The Markets

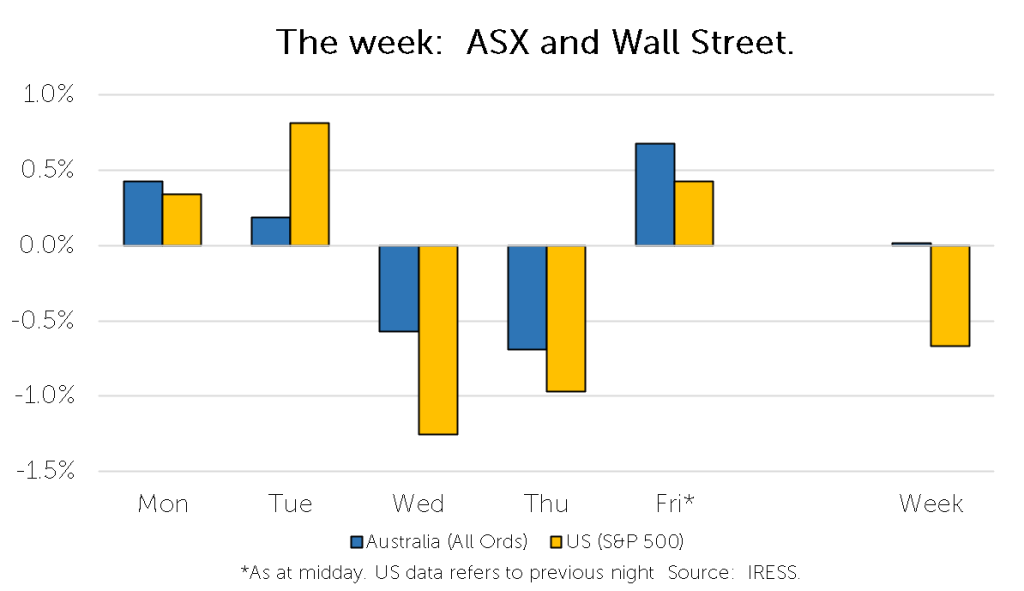

This week: ASX v Wall Street

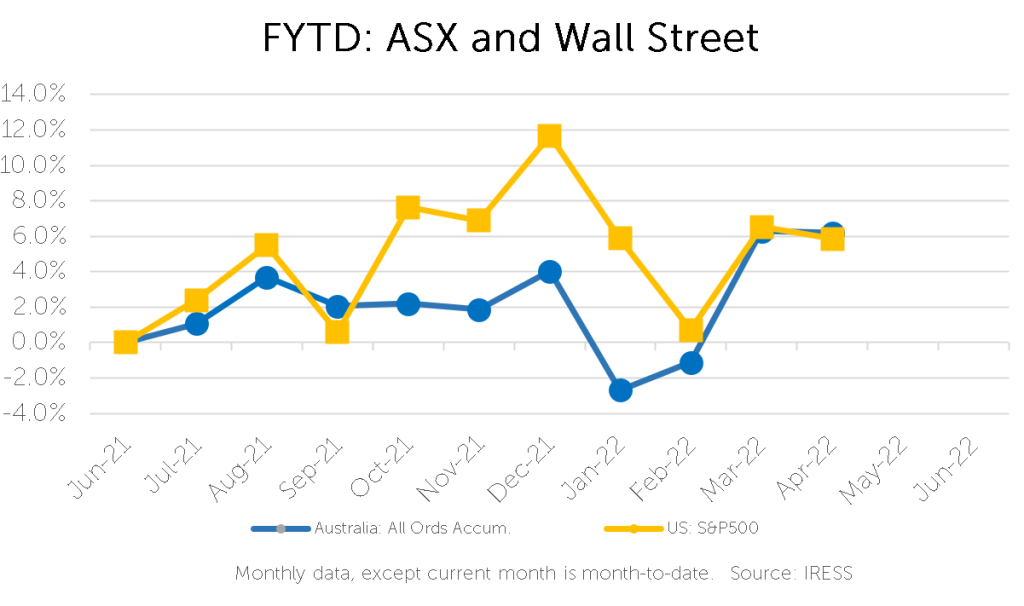

FYTD: ASX v Wall Street

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.”

– Warren Buffet

A company’s share price is often seen as the clearest signal of its operating performance: past, present, and future.

However, we know this often is not the case. The volatility in markets sees share prices rise and fall by extraordinary amounts, much more frequently than we would expect. This often far exceeds any changes in a company’s operating performance – particularly when viewed over a longer-term horizon (as first highlighted by Robert Shiller in 1981: “Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?”)

And so, sitting at our desks on a Thursday evening, we contemplated EarlyPay’s (formerly CML Group) journey over the past five years.

There is no doubt that the company’s share price has had its ups and downs. But how would we view its performance if we took away this ‘signal’, that is, if we played out Warren Buffet’s scenario?

Put another way, if clients had bought shares in the company five years ago and the stock market had closed (i.e., the market’s “price signal” was removed), would they have been pleased with its performance?

Of course, without share price performance, we could only look at financial performance (i.e., actual profitability) to answer this question. And under this condition, it is hard to come up with any answer other than “yes”.

The disconnect at times can provide some excellent buying opportunities, and has seen a return of approximately 115% for clients over the last 5 years*

Digging into the numbers

To answer the question posed earlier, we should look at several broad metrics.

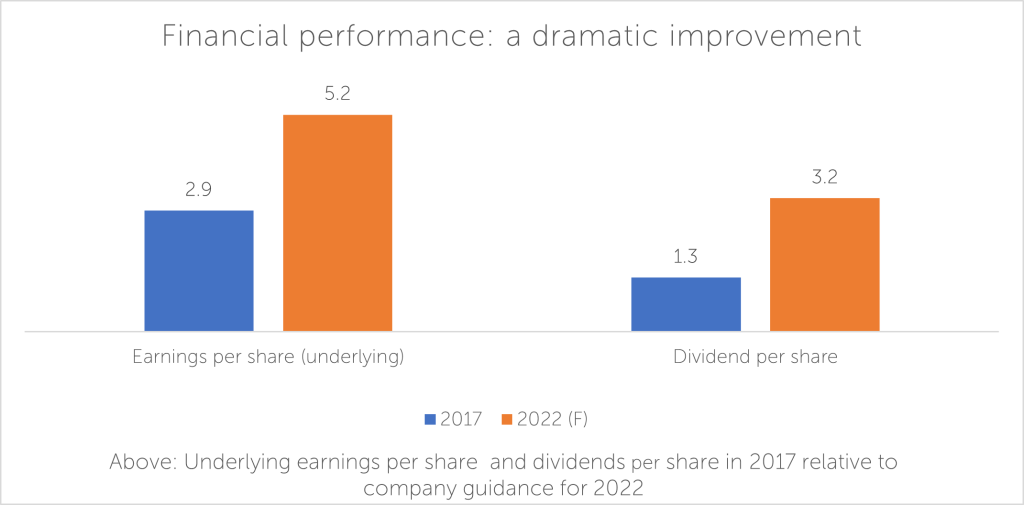

The first is a simple, but powerful one: have earnings per share risen? The chart below shows that the answer to this is a definitive “yes”.

Earnings per share in 2022 should be at least 5.2 cents, almost 80% higher than they were five years ago. And so, in 2022, we anticipate the company will have grown its earnings over the past five years by more than 12% per annum – despite setbacks suffered during two years of COVID.

Furthermore, shareholders have directly seen the benefit of this, with a substantial growth in the profits returned to them in the form of dividends. Dividends per share will grow from 1.3 cents per share to 3.2 cents per share a compounded growth of more than 19% per annum.

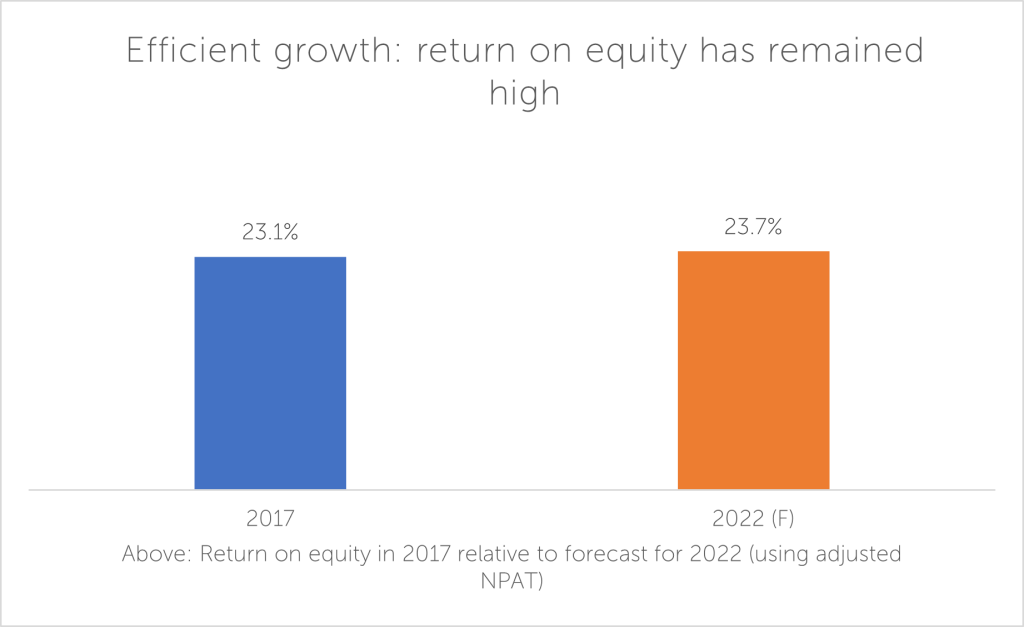

So, we can agree that the business has grown substantially. But not all growth is good. The other question we should ask is: Has the business grown efficiently i.e., without needing to invest too much capital?

A good way to judge this is to look at not just profits, but profits per dollar of equity invested in the business.

We expect the return on equity for the business (that is the dollars of profit for every dollar of equity invested into the business) to be similar to that achieved in 2017, despite the business funding more than double the amount of invoices!

And so, the answer to whether growth has been efficient is once again a yes.

What has driven this?

The business has significantly grown the value of invoices it has funded, from approximately $1bn in 2017 to an anticipated $2.4 bn in 2022 (more than double).

It has also leveraged its customer base to grow into other product verticals such as equipment and trade finance and pursued value accretive acquisitions.

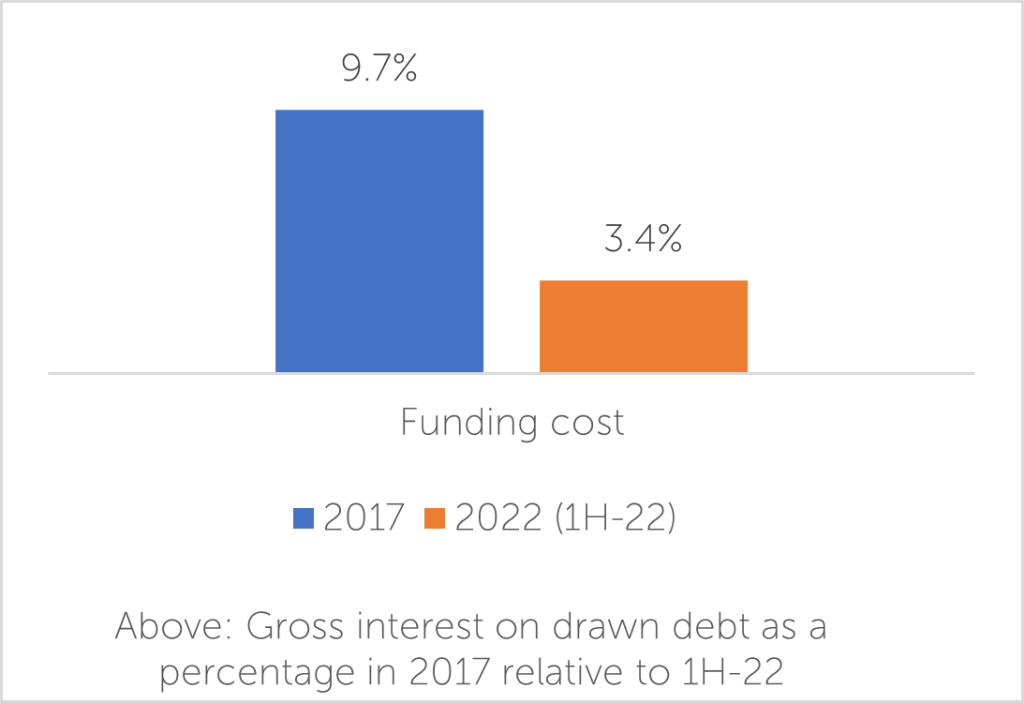

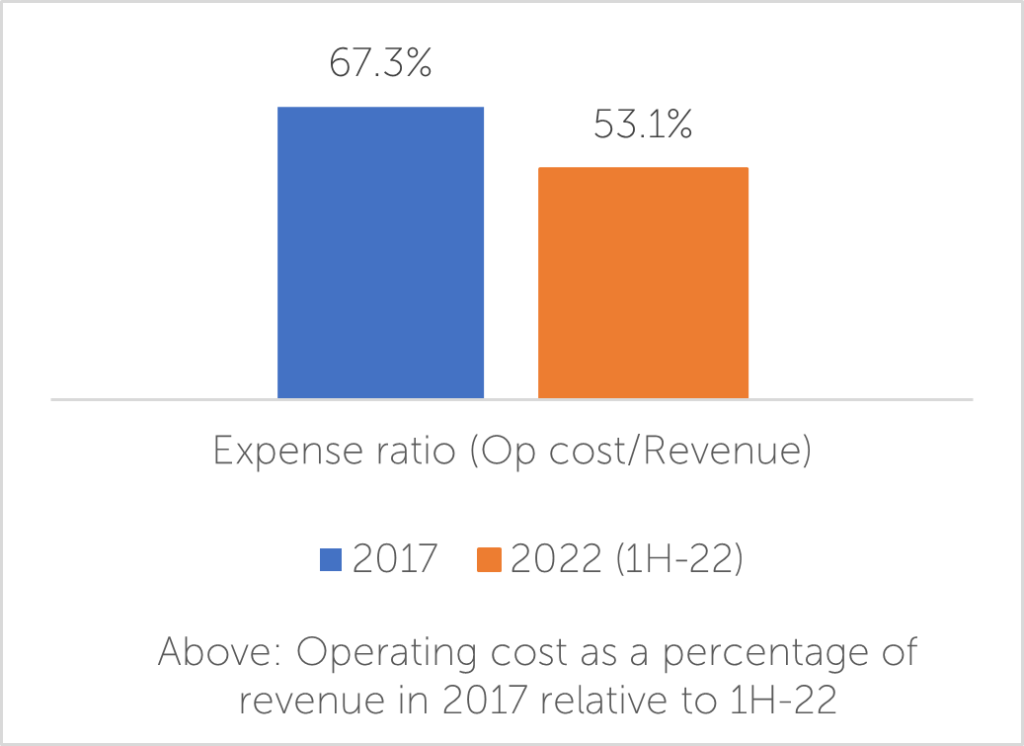

All the while it has maintained excellent cost discipline (aided by the recent acquisition of technology platform Skippr) and seen significant benefit from its growing scale through lower funding costs.

And so, despite its ups and downs in share price, EarlyPay has steadily been building value and quietly going about its business.

What the numbers may look like in the future

We have been quite impressed by the business’ recent performance and see that it has a strong runway for growth and several levers it can pull to realise this.

The acquisition and integration of the Skippr platform has led to a significant improvement in efficiency, which has allowed the business to reallocate its headcount out into growing its sales force.

The benefit of this is beginning to show, with invoices financing rebounding significantly post COVID, expected to be more than double what they were just five years ago.

Furthermore, the business continues to leverage its customer relationships to expand into other finance verticals, with the equipment finance book now back into growth and trade finance proving to be highly margin accretive.

We also think the Skippr acquisition has significantly improved the business operating leverage. This was evident in the company’s report for the half-year, where we saw a larger percentage of the revenue growth fell through to the bottom line.

Furthermore, we see that the business has further scope to improve its funding costs (as it has over the past 5 years) and should be able to pass on higher rates to its customers in a rising interest rate environment.

The bigger picture is that EarlyPay’s business is well-positioned for the current economic environment.

Its growth is strongly linked to the overall growth of the economy.

That is, as the economy grows: be it nominally (i.e. through prices rising/inflation) or real (through a higher volume of goods and services sold), the value of invoices funded will increase, which should translate to higher revenue.

EarlyPay should also be resilient in an economic “downside scenario”. In slowing growth environment, it should benefit from an increase in the need for funding as liquidity tightens for businesses and has historically experienced no material defaults or losses.

Investing under the Buffet Scenario

And so, under this ‘Buffet Scenario’, we see that the performance of the business has been quite pleasing over the past five years.

This value will ultimately be recognised at some point, either on market through its share price, or off-market through a takeover bid as we have recently seen with Cardno and Intega.

We have been happy to focus on the underlying performance of the business, as it has quietly continued to build value, despite the volatility in its share price.

What has this volatility meant to us? If we were to boil it down it has simply provided some excellent buying opportunities.

Clients invested since 2017 have seen a return of approximately 115%* over the period relative to 89% if we had simply “bought and held’.

*Total return on an IRR basis from June 30 2017 to today. Individual client returns may vary.

Company News

Cardno announced the sale of its International Development division (an announcement we missed in last week’s Investment Matters!).

The sale of the largest of the remaining businesses in the listed entity for AUD$56.5 will see $1.45 per share returned to shareholders (a combination of capital return and dividend) and was in line with our expectations.

What will remain is Cardno’s South American Caminosca operations and the Latin American business (which are winding down and expected to be cash flow generative), as well as an estimated AUD$15m in cash, or approx. $0.38 per share.

It remains to be seen how much of this remaining capital is returned to shareholders and what other latent value may be extracted from the listed entity/vehicle, which is currently trading at $1.64 per share.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.