© 2024 First Samuel Limited

The Markets

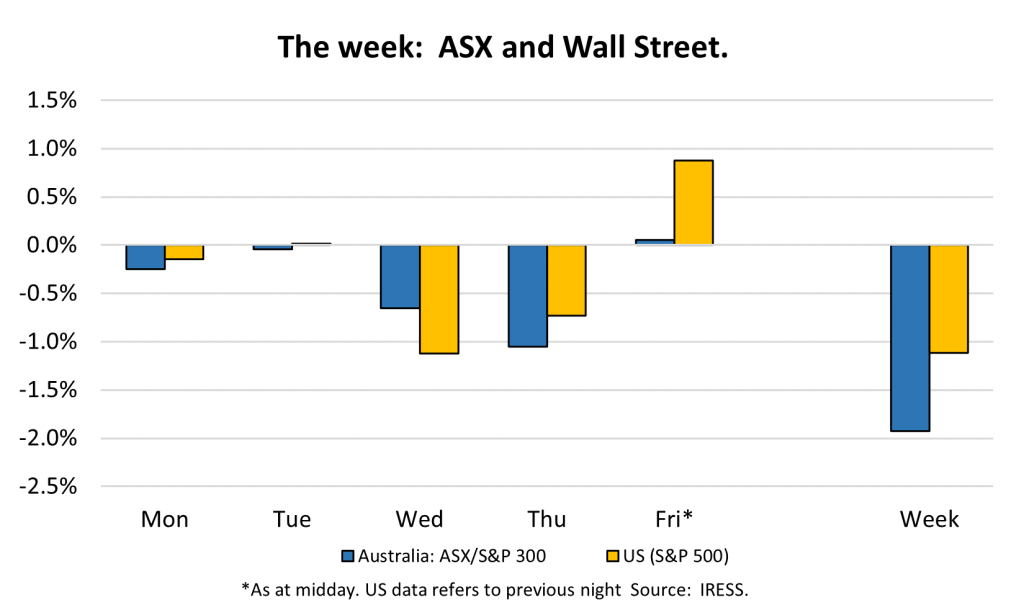

This week: ASX v Wall Street

FYTD: ASX v Wall Street

In addition to the usual market updates, this week’s Investment Matters provides updates on two companies in client portfolios: Costa Group and Aristocrat.

And the ABS April Retail Sales data reinforced our cause for concern on the well-being of the Australian consumer. Client investment portfolios have been positioned for this occurrence

Retail trends demonstrate that consumers are applying the brakes

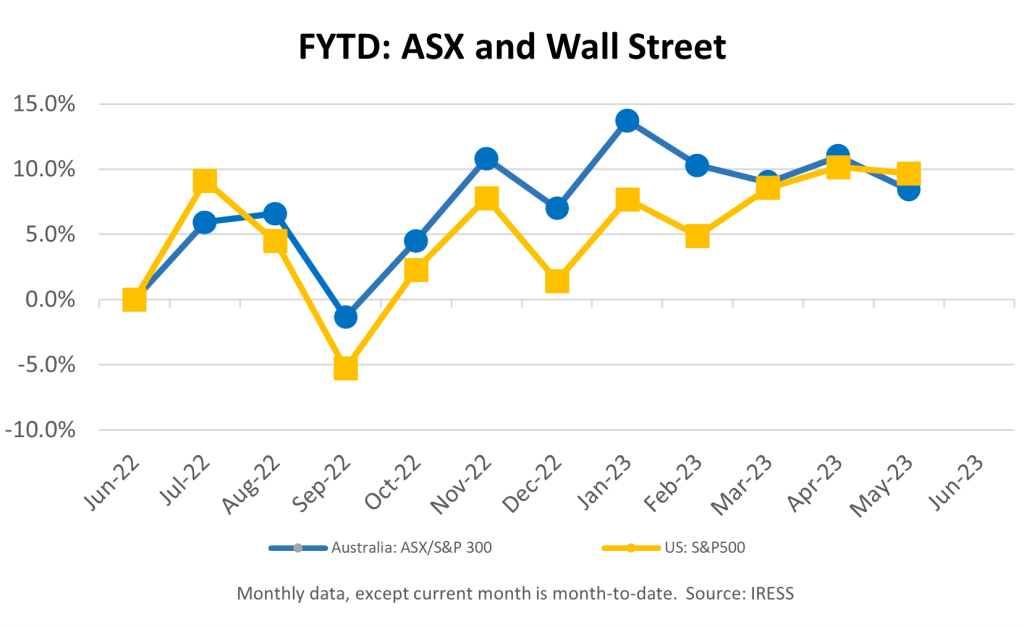

We’ve written in recent Investment Matters that we have been concerned about the collective impact upon the consumer from (a) the fixed-rate mortgage ‘cliff’ as well as (b) general inflationary pressures in household goods and energy.

Cheap 2- and 3-year fixed rate mortgage customers (2021/2022 vintage) may be encountering a ~50-60% increase in their mortgage payments as these cheap deals expire – causing a significant bite in household cashflow! Throw in a lift in energy, insurance premiums and other living expenses and available weekly disposable cashflow quickly dissipates.

Figure 1: $500bn of fixed rate loans rolling off

But we’ve also been surprised at the resilience of consumer spending up until now. Our take on that is that many consumers who faced a significant increase in mortgage payments were simply not that organised or risk-averse enough to take proactive steps to mitigate this impact. That mortgage ‘shock’ will prove to be just that.

Our clients have very limited exposure to consumer discretionary companies in general and no material holdings in the retailers discussed below.

Moving from uncertainty to real-time data – the macro and the micro

Share markets use an enormous amount of energy forecasting. But the impact of rising interest rates and the uncertainty regarding consumer response is pure speculation until data begins to emerge.

This week critical data did emerge, and it was not comforting for those companies exposed to consumer spending.

The Macro

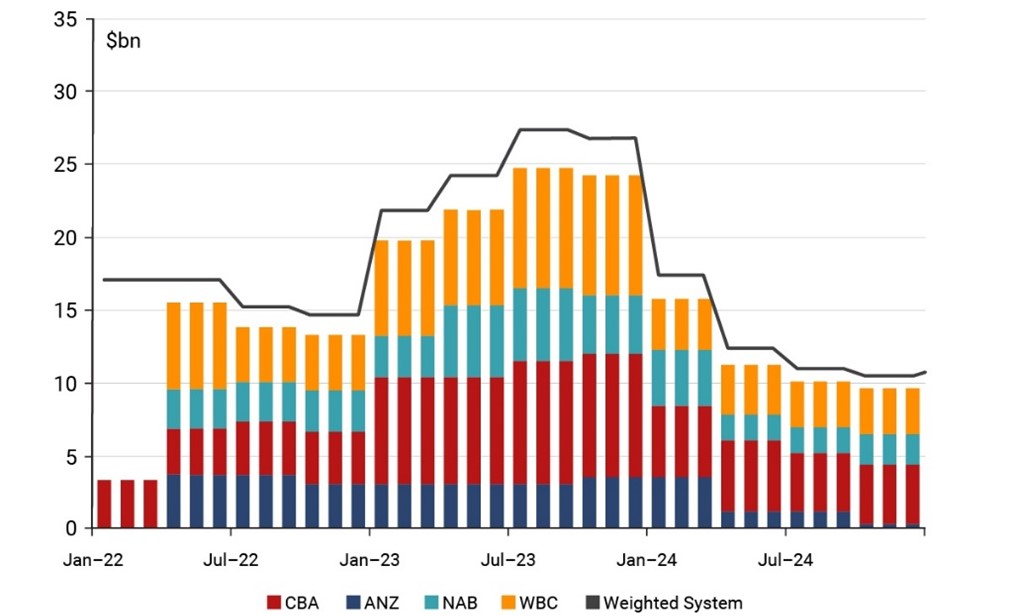

Important macroeconomic news came in the form of the April retail sales’ data released by the ABS. As the Macquarie Equities economists noted

“Nominal retail sales in Australia was flat in April, in line with our expectations” (mkt: +0.3% m/m).

ABS Retail Sales data summarised

- Of the non-food categories, the pace of the decline in household goods spending picked up in the month

- Clothing-related and department store sales rose strongly – boosted by “cooler and wetter than average weather across the country”

- The value of food related sales fell for the first time in over a year. Spending on dining out fell 0.2% m/m despite support from large scale sporting and cultural events

The pace of deceleration occurring is most evident in the stark difference in the three month annualised growth rates between the April and March ’23 as seen above.

The Micro

Early in the week we saw City Chic Collective (CCX) release weak sales (down 15% on FY22).

The biggest market wide impact came from the trading update provided by Universal Store (UNI).

UNI is a mixed-brand apparel retailer appealing to teenage/youth customers through an online and physical store presence under Universal Stores, Perfect Stranger and THRILLS. As a successful, growing, and innovative company its announcements carry higher importance that weaker competitors.

UNI noted “increasingly clear signs that the youth customer is seeing pressures on their discretionary spending levels”.

While the 1H23 financial result in March had provided the first seven weeks trading conditions which were quite positive (+14% growth in sales year-on-year), it is apparent that there has been a significant shift in consumer behaviour in the April/May period. New guidance for the fiscal year ending June now implies a drop off in sales of ~10% in the past couple of months. It seems likely to us that the ‘Bank of Mum and Dad’ has necessarily had to trim their children’s allowances.

Further to this trend, the release of Treasury Wines (TWE) FY23 Performance Outlook points to similar operating difficulties in lower-end wine sales in its US business while the Penfolds brand continues from strength to strength. Financial pain is not being shared equally.

Aristocrat (ALL) – Financial results and NeoGames acquisition

Born in the early 1950s, manufacturing the old ‘one-arm bandit’ poker machines, the company has grown to become a very large globally focussed company, with a market capitalisation of $25 billion. Aristocrat is clearly a blue-chip holding and the 15th largest company on the exchange. It is a significant position in a wide range of clients’ accounts – excluding those with a gambling restriction.

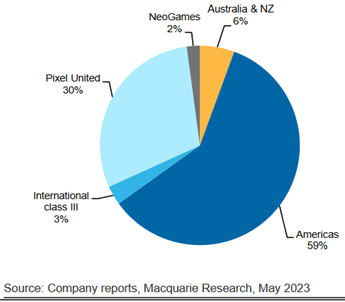

Over the past 20 years the company has evolved to rely on three distinct areas:

- Game technology: the development and deployment of games including casino, strategy social and poker machine games. Game development includes the intellectual property used to promote extended gameplay and the integration of global brands and cultural themes to drive customer interest.

- Mobile and social gaming (Aristocrat’s Pixel United business): The emergence of the mobile phone, and almost global demand for a variety of games (such as Candy Crush Saga) has created an industry which earns more than US$80.2 billion in revenue in FY22. Pixel United’s revenue was almost $2 billion.

- Infrastructure and technology: Based on its development experience Aristocrat has grown into a key provider of back-office technology for gaming businesses globally.

Driven by huge levels of cashflow (profit from operations after sustaining capital expenditure) of more than $800m per year, the company has defended and grown its #1 market position through a series of strategic acquisitions.

Aristocrat’s leadership in game technology not only provides an opportunity for sales of the machines and games outright. Its technology is so powerful that casinos are forced to rent the best games instead, with Aristocrat taking a share of revenue generated. This so-called “participation revenue” forms a huge share of North American revenue.

Last week the company provided the market both its 1st half FY23 financial reports as well as the announcement of the purchase of NeoGames for $1.5 billion. NeoGames is both a global leader in RMG (real-money games) and the owner of strategically important PAM (Player Account Manager) technology. The acquisition extends the company’s two core strengths, mobile gaming and infrastructure.

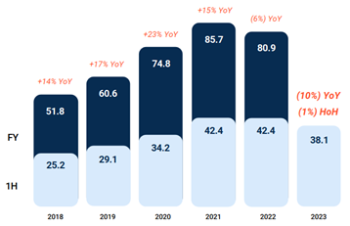

The 1st half financial results highlighted the impact of the globe returning to normal life post COVID. As different parts of the world went into lockdown through FY20 and FY21, spending on mobile games grew significantly faster than pre-COVID rates.

The past 18 months have seen slower sales as people returned to normal activities. FY22 global sales were 6% lower than FY21, and FY23 appears to have continued to weaken according to Figure 2 below.

Figure 3: Global mobile gaming market: the Covid impact

Net the impact of COVID and the recovery still leaves this market with a growth rate of more than 9% p.a. since 2018. The growth rate the market can achieve over the next 2-3 years will be critically important to the Aristocrat share price.

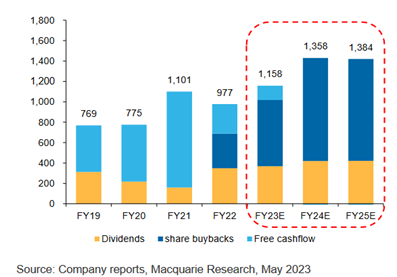

Strong cash flows provide balance sheet flexibility

Another attractive element of the investment case in Aristocrat is the strength of its balance sheet. Following the non-completion of the (never consummated) PlayTech acquisition in February 2022, the company was left with additional funds it had raised for the deal.

The balance sheet is now positioned for a combination of other acquisitions (NeoGames), dividends and buybacks. In total, the market is anticipating more than $1.3 billion to be returned to investors in FY24.

We suspect that Aristocrat will also pursue at least one additional acquisition. With US casino visitation skyrocketing post COVID it is likely that these casinos will continue to invest in new products from companies like Aristocrat, helping form a strong base of earnings growth.

Figure 4: Aristocrat is well placed to create value for shareholders

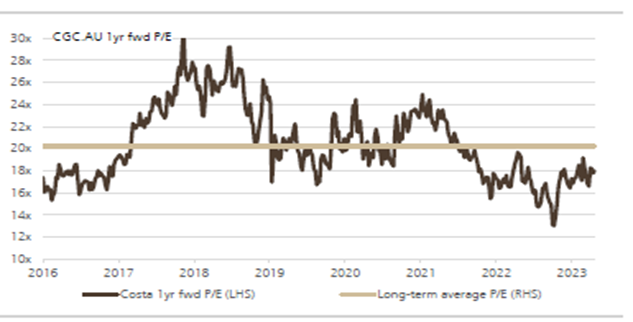

Costa (CGC) – shares looking riper for investor picking

We’ve recently been topping up our portfolio holding in Costa Group, one of the leading growers of fruit and vegetables in Australia. The release of a trading update in line with its Annual General Meeting (AGM) has been warmly received by the market.

One of the reasons for increased optimism on CGC has been the quality of the citrus crop (think oranges) and the expected improved performance of the international business (Morocco berry pricing & Chinese growth). There are signs of improved operating conditions after a challenging series of La Nina weather events and a global health pandemic in the past 4 years.

AGM Trading update highlights

For citrus:

- The early outlook for their recently acquired 2PH farm in Queensland has been “very positive relative to the prior year…with positive indications for both yield and fruit quality”.

- Export market demand (65-70% of their crop) & pricing from major markets for Costa citrus is “expected to be favorable for this season”.

- In FY22, citrus quality issues were a $40m drag (~20%) on CGC’s earnings last year… This looks like it can reverse + the company will achieve additional “on” year production volumes.

- Citrus will be the key contributor for CGC into the 2H.

International Business (predominantly Morocco/Africa and China):

- The 2023 International segment harvest is “shaping up to be an exceptional year with very strong profit results emerging from both China & Morocco”

- The harvest is to be completed by mid-June 2023, which largely de-risks the year.

- More than 50% of the FY23 Group earnings will come from exports

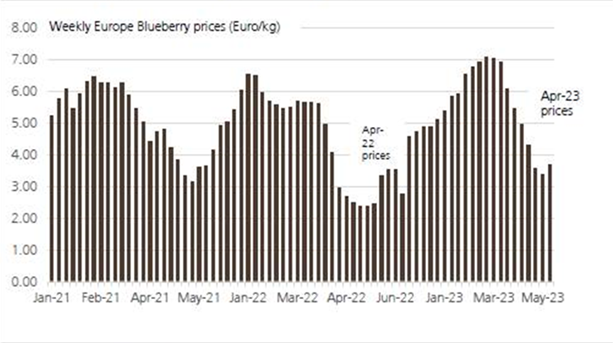

- A late harvest is starting to drive a rebound in blueberry prices

Figure 5: Blueberry pricing

Elsewhere:

- Avocados are stronger while results from their domestic tomatoes/mushrooms harvests are a bit mixed.

- Domestic berry pricing is a bit weaker, but we think there can be offsets to this mix/volume such as the Arana variety. There are four new blueberry varieties being launched this year

On balance, given the diversification of produce types and geographic regions the business operates in, there is inevitably a mixture of influences upon performance. But the balance is a net positive performance. We still believe there is valuation support & that CGC remains under-owned.

Figure 5: Costa Group Forward Price Earnings (PE) multiple – below long-term average

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.