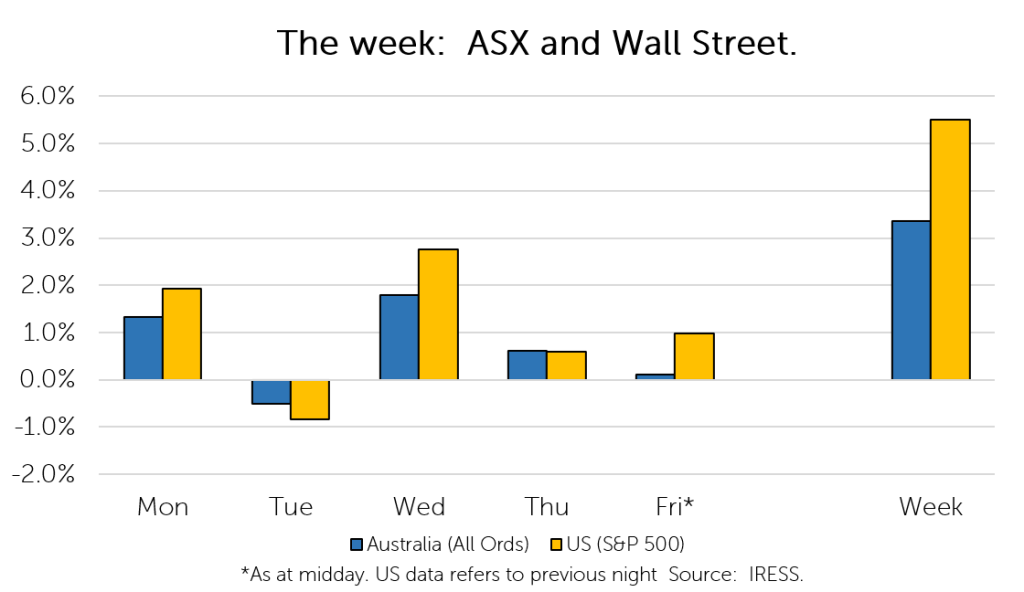

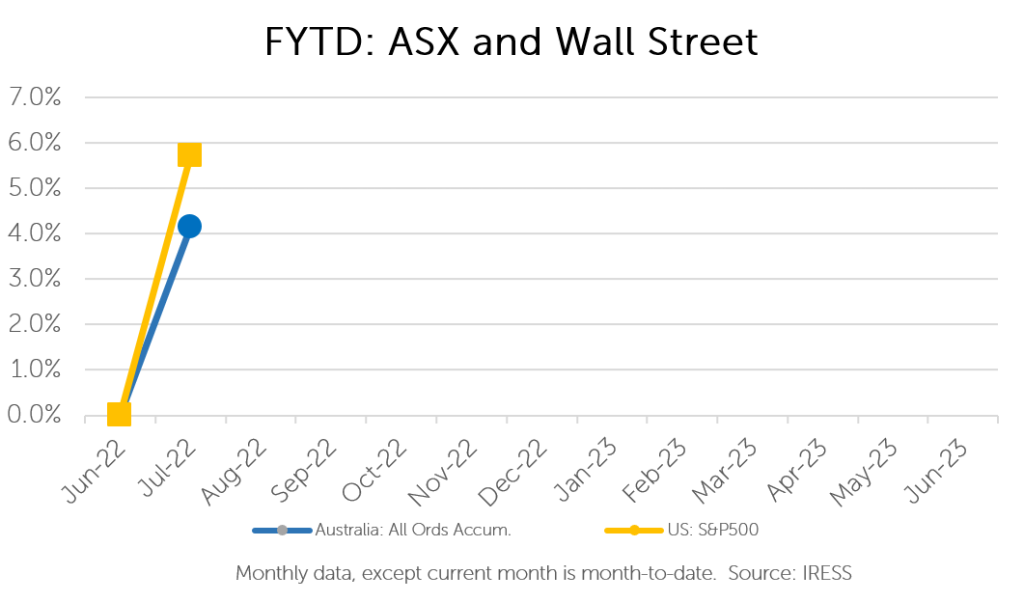

The Markets

This week: ASX v Wall Street

FYTD: ASX v Wall Street

If the big four were likened to another big four (the Beatles), it would be safe to say that ANZ has been a shoo-in for Ringo (over the last few years).

The bank has ceded share to its larger bandmates as competition has heated up in the home loan market.

However, this week it took a big step towards beefing up its presence. We, of course, are referring to its proposed acquisition of Suncorp’s banking division.

The acquisition represents further consolidation of the banking sector, a jump in market share for ANZ and further diversification as it expands its presence in Queensland.

We discuss the details below and postulate whether this may become a broader trend in the finance sector.

The details

The price tag put on Suncorp Bank is $4.9bn, to be funded by a mixture of cash on ANZ’s balance sheet and new capital.

The bank is looking to raise $3.5bn as part of a rights issue to fund the acquisition, which was pitched at a 15% discount to its previous price (an attractive price in our view). We participated in the raise on clients’ behalves.

On face value (and assuming proposed synergies are realised) the acquisition appears to be at a reasonable price. And judging by the market’s reaction (the small number of shares that weren’t subscribed to were quickly hoovered up), the acquisition is viewed favourably, particularly relative to the alternative that was proposed – a takeover of accounting software MYOB (which would have been a rather odd adjacency to add).

Several dimensions to the acquisition have been explored in the press: regulatory (will it be approved, will the ACCC object?), operational (will the stated synergy benefits come through, how quickly? At what cost? With what technology?) and cultural (will Suncorp lose its regional small bank roots?).

Each of these dimensions are interesting, with many, particularly those around synergies, only able to being answered in time (4-6 years, in ANZ’s estimate).

However, the potential benefits are clear.

The reasoning

An integrated Suncorp will immediately gain the benefit of more favourable capital treatment under an internal ratings-based approach (in layman’s terms: the ability to make more loans with less capital), and of course, the lower cost of capital afforded to the four financial pillars of the Australian economy (given the implicit fiscal backstop that underwrites them).

Furthermore, both companies have old and ailing technology backbones which require investment, which (in theory) will be more efficiently delivered by integrating the best from each business.

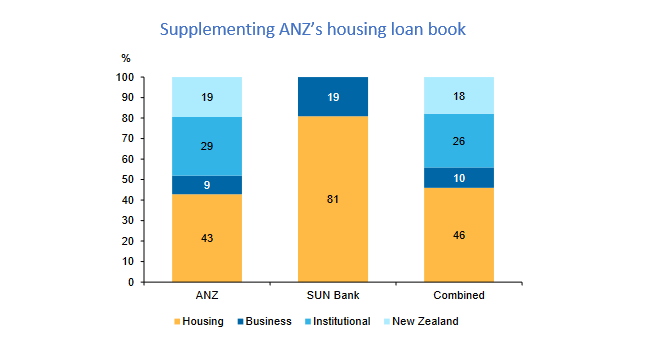

The acquisition would also help bolster ANZ’s residential housing loan book, supplementing some of the market share it has lost over the past years.

Source: Macquarie Research

In addition, the low-hanging fruit of “efficiencies” and “restructuring” (branch closures, etc) will be there for the picking, with ANZ estimating it can reduce Suncorp’s operating cost base by a third in the coming years.

Clients’ positioning

We continue to remain cautious in general about the outlook for the banks and our clients hold a significantly lower exposure than Australia’s bank-heavy index (S&P/ASX300).

There are clear tailwinds emerging, including the potential for higher net interest margins with rising interest rates (banks dragging their feet when it comes to lifting deposit rates). However, equally, there are headwinds, as borrowing capacity shrinks impacting volumes, the competition heats up in a slowing housing market and the potential for impairments in a weaker economic environment.

ANZ’s trading update, delivered alongside the acquisition announcement, gave us some insight into these dynamics.

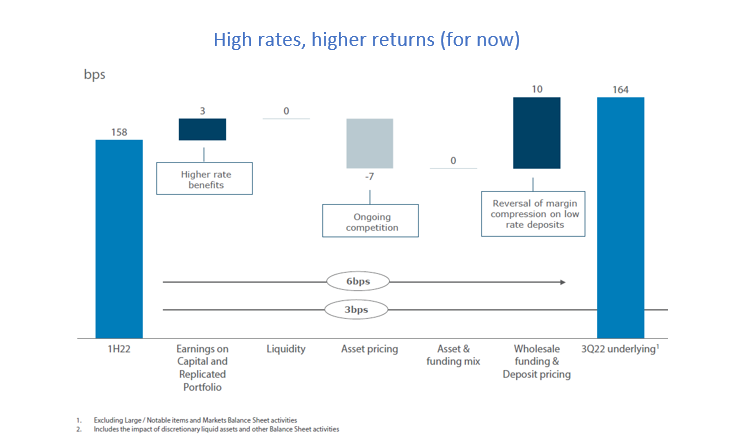

The market cared about three key figures: net interest margins (the difference between interest charged on loans and interest paid to fund this – e.g. to depositors), volume growth (loan growth) and provisions/loan quality (estimates of future losses and realised losses).

Net interest margins lifted, as the benefit of higher interest rates (particularly in New Zealand) flowed through, however, this was offset somewhat by rising competition as can be seen below:

Source: ANZ

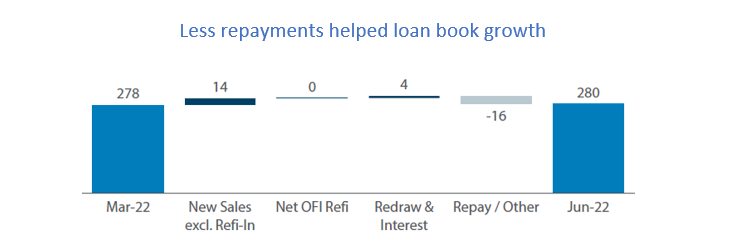

Loan volumes grew modestly, however, a large proportion of this was due to reduced repayments (potentially signaling the impact of rising variable interest rates).

Source: ANZ

And lastly, provisions for bad loans have remained steady, with ANZ not seeing a need to adjust its provision balance even with an uncertain economic environment on the horizon. Loan quality also remains high with impaired assets at a three-year low.

Thinking beyond ANZ and Suncorp

The broader context to the transaction is that in a rising interest rate environment, funding is becoming more expensive for all companies. Furthermore, capital intensity, in nominal terms, is increasing as inflation lifts all costs, including the cost of investment. We may therefore see more companies decide that they are “better together” than apart, particularly in the financial sector.

As interest rates rise and investors demand higher returns, it makes sense that we see more consolidation of this type, particularly in the finance sector. Recent examples can be found in the insurance broking sector (AUB, PSC, SDF), telco (TPG and Telstra’s recent MOCA), and consumer finance (Latitude and Humm).

In a weaker economy we anticipate that we are likely to see further opportunities for consolidation within sectors – a potentially powerful theme in the portfolio moving forward.

The information in this article is of a general nature and does not take into consideration your personal objectives, financial situation or needs. Before acting on any of this information, you should consider whether it is appropriate for your personal circumstances and seek personal financial advice.