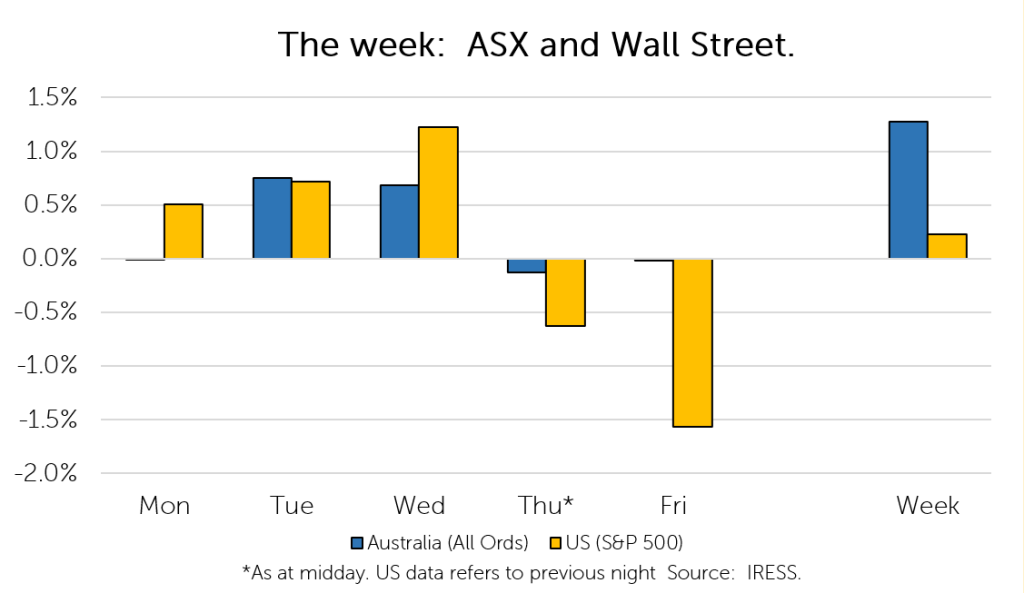

The Markets

This week: ASX v Wall Street

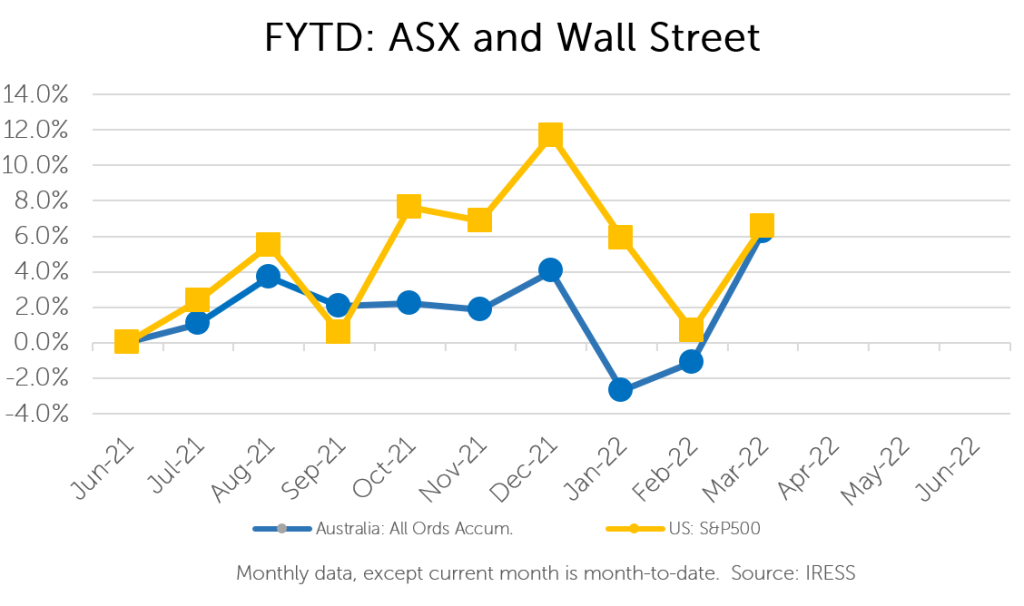

FYTD: ASX v Wall Street

After a week away, Investment Matters is back.

During our hiatus, part of which was spent 1000 metres below ground (more on this later), the Investment Team has made a notable addition to client portfolios.

Seven is a name that shouldn’t be foreign to readers, most notably as one of the many ageing faces of entertainment in Australia.

However, while the name carries connotations of media empires of old, the world of entertainment is but a very small part of Seven Group, the company which was purchased for clients last week.

Firstly, we should make a clear distinction. Seven Group is but a distant cousin to Seven West Media (ASX:SWM), the separately ASX listed company which houses Seven’s media operations.

In contrast, Seven Group (ASX:SVW) is a diversified conglomerate that owns several businesses embedded within the core of the Australian economy.

We take a brief look at the Seven Group and why we see emerging value in an old name.

“What is in a name?”

What does the Seven Group of today look like?

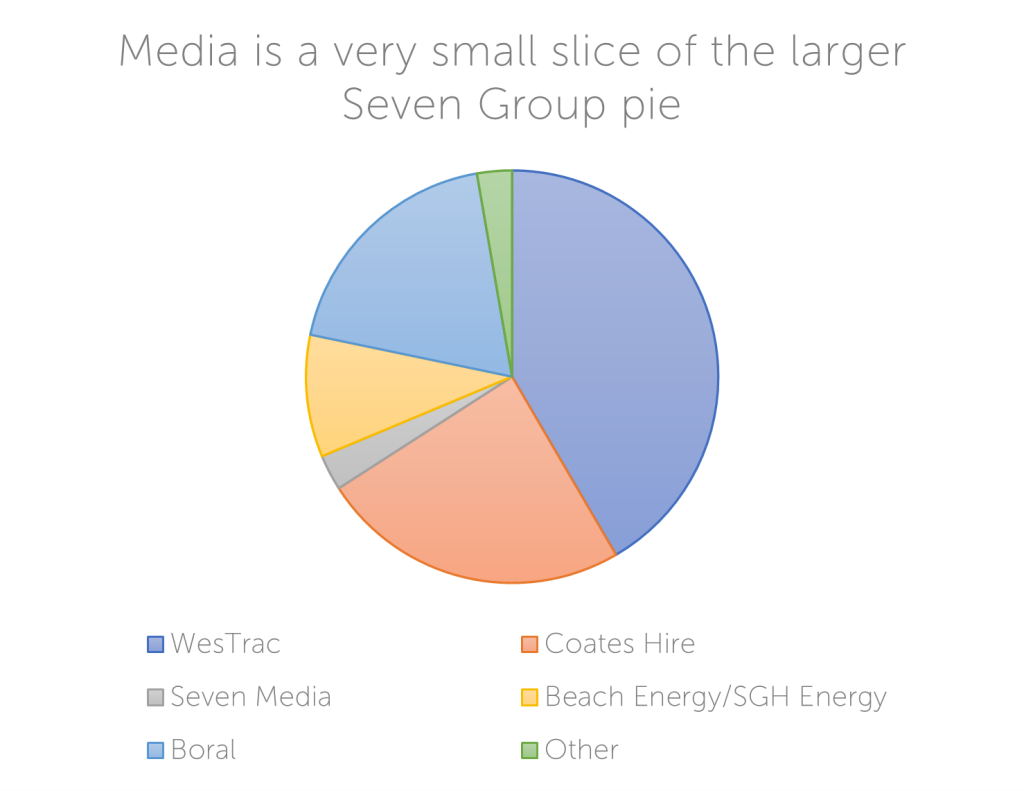

There are many moving pieces within what can only be described as the conglomerate that is Seven Group.

However, a high-level view of the company is illustrated in the chart below:

As can be seen above, today Seven Media is closer to a rounding error, constituting less than 5% of the value of the company.

The company mainly consists of three businesses.

Readers should be familiar with one of the three largest constituents of the company: Boral. After an on-market takeover, Seven Group now owns close to 70% of the business. After the sale of Boral’s North American assets, Boral is now smaller and much more domestically focused.

We see Seven Group as a cheap way to buy back an exposure to Boral – which we continue to like for the same reasons we did when we first decided to own it. It provides an exposure to further fiscal stimulus including infrastructure spending and is likely to benefit from further inflation.

The other two large constituents are WesTrac and Coates Hire.

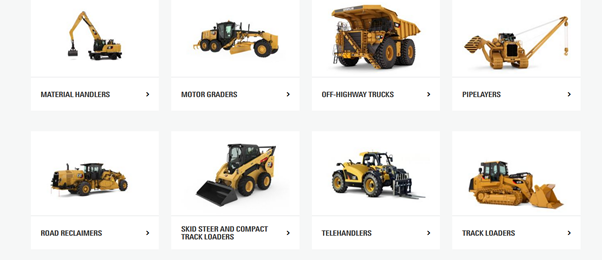

WesTrac is the Australian dealer for global construction equipment manufacturer Caterpillar. It is one of Australia’s largest equipment suppliers to the construction, mining and agriculture sectors. This includes many of the “yellow goods” that keep the resources sector ticking over such as dozers, excavators, and haul trucks.

With commodity prices booming, we expect WesTrac to be a beneficiary as producers begin to spend again, with capital expenditure in the mining sector having stagnated over the past decade.

Coates Hire is another name that should be familiar to readers, as the largest equipment rental company operating in Australia. This spans a wide range of equipment, which is most notably used in the construction and maintenance of civil infrastructure.

As illustrated in this week’s Federal budget, there is a renewed, bi-partisan appetite for government to take on a bigger role in actively managing the economy. With Australia’s critical infrastructure continuing to age and a need to backfill capacity to accommodate the population-driven growth of the past two decades, we see Coates as a beneficiary of Australia’s current infrastructure pipeline and future fiscal stimulus.

Furthermore, as a business with a large amount of “assets in place” (i.e. equipment it has already paid for), the value of Coates’ equipment is likely to rise in an inflationary environment. In other words, as equipment becomes more expensive to manufacture, its existing fleet is likely to be worth more.

Latent value

We like the underlying businesses that Seven owns. But fundamentally what we like more is the price we are paying for them.

In our assessment, the company as a whole is trading at a significant discount to the sum of its many parts – many of which are cheap in their own right. As these discounts are closed, we see significant returns on offer for shareholders.

Furthermore, the company has a strong track record of taking strategic stakes in companies to unlock value – as we saw with Boral, which provides further potential for upside.

Company News

1000 meters below: our visit to Peak and Hera

We escaped our three by three cubicle for the day to go on a “fact-finding mission” in central-western New South Wales.

Of course, what we eluded to was Aurelia Metals’ site tour, which they hosted early this week.

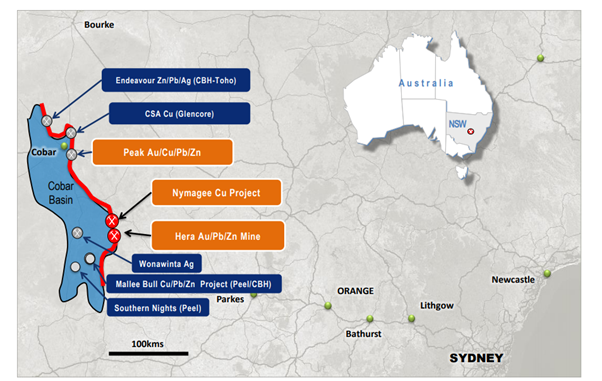

The tour covered two of Aurelia’s larger mines: Peak and Hera, shown below:

Our first stop was Hera.

Having commenced production in 2014, Hera has been one of the bedrocks of Aurelia’s portfolio and continues to operate as a producing mine.

However, the day’s focus was on the soon to be developed next chapter in Aurelia’s story: Federation, which lies 10km from Hera.

Federation is one of the most significant discoveries in the region for over 30 years, with drilling results demonstrating very high grades of lead and zinc.

All is progressing well with the project. The environmental impact statement for the site was released in February and land has been cleared in preparation for the box cut, with first blast expected on 6th April.

The progress of early works can be seen here. During the visit, we gained a greater appreciation of the considerable infrastructure needed to progress the project, much of which is already in place (given the site’s proximity to Hera).

While there wasn’t a lot to see above the surface, our focus was on what may lay below the surface – which the drilling intercept below gives some insight into (showing a pocket of very high-grade ore).

Our second stop was Peak.

The Peak mine has been in operation since 1992 and is unique in that it is one of few mines in operation today with a central shaft (as seen below), which is used for ore haulage.

What is unique about the mine is that even after operating for 30 years later, it continues to be developed and explored in depth. This is due to the geology of the Rookery Fault, which runs through the Cobar region and has produced very narrow but deep deposits.

We ventured as far as 1000 meters below the surface where development continues at the mine’s high-grade Kairos zone.

As we have seen in the past, there is a lot of optionality remaining in the deposit: with potential for the discovery of very high-grade zones at depth that deliver a very high NSR (net smelter return – the return from the sale of metal concentrate).

What also impressed us was the recently upgraded processing circuit. Aurelia processes a number of metals at peak, resulting in three separate concentrates: copper, zinc and lead. This is optimised by varying the ore processed from Peak, which includes several metal specific processing “runs” and the blending of ore to “smooth out” feed to the circuit and production.

Overall, we came away from the visit impressed by the considerable optionality that continues to emerge in the business.

The critical deliverable in the next 12-18 months remains the development of the Federation deposit.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.