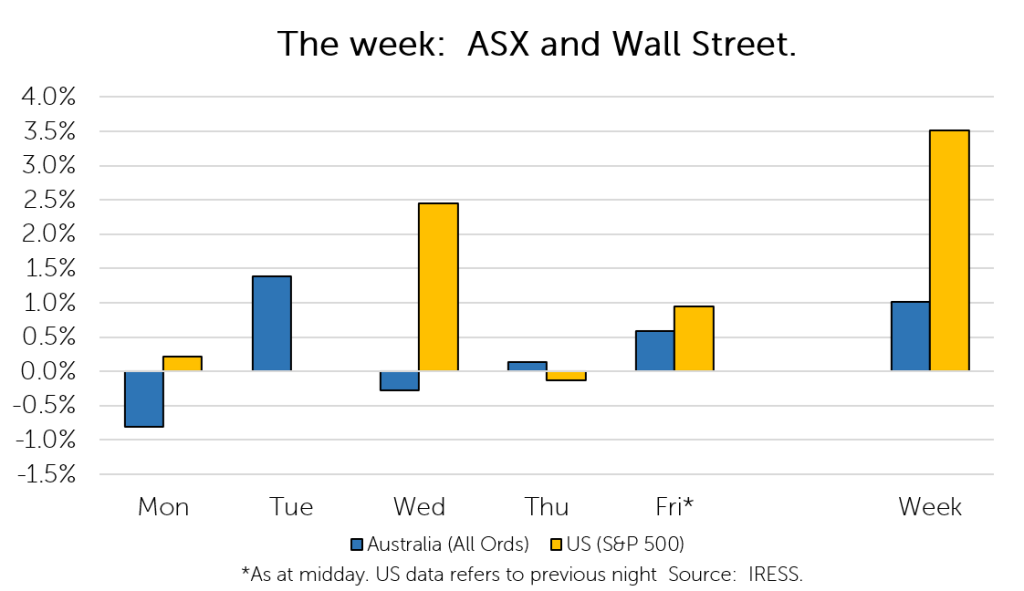

This week: ASX v Wall Street

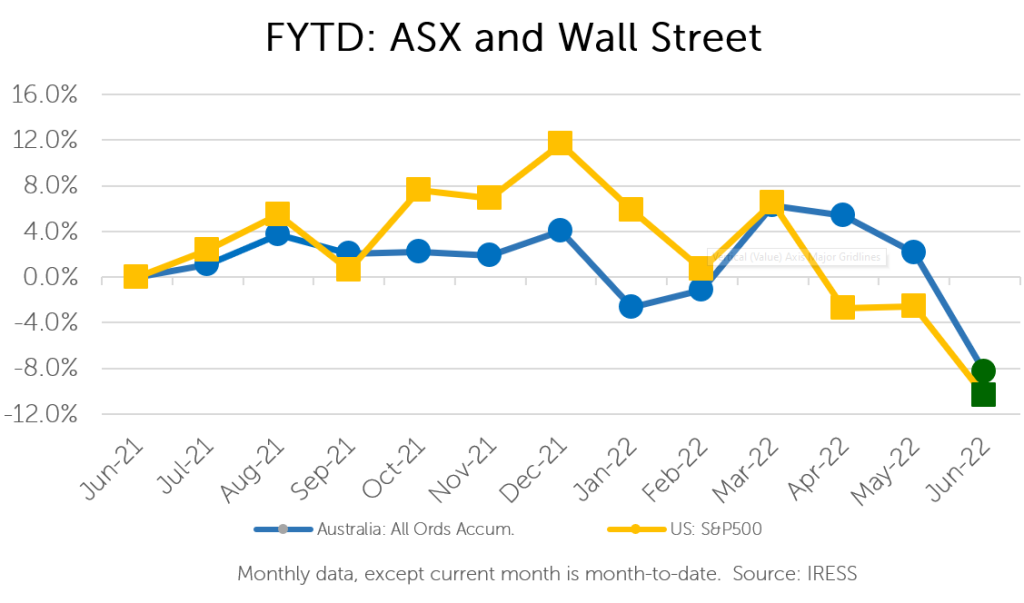

FYTD: ASX v Wall Stree

Economics is often spoken of or framed with a degree of exactitude. Reducing the complex interactions between various actors into a concise set of formulas and diagrams has, in a sense, helped industrialise the study and application of economics.

However, as we are constantly reminded, economists often “get it wrong”, assumptions that markets consist of rational, steady pulsed calculating machines (as opposed to human beings!), can lead to some flawed conclusions. A physical science or social science? Economists appear to be stuck between a push and pull between these leanings.

Of course, the introduction of behavioural economics has, broadened the remit of the humble economist. The foundational work of Kahneman and Tversky, demonstrated that we are far from calm, rational actors. We hold deeply entrenched, strong behavioural biases that can result in sub-optimal decision-making. For instance, gains are often less pleasurable than losses are painful, even when they are of the same magnitude.

This bias, named Prospect Theory is particularly relevant in today’s market. We can easily see how this deeply ingrained human aversion to loss leads to the “sell first, ask questions later” tendency that we have spoken about in our monthly CIO videos.

And so, this week, we take a look at how investor behaviour may impact returns and how the math of when you buy can be as important as what you buy.

Behaving and behaviour

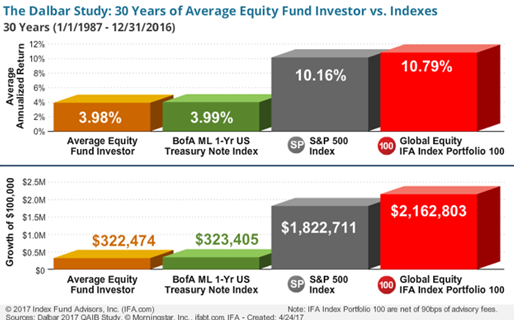

In assessing the impact of investor behaviour on long-term returns, the investment industry often quotes DALBAR’s Quantitative Analysis of Investor Behaviour (QAIB). The longitudinal study, which covers a period of over 30 years, looks to measure the effects of investor decisions to buy, sell and switch into and out of funds over short and long-term timeframes.

The study has consistently concluded that by moving in and out of funds, chopping and choosing, buying and selling, investors irrationally destroy a significant proportion of returns over the long term.

The charts above give a snapshot of this. From 1987-2016, investors achieved an average annualised return of 3.98%, in comparison to the broader fund management industry’s return of 10.79%.

At face value, this gap is, astonishingly high. It is the difference between the growth of $100,000 to $322,474 vs $2,162,803.

Anecdotally over the years at First Samuel, we have accumulated plenty of evidence to support this. That is why we believe the strong relationships between our clients and advisors are a key element in growing and preserving wealth over the long term. The behavioural element of investing and being invested should not be understated.

But are investors THAT irrational?

While we do not doubt that investor behaviour is an important variable that determines long-term returns, we can’t help but put our sceptic hat on when reviewing the DALBAR study’s conclusions.

In a zero-sum game (that is, a world where your underperformance is my outperformance), this serious underperformance by investors should result in some serious outperformance by someone else. And in the aggregate, we know that this level of outperformance is simply not achieved by the broader fund management industry.

On closer inspection, it appears the methodology behind the DALBAR study has its flaws. Essentially, the DALBAR study calculates investor returns as if all of their money had been invested at day dot.

In reality, we know this is not the case. Superannuation contributions, for instance, result in consistent contributions over an investor’s time horizon (for instance, at the end of the financial year). Therefore, in contrast to the study’s assertion that underperformance is purely behavioural, an element of it may be structural.

That is, in an upward trending market, investing a larger sum earlier should result in more time to achieve returns and larger growth of wealth.

This results in the gap between fund returns and the average investor looking much larger than it may in fact be.

What about in a downward trending or bear market? In this case, DALBAR’s methodology would be biased towards showing investors outperforming.

This has been confirmed in studies by Morningstar, which, using a different methodology which takes into account the impact of when funds are invested. These studies have shown that investors do underperform, but by a smaller, yet still meaningful amount (circa 0.76% per annum) *.

Finding a solution

So, what can be done about the structural element of underperformance that results from contributing funds over time?

We are not huge proponents of market timing. However, what we do believe is that a managed discretionary account (MDA) structure, with securities held individually for clients, does result in scope to reduce some of the structural underperformance that the DALBAR study highlights.

Simply, under the structure at First Samuel, when a client contributes funds, cheaper securities can be purchased or purchased more, while more expensive securities may not be purchased or purchased less.

In contrast to market timing, this methodology takes a stock-specific view grounded by bottom-up valuations.

While we have little confidence in the ability to time markets we do believe that there is potential to differentiate between cheaper and more expensive stocks at the point of investment, particularly when prices are at extremes relative to valuations.

We see this is a key differentiator of First Samuel and an MDA structure. This is in contrast to a unitised fund (a common structure amongst Industry Superannuation Funds), where contributed funds are invested holus-bolus into securities, regardless of their price.

This, combined with the trusted relationships established between our clients and advisors, we believe provides a winning formula to add value outside of pure investment-driven outperformance.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.