© 2024 First Samuel Limited

Photo © Getty Images from Via Canva.com

Regulation of personal financial advice in Australia has been increasingly knotty, often incoherent and always bureaucratic. Rules designed with the good intention of protecting the investor have led to extraordinary complexity without benefitting the very same investor.

Statements of Advice had become the stuff of urban legends, ballooning to meet arcane regulations. The 80-page SoA with 60 pages of fine print became standard. Investors needed an adviser to advise on interpreting the advice.

Then along came the Hayne Royal Commission. That body, whilst focussing on the sins and omissions of retail financial services, did touch upon the legislative framework that regulated the personal financial advice industry. It recommended a review.

The then government ordered a review. That review1, submitted to the now government in December 2022, was itself reviewed, the response to which was released earlier this month. With much fanfare.

The government has accepted, so far, 14 of the 22 original recommendations to improve the quality of personal financial advice. It is still reviewing the other eight. Don’t hold your breath.

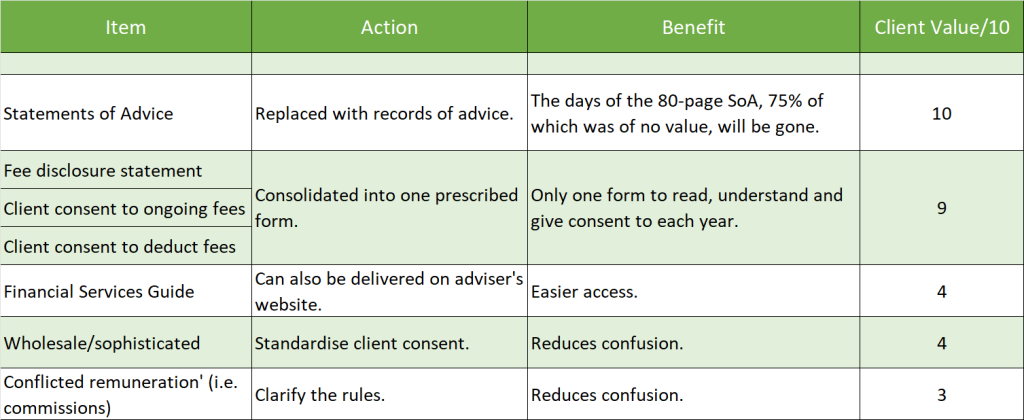

Whilst the actual legislative detail has yet to be released, the government has outlined the proposed changes.

Generally, these changes make sense for both the industry and for investors. As far as they went.

Significant proposed changes – a summary

__________

1.Quality of Advice Review, December 2022.

Who cares?

Clients should be pleased. Well, somewhat. There should be less pestering of you for fewer forms to read, understand and sign. And advice documents will be more concise and easier to read.

This means that the time your Private Client Adviser can spend with you and on your arrangements will increase.

What’s missing?

Like the dog that didn’t bark in the night, it’s what’s missing that matters to the broader population. The review of the review didn’t address some particular areas. These are probably not important to our clients, but point to the government’s view of the world.

For example, only public offer superannuation funds, e.g. industry superannuation funds, will be able to give advice outside of that which relates to their own products. Banks, for example, will not have that ability.

But what is included is that superannuation funds will now be able to charge ‘collective fees’ for financial advice. That is, charge all members of the fund for the provision of financial advice, whether advice is taken or not.

What now?

Until the government passes the legislation, you will still be confronted with the “ancien régime.” In the meantime, we shall keep you up-to-date as the changes work their way through the labyrinth that is government. And put into effect the changes as soon as we can.

Yes, you can thank the government for making some things simpler. But, but, but; it’s only scooping up some of the dross that has arisen over the last decade or so. And, as always, the devil will be in the detail.

Get in touch with your Private client advisor to discuss anything from this article.

Read the previous Wealth Intelligence.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.