The Markets

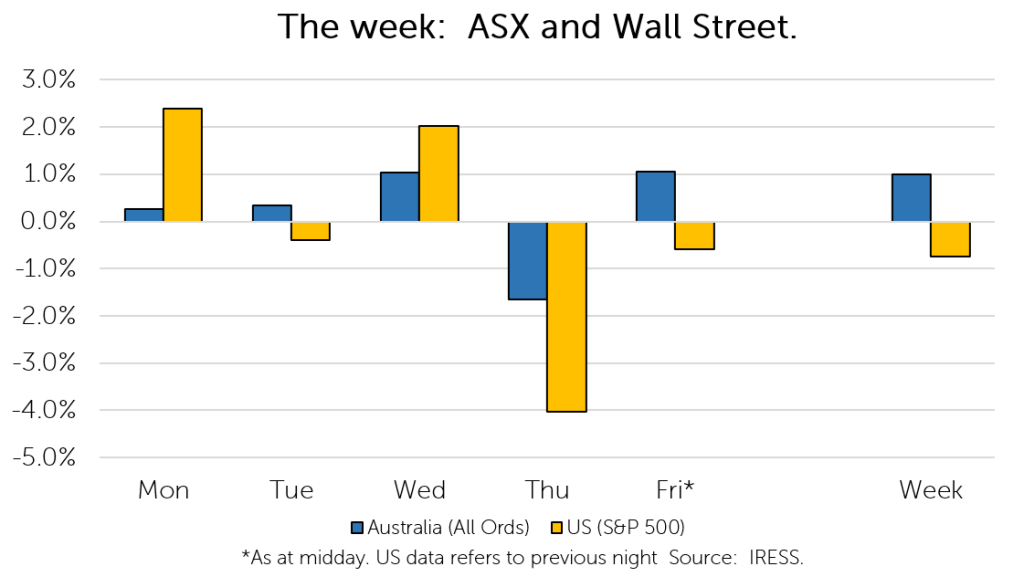

This week: ASX v Wall Street

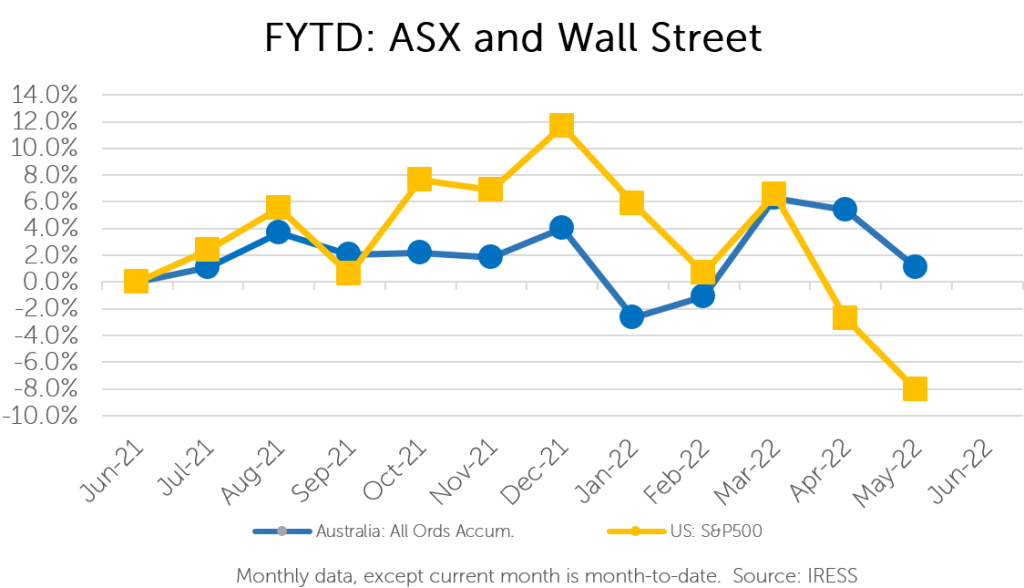

FYTD: ASX v Wall Street

The papers are liberally peppered with headlines about supply chain pressures at present.

Be it food shortages in Sri Lanka, India’s decision to ban wheat exports, or Walmart’s shock earnings miss on Monday.

Yet it is difficult to fathom that we may be heading towards a time where another, much more peculiar shortage is developing.

If recent events are anything to go by, the future might involve a pool of large companies in the Australian market beginning to evaporate.

Don’t believe us? Read on.

It’s a raid

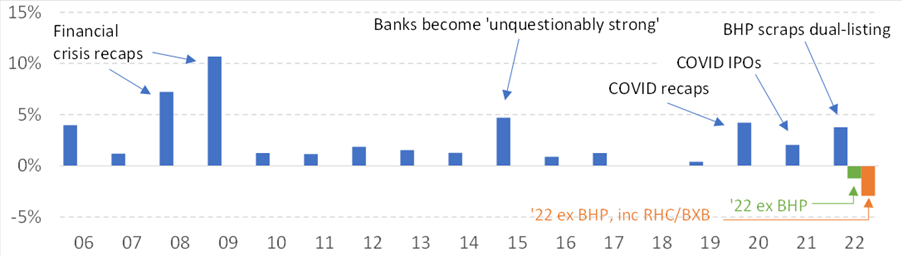

We (once again) begin with a chart, from the ever-informative Hasan Tevfik at MST Marquee.

The chart plots the change in the size of the overall Australian market, if we took out the impact of share price movements.

We can see that during periods of stress such as the Global Financial Crisis (2008-2009), there is a lot of money that makes its way into the market. This happens as companies look to shore up their balance sheets (many of them financial companies). A similar thing occurred after COVID took hold.

This was followed by a flurry of all sorts of strange and colourful companies that listed in the “IPO boom” in its aftermath (many of which sit here today having seen better days). However, this disguised the wave of large companies that were slowly dragged off the ASX boards. You may remember some of them:

- Infigen (November 2020)

- Healius Medical Centres (November 2020)

- Coca Cola Amatil (July 2021)

- Asaleo Care (July 2021)

- WPP Australia (May 2021)

- Tilt Renewables (August 2021)

- Huon Agriculture (November 2021)

- Spark Infrastructure (December 2021)

- ALE Property Group (December 2021)

And then we get to this year, when the IPO boom has died down to a whimper. Yet, cashed up alternative asset managers (be it private equity, pension funds or bloated industry superannuation funds) have continued to be on the hunt, gobbling up:

- Sydney Airport (March 2022)

- Senex Energy (April 2022)

- CIMIC Group (May 2022)

This list has grown to include potential takeovers of Link Group, Brambles, Crown Resorts and of course Ramsay Healthcare.

If these deals were to go through (and ignoring the repatriation of BHP’s UK shares) we would see almost 2.5% of the entire Australian market paid back to investors – a phenomenon termed “de-equitisation”.

More money than people know what to do with…

The problem? Investors have to deploy a growing capital base into 2.5% less assets.

And here is the crux of it; ultimately shares are, in a way, physical things. They represent an economic interest in a corporation which owns capital, be it intangible (e.g. intellectual property) or tangible (physical property – things you can touch).

Like coffee, or wheat or (God forbid) toilet paper, these resources are also being competed for. Buyers are happy to snap up assets in a volatile market that is full of short-termism and short on activists willing to push for change.

Furthermore, as inflation rages, the value of physical assets (at least in nominal terms) is rising. Which reminds us of an observation of baron T Boone Pickens during the 80’s:

“It has become cheaper to look for oil on the floor of the New York Stock Exchange than in the ground.”

Given investors prefer the franking enhanced sugar hit of dividends over capital re-investment and we are running out of new companies (of quality) to list, we fear assets are being replaced far slower than they are being taken away.

The result would be a more concentrated ASX, with investors (particularly passive ETFs) forced to pile more money into the same assets (we say, staring at an index where BHP represents 11% of the entire market!).

…But opportunity for some

Whether the trend of de-equitisation will persist is up for debate. It is no doubt a function of the current market environment where there are ample capital chasing investments. This may change if interest rates continue to rise, companies begin investing again and some of these assets make their way back to the boards.

In this environment we think there is benefit in being smaller and more nimble as an investment manager. Given our size and the flexibility we offer, clients are not restricted to only owning the shortlist of mega-cap companies, in accordance with their size in an index.

In the meantime, we are happy to benefit from some of the activity that is occurring. Often, this involves taking a long-term view of stocks that are “unloved”, as we did with Ramsay Healthcare.

Takeovers have been an important source of returns in First Samuel portfolios (most recently with the takeover of Intega and Cardno) and we expect them to continue to play a part moving forward.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.